GST Compliance Solution

Most businesses have made the necessary changes in order to implement GST. But what happens next? GST entails electronic filing of multiple monthly state-wise returns, transaction-level data upload, numerous reconciliations (revenue reconciliation, reconciliation with vendor details uploaded on GSTN) and complex tax computation.

Today’s tax tools may not be able to cater to needs of technology-driven GST compliance requirements and could pose severe challenges for your teams. Hence, the need for a technology solution crafted specifically for India’s GST.

As a leader in tax technology services, PwC has successfully developed and implemented tax compliance solutions across various countries. To assist companies in India, we have customized this proven global compliance solution with state-of-the-art technology for India’s GST. We have also implemented this solution in Indian Companies for GST compliance.

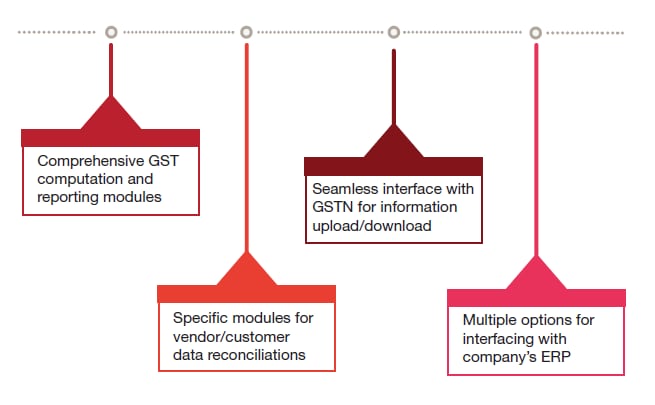

End-to-end automation of GST compliances

Contact us