Introduction

PwC’s Financial Services Data and Analytics team is pleased to present the second edition of its newsletter. This edition focuses on the important concept of ‘data mesh’ architecture, which is a stark contrast to the existing prevalent data architectures that are more centralised in nature. The key objective of a data mesh is to eliminate challenges of data availability and accessibility at scale. It encourages the utilisation of best practices from different tech stacks for data domains which are spread across geographically or physically distributed data environments. This concept allows the use of data as a service via APIs acrossmulti-cloud, distributed data governance standards and data domains between different data teams or business functions.

With data footprints expanding across geographiesand product portfolios, increased data sharing across intra-company and inter-company ecosystems, growing data complexity and an evolving regulatory landscape around data governance, organisations are looking for new age data management solutions to meet their business needs. In this context, the data mesh is a concept/platform that is worth exploring.

This newsletter also presents industry and alliance updates on interesting use cases involving the usage of artificial intelligence (AI) in the banking and insurance sectors along with the latest updates from the non-banking financial company (NBFC) industry.

Happy reading!

Topic of the month: Data mesh

Introduction

We now live in a data economy where the competitive position of an organisation depends on its ability to harvest the disparate data sets residing across data platforms, business functions and geographies into actionable insights. Organisations have been able to unlock these insights through data management solutions like data warehouses and data lakes.

Data meshes – a decentralised data architecture – are another solution that could help organisations solve challenges related to data management.

A data mesh involves decentralisation and distribution of data ownership. It enables users to access or query data across different domains without having to consolidate the data into a centralised data repository. This facilitates usage of data as a product by maintaining it across different domains and regulatory environments at an organisational level. A data mesh also helps in removing domain scalability constraints and makes change management more agile.

In 2019, Zhamak Dehghani introduced the concept of a data mesh to the world and developed its underlying principles. In recent times, there has been increased adoption of data meshes in organisations with federated data across different geographies encompassing various data governance guidelines.

Four pillars of a data mesh

1. Federated governance: A federation of data domain and platform product owners is entrusted with decision-making autonomy while working within the framework of certain globalised rules.

3. Data as a product: Domain teams own data end to end. Data accuracy and accountability lie with the data owner within the domain. Based on another team’s needs, the domain team shares the data with others as products. The data teams adopt a product lifecycle approach which follows agile principles – to deliver quick, incremental value to data consumers.

2. Domain-oriented decentralisation: Data is decentralised and loosely coupled as products, and managed by domain experts (thus, there is no bulk movement of data to a data lake). A data mesh offers end-to-end ownership based on the principle of ‘build it, own it, run it’ (BOR).

4. Self-serve infrastructure as a platform: A data mesh leverages the principles of domainoriented design to deliver a self-serve data platform that allows users to abstract the technical complexity and focus on their individual data use cases.

Illustrative scenarios for adoption of a data mesh

Source: PwC analysis

Data mesh vs data lake

The following table provides a comparison between the features of data lakes and data meshes:

Source: PwC analysis

An illustrative view of an organisation after implementing a data mesh

Conceptual flow of a data mesh

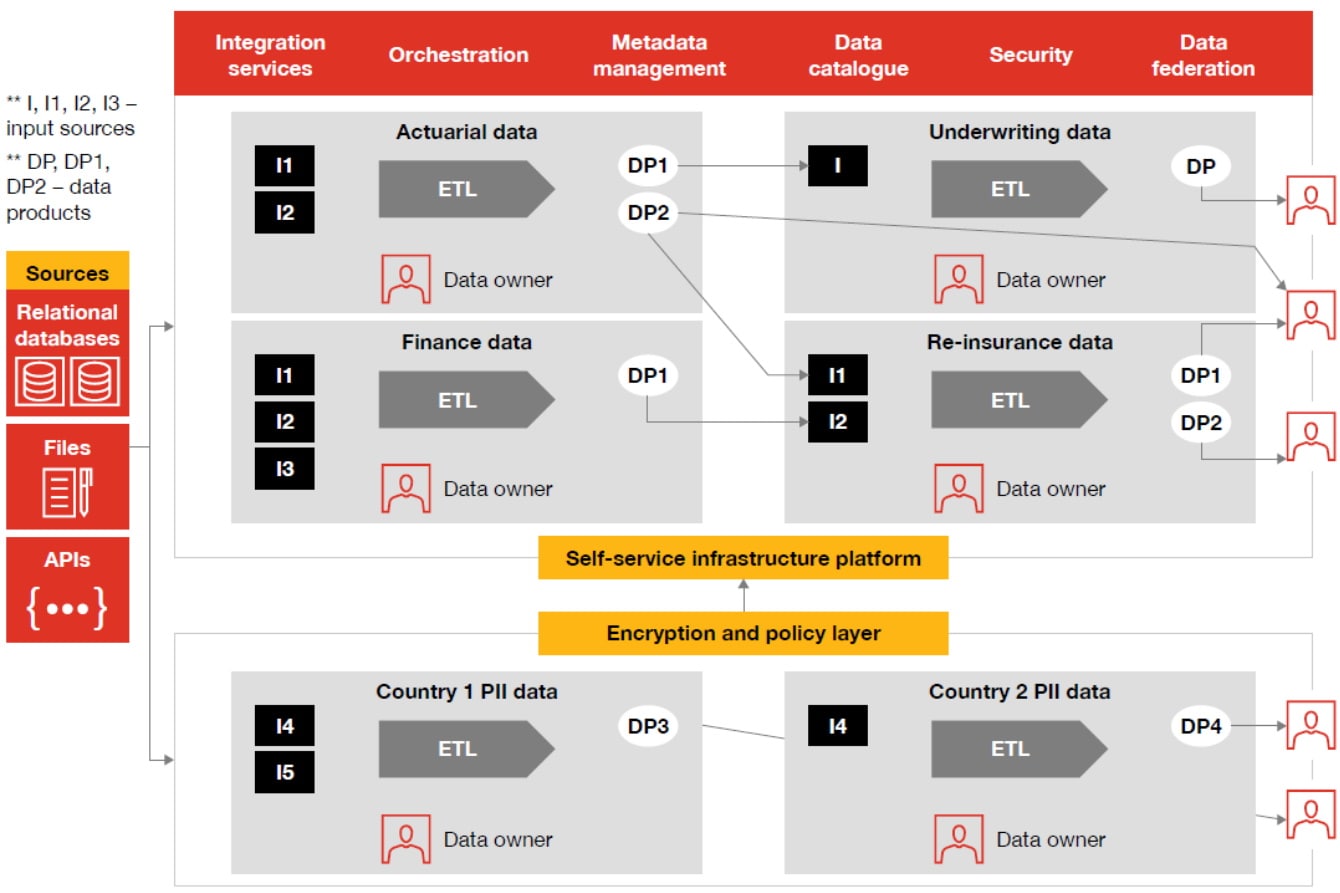

The figure below illustrates how the data mesh architecture can be implemented in the case of a large insurance company spread across two countries (1 and 2).

The organisation needs to adhere to laws such as the General Data Protection Regulation (GDPR, 2016) in Europe and the California Consumer Privacy Act (CCPA, 2018) in the US, along with many other data protection and privacy policies simultaneously. The figure shows the different data sources that are acting as a platform for different departments without being part of a single data repository. Data owners have the freedom to choose their own technology stacks for their respective data architectures and are completely responsible for the data integration, quality and governance aspects of their domain throughout the lifecycle of the entities. The personally identifiable information (PII) is being shared through an encryption layer outside the regulated zones for utilisation in different data and analytics initiatives without the need for storing this data outside the defined jurisdictions.

Source: PwC analysis

Benefits of a data mesh

- Clear data ownership and accountability for seamless data governance for each domain

- Uniformity of data sets across geographies resulting in efficient decision making in global organisations while simultaneously upholding the independence of specific business functions

- Improved response time in catering to complex business needs, fostering innovation with decentralisation of knowledge and skill sets

- Ease of data retrieval across domains, geographies and platforms

- Adherence to changing compliance and regulatory requirements with ease for each domain

- Ability to optimise data management capabilities in hybrid multi-cloud environments in terms of integration, storage and computation

1. Karnataka Bank launches centre of excellence (CoE) for data-driven transformation:

FinTechs and neobanks have been leveraging technology to acquire new customers with customised offers and have been capturing the market share of traditional banks. To increasegrowth and reduce risk, Karnataka Bank has launched a CoE to identify existing data assets and leverage them for data-driven decision making at every stage of the customer lifecycle.

2. How payment processing firms want to leverage the metaverse:

Payment processing firms such as Visa, Mastercard and Amex see huge potential in the metaverse to target millennials and Gen Z with new financial products, virtual cards/transactions, NFTs (nonfungible tokens), and alternative credit-scoring models. Mastercard has filed 15 patents for verifying payments, NFTs, etc., while Visa’s creator programme works on blockchain-based metaverses.

3. Godrej Industries launches its financial services subsidiary Godrej Capital:

Godrej aims to strengthen its foothold in financialservices with the launch of Godrej Capital. This will be the holding entity for Godrej Housing Finance (a housing finance company) and Godrej Finance (an NBFC). The company entered into the housingfinance business in 2020 and plans to build an INR 30,000 crore balance sheet by the end of 2026.

4. Refinitiv launches Quantitative Analytics, a cloud-based solution powered by Snowflake:

With access to over 60 financial data sets, quantitative alpha models, and additional third-party and alternative data sets, Refinitiv Quantitative Analytics on Snowflake provides a scalable platform for managing quantitative analysis and investment data.

Faster onboarding, real-time updates, scalability, and lower server and data maintenance costs are all supported by the flexibility and security of the Snowflake Data Cloud, which allows customers in the financial services sector to discover, access and collaborate with data without the common challenges related to movement.

5. I-powered alternative data driving extreme market research for active investment management

Alternative data offers many advantages. One of the most essential features is its potential to generate proprietary real-time signals that provide alternative perspectives and unexpected insights. The capacity to look beyond traditional financial data to understand corporate performance, market dynamics and consumer behaviour is extremely beneficial for organisations and investors who want to plan and execute their investment strategy in a measured, informed and risk-averse manner.

However, despite these benefits, systems for adding alternative data into investing and risk models face a number of hurdles. Alternative data assets are known to be unstructured, lack precise patterns, and, given their high data collection frequency, need considerable storage and processing resources.

7. Google collaborates with Mizuho Financial Group for digital transformation:

Mizuho Financial Group will leverage Google Cloud for digital transformation, primarily focusing on hyper-personalisation by creating a new digital marketing platform and integrating with Google Analytics. This collaboration will help the group create new age financial products and services such as banking as a service, secure its IT infrastructure, and transform its corporate culture.

6. PhonePe backed by Walmart is set to acquire WealthDesk and OpenQ for about USD 70 million:

WealthDesk, which is situated in Mumbai, is a B2B2C investment technology platform that enables portfolio-based investing in addition to equities and exchange-traded funds (ETFs), bringing together the advisory, broking, asset, and wealth management ecosystems.

OpenQ, on the other hand, provides trading baskets and investment analytics to consumers and institutional customers. Post acquisition, WealthDesk and OpenQ will be instrumental in enabling the wealth management ecosystem PhonePe is working towards.

1. RBI might ease credit card licences to NBFCs

Currently, NFBCs are not allowed to issue credit cards independently. SBI cards and Bank of Baroda (BoB) are the only two public sector NBFCs allowed to issue credit cards. The Reserve Bank of India (RBI) has come up with a gamut of restrictions and checks which may make it easier for NBFCs to obtain credit card licences, as per a research note published by leading Australian financial services company.

3. RBI restricts lending limits of NBFCs to align with banks

With the share of NBFCs in financial activity in India increasing, the RBI has been trying to bring them under the same level of regulatory scrutiny as banks. In an attempt to do so, the RBI has notified that the total exposure of an NBFC towards one entity should not exceed 20% of its capital base. This shall be applicable to all NBFCs falling in the upper layer of the RBI’s scale-based regulatory framework.

2. Government all set to launch 75 digital-only banks and NBFCs by the end of this year

In the aftermath of the pandemic, the Government of India (GOI) aims to maintain financial stability during exceptional times in the future. The GOI has planned to set up a large number of digital-only banks to realise the goal of financial stability.

PwC in focus

- Our report on ‘Insurance 2025 and Beyond’ focuses on five strategic imperatives to help insurers reimagine their business models and capture future growth. The report also highlights the five key trends, the position of the industry today and its vision in the coming years. Read the full report here.

- To generate returns, private equity companies have typically depended on deep business expertise and experience. However, that is no longer sufficient for success, and private equity firms must rethink data and cloud in order to thrive. Our report talks about how data and analytics driven transformation is vital for these companies to thrive in the next five years. Read the full report here.

- In the banking, insurance and financial services industries, artificial intelligence (AI) is a musthave technology tool. According to a survey conducted by PwC and FICCI, the top business driver for deploying AI in financial services is to improve customer experience. ‘Maturity of using and adopting AI-enabled solutions with a deeper understanding of not just the business case, technology, and data but also the risks around security, privacy, and accountability will differentiate the leaders from the rest,’ said Sudipta Ghosh, Partner and Leader – Data and Analytics, PwC India. Around 82% of those surveyed have used chatbots to help with customer service, 65% have used a fraud detection model, and 56% have deployed a virtual assistant. Read the full report here.

Acknowledgements: This newsletter has been researched and authored by Aniket Borse, Anuj Jain, Arpita Shrivastava, Dhananjay Goel, Harshit Singh, Jigyasu Bhatnagar, Kishan Sanghani, Krunal Sampat, Mamta Kumawat, Rachana Kanikarla and Sandeep Kumar.

Contact us