Buoyed by a large untapped population and the anticipation of better clarity from regulators, alternative lending platforms are poised for massive growth in the future. We introduced alternative credit decisioning (ACD) models in a previous post. The efficacy of such models hinges on the type of data that is fed into them—an area of innovation which a new breed of tech-savvy financial services players are exploiting.

The limitations of data in traditional scoring

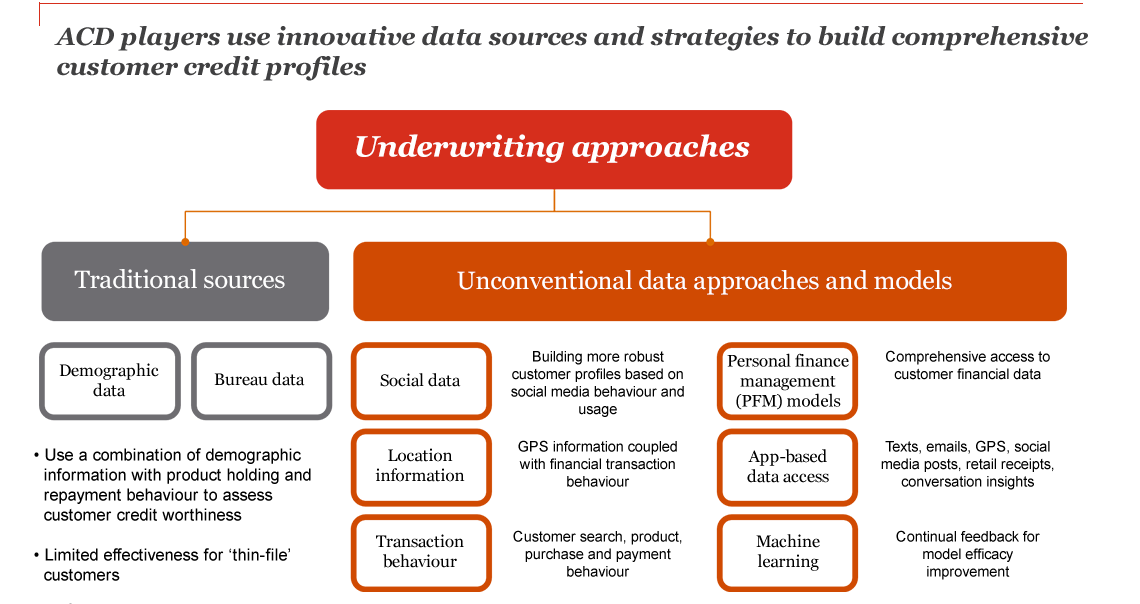

Traditional lending houses, whilst leveraging sophisticated advanced analytical models, tend to limit themselves to basic demographic and bureau data and customer-specific financial data in order to gauge credit worthiness. Credit assessment of unbanked, underbanked or ‘thin-file’ individuals remains subjective, time-consuming and expensive. As a result, this section is invariably screened out of traditional credit models and thus remains trapped in in a vicious cycle of little or no access to credit.

Expanding data sources for new age underwriting

In contrast to traditional lenders, online FinTech lenders study both conventional and unconventional data points using ACD models to build more robust customer financial identities. In addition, the use of more streamlined distribution models enables faster and more efficient disbursal turnaround times.

This approach of harnessing unconventional data sources for a holistic assessment of customer credit worthiness has transformed the lending space. Lenders today use consumer information such as mobile pre-/postpaid usage, social data, utility payment behaviour and e-commerce transactions, in combination with conventional credit bureau reports, to predict the creditworthiness of no-file or thin-file consumers. For example, a leading FinTech start-up in India uses mobile phone data and e-commerce sales as additional data points for analysing consumer behaviour. Parameters such as long call duration, conversations during working hours, frequent high-value mobile top-ups and international dialling are taken as positive indicators, while calls restricted to local networks and low-value top-ups are associated with lower credit scores. The company also gathers information through individual psychometric tests that gauge a customer’s intention to pay—a technique that is especially valuable in the case of thin-file/no-file customers, where other data is scarce.

Making models more intelligent through machine learning (ML)

The next wave in this highly evolutionary space is the use of ML algorithms along with ACD to enhance the accuracy of credit assessment. Reinforcement models are used to learn from mistakes and ensure that bad customers are segregated early from good customers based on behavioural patterns. Leveraging this approach adds a new self-learning dimension to existing credit models, as models continually compare predicted behaviour to actual behaviour, thus improving model output efficiency.

A number of start-ups are using ML to differentiate their ACD offerings and are developing innovative business-to-consumer (B2C) models. A recently launched FinTech start-up uses ML to accurately estimate optimal loan sizes for its potential customers.1 Another uses ML to identify meaningful patterns in the data that it assimilates, including data extracted through some innovative approaches: The company has built on the application programming interfaces (APIs) of government sites to extract the tax filing behaviour of its customers and also claims to use natural language processing (NLP) to collect data on loan performance.

However, almost all the books in ACD markets are yet to mature, which means that unknown risks are yet to be identified, let alone be mitigated.

Future of lending

The use of advanced analytics techniques such as ML should make ACD models more sophisticated, thereby raising the level of this already competitive playing field. While traditional lenders will have to evolve their processes to compete in this ever-changing landscape, the end consumer is set to be the ultimate winner as more accurate assessment of credit worthiness will translate into more favourable credit facilities.

Sources:

- Variyar, M. (2016). FinTech cos like CapitalFloat, LoanTap are using bots to decide if you’re eligible for a loan. Economic Times. Retrieved from http://tech.economictimes.indiatimes.com/news/startups/fintech-cos-like-capitalfloat-loantap-are-using-bots-to-decide-if-youre-eligible-for-a-loan/55325018 (last accessed on 6 December 2017)