Meet Sarita, a god-fearing lady of 32, who works as a part-time maid at multiple houses in a certain neighbourhood. Her character is commendable and she is often recommended to other households based on her superior work ethic and integrity. A mother of two, Sarita is devoted to providing her children with the opportunities she never had, including an education that will help them achieve a successful future. With no formal banking history and her children’s fees to pay, Sarita is forced to head to a pawnshop and pledge her jewellery as security for a loan that comes at a staggering interest rate of 30-35%.

Like Sarita, there are many hardworking small merchants out there who, due to their lack of credit history, are denied loans that could help keep their businesses afloat. Can alternative lending help these merchants avail of a loan as easily as someone with an active credit history?

To understand the growing interest in alternative lending, it is important to first understand India’s demographic landscape. With digital footprints limited to a small size of the overall population, a majority of people still rely on primitive methods to procure funds, such as borrowing money from social groups and their family. Moreover, for a large percentage of individuals, past credit history is either incomplete or unavailable altogether. The traditional method of generating credit scores has prevailed through the years, with credit bureaus mainly relying on credit card and loan history details for generating scores. This reliance on past credit history poses a significant lending challenge for financial institutions.

In recent times, the Indian population has begun to increasingly adopt a digital way of life, with online and mobile payments now replacing cash payments. Ever since the government’s demonetisation drive, digital modes of transactions have received a boost. The 55% increase in the usage of digital payments in 2016-17 is proof that this trend is likely to continue in the coming years.

With the increase in online payments, merchants are gearing up to service this demand by rapidly expanding their acceptance infrastructure. They are now beginning to accept various digital payment systems, including credit and debit cards, mobile wallets, mobile banking and Unified Payments Interface (UPI). This explosive growth in the payments industry, enabled by increasing Internet and mobile penetration, the changing mindset and favourable regulations, has laid the foundation for alternative lending in India.

With consumers moving to make even ‘kirana’ store purchases through digital means, alternative lending players can now customise small-ticket loans to address the unique needs of these merchants, instead of offering generic ones, thereby further bringing down the risks associated with unsecured lending. By assessing credit worthiness based on non-traditional sources of data and advanced analytics, alternative lending is fast becoming a major source of capital for small merchants who would otherwise not have had the means to obtain bank loans on regular terms. Moreover, the rapid embrace of digital payments by all segments has led to an increase in digital data points that these non-traditional lenders use to assess credit risk, further widening the scope for alternative lending in the market.

Digital wallet companies are offering business loans to merchants, chiefly those selling on the e-commerce platforms of their parent companies.

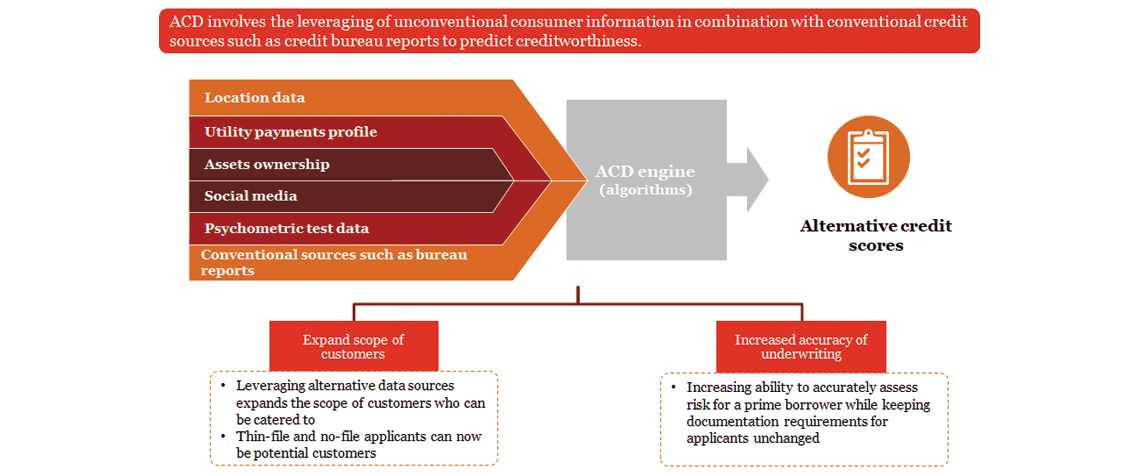

What is alternative credit decisioning (ACD)?

Prerequisites for the success of alternative lending

Robust ACD model

Different sources of data have varying levels of predictability. This is a fact that must be considered while evaluating which type of data should be used to arrive at a suitable credit decision. Credit scores can be created by pooling together financial, social and demographic data points, including customer lifestyle and purchasing trends. Data from online social networks, mobile phone records and psychometrics are also parameters that are currently being used to evaluate the potential of borrowers. The success of alternative lending firms largely depends on the identification of the right borrower to lend to at the right time and the right place. Therefore, it is crucial that the chosen non-traditional data helps verify the identity of an individual and provides futuristic insights into behaviour, particularly in relation to the likelihood and ability of repayment. This will not only lead to potential cost savings on tasks such as conducting physical verification of clients but also present cross-sell and up-sell opportunities for the existing client base.

Customised products

Understanding user requirements and expectations is key for customer acquisition and retention. Therefore, offering personalised products that are best suited to the merchant’s needs is the ideal way to build trust and ensure long-term sustainability. The ability to scientifically match the appropriate borrower profile to the best-suited loan offering would lead to potentially higher chances of loan approval. To enable this, there must be a set of pre-baked products that have been customised to fit the specific requirements of different merchants. For example, the funding requirement for a grocery store owner could be bi-weekly or monthly, compared to that of a carpenter who might require credit on a quarterly basis. Thorough market research, combined with data analytics, products can be designed based on the type of merchant and their unique funding cycle, thereby ensuring an individual has access to credit when he/she requires it the most. These tailored products should also be advertised or pushed out to existing customers based on their profiles, past engagements and purchasing trends to ensure high visibility.

User-friendly infrastructure and delivery channels

New financial technologies have given online lenders the ability to set up shop relatively quickly. While doing so, it is crucial that these apps enable maximum customer engagement and retention through high speed and transparency, thus resulting in user-friendly interfaces and experiences with the platform. The digital infrastructure of these apps should be designed to reduce critical pain points of the loan origination processes for consumers and SMEs across stages-from loan application to approval and funding and, finally, loan disbursal. The goal should be continued simplification of the end-to-end user experience by making it faster and easier for borrowers to access capital. Providing a consistent experience across the various delivery channels will enable the user to interact more frequently with a platform of his/her choice-that is, web or mobile.

Firms often make the mistake of initiating front-end design without completing the entire process design. With the competitive advantage of a firm depending on lean operations and low transactional costs, establishing suitable technology infrastructure, including the selection, design and construction of an appropriate technology stack, is of utmost importance for an alternative lending firm.

Joydeep Lahiri is a Principal Consultant and Namrata Kacholia is a Consultant in the FinTech practice at PwC India.