Litigation Management Solution

The litigation process is not only time-consuming and somewhat tedious, but also needs innumerable questions to be answered. The Tax Litigation Manager is a one-stop solution that automates this process. It not only captures the various aspects of tax disputes and is initiated when an assessment commences, but also ensures that the figures obtained from tax returns and reliefs are captured and referenced.

Leveraging understanding of the law on assessment of income and the redressal mechanism available to assesses, this tool seeks to standardise the litigation compliance process and related documentation.

Managing the litigation process

Features of the tax litigation tool

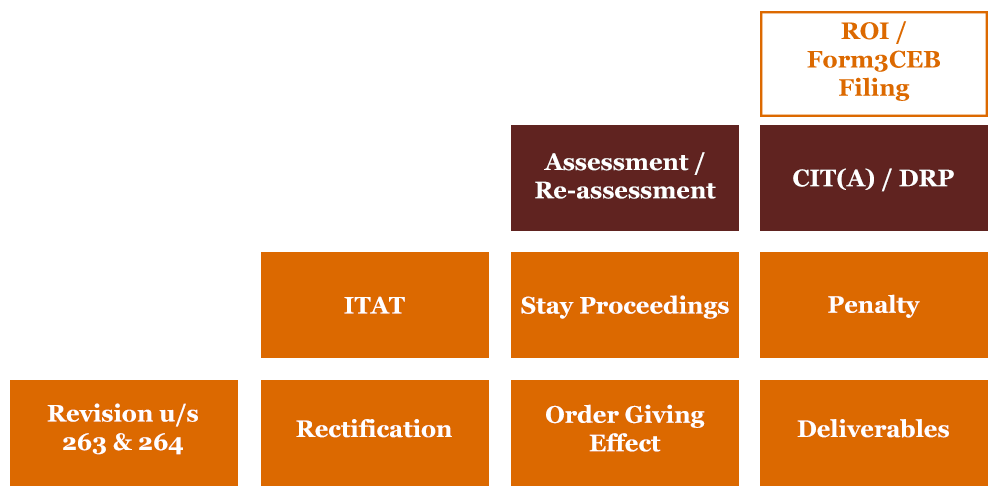

The tool captures the entire gamut of the litigation process from Rate of Interest (ROI) or Form 3CEB filing to an appeal for relief to a High Court or the Supreme Court

It standardises the various legal documents needed to complete the litigation process.

It can be integrated with the FileIT database and provides automatic storage facilities, based on PwC’s filing guidelines.

The tool enables integration with Precision to access billing-related information and other financial details for analysis and decision-making.

It comprises dashboards to help different layers of users to analyse the status of case files and track pending or long-drawn-out cases.

It can be integrated with the CCH tool to access Return of Income-related data, which is the key to the ‘Assessment of Income’ process and a source of dispute.

The tool includes a task-tracking and email intimation facility to make users aware of their position in the process and the action they need to take.

Contact us