Download the article

![]() 30-minute read

30-minute read

The India Middle East Europe Corridor (IMEC) marks the latest addition in India’s growing portfolio of investments in transnational economic corridors. Mohammad Athar, Anurag Sehgal, Dhruv Gadh and Probal Ghosh examine the transnational corridor initiatives to sift out best practices and recommend a successful corridor development strategy.

A bird’s eye view of TNECs

TNECs1 are emerging as powerful instruments in shaping India’s growth story. As the world witnesses a growing trust deficit and increasing geopolitical conflicts underline the need for alternative forms of trade and transport connectivity routes, India perceives transport corridors as an essential resource to meet its fast-paced economic growth and to strengthen strategic alliances.2

TNECs are important for the coordinated and integrated development of transport infrastructure and transit facilities, and for trade facilitation at the regional, subregional or national level to enhance growth and development outcomes for participating regions. For instance, the International North-South Transport Corridor (INSTC) will provide India more direct access to Central Asia.3 India has also finalised a 10-year contract to develop the Chabahar port in Iran, which could be the terminating point for the north-south corridor.4 More recently, the strategically located India-Middle East-Europe Economic Corridor (IMEC) is poised to connect the West with the East, facilitating transit and boosting India’s access to markets.

Corridors act as links in the international transport network and ensure efficient cross border trade in goods and services

Considering the vast resources and investment required for the development of TNECs, it is important to ensure their long-term viability. A strategically located corridor with substantial market access that leverages historic trade ties and industrial complementarity between participating nations will be most viable. TNECs must also focus on economies with a potential for diversifying trade capabilities to usher in long-term growth. It is also important that TNECs’ conceptualisation be grounded in sustainable development practices. Besides this, robust diplomatic ties between member nations is key, keeping in mind the need for inter-country collaboration.

Figure 1: Drivers of a corridor’s viability

Source: PwC analysis

Some of the advantages of TNECs are:

- Trade expansion and diversification

- Investment flows

- Innovation and technology transfer

- Wider socio-economic benefits

Trade expansion and diversification

TNECs open up avenues for diversifying the trade baskets of participating nations along the corridor region, allowing for the subsequent diversification of economies. Take the example of the North-South Economic Corridor which was developed under the Greater Mekong Subregion (GMS) programme and plays a critical role in providing China’s Yunnan Province and northern Lao PDR access to important sea ports. The corridor makes key markets accessible,5 thereby enhancing investment opportunities in agriculture, tourism, power, logistics and manufacturing sectors.

Investment flows

TNECs have the potential to catalyse investment flows, leading to the stimulation of local economies. In the South Asia Subregional Economic Cooperation (SASEC) programme, SASEC countries have signed and implemented 79 Asian Development Bank (ADB)-financed investment projects worth around USD 18.41 billion in the transport, energy, trade facilitation, economic corridor and health sectors as of February 2023.6 The transport sector accounts for the majority of projects – 46 projects worth over USD 13.17 billion. Similarly, the development of the Almaty-Bishkek Economic Corridor, a regional integration project linking Almaty, the largest city in Kazakhstan, and Bishkek, the capital of the Kyrgyz Republic, has spurred the development of major tourism infrastructure projects.

Innovation and technology transfer

Interaction of firms across corridor regions leads to benefits such as technology transfer and innovation spillovers. The Cascadia Innovation Corridor (CIC), for example, is a public-private effort to integrate the region spanning the Canada-US border. With the inception of the corridor in 2016, came the Cascadia Venture Acceleration Network (CVAN) – a partnership of 48 organisations that provides tech start-ups with funding and collaboration opportunities across borders.7

Wider socio-economic benefits

In addition to their trade benefits, these corridors also have the potential to usher in wider socio-economic benefits. Investment into transport corridors is often aimed at creating economic surpluses which can also have a spillover effect across regional economies and society at large. The development of Vietnam’s National Highway No. 5 on the back of complementary reforms in education and trade openness, for instance, helped reduce the absolute number of people living in poverty in the populous Red River Delta region by 35% between 1995 and 2000. This reduction rate outpaced the national average reduction rate of 27%.8 Similarly, corridors can often encourage collaboration to ameliorate other social issues, for instance, the GMS programme has helped beyond easing cross border trade. The six nations under the GMS umbrella have ‘committed to step up efforts to stem the trafficking of people across borders’.9

The integration that economic corridors allow becomes especially relevant in the context of globalising trade relations among countries. Such trade relations have created a need to ensure integration of transport infrastructure for the export of manufactured goods. Corridors, then, are important links in the international transport network which provide spatial connection for economic centres through various modes of transport.

Given this background, the announcement of IMEC marks a promising stride. First announced at the G20 Summit held in New Delhi in September 2023, IMEC aims to provide reliable and cost-effective cross-border ship-to-rail transit networks to supplement existing maritime routes.10 The corridor is expected to stimulate economic development through enhanced connectivity and economic integration between the European Union (EU) and seven countries – India, the US, Saudi Arabia, the United Arab Emirates (UAE), France, Germany and Italy.11 The corridor is meant to pave the way for secure regional supply chains, increase trade accessibility, enhance economic cooperation, lower costs, generate jobs and lower greenhouse gas emissions.12

Figure 2: Proposed route of the IMEC corridor

Source: PwC analysis

The suitability of IMEC is derived from the varied strengths of the countries/regions that constitute the corridor

Pivotal to IMEC’s success will be a robust network of transportation and the development of economic infrastructure which could provide a further boost to Indian exports to the six Gulf Cooperation Council (GCC) countries as well as to the EU. Exports to GCC nations from India grew by 44% to about USD 43.9 billion in FY 2021–22 compared to the previous fiscal’s USD 27.8 billion.13 India’s exports to the EU stood at USD 33 billion approximately in 2020.14 India not only serves as a key market for other IMEC nations but also depends on them for various imports. The GCC nations, for instance, account for almost 35% of India’s oil imports and 70% of gas imports.15 Bilateral trade with the GCC countries, currently India’s largest trading partner bloc, reached over USD 154 billion in FY 2021–22 with imports of ~USD 110 billion. Of this, non-oil imports accounted for USD 37.2 billion of total trade.16 India also shares similar trade ties with the EU nations. In 2020, the total bilateral trade in goods between the two stood at EUR 65.30 billion, with imports accounting for EUR 32.20 billion. In this period, India was the EU’s 10th largest trading partner, occupying 1.8% of the EU’s total extra-EU bilateral trade.17

For IMEC to realise its goals, it has to be able to first navigate certain challenges. The following section of the article examines what constitutes a successful corridor development strategy, the challenges that need to be addressed, and discusses other transnational corridor initiatives across the globe which hold lessons for IMEC.

Our take

Key challenges and recommendations for TNECs

Considering the scale of corridor projects, their development brings with it a host of challenges. These can be split into three broad categories – conflict-related, infrastructural and policy-level challenges. The following section discusses each of these challenges in detail.

Regional conflicts

Conflict and instability, in general, have negative implications for the development of trade and integration of economies — one of the key objectives of TNEC projects. Given their large geographical spread, TNECs are often vulnerable to regional conflicts. Regional conflicts have impacted projects such as the proposed Lome-Ouagadougou-Niamey Economic Corridor Project in West Africa,18 the Brunei-Indonesia-Malaysia-Philippines East ASEAN Growth Area (BIMP-EAGA),19 and a proposed Djibouti regional economic corridor,20 either in their development or operationalisation phases.

Besides being vulnerable to the risks related to paucity of infrastructure and weak institutional structures, TNECs are often exposed to the additional challenge of regional conflicts

In assessing the proposed Lome-Ouagadougou-Niamey Economic Corridor Project in West Africa, the World Bank noted that about 19% of Burkina Faso’s population and 1% of Niger’s population reside in 'high-intensity conflict zones', with violence being reported in ‘the direct corridor vicinity’.21

In its assessment, the funding body added that the region crossed by the corridor is marked by ‘widespread fragility and insecurity’,22 adding to already high transport cost and time. Such a situation could potentially hinder trade flows and corridor operations.

Additionally, while assessing the prospects of the proposed Djibouti regional economic corridor, the World Bank said that the Horn of Africa, or HoA (comprising Djibouti, Eritrea, Ethiopia, Kenya, and Somalia), is known for its ‘long history of fragility … and seemingly intractable conflicts’.23 The World Bank also noted that the political and governance risks associated with the corridor, which is aimed at improving regional connectivity and enhancing logistics efficiency in Djibouti along the Djibouti-Addis southern corridor, were ‘substantial’.24

Thus, instability due to conflict can have a strong impact on investors’ decisions to invest in TNECs in such geographical regions while also affecting existing trade routes and supply chains.

Recommendations to overcome regional conflicts

To effectively develop and operationalise TNECs in conflict-prone areas, it is important to formulate strategies that help mitigate socio-political impediments. Some possible measures could include:

- Alignment with existing conflict mitigation strategies and action plans:

- Creation of forums for discussion and collaboration

- Conflict resilient trade and transportation protocols

Alignment with existing conflict mitigation strategies and action plans:

This involves making provisions for strategies and plans that aim to address conflict, violence risks and underlying drivers of conflict through development interventions and incorporating these in corridor development measures. Project designs should be made conflict sensitive and contribute to infrastructure and policy developments which can address the factors leading to conflict. Projects could, for instance, focus on the social aspects such as integration of unemployed youth into their programmes or the development of community infrastructure to address the issues related to scarcity.25 For the proposed Lome-Ouagadougou-Niamey Economic Corridor Project in West Africa, the corridor programme is being closely aligned with the complementary conflict mitigation strategy and action plan prepared by Burkina Faso and Niger.

Creation of forums for discussion and collaboration

Political impediments may be countered by the creation of platforms and forums for inter-governmental dialogue and collaboration to formulate measures which can deescalate existing or potential tensions. Furthermore, the corridor countries can collaborate to strengthen their institutional capacities to address the conflicts in border areas.

Conflict resilient trade and transportation protocols

Synchronisation of trade and transportation protocols is key to the operationalisation of TNECs. Harmonisation of policies between corridor nations facilitates the smooth flow of goods and eases transactions. In conflict-prone/conflict affected regions, such policies can be formulated with a focus on addressing issues of conflict. These could include developing multi-modal transport systems such as road, rail, sea and air which can reduce the dependency on a single route or mode.

Apart from the above-mentioned steps, joint economic and infrastructure development should be a key focus area as collaborative investment projects that benefit all parties ensure equitable distribution of costs and benefits to reduce tensions and foster collaboration. Moreover, measures also need to be adopted to ensure transparency and accountability in decision-making processes to help build trust among participating countries.

Inadequate infrastructure

Inadequate physical infrastructure could pose a significant hindrance to successful corridor operations and needs to be addressed through substantial investments of capital and time.

Transport and logistics infrastructure are central to the successful operationalisation of TNECs and form an intricate network that spans various modes of transportation and their associated facilities. The development of this infrastructure also includes numerous stakeholders who are required to coordinate with each other to develop and operationalise TNECs effectively. These stakeholders encompass government agencies responsible for infrastructure (e.g. ports, roads, railways and border posts) and for regulation of services (e.g. transport, customs, immigration, security, health, agriculture and trade) as well as private sector operators (e.g. roads, railways, ports, terminal operations, freight forwarding, cargo clearing and finance).

TNEC infrastructure can be broadly categorised into two components:

- trade gateways, which encompass seaports and land ports

- connecting infrastructure comprising road, railway, and/or waterway networks linking these trade gateways with other hinterland facilities such as dry ports/inland container depots (ICDs) or economic clusters.

The key classes of infrastructure required at trade gateways are cargo handling, storage and connectivity-related infrastructure, customs-related infrastructure and other infrastructure, covering safety, health, security, and communication through which operational efficiencies may be achieved

Inadequacies in infrastructure could lead to challenges such as differences in connectivity infrastructure standards. Inconsistent railway gauges and road types across borders can hamper cargo movement. Moreover, time as well as the cost of cargo movement can increase due to limited end-to-end connectivity to sea and land ports. In terms of viability, TNECs’ capacity is impacted by the weakest links in their infrastructural elements. These weaknesses manifest themselves as suboptimal operational efficiencies which can impact port gateways to linking networks, deterring smooth cargo flows.

The lack of efficient intermodal infrastructure between transport modes at land and sea borders can also lead to increased costs and delays in the movement of goods; therefore, this aspect must also be addressed for a well-functioning corridor.

Recommendations to address inadequate infrastructure

Upgrading the weakest links in the corridor infrastructure such as expanding capacity at congested ports, improving road conditions and modernising railway systems should be prioritised. Other possible solutions can be:

- Standardising connectivity and cross-border infrastructure

- Development of efficient intermodal infrastructure and border management

- Promoting a sustainable and resilient infrastructure

Standardising connectivity and cross-border infrastructure

To ensure compatibility across borders and synchronised infrastructure development, it is critical to adopt uniform standards for railway gauges, road types and other transport infrastructure. This would require collaboration and agreements among member countries. Member countries’ investments in cross-border projects to resolve inefficiencies, including gaps in hard infrastructure and poorly integrated border facilities will be effective in facilitating smooth goods and cargo flows. Joint planning and funding mechanisms for transnational infrastructure projects may also be necessary to allow benefits and allocate responsibilities among corridor nations.

Development of efficient intermodal infrastructure and border management

Regional integration can be achieved by strategically located intermodal hubs that offer smooth transitions between different modes of transport such as rail-to-road and road-to-sea connections. To enhance the efficiency of transnational corridors, investments can be made in technology and infrastructure at border crossings that can help avoid delays. Interventions to facilitate transnational corridor exchange could include automated customs clearance systems and dedicated freight lanes.

Promoting a sustainable and resilient infrastructure

Effects of climate change may pose physical risks to infrastructure projects. Disaster-resilient features should be incorporated within the design of such projects to reduce climate vulnerability. Furthermore, the needs of all relevant stakeholders, such as local communities also need to be considered to amplify the socio-economic benefits of TNECs, including aiding inclusive growth.

Policy synchronisation

Successful TNEC operationalisation cannot depend solely on hard infrastructure. Operationalising a TNEC can be a complex process since multiple authorities are involved and procedural differences may occur across corridor nations. These divergences can complicate coordination and cross-border operations management. Lack of uniform data requirements, multiple sets of regulatory processes and inefficiencies in service providers’ operations within the same country and between corridor countries can significantly lower corridor efficiency.

Recommendations to achieve policy synchronisation

Figure 3: Key elements of policy synchronisation

protocols

Source: PwC analysis

Policy harmonisation could be achieved through the following ways:

- Establishment of protocols for effective flow of cargo

- Easing cross border transport movement

- Enabling efficient cross-border operations

Establishment of protocols for effective flow of cargo

These protocols serve as guidelines for standardising procedures and as a framework to govern efficient cross-border cargo flow. They bring benefits such as ensuring uniformity, complementarity and overall efficiency, thus creating an environment in which diverse entities operate in harmony.

Easing cross border transport movement

Development of cross-border infrastructure and linkages, while important, must be undertaken alongside bilateral and multilateral dialogue aimed at strengthening institutional and regulatory commitments. For TNECs, creating regional- and national-level transport and trade facilitation bodies can accelerate trade and transportation flows significantly.

Enabling efficient cross-border operations

This is a critical component for the synchronisation of transport and logistics infrastructure within a corridor. It helps address the time cost incurred in the clearance of goods through international border facilities (both seaports and land ports).

Since it is important to address this gap as delays in goods movements drive costs up significantly, interventions are necessary to streamline procedures related to customs, port authorities and various participatory government agencies (PGAs) carrying out activities such as inspection and approval of goods based on specific regulations, implementation of health and safety standards, and to importers and customs brokers.

Elements for sound policy synchronisation

Figure 4: Good policy synchronisation practices

| Element | Prominent global examples | |

|---|---|---|

| Integrated information systems | The US-Mexico border modern cargo inspection facilities | |

| Collaborative border management | The Schengen Area in Europe | |

| Advanced technology adoption | The Malaysia-Singapore land border | |

| Advanced security infrastructure | The US-Canada border's advanced surveillance systems, biometric technologies, and automated license plate recognition | |

| Efficient customs and immigrations compliance | The Eurotunnel between the UK and France with streamlined customs and immigration procedures | |

| Pre-arrival documentation and compliance | The US-Canada Free and Secure Trade (FAST) programme* | |

| Technology integration | Single Window systems such as the Singapore National Single Window* | |

| Supply chain visibility | Blockchain technology can be used for real-time visibility into the movement of containers | |

| Integration with trusted trader programmes | Companies can participate in customs trade partnership programmes | |

| Cross-border collaboration platforms | The European Union's e-customs for collaboration among EU member states* | |

Source: PwC analysis

Adopting best practices for IMEC

Our report studied the existing corridors to look at the best practices for drawing investments for infrastructure development and policy synchronisation for cross-border collaboration which could be emulated by the IMEC.

The GMS economic corridors

In the GMS, the economic corridor approach was adopted in 1998 — one of the early examples of successful corridor operationalisation and a means of achieving connectivity. The GMS corridor programme planned infrastructure by considering the economic potential of specific geographic areas around transport links.26 The corridor development effort has so far been concentrated on three main corridors, namely the East–West Economic Corridor (EWEC), North–South Economic Corridor (NSEC) and Southern Economic Corridor (SEC).27 The corridors connect regions between the six countries that share the Mekong – Cambodia, China, Lao People’s Democratic Republic, Myanmar, Thailand and Vietnam.

The GMS programme’s activities can be grouped under three main categories:

- physical infrastructure development

- policy and institutional initiatives to maximise the benefits and opportunities from physical infrastructure

- initiatives to address common social development and environmental sustainability concerns.

Among the GMS’s flagship programmes are telecommunications, regional power interconnection and trading arrangements, facilitation of cross-border trade and investment, enhancement of private sector participation and competitiveness, development of human resources and skills competencies, and a strategic environment framework.28 For upcoming corridors, the GMS programme highlights the importance of infrastructure development in implementing a corridor approach for subregional development.

Over the past two decades, the GMS programme has achieved substantial success in improving regional connectivity through investments of USD 15 billion as well as more than 180 technical assistance projects. Considering the scale of the sub-region, the programme is a prime example of inter-regional cooperation.

Moreover, the GMS’ Economic Corridors Forum (ECF) and the GMS Business Forum (with representatives from all six member countries) provide useful insights into successful collaborative action for similar projects. The focus activities of the GMS Business Forum included strengthening transport linkages, improving access to finance for small and midsize enterprises (SMEs) and developing an efficient disaster risk management and monitoring system in the GMS.29

The South Asia Subregional Economic Cooperation (SASEC)

The SASEC programme brings together Bangladesh, Bhutan, India, Maldives, Myanmar, Nepal and Sri Lanka in a project-based partnership with an aim to promote regional prosperity by improving cross border connectivity, boosting trade among member countries and strengthening regional economic cooperation.

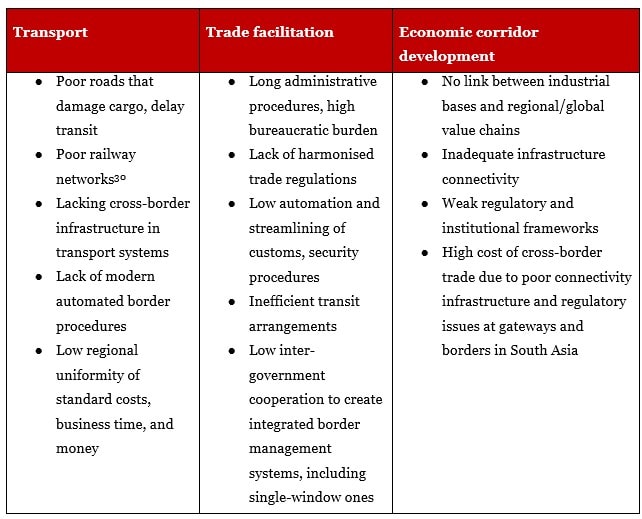

There are, however, challenges that SASEC must navigate due to the involvement of diverse transportation modes, each managed by different stakeholders and subject to varying laws and regulations specific to geographical locations.

To address the prevailing challenges, the SASEC Operational Plan 2016–2025 was devised to outline the strategic goals of the SASEC partnership, delineating operational priorities across the four primary sectors of the SASEC initiative. The plan is a comprehensive framework to navigate and strategically prioritise actions for enhanced collaboration and sector-specific advancements within the SASEC partnership.

Figure 5: Challenges faced by SASEC

Source: PwC analysis

Moreover, since its inception, SASEC countries have actively pursued bilateral and multilateral agreements to fulfill their strategic objectives and facilitate seamless trade, to help them achieve the overall objective, vision and policy harmonisation. The SASEC has established specialised forums on customs and electricity transmission to provide more focused technical support to national and bilateral efforts in these areas. The Bangladesh Bhutan India Nepal (BBIN) Motor Vehicles Agreement (MVA) is a good example of cross-border cooperation among the four countries to ease the movement of vehicles and goods transiting through these countries.31

The SASEC Operational Plan 2016–2025 document is also a good template to demonstrate how one can formulate solutions to infrastructure issues and challenges related to TNEC’s operationalisation. For instance, the document provides a clear roadmap outlining developmental priorities such as continued enhancement of road transport and other gateways like railways and ports. For trade facilitation, too, it provides guidance for developing a comprehensive approach to transport and trade facilitation that will expand the current focus from land-based to sea-borne facilitation which can complement the investments made in multimodal networks.32

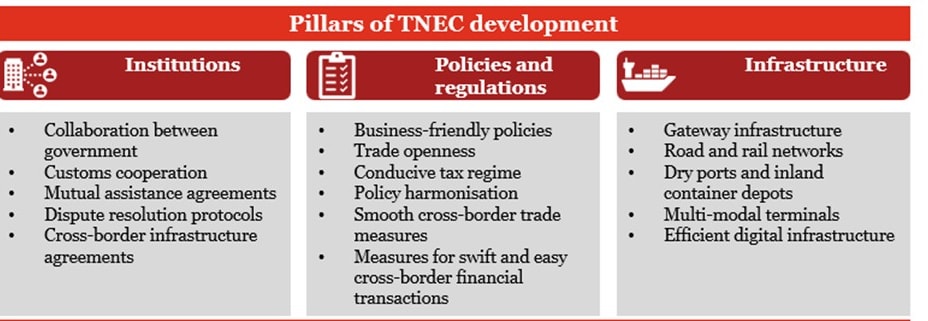

The road ahead: Bringing synergies among the three pillars of a successful corridor development strategy

The collaboration among the three pillars – institutions, policies and regulations, and infrastructure – of a corridor development strategy forms the backbone of TNECs. Robust institutional frameworks are key to a corridor’s success as they facilitate collaboration among governments, ensuring effective governance and dispute resolution. Moreover, harmonised policies and regulations create a conducive business environment, streamlining trade procedures and financial transactions. Standards, customs, time and cost spent at borders, institutions and governance, dispute settlement and safeguards are crucial elements for the smooth operationalisation of the physical infrastructure, and therefore, the corridor itself.

In developing and operationalising a corridor, it is important that critical transport infrastructure facilities (physical infrastructure, logistics networks and maintenance) be adequately developed. This ensures a seamless flow of goods and services within, across and beyond the corridor.

Figure 6: Three pillars of TNEC’s development

Source: PwC analysis

If fully realised, the benefits of the development of a consolidated trade route as proposed by the IMEC will include:

- reduced trade costs

- enhanced market access

- stimulation of investment opportunities between participating countries.

As elaborated earlier, the development plan for IMEC must draw lessons from the experiences of programmes such as the SASEC and the GMS since both projects highlight the importance of a comprehensive approach in addressing the key risks and challenges in the development of a TNEC.

Recognising the critical role of physical infrastructure, concerted efforts around investments into the development and maintenance of essential transport facilities is imperative as this ensures an uninterrupted flow of goods and services and highlights capacity redundancies which can be reduced or eliminated. Additionally, a laser focus on the institutional and policy aspects addressed earlier in Section 3 could help overcome bureaucratic hurdles and enhance operational efficiency. Proactive measures should also be taken to mitigate the impact of regional conflicts, which pose significant threats to the stability and viability of TNECs. Prioritising these areas and fostering regional cooperation could help pave the way for developing resilient and sustainable TNECs, and for driving inclusive growth and prosperity across borders.

Also contributing to this article were Bipasha, Stuti Toshi, Ashrith Mallipeddi, Shashank Dhinghra, Shivanshu Sharma and Utkarsh Pradip Baviskar.

Sources

- As per the United Nations Conference on Trade and Development (UNCTAD), corridors are “strategic mechanism that allow for a coordinated and integrated approach to transport, transit, trade facilitation…at the regional/ subregional/ national level”. When such corridors run across nations, they are referred to as transnational economic corridors (TNECs).

- From East to West, India is making a big push for transnational transport corridors. Here’s why

- Chabahar port opens door for India to Central Asia, giving an edge over China

- Why India’s takeover of Chabahar port is a big deal

- Greater Mekong Subregion. Economic Corridors in the Greater Mekong Subregion

- SASEC

- https://news.gov.bc.ca/releases/2017JTT0161-002032

- Melecky, M. et al (2018). Wider Economic Benefits of Transport Corridors: A Policy Framework and Illustrative Application to the China-Pakistan Economic Corridor, World Bank. Retrieved from Munich Personal RePEc Archive (MPRA Paper No. 85077)

- ADB (2005). Competitiveness. Connectivity. Community: Connecting Nations, Linking People

- QUESTION NO-700 INDIA-MIDDLE EAST-EUROPE ECONOMIC CORRIDOR

- LS-USQ-No.715-dt.-07.02.2024.pdf (commerce.gov.in)

- https://www.mea.gov.in/rajya-sabha.htm?dtl/37570/QUESTION+NO700+INDIAMIDDLE+EASTEUROPE+ECONOMIC+CORRIDOR

- India’s Exports To GCC Countries Grew By 44% In 2021-22: FIEO

- Embassy of India (Belgium, Luxembourg & European Union). India EU trade statistics (2020)

- Press Information Bureau (2022). India-Gulf Cooperation Council (GCC) decide to pursue resumption of FTA Negotiations

- Ibid

- Press Information Bureau (2022). India-Gulf Cooperation Council (GCC) decide to pursue resumption of FTA Negotiations

- Embassy of India (Belgium, Luxembourg & European Union). India EU trade statistics (2020)

- The World Bank (2021). International Development Association Project Appraisal Document For Proposed Credits & Proposed Grants For A Lome-Ouagadougou-Niamey Economic Corridor Project

- BIMP-EAGA (2023). ‘Mindanao: Land of Peace, Plenty, and Beauty Is Ready for Investments’

- The World Bank (2021). ‘Project Appraisal Document On A Proposed Credit In The Amount Of SDR 49.5 Million To The Republic Of Djibouti For A Horn Of Africa Initiative: Djibouti Regional Economic Corridor (Report No: PAD4404)

- Ibid

- The World Bank (2021). International Development Association Project Appraisal Document For Proposed Credits & Proposed Grants For A Lome-Ouagadougou-Niamey Economic Corridor Project

- Ibid

- The World Bank (2021). International Development Association Project Appraisal Document For Proposed Credits & Proposed Grants For A Lome-Ouagadougou-Niamey Economic Corridor Project

- The World Bank (2021). ‘Project Appraisal Document On A Proposed Credit In The Amount Of SDR 49.5 Million To The Republic Of Djibouti For A Horn Of Africa Initiative: Djibouti Regional Economic Corridor (Report No: PAD4404)

- The World Bank (2021). ‘Project Appraisal Document On A Proposed Credit In The Amount Of SDR 49.5 Million To The Republic Of Djibouti For A Horn Of Africa Initiative: Djibouti Regional Economic Corridor (Report No: PAD4404)

- The UN finds that disputes and grievances over resource use can “contribute to violent conflict when they overlap with other factors, such as high levels of inequity, poverty”.

- ADB (2013). What is Economic Corridor Development and What Can It Achieve in Asia’s Subregions?, ADB Working Paper Series (No. 117).

- Ibid.

- ADB (2005).Competitiveness. Connectivity. Community: Connecting Nations, Linking People

- Asia Pacific Trade Facilitation Forum 2017

- Issues include insufficient loop lengths, missing shorter links in border areas, and insufficient gauge conversion programmes.

- Press Information Bureau (2016). Speech of the Secretary, Economic Affairs at the South Asia Subregional Economic Cooperation (SASEC) 2025 – Second Regional Consultation Workshop

- SASEC & Asian Development Bank (2016). South Asia Subregional Economic Cooperation Operational Plan 2016–2025.