Our team worked with industry partners in real estate and recruitment to set up the GCC, benchmarked compensation for the client in accordance with industry standards, and offered recruitment support and payroll management services.

Outcome: The client was able to find a one-stop solution for an end-to-end GCC setup that capitalised on local market knowledge.

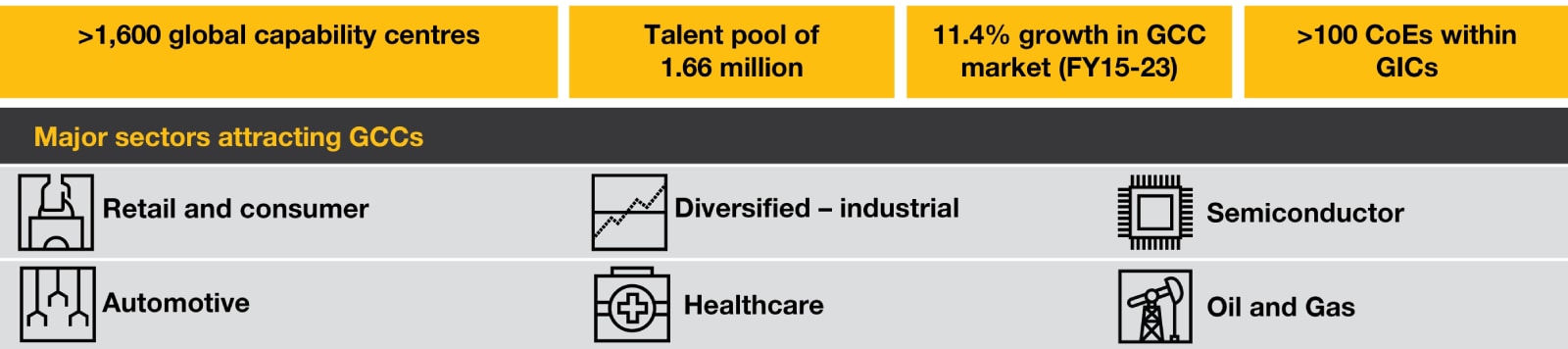

In the last couple of years, more than 150 multinationals have set up their GCCs in India.1 Today, India is at the heart of the GCC growth momentum, but its offshoring story dates back to 1985 when Texas Instruments set up its office in Bengaluru.2 In the 1990s, other companies followed suit with many airlines and technology companies starting their operations in India. Originally called ‘captives centres’, they have, over the years, come to be addressed as GICs (global in-house centres) or GCCs. In 2012, there were about 760 GICs operating out of India. In 2016, that number went over 1,000. Today, India houses over 1,600 GCCs. By 2025, the country is poised to have 1,900 such centres with the market size touching USD 60 billion.3

While these GCCs have been performing a variety of functions for their parent organisations and have grown significantly in number, headcount and stature, the needle has moved considerably over the past three decades or so. Consistent performance and a commitment to shared goals have helped GCCs build trust with all their stakeholders including their parent companies for long-term success and growth. In fact, silos have been broken, global roles are being anchored from the India offices and work has been flowing seamlessly across borders.

Today, GCCs operating across all service lines – IT services, BPO, engineering services and software product development – have gone up the value chain by delivering complex work requiring significant understanding of business context and imperatives. They have made a mark in key industry verticals such as banking and financial services, software, telecom and semiconductor with growing concentration in aerospace, automotive, oil and gas, healthcare and pharma.

GCCs in India: The journey in numbers