Download the report

Our Take

Charting a roadmap for strategic investments to power open innovation

![]() 21-minute read

21-minute read

Corporate venture capital (CVC) funding participation in startups is increasing at a rate of 7% year-on-year in India.1 But most of these units are risk-averse and lack tailored roadmaps. Amarjeet Makhija and Vishnupriya Sengupta explore the CVC landscape in India and explain why they are a compelling proposition to tap into open innovation.

Overview: The promise of open innovation

The Indian economy, growing steadily amid a global slowdown, is on a transformative path. Its thriving startup ecosystem, the third largest in the world,2 is the linchpin of its unique growth journey. India’s startups, considered major innovation engines, are often on the radar of venture capital (VC) firms, angel investors and family offices.

More recently, corporate venture capital (CVC) units have joined the bandwagon. CVCs are investment vehicles formed by a corporate entity to invest in multiple startups with strategic goals in mind including, but not limited to, gaining access to innovative products, technologies, services or uncharted territories and building sustainable partnerships.

In February this year, the strategic investment arm of a multinational technology company received yet another round of funding to accelerate the company’s investments in early to mid-stage startups to fuel technology innovation.

These CVCs differ from traditional investors including VCs in one key aspect – they prioritise strategic benefits over financial returns (Table 1). For them, the promise of open innovation is the pivot, as it gives major players access to innovation outside their own research and development (R&D) units, while also ensuring that their business models aren’t disrupted by new, more innovative competitors. This helps a company make its value chain resilient to external shocks and ensures that the company faces minimal upheaval from technological disruptions.

Table 1: CVCs versus VCs

Sources: PwC analysis, The Economic Times, View: (C)VC in mind, strategy at heart; Inc42, What Is Corporate Venture Capital (CVC)? Here’s All You Need to Know

According to PwC’s 28th Annual Global CEO Survey,3 over the next three years, CEOs expect more pressure from technology, climate change and nearly every other megatrend affecting global business than they experienced over the previous five years.4

In such a scenario, CVC units can offer a solution. Adopting a collaborative approach when investing in startups can result in ‘co-developing’ an innovation from an early stage. A CVC provides infrastructural support and a sandbox environment to a startup where it can develop and test proofs of concept (PoCs). The CVC’s corporate parent then reaps the benefits when that technology matures, gaining a competitive edge among peers.

For startups, the appeal of CVCs goes beyond funding. They get to leverage the resources of the corporate investor and gain access to a broader market and customer base as well as fresh sales and distribution channels. Their workforce gets exposure to technological know-how at the innovation hub of the corporate. Moreover, association with a well-known brand affords them enhanced visibility, ultimately paving the way for more funding in the future.

Figure 1: Benefits unlocked by CVCs

Source: PwC analysis

However, as the first step, it is important to find the best option for a company’s open innovation strategy. This entails an understanding of the different open innovation vehicles that may be leveraged to tap into the power of different startup maturities. Following are some of these vehicles:

CVC

This involves acquiring minority equity (non-controlling) stakes in startups to gain strategic and financial gains.

Accelerator

This is a programme that supports external early-stage startups after assessing the product-market fit (PMF), and then helps it grow fast. The company later integrates the startup’s technologies at mutually agreed-upon terms.

Incubator

Incubators provide early-stage startups with resources and mentorship. Incubator programmes involve actively brainstorming ideas with entrepreneurs from the initial stages and then helping them conceptualise business models.

Venture client

A venture client relationship entails a company purchasing products or services from a startup, gaining low-cost access to innovative technology and then supporting the startup’s growth as an early adopter.

Venture studio (venture building)

This involves a corporate innovation tool that uses a combination of internal resources and external partnerships to ideate and launch new startups, often by matching them with experienced founders and providing guidance through a successful launch.

Partnerships and joint ventures

This entails a collaborative initiative or an entirely new company built between the corporate entity and startup(s), to enable joint design of products and services in a specific sector or industry.

Venture mergers and acquisitions (M&A)

This involves acquiring majority equity (controlling) stakes of very late-stage startups to gain market share.

Figure 2: Overview of different corporate venturing vehicles by startup maturity

CVCs and the funding landscape

Globally, corporate spending in startups has increased exponentially since 2018 and reached a 20-year high of USD 73.1 billion in 2020 – the year of the COVID-19 pandemic.5 Reflecting a similar pattern, the funding and deals landscape in India peaked around the COVID-19 pandemic, as shown in Figure 3. Between 2019 and 2024, the highest amount of funding by CVC units and other investors was recorded in the years of the pandemic – 2020 – USD 13.4 billion – and 2021 – USD 18.4 billion, while the highest deal count was witnessed in 2021 and 2022 at 1,068 and 1,072 respectively.6 It’s important to note that while the deal count was at its highest in 2022, the funding amount hit the lowest amount per deal in the same year. In 2024, there was a strong rebound in investment activity – funding increased compared to 2023 and the funding amount per deal was comparable to 2020 levels.

Figure 3: Funding and deal count (2019-24)

Source: PwC analysis of Traxcn data

Note: 'Other investors' refers to corporates that are investing in startups using vehicles other than CVCs.

In terms of sectors, the retail and consumer (R&C) sector received the maximum funding at USD 21.54 billion as well as the highest number of deals at 1,200+ over the last six years from CVCs as well as other investors.7 This was followed by the financial services and products sector, which secured USD 12.84 billion in funding and saw 636 deals.8

Growth in sector-specific CVC funds, particularly in technology-driven sectors, indicates that companies are setting up CVCs with a clear focus on areas where they see high potential for disruption and innovation.

The global trend of CVC funding peaking rather than plunging during the pandemic indicates that companies worldwide no longer see funding startups with the intention to innovate as a discretionary spend.9 Rather, it is now perceived as an urgent necessity and companies would likely double down on such investments during an upheaval rather than cut back.10

The story is somewhat different in India. While CVC funding participation in startups is increasing at a rate of 7% year-on-year,11 most of them are risk-averse and lack uniquely tailored roadmaps. The country’s CVC units follow a similar pattern as Indian family offices – i.e relying on VCs for evaluation and due diligence of startups prior to investing.

Unlike global CVCs, the investments are primarily driven by financial returns rather than strategic adjacencies, mirroring the VC ecosystem. Over time, CVCs in India may need to shift focus from financial goals to strategic ones like their global counterparts.

Besides, Indian CVCs are typically part of a consortium. As CVC investments are still at a nascent stage and evolving, they aren’t done independently and are often made by taking a cue from institutional investors who conduct a thorough due diligence prior to investing.

Moreover, like their global counterparts, CVCs could consider impact investment opportunities that help diversify their portfolio to reduce the overall risk profile and meet corporate social responsibility objectives. A case in point is that of a Japanese automotive giant that recently formed an India-based impact CVC arm. The objective was to focus on social-impact startups in India, offering equity funding and accelerator programmes.

Also, currently, most CVC activities in India are restricted to major cities, unlike VCs, which are making investment inroads into startups in tier-2 and tier-3 cities. According to PwC India’s analysis, over the last six years in India, the lion’s share of funding (CVCs and others) was made in three cities: Bengaluru, which saw the maximum amount of funds invested at USD 21.1 billion, followed by Mumbai at USD 18.4 billion, and the national capital region (NCR) at USD 17.1 billion.12 These three hubs also witnessed the maximum number of deals.13

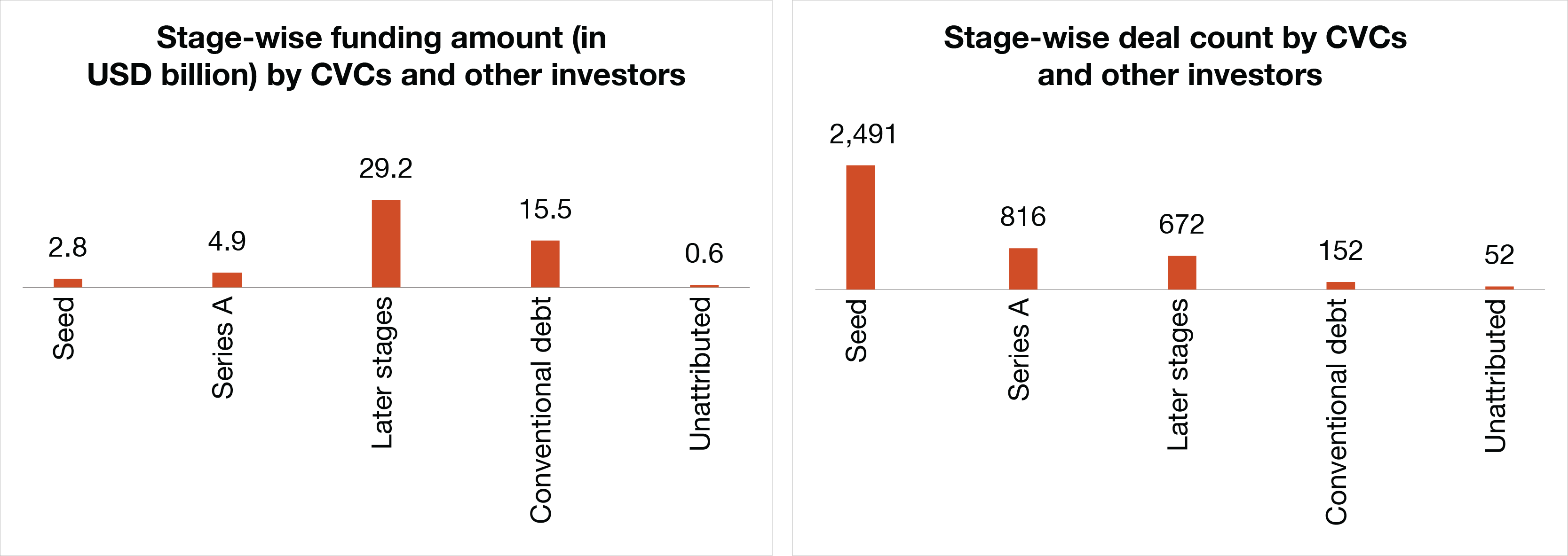

Apart from the relatively low number of CVCs in the country, the fact that most of them invest in startups only at a later stage also points to their risk-averse nature. In fact, most of the funding in the country, including by CVCs, occurs at a later stage (Figure 4). Even though the maximum number of transactions by CVCs and other investors (2,491) occurred at the seed stage over the last six years, the majority of funding in that period (USD 29.21 billion) was disbursed only in the later stages.

Figure 4: Round-wise dispersion of funding (2019-24)

Source: PwC analysis of Traxcn data

Note: 'Other investors' refers to corporates that are investing in startups using vehicles other than CVCs.

Our Take

Forging a symbiotic relationship

The time is now for CVCs in India to adopt a proactive and strategic approach, prioritising technology investments for tapping into open innovation and accessing innovative solutions developed by the R&D cells of startups to stay competitive and access new markets. As the ecosystem matures, there is significant potential for CVC growth by way of investing in startups that can provide synergies with existing business units, enhance digital transformation efforts, or help in sustainability initiatives.

It may also work to a CVC’s advantage to consider putting its depth of commercial knowledge and expertise to good use. The recently set up CVC arm of an airline, for instance, aims to invest in startups working on cutting-edge innovations in the aviation sector as well as in consumer startups working in sectors that serve as touchpoints in passenger journeys, such as travel, lifestyle and hospitality.14

A well-oiled CVC unit, with the right startup portfolio, can make a company’s value chain resistant to technological disruption with access to open innovation. Thus, for CVCs to reach their full potential, it’s crucial to lay the foundation from the outset and have the right roadmap in place. For companies to ensure that the establishment of their CVC unit is successful, PwC India proposes a strategic roadmap that stands on the three pillars of:

Strategy

- Goals and objectives: By conducting a detailed assessment and gaining a deep understanding of the company's position in the local market, suitable goals and objectives have to be defined, aligned with the overall topline corporate strategy. On this basis, a suitable vision and mission statement for the CVC fund can be formulated.

- Investment mandate and strategy: Based on its overall defined mission and by benchmarking against global best-in-class competitors, the CVC unit must derive its investment mandate and strategy. This could be done by analysing the financial capabilities of the corporate, the size of the overall target market and often by considering the yearly investment budget for annual R&D spend. The CVC target market could be defined by geography, industry sector and the development stage of startups.

- Areas of investment: Within the defined industry sectors, it is important to understand the investment ecosystem, including upcoming technologies and business models. This understanding allows a CVC unit to set clear guidelines for the structure and operations.

Structure

- Governance regulations and compliance: The company needs to derive the right governance structure for its CVC unit by defining the appropriate parties and stakeholders as decision makers.

- Investment process: The right investment process aligned with the company’s vision and other dimensions needs to be determined and accordingly an authorisation matrix that is suited to it is to be defined.

Operations

- Team capability and setup: Depending on the selected investment mandate and annual investment budget, a team with the right skill sets, functions, backgrounds and size has to be set up.

- Internal and external interactions plus linkages

- BU and portfolio engagement: One key determinant of success for a CVC is the ability to create synergies between portfolio companies and other business units (BUs) of the corporation. So, it is essential to define dedicated and responsible employees in different BUs which support value creation with the portfolio startups.

- Reporting and monitoring: Based on financial and qualitative key performance indicators (KPIs), performance needs to be tracked and aligned with the predefined KPIs. As portfolio sizes of CVCs increase, the use of appropriate enterprise resource planning (ERP) and customer relationship management (CRM) systems becomes critical.

- Budgeting and procurement: To derive annual budgets, including investments and operational costs, it is necessary to identify all cost positions when setting up a CVC.

- Metrics and incentives: Based on the measured KPIs, incentives have to be developed not only for CVC fund members but also for members of other BUs, who must be incentivised to collaborate.

- Ecosystem linkages: It would also help to develop the ability to leverage, incorporate and network within the wider VC ecosystem in order to get access to interesting investment plus collaboration opportunities. This would also enable the CVC unit to help portfolio startups beyond the abilities of its corporate entities.

- BU and portfolio engagement: One key determinant of success for a CVC is the ability to create synergies between portfolio companies and other business units (BUs) of the corporation. So, it is essential to define dedicated and responsible employees in different BUs which support value creation with the portfolio startups.

The establishment of a structured corporate venturing approach, embedded in an enabling investment strategy and aligned with the overall company vision, is an important tool for companies to foster strategic innovation, gain exposure to new businesses, and remain viable and resilient in the long-term. It is therefore crucial for underlying strategic and financial investment motivations to clearly analyse and define the operational tie of the investment engagement to the overall business ambition of the corporation. This link to the operational capability is defined by the integration of the startup’s activities into the investing corporation’s value chain. A case in point is the CVC unit of an American chipmaker giant, which invests in early-stage startups in sectors that shape the future of computing: silicon, frontier, devices and cloud.

The best performing CVCs in the market have an individually adapted balance well-suited to the parent companies’ capabilities, industry specifics, stakeholder requirements and geographical location of the market they operate in.

Select recommendations

India offers abundant opportunities for corporates to embrace innovation and new technologies. The country is home to over 100 unicorns15 and more than 240 GenAI startups.16 The Indian government has been persistent in its efforts to boost the country’s startup ecosystem. CVCs, in turn, can unlock fast-paced innovation by leveraging the country’s startup ecosystem. Here are a few select recommendations:

Going forward

Even as CVCs in India are at the initial stages of evolution, the country’s technology-ready talent pool and rapidly growing startup landscape offer promising advantages to early movers. CVCs, which usually acquire non-controlling stakes in startups and take a collaborative approach to developing innovative offerings, promise a flexible and cost-effective alternative. They are also more effective, given that CVC deals are tailored to a company’s specific needs at a particular time and CVC units closely monitor the startup’s progress.

Indian CVCs, which currently lean towards investing in later stages, can benefit significantly from investing in early stages by gaining exclusive access to disruptive technology that could, in time, give them a competitive edge. By using the framework that works best for specific deals and by factoring in all challenges, Indian CVCs can unfold a new chapter of open collaborative innovation.

Contact us

Amarjeet Makhija

Partner and Leader, Startups and Unicorn Practice, PwC India