Download the full report

Intelligent reinvention for tomorrow

28th Annual Global CEO Survey: India perspective

Foreword

2024 foregrounded artificial intelligence (AI) that can work magic in the boardroom as well as the living room, on the shopfloor as well as the dancefloor. Love it or hate it, organisations can no longer afford to ignore this non-sentient agent which is creating new value pools and compelling businesses to either shape up or ship out. It is no more about ‘playing catchup’, but rather about remaining economically viable in the face of current operational and long-term strategic challenges.

And then there is the threat of climate change – with 2024 being declared the hottest year on record,1 unseating 2023 with temperatures that were a notch higher. In PwC’s 28th Annual Global CEO Survey: India perspective, CEOs weighed in on these two defining megatrends - technological disruption and climate change - whose impact goes beyond the realms of business.

The survey conducted in October and early November 2024 polled 4,701 CEOs across 109 countries, of which 76 were from India.

The magnitude of impact of these external forces on businesses is unprecedented. Furthermore, if climate change – which has been a recurring theme over the past few years – is to be addressed, AI has to be technically, organisationally and operationally scaled up, and at speed. This underlines the need for businesses to reinvent intelligently and unlock new sources of value to address the interconnected forces of climate change and AI.

As the survey indicates, CEOs are cognisant of the fact that their organisations are being pushed to the edge. The report, therefore, examines in detail how these two megatrends are poised to shape the future of business and society, and fuel intelligent reinvention for business viability in the decade to come. Like every year, it also provides insightful data on other macro and micro issues that influence business and organisational dynamics.

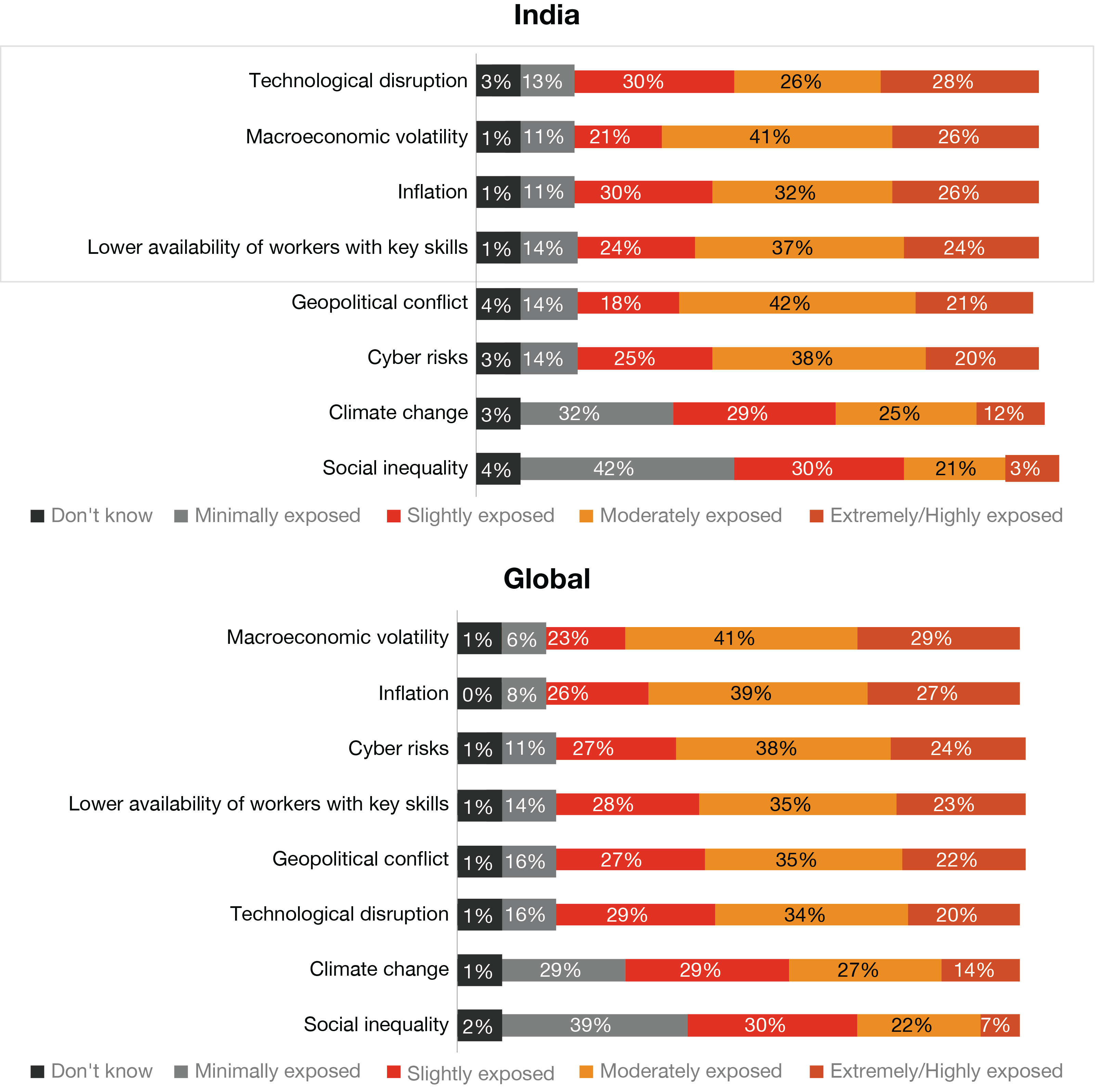

India CEOs, for instance, called out technological disruption as the top threat they were highly exposed to, followed by macroeconomic volatility and inflation. Global CEOs, however, indicated they were highly exposed to macroeconomic volatility, inflation and cyber risks, and not so much to technological disruption.

As in 2023, India CEOs, compared to their global peers, were yet again more optimistic about their country's economic growth and their companies' revenue growth. They were also emphatic about correct strategic choices being the most important determinant of their companies’ economic viability for more than 10 years. Those strategic choices have, in some instances, resulted in creating new value in motion by leveraging AI as a value driver and climate change action as a value pool.

Moreover, with technological disruption being a major concern for India CEOs, they are keen to embed the value in motion principle across products and services they design, engineer and deliver. Our report substantiates this point. Product and service innovation is the top reinvention action taken to a large/very large extent by India CEOs over the last five years, followed by targeting new routes to market and a new customer base.

Interestingly, over the last five years, four in ten India CEOs – similar to their global counterparts – have already ventured into other industries, generating 1–20% of their revenue from sectors such as consumer, industrial manufacturing, and aerospace and defence. Given India’s vibrant consumer market with its range of demands, segments and requirements, government initiatives such as Make in India and Production-Linked Incentive (PLI) schemes, the country’s allure as a key player in the global supply chain, and trade agreements, the choice of industries by India CEOs comes as no surprise.

The job market too seems favourable, as 68% of India CEOs (as against 57% last year) are likely to increase their headcount in the next 12 months. Disruptive technology, therefore, appears to have spelt out the need for a larger talent pool with relevant skills, even though Generative AI (GenAI) has resulted in productivity gains over the last one year.

In view of these findings, the report sheds light on how businesses can operate in this dynamic environment through a ‘sensing-seizing’ opportunity loop – identifying issues (sensing) and orchestrating resources to maintain and create new sources of value (seizing). It further outlines five reinvention actions that CEOs could take to build the future today and enable the nation to develop its growth narrative while navigating global crests and troughs.

We hope you find the report engaging and are able to derive actionable insights from it.

Sanjeev Krishan

Chairperson, PwC in India

Vivek Prasad

Markets Leader, PwC India

Opportunities amidst headwinds

The future is now – the reason why CEOs feel the need to weigh in on it. For India CEOs, in particular, there is much to look forward to – the country aims to become the world’s third-largest economy and hit USD 1 trillion in merchandise exports by 2030,2 achieve Viksit Bharat status by 2047, and reach net-zero emissions by 2070.3 A Viksit Bharat would entail a prosperous and inclusive society with a high GDP, encompassing advancements in technology, education, healthcare, infrastructure and social equity.

With India on an upward trajectory, India CEOs’ optimism about the country’s growth prospects persists for the second consecutive year. This is notwithstanding the threats they perceive in terms of global headwinds, macroeconomic volatility, inflation, and low availability of workers with key skills. PwC’s 28th Annual Global CEO Survey: India perspective reveals that 87% of India CEOs are upbeat about the country’s economic growth, while 74% are confident about their respective companies’ revenue growth.

Data substantiates this optimism. India remains the fastest-growing major global economy4 and its GDP growth has averaged 8.3% over the last three years, demonstrating resilience despite global uncertainties. While economic growth had slowed to 5.4% in the July–September quarter of 2024,5 forecasts for FY25 remain positive, with India’s GDP expected to grow at 6.6%6 while staying relatively insulated from global economic shocks. 7 In its latest India Outlook, S&P Global Ratings predicts that the Indian economy is set for resilient growth in 2025 – pegged at 6.7% and 6.8% for FY 2025–26 and FY 2026–27 respectively – on the back of strong consumption, steady services sector growth, and ongoing investment in infrastructure.8 According to the ratings agency, higher labour force participation, infrastructure and technology improvement, and stronger public and household balance sheets can support economic growth in India.

Businesses have undoubtedly benefited by putting the pedal to the industrial metal with government initiatives such as Make in India and Production-Linked Incentive (PLI) schemes that have created employment opportunities and given a fillip to the manufacturing industry. Electronics production in India has surged to INR 9.52 lakh crore, growing at an annual compounded rate of 17.4% from INR 1.9 lakh crore in 2014–15.9 The Semiconductor Incentive Scheme 2.0 that aims to develop the entire semiconductor value chain, encouraging component companies, raw material suppliers, and chip packaging units to set up operations in India10 is poised to position the country at the forefront of the global semiconductor industry.

Disruptive technology, particularly AI, is also set to empower India at scale. In 2024, AI made headlines by virtue of its expanding influence. It impacted businesses, struck a chord with consumers, and blurred lines between workspace and personal space. GenAI, India CEOs contend, has upped productivity by over 50% for both employees and CEOs and, more importantly, translated into increased revenue in the last 12 months.

Many India CEOs are aggressively integrating or set to integrate AI and GenAI into their company’s business products and processes over the next three years – not by choice but by compulsion. AI is, in fact, the engine of product and process reinvention, a consistent theme for India CEOs for the last five years.

According to the survey:

With consumer expectations changing rapidly and a shift towards greener products, the nature of manufacturing too is changing to factor in not only the reusability and recyclability of a product, but also the creation of digital replicas and simulations of supply chains in order to build more redundancies that can future-proof operations and ensure business continuity.

Sanjiv Puri, Chairman and Managing Director, ITC Limited

“We live in a very dynamic and uncertain world, given the challenges of climate change, geoeconomics and geopolitics, reglobalisation, among others. Organisations must be nimble and consumer-centric, and stay ahead of the curve by investing in the core levers of digital transformation, innovation, supply chain management, efficiency, resilience and sustainability.”

Key India findings

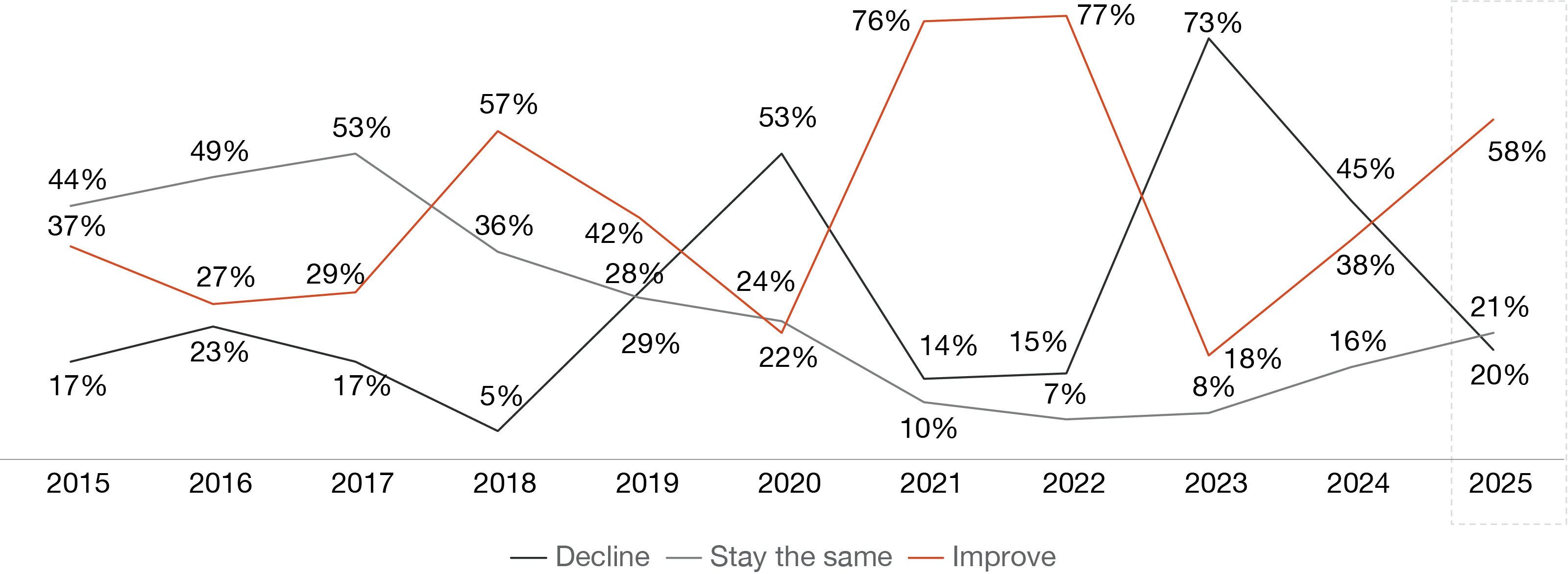

Optimism about global economic growth has continued to increase from a low point in 2023

Global CEOs’ expectations for global economic growth in the next 12 months

Nearly 87% of India CEOs are optimistic about domestic growth, compared to 57% globally. Globally too, optimism has risen, with 58% expecting increased growth in the next year, up from 38% last year and 18% two years ago.

The most common reinvention actions taken by four in ten India CEOs over the last five years are developing innovative products and services and targeting new routes to markets – for example, selling directly to consumers rather than through intermediaries.

One-third of India CEOs noted revenue increases from climate-friendly investments over the past five years. In addition, more than 60% said these investments had either reduced cost or had no significant cost impact.

Technological disruption remains top of mind for India CEOs, followed by macroeconomic volatility and inflation, and low availability of skilled labour. Disruptive technology was also listed by India CEOs who believe their companies will be viable for 10 years or less as one of the top two factors influencing their companies’ low economic viability.

Businesses across the world have witnessed efficiency gains and increased revenue with GenAI in the last 12 months. However, while 51% of India CEOs are positive about GenAI’s impact on profitability, trust remains an issue, with only a third of global and India CEOs having high trust in AI’s integration into business processes.

For the second year in a row, India continues to be among the top five investment destinations globally over the next 12 months for global CEOs looking to grow the revenue of their companies.

Four in ten CEOs in India and across the world said their companies have started to compete in at least one new sector/industry in the last five years. Of these, 50% of India CEOs (as against 58% globally) stated that 1–20% of their revenue came from entering a new sector or industry in the last five years.

Sustained growth drives sustained confidence

While 86% of India CEOs had agreed last year that the Indian economy would improve over the next 12 months, there is a 1% increase this year, with 87% of India CEOs expressing optimism about their territory’s growth compared to 57% globally.

Rishad Premji, Executive Chairman, Wipro Limited

“I think India has two fundamental advantages that can be leveraged in the global scenario. First, it’s probably the largest consumption economy. Second, it is and can continue to truly be the skill capital of the world.”

rishad premji

The confidence, however, seems skewed towards India’s prospects, as only 49% of India CEOs are buoyant about overall global economic growth as against 58% of global CEOs. Globally, however, CEOs’ optimism has improved from last year, with 57% now expecting growth in their territories, up from 44% previously.

87% of India CEOs compared to 57% of global CEOs are optimistic about their territory’s growth

Q: How do you believe economic growth (i.e. GDP) will change, if at all, over the next 12 months in the global economy/your territory?

Businesses the world over also have higher revenue expectations over the next year and three years on. And again, India CEOs evince greater optimism compared to their global counterparts about their companies’ revenue growth prospects both in the short term (57% as against 38%) and in the long term (74% as against 53%).

India CEOs are more confident than global CEOs about their companies’ prospects for revenue growth in the next year and three years on

Q: How confident are you about your company’s prospects for revenue growth over the next 12 months/3 years?

Expectations for higher revenue growth are in turn prompting companies to increase hiring, with 68% of India CEOs planning to hire more staff, compared to 57% last year. Globally, 42% of CEOs will increase headcount in the next 12 months, and this is perhaps more on account of rather than in spite of AI.

India’s robust economic growth, improved ease of doing business (EoDB), infrastructural developments, and its young and skilled workforce continue to attract investors. Consequently, the country remains among the top five territories (along with the US, the UK, Germany and Chinese Mainland) for global CEOs’ investment plans in the next 12 months.

India remains among the top five territories global CEOs would like to invest in. India CEOs would like to invest in the US, UAE and Germany.

More India CEOs are concerned about the viability of their businesses this year

Technological advancements and evolving market demands, coupled with sustainability pressures, have brought home the need for businesses to reinvent. So, although a sense of optimism surrounds India’s economic growth and the potential for companies’ revenue growth, a sizeable section of CEOs have underlying doubts about the long-term viability of their businesses. A staggering 42% of global as well as India CEOs believe their companies would be economically viable only for 10 years or less on their current trajectory.

It is interesting to note that this year, more India CEOs are concerned about the economic viability of their businesses compared to the previous year. In 2023, nearly 60% of India CEOs were confident that their companies would be viable for more than 10 years on their current path. But in 2024, there has been a five percentage point dip, and a larger number of India CEOs now feel the need to recalibrate their decision-making processes and press the intelligent reinvention reset button to survive in the marketplace.

Sanjiv Puri, Chairman and Managing Director, ITC Limited

“Our philosophy of growth is premised on three axes. First – scale up the core. This is par for the course for everything in India because there is so much more headroom to grow given the levels of penetration and potential for increase in per capita incomes. The second axis is looking at the adjacencies the core can address, while the third is leveraging institutional strengths and factoring in the megatrends of digital transformation and sustainability, identifying the new growth levers that could be seeded for the future.”

54% of India CEOs (as against 59% in 2023) believe their companies would be viable for more than 10 years on their current path

Q: If your company continues running on its current path, for how long do you think your business will be economically viable?

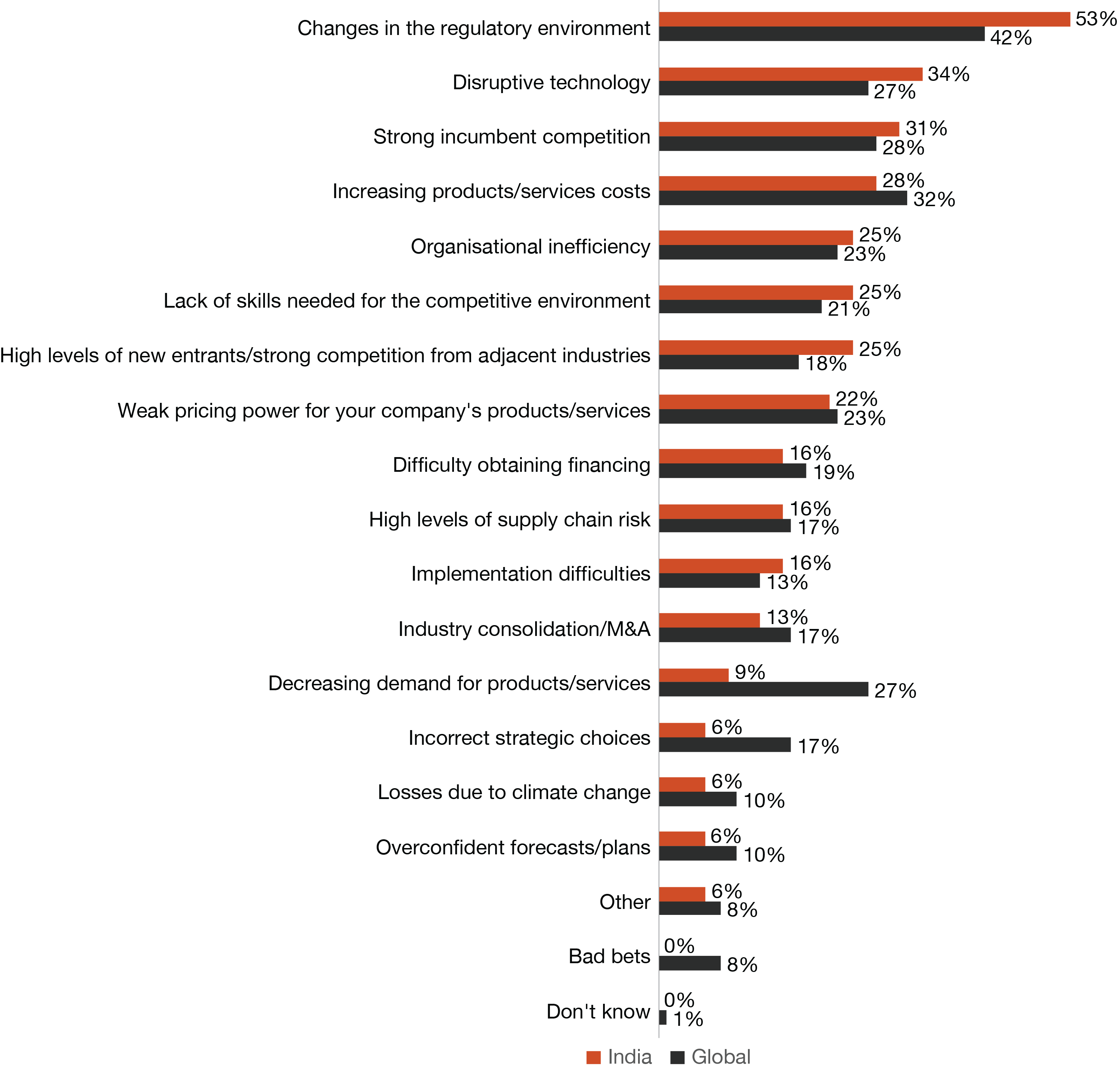

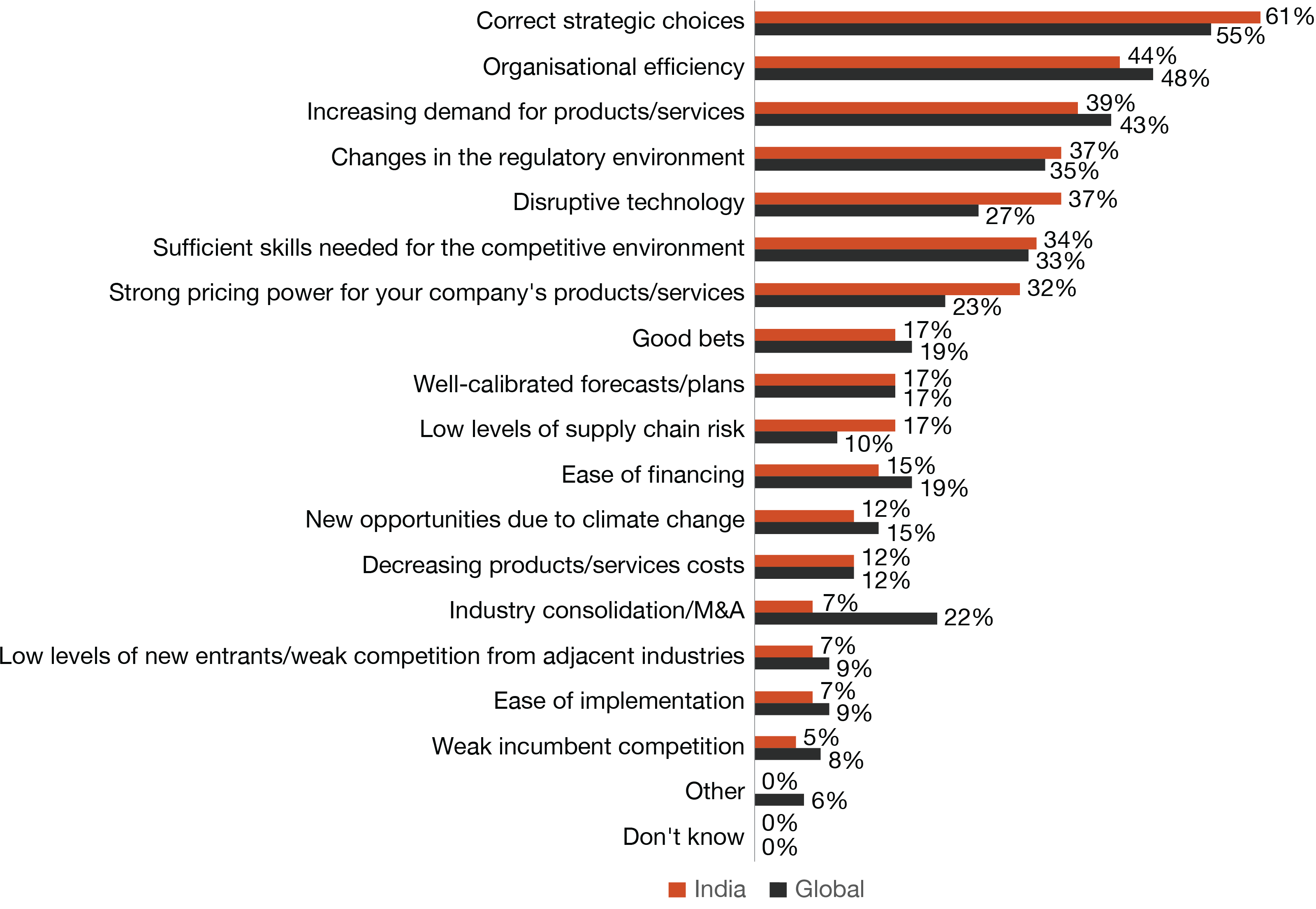

For both global and India CEOs who believed their companies would be viable only for 10 years or less, changes in the regulatory environment was the top factor most influencing their companies’ low economic viability. While 53% of India CEOs were most concerned about changes in the regulatory environment affecting company viability, the global percentage was lower at 42%.

Regulatory challenges that often arise from the need to balance innovation, consumer protection, privacy, and national interests can significantly impact the business viability of companies both in India and abroad. The Digital Personal Data Protection Act as much as the European Union’s (EU) General Data Protection Regulation with their data privacy standards could pose a hindrance with their data privacy standards. Sectoral regulatory frameworks and anti-trust and competition laws, as well as the Carbon Border Adjustment Mechanism proposed by the EU to address carbon leakage, provide cause for concern.

In addition, 34% of India CEOs listed disruptive technology as the second factor most influencing their companies’ low viability, followed by strong incumbent competition (31%). Global CEOs, however, expressed more concern about increasing costs of products and services (32%), followed by strong incumbent competition (28%) and disruptive technology (27%).

Changes in regulatory environment and strong incumbent competition are listed by both global and India CEOs among the top three factors that will most influence the economic viability of their companies

Q: What factors do you believe will most influence your company's economic viability? Asked to those with viability of 10 years or less.

For global and India CEOs who stated that their companies would be viable for 10 years or more, the key factors most influencing the high economic viability of their organisations were correct strategic choices, organisational efficiency, and increasing demand for goods and services. The correlation between the three factors is undeniable. Outcome-driven strategic choices can result in a higher profit margin, but these choices call for organisational efficiency and a spike in demand for goods and services, without which the strategic choices are limited. India CEOs (37%) also considered changes in the regulatory environment and disruptive technology as pivotal factors influencing a company’s high viability.

For companies worldwide and in India with viability of more than 10 years, correct strategic choices and organisational efficiency are key

Q: What factors do you believe will most influence your company’s economic viability?

This is understandable. Regulatory simplifications, among other factors, enabled India to improve its ranking on the World Bank’s EoDB ranking to 63 in 2020 from 142 in 2014. Simplification of laws and a liberal foreign direct investment (FDI) and foreign trade regime facilitated business activities, while disruptive technology prompted businesses to leverage this opportunity to reconfigure some of their functions for sustenance and building trust with stakeholders. While a favourable regulatory environment can foster innovation, attract investment and infuse growth, companies that are able to leverage disruptive technology can gain a competitive edge by adjusting and adapting to changing customer preferences quickly.

But do these factors suffice to ensure high business viability? The next section attempts to answer that question.

Two defining forces prompting reinvention

While AI and climate change may have started laying the foundation for new value enablers and value pools, it is important to take a step back and develop a holistic view of how AI can play an integral role in driving climate action by enabling more efficient resource management, renewable energy forecasting, and optimisation of energy usage, and by improving the accuracy of climate models. Thereafter comes execution: a clear set of reinvention priorities determined by these forces, powered by strategic choices and informed decision making.

Rishad Premji, Executive Chairman, Wipro Limited

“The most dangerous thing to do is to have fixated views. It is important to challenge one’s thinking. Speed is also of essence and so is agility. Organisations that have this deep sense of agility and foster a learning mindset will continue to remain viable.”

a. Sensing-seizing opportunity loop: AI

Unlike inflation, which is a recurrent challenge that businesses have historically and persistently navigated through pricing strategies and cost and resource management, technological disruption is largely unpredictable and could render business models obsolete. As against 20% of global CEOs, 28% of India CEOs list technological disruption as a key threat their companies are extremely/highly exposed to in the next 12 months. There is reason for this concern. In customer service, AI-driven chatbots and virtual assistants have begun to replace human representatives in support roles for handling routine inquiries and resolving simple issues in sectors such as banking, telecom and retail.

28% of India CEOs list technological disruption as a key threat they are highly exposed to in the next 12 months. This is followed by macroeconomic volatility and inflation

Q: How exposed do you believe your company will be to the following key threats in the next 12 months?

So, while technological disruption could translate either into a challenge or an opportunity depending on how it is capitalised, it will have far-reaching implications for organisations, governments and the workforce. Businesses that are unable to digitally transform and speed up their execution may fail, while those that leverage the full power of technology are likely to maintain competitive differentiation and create value for society at large.11

Rishad Premji, Executive Chairman, Wipro Limited

“I believe that any technological disruption creates value in the business model, because that centres around how one provides solutions to customers leveraging skills on scale. This creates opportunities but it also has some inherent challenges. Organisations that are able to pivot their businesses and recognise the new opportunities will win in the marketplace.”

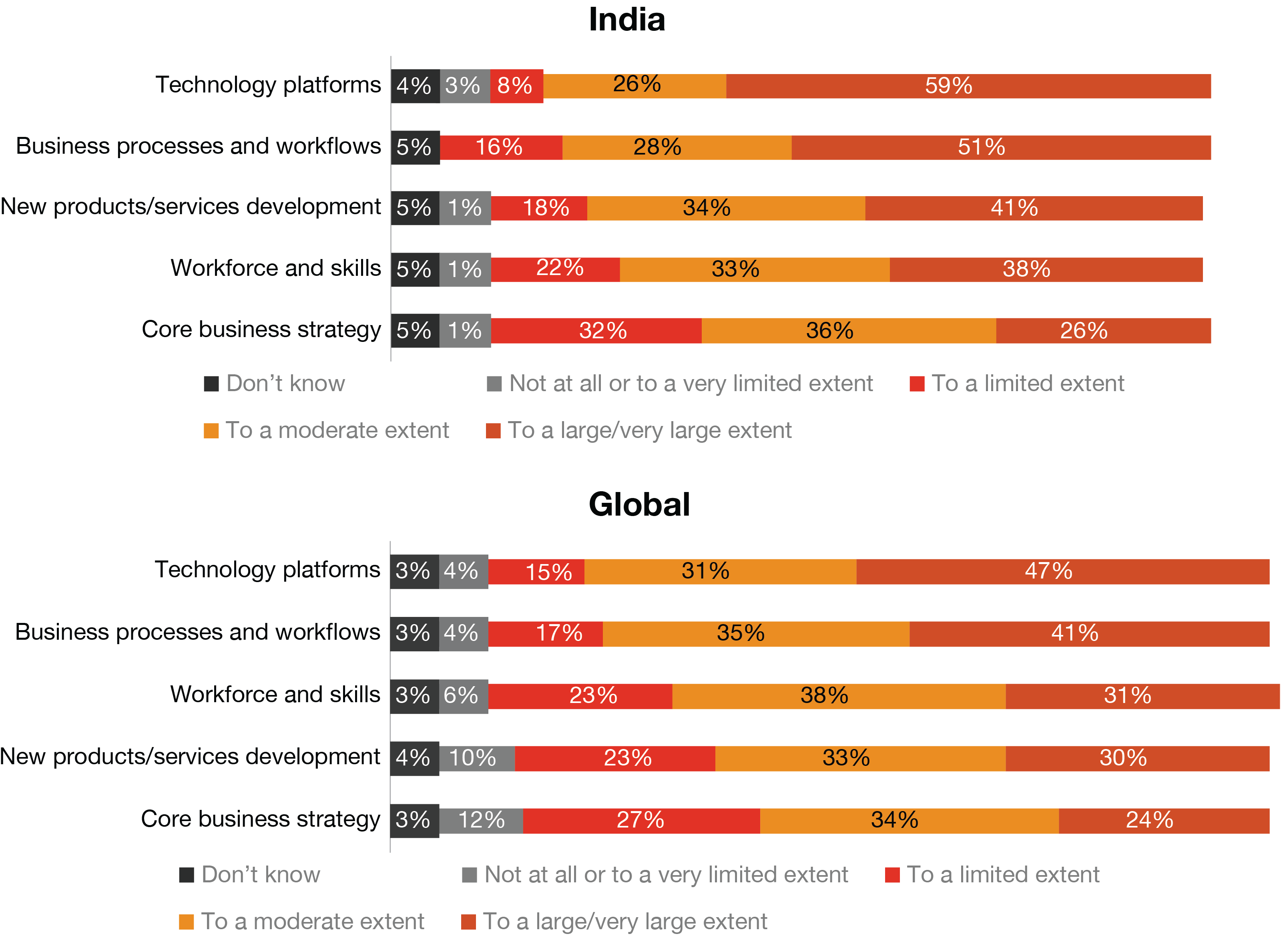

AI, most CEOs agree, can empower organisations at scale and accelerate transformation. And in view of the India government’s announcement to launch the IndiaAI Mission and its investment in building a robust AI ecosystem, it is time for businesses to seize the moment to harness the potential of this technology. Those that are early adopters are already transitioning to a different spectrum of productivity. Combining the power of intelligence and insights, AI can ensure that every employee gets an opportunity to achieve more. That explains why more India CEOs – 59% and 51% as against 47% and 41% of global CEOs – predict, to a large/very large extent, AI’s systematic integration into technology platforms and business processes and workflows in the next three years.

More than half of India CEOs – as against 47% and 41% global CEOs respectively – report plans to integrate AI into technology platforms and business processes and workflows

Q: To what extent, if at all, do you predict AI (including GenAI) will be systematically integrated into the following areas in your company in the next three years?

Generative AI, on its part, is perhaps the first technology that is consumer-led rather than business-led – and whose power lies in its ability to democratise access to sophisticated tools and skills.

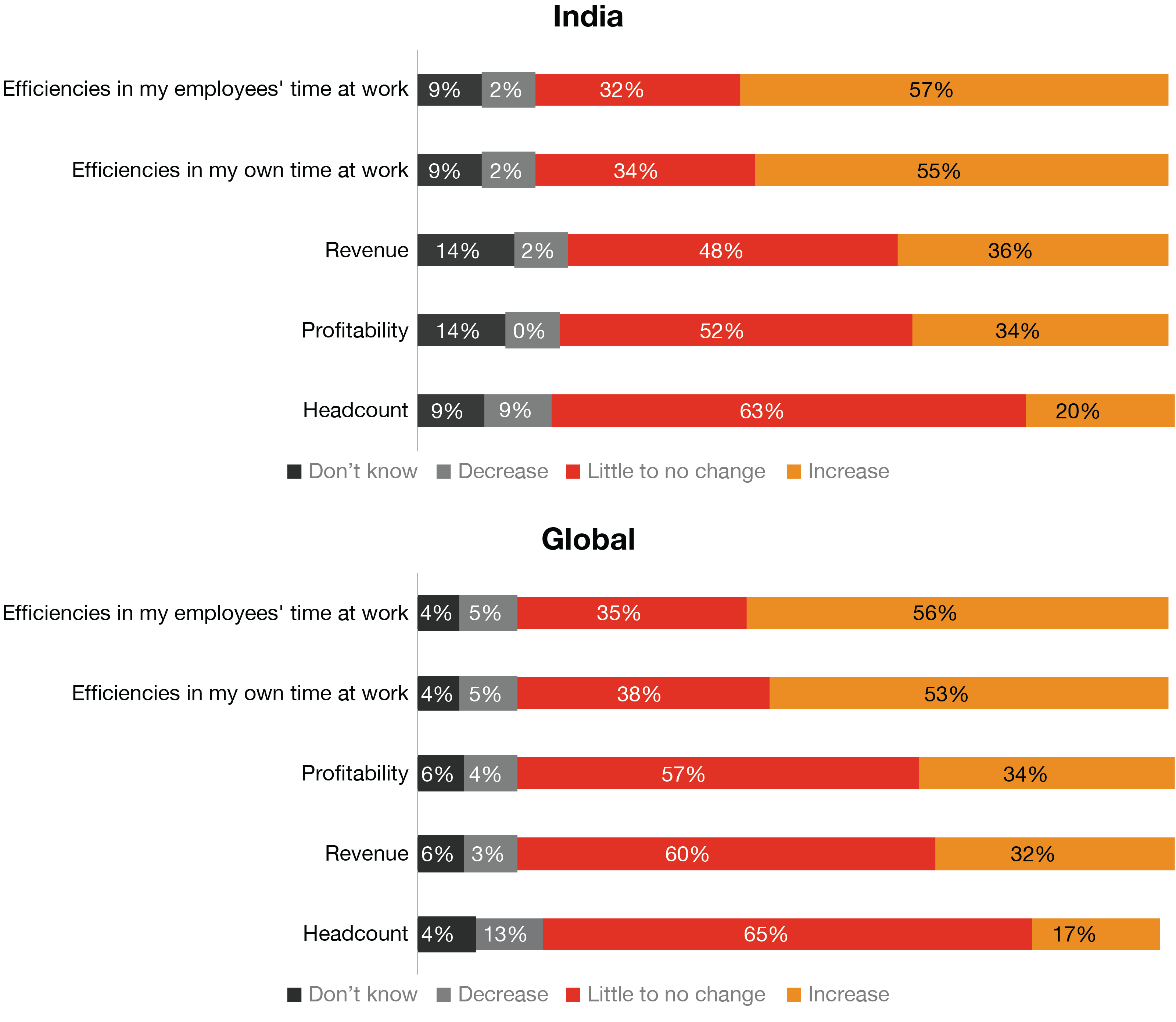

GenAI increased profitability for 34% of India CEOs, the same as global CEOs, and revenue for 36% of India CEOs as against 32% of global CEOs in the last 12 months

Q: To what extent did generative AI increase or decrease the following in your company in the last 12 months?

Companies worldwide are adopting GenAI at scale and seeing promising results, as PwC’s survey indicates:

- More than half of the CEOs in India as well as globally said that GenAI increased efficiencies in how employees and they themselves manage their time over the last one year. Importantly, around one-third of India CEOs report increased revenue and profitability arising from this technology.

- One year on, expectations about GenAI’s impact on profitability are slightly higher than a year ago: 51% of India CEOs and 49% of global CEOs emphasise that GenAI will increase company profitability over the next 12 months.

- In terms of the impact on jobs, although over one in ten India CEOs said they reduced their headcount over the last 12 months because of GenAI, one in five reported an increased headcount.

Sanjiv Puri, Chairman and Managing Director, ITC Limited

“As part of ITC’s digital-first culture, we have explored AI, including GenAI, across our value chain. It is today being leveraged in many applications across businesses. However, given the wide spectrum of evolving advancements in the area, I think we are still scratching the surface. AI has tremendous potential but given the worldwide challenges of livelihood creation, we will need to watch its potential impact on jobs and also dial up on the need for skilling and upskilling to create new opportunities.”

The findings are consistent with earlier PwC research. In PwC’s Global Investor Survey 2024, two-thirds of investors and analysts said that they expected the companies in which they invested to achieve productivity gains from GenAI in the year ahead.12 Another recent survey by PwC India found that 40% of companies across the technology, media and telecommunications (TMT) sector are already seeing the impact of their implemented GenAI use cases and are on track to achieve the desired return on investment. In fact, 21% of them expect GenAI use cases to yield the desired return on investment (ROI) in just a year.13

Banking on GenAI’s transformative potential, PwC India too has announced a collaboration with Meta to expand and scale its open-source AI solutions to enterprises and citizen services on Meta’s Llama models. It also plans to develop innovative solutions powered by GenAI, further accelerating the country’s digital transformation journey.

b. Sensing-seizing opportunity loop: Climate change

India has been playing a key leadership role in the global fight against climate change with its push for green hydrogen and Mission LiFE of Lifestyle for Environment, demonstrating a firm commitment to a growth trajectory that balances economic advancement with ecological responsibility. India’s role in launching the International Solar Alliance that has 120 signatory countries, the Coalition for Disaster Resilient Infrastructure, and a global grid for renewables underlines this commitment. In fact, the International Solar Alliance was conceived as a joint effort by India and France to mobilise efforts against climate change through the deployment of solar energy solutions. Also, India’s National Hydrogen Mission aims to make the country a hub for the production and export of green hydrogen. The International Energy Agency believes14 India could become a global leader in renewable batteries and green hydrogen, fetching the country potential revenues of USD 80 billion.

In 2019, few India CEOs were concerned about using data on the impact of climate change on business to make decisions around long-term success and durability of their businesses, nor did they consider climate change as a threat to their organisation’s growth prospects. Five years on, the needle has moved considerably as organisations in India are now making investments to address climate change. Many companies, however, are yet to convert climate-friendly investments – which include transitioning to energy-efficient operations, developing greener products and services, and implementing emission-reducing technologies – into additional revenues. Be that as it may, sustainability is being increasingly built into the fabric of businesses across geographies, not only as a stakeholder management issue, but also as a vector of investment.

Sanjiv Puri, Chairman and Managing Director, ITC Limited

“The sheer pace and quantum of challenges posed by sustainability globally implies that this is an area where one can never say that one is doing enough. India has made appreciable progress in several areas and has defined clear priorities, including investing in inclusive growth and energy transition. This transition is not only about capex alone but also about redefining value chains and ensuring just transition given the social dimensions. India therefore seeks to balance such priorities in its commitment to sustainable and inclusive growth.”

More than half of global CEOs (56%) said their personal incentive compensation was linked to sustainability metrics. In India, the percentage of CEOs who said that a certain proportion of their personal incentive was determined by sustainability metrics was slightly higher at 58%. The higher the percentage of CEO compensation at stake, the higher is the revenue likely to be generated from climate-friendly investments.

Indian companies are actively bridging the gap between intent and action when it comes to sustainability, combining profit with purpose. This is corroborated by another 2024 PwC India report, Decoding the Fifth Industrial Revolution, in which 93% of senior executives across six industries in India said they would like to be known for their sustainability initiatives, and yet achieve 2x to 3x profitable growth over the next three to five years.15 More than half of the executives in this PwC India study had emphasised that they were prioritising investments this year towards building mechanisms to facilitate adoption of renewable energy sources, implement energy-efficient practices, reduce waste generation, and manage water usage responsibly through digital and other technologies.16

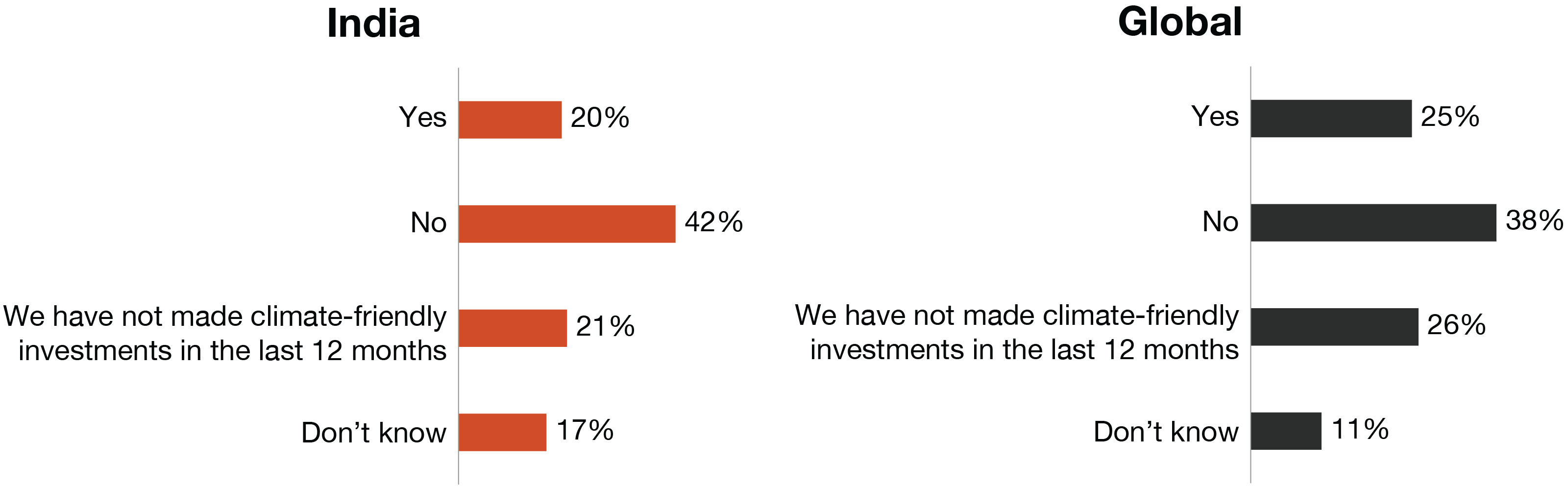

The commitment to climate-friendly investments holds firm for a few companies even when it means accepting lower rates of return, as is evident in PwC’s 28th Global Annual CEO Survey:India perspective. A fifth of India CEOs, as against a fourth of global CEOs, pointed out that their company had accepted rates of return for climate-friendly investments that were lower than its minimum acceptable rate of return for other investments.

In the last 12 months, a fifth of India CEOs as against a fourth of global CEOs said their companies had accepted lower rates of return for climate-friendly investments

Q: In the last 12 months, has your company accepted rates of return for climate-friendly investments that were lower than the minimum acceptable rate of return your company uses for other investments?

When global CEOs took stock of the financial impact of climate-friendly investments over the last five years, these moves were revealed to be six times more likely to have resulted in increased revenue than decreased revenue. In addition, two-thirds of global CEOs reported that climate-friendly investments had either reduced costs or had no significant impact.

In India, on the other hand, 38% of CEOs underlined that climate-friendly investments initiated by their companies in the last five years had increased revenue, while 33% of them said that such investments had increased costs. Notably, 23% of CEOs in India reported cost reduction due to climate-friendly investments.

38% of India CEOs said that climate-friendly investments initiated by their companies in the last five years had increased revenue from products/services sales. 33% underlined that such investments had increased costs in the last five years

Q: To what extent have climate-friendly investments initiated by your company in the last five years caused increases or decreases in the following?

Intelligent reinvention for tomorrow

Shifting consumer preferences and the inter-connected forces of AI and climate change, as noted, are radically transforming how companies create, deliver, and capture value. A 2024 PwC India study revealed that nearly 50% of senior executives, on an average, across industries in India are prioritising investments into building capabilities towards driving rapid value reinvention.17 They are integrating advanced technologies and human expertise to rapidly reconfigure and incorporate changes in product design as per customer requirements.

So, while manufacturing has been at the forefront of reinvention, largely fuelled by shifting customer preferences, other industries are beginning to follow suit, and with good reason. The findings of our CEO survey establish a clear link between reinvention and profitability. CEOs who have taken more reinvention actions in the last five years have reported higher profit margins in the last 12 months.

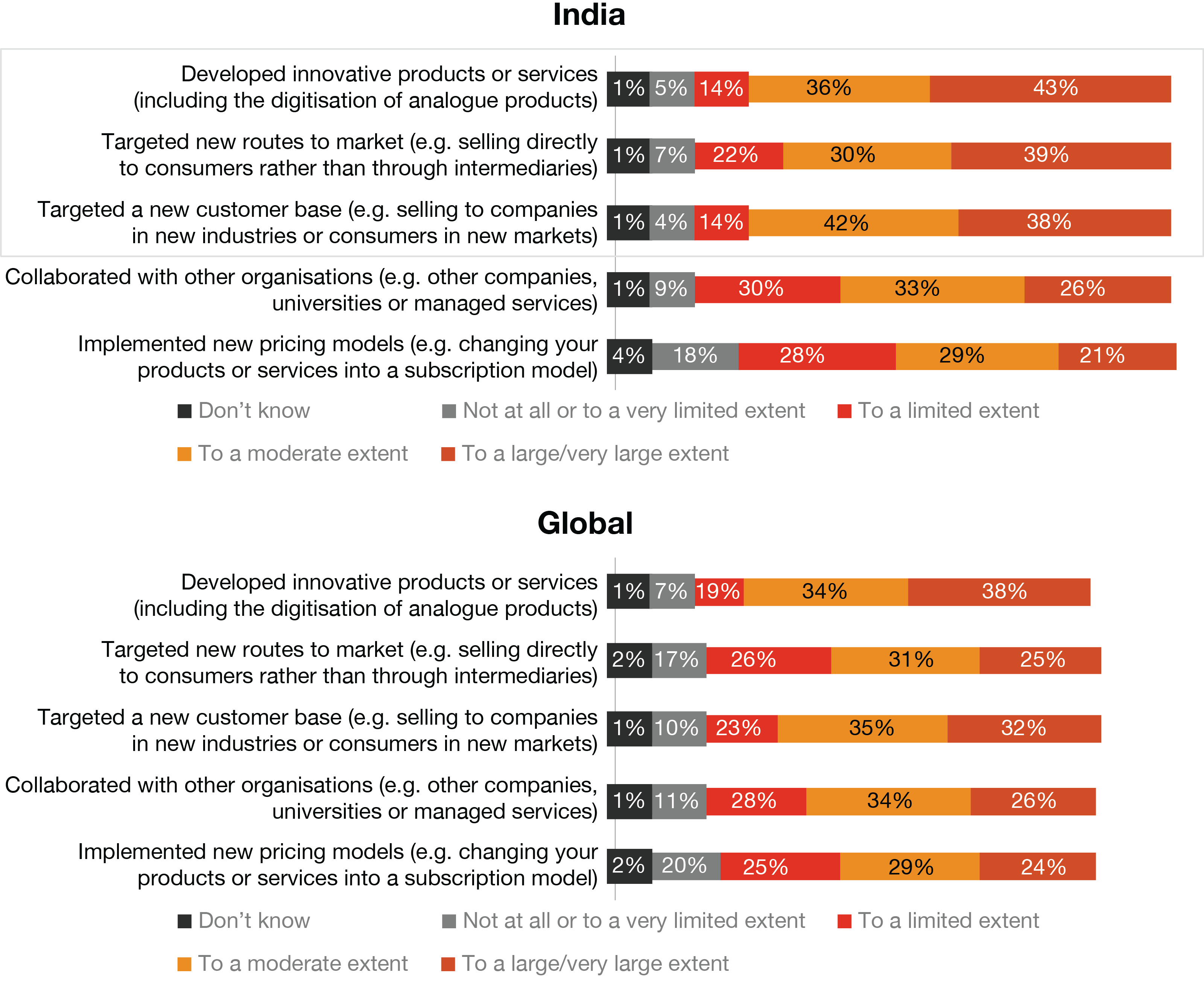

This year, India CEOs reported having taken at least one major action to reinvent their business model, with the top three actions being:

- developing innovative products/services (43%), including the digitisation of analogue products

- targeting new routes to markets (39%)

- targeting a new customer base (38%) – for instance, selling to companies in new industries or consumers in new markets.

For more than 40% of India CEOs, product and service innovation is the most common reinvention action in the last five years

Q: To what extent has your company taken the following actions in the last five years?

Reinvention entails a sensing-seizing opportunity loop, and that demands focus and a determined effort. Leading indicators that can often foretell that the industry is ripe for reinvention include:

- new market entrants

- increase in venture capital investment

- redistribution of market share among incumbents.

This in turn necessitates resource reallocation from lower priority projects to build an at-scale new business rapidly. As business model reinvention clearly changes how a company operates, delivers value, and interacts with customers, it necessitates new skills and ways of working. But companies often lack agility when it comes to moving financial investments and people between business units and projects – although reinvention and dynamic resource reallocation go hand in hand with a strong link between higher levels of financial and human resource reallocation and the revenue generated from distinct new businesses.

In our earlier CEO survey, lack of skills in the company’s workforce was among the top three barriers to reinvention reported by India CEOs.18 The concerns persist in the 28th Annual Global CEO survey: India perspective, with 61% of India CEOs underlining lower availability of workers with key skills as a significant threat their companies were moderately and extremely exposed to.

Therefore, any discussion of reinvention is incomplete without considering the critical need for workforce transformation. In fact, this is an area where disruptive technologies could be leveraged to upskill the workforce. Forward-thinking organisations are already using GenAI, augmented reality (AR), and virtual reality (VR) to provide interesting and customised skilling mechanisms to the workforce.19

Irrespective of the leg of reinvention journey each company is in, the following are some other actions that can provide business opportunities for growth and differentiation, factoring in the two forces of AI and climate change:

Solve the AI trust equation

To leverage the full potential of GenAI adoption, trust is key. In the design of the technology itself, ethical considerations need to be factored in. Accurate data must be fed into the system for an output devoid of hallucinations. Robust data governance guardrails are also essential.

Adopt a systematic approach to GenAI

With high expectations about GenAI’s positive impact on profitability in the year ahead, there is more reason to provide secure access to GenAI and similar such technologies to enhance workforce productivity. Companies that do not prioritise integrating GenAI with workforce will be unable to meet employees’ aspirations.

Search for sustainable value

CEOs need to challenge themselves and their teams to bring climate-friendly products, services and technologies to market. Some CEOs have already started doing that to drive meaningful sustainability initiatives without any organisational hindrance.

Strengthen the decision-making process

Decision-making needs to be approached as a science, one that leverages the power of data and analytics, more than being driven by intuition. Decisions need to be mapped to shareholder value by identifying those that will have the biggest impact on the company’s future.

Draw synergies across industries

Companies that identify opportunities in sectors that leverage their existing resources and are complementary to their capabilities can have a competitive edge in the marketplace. Given the returns generated by making inroads into other industries, it is evident that this trend will persist.

Continual reinvention

India CEOs, as discussed earlier, have good reason to be optimistic about the country’s growth. India’s fast-growing economy, technological prowess, strong infrastructure, and improved EoDB have reinforced the nation’s position among the top five investment destinations.

Much of the optimism displayed by business leaders, however, is tempered by the challenges posed by technological disruption, macroeconomic volatility and inflation. Therefore, it is critical to focus on continual reinvention, all the while remaining acutely aware of the interplay between macroeconomic conditions, geopolitical reconfigurations, and other external and internal threats that could derail progress. To maintain focus, a few key questions that CEOs could ask themselves are:

- Am I moving fast enough and with discipline to build AI (especially GenAI) into workflows and processes, and simultaneously prioritising Responsible AI practices to safeguard stakeholder trust?

- What untapped opportunities can I avail of to drive revenue growth and profitability? What climate-friendly products and services can I add to the business portfolio? Am I investing enough in process improvements to improve the quality of our decisions?

- Do I have a clear view on the potential for my industry’s structure and boundaries to shift? How do I align my company’s operations, capabilities, and business model to the new value propositions and value pools being created because of these shifts?

New domains of growth that cut across sectors and improve the economic viability of businesses can only be created through intelligent reinvention measures around climate change, AI, and other megatrends such as a fracturing world, social and demographic instability, and strategically working around the company’s vision and mission.

Sanjiv Puri, Chairman and Managing Director, ITC Limited

“Any organisation has three assets – values, vision and vitality. Vision forms the fulcrum, vitality involves the process of growth and increasing competitiveness to fuel that vision, and values is the sticky glue that holds together the vision and vitality. These three tenets are part of the ethos of trusteeship. As trustees rather than owners of societal resources, our commitment to excellence cannot be compromised under any circumstance. It is for us to create not just economic capital but also social and environmental capital. That is responsible business.”

Staying the course on the reinvention track is therefore key to responsible business viability. As the research indicates, some CEOs have already commenced the reinvention journey, while others are beginning to understand its need. The time is now to convert that understanding into bold, decisive actions.