Download the report

Foreword

For businesses in India, 2024 holds promise. Optimism voiced by business leaders in India runs through PwC’s 27th Annual Global CEO Survey: India perspective. Stressing the imperative to embrace change, most CEOs polled said they have started taking some concrete steps toward reinvention to remain resilient. India’s air of positivity is being felt across the world, too – the CEO Survey shows that India has risen to the fifth position as an investment destination for global CEOs, up from the ninth position it held in 2023.

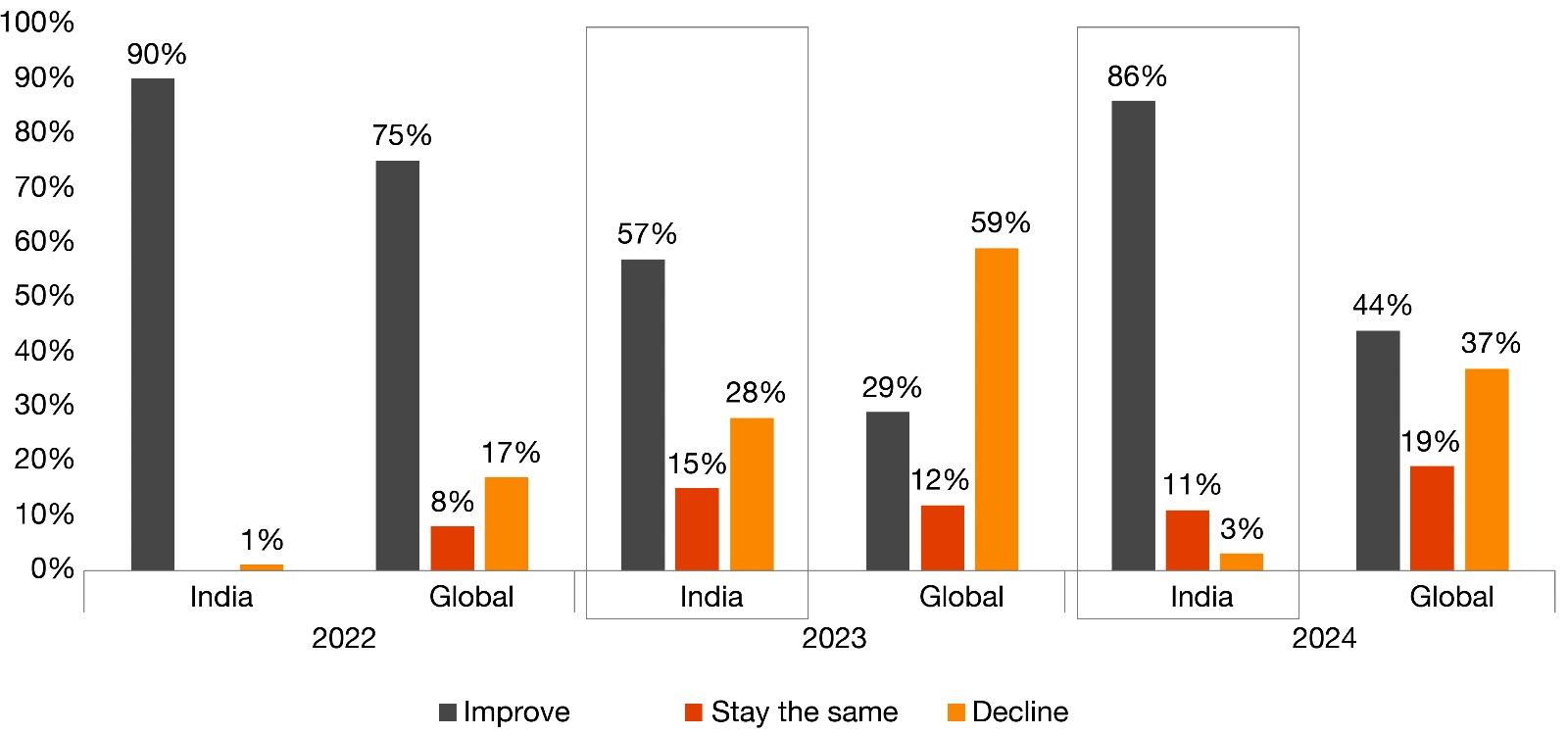

Clearly, despite three years of global macroeconomic headwinds — including a pandemic that severely impaired businesses and conflicts in Europe and West Asia – India is looking at robust gross domestic product (GDP) growth. Global companies are hopeful about the future, too, though – unlike their visibly upbeat India counterparts – they are still somewhat cautious in their predictions for the year. As per our survey results, 86% of India CEOs said they believed the economy would improve in their own territory – as against 44% of global CEOs who believed this about their respective territories.

It was against this backdrop defined by positive trends in India’s economy today that the 27th Annual Global CEO Survey was conducted. PwC surveyed 4,702 CEOs across 105 countries and territories, 79 of whom were from India. 41% of India CEOs represented privately owned companies; 59% were from publicly listed companies. The sector-wise break-up showed that the largest number of business leaders were from the industrial manufacturing and automotive sector (24%), and consumer sector (24%), followed by financial services (16%), energy, utilities and resources (15%), technology, media and telecommunications (11%), and healthcare (10%).

Key India findings

- Almost 9 out of 10 India CEOs believe that the Indian economy will improve.

- 7 out of 10 India CEOs are very confident about their company’s prospects for revenue growth over the next three years.

- Changing customer preferences, agree India CEOs, is the top reinvention driver.

- Cyber and health risks along with inflation are the three key threats in the next 12 months.

- Generative AI (GenAI), India CEOs anticipate, will deliver significant top and bottom line benefits and enhance the company’s ability to build trust with its stakeholders.

- For India CEOs, the top three reinvention actions to create, deliver and capture value are:

- adopting new technologies

- developing novel products/services

- forming new strategic partnerships.

Evidently, a majority of Indian business leaders are taking proactive steps to ensure long-term business viability as they mobilise resources to deal with two megatrends – climate change and technological disruptions, particularly GenAI. This year’s report, therefore, is built around three themes that emerge from the survey findings:

- India’s growth story: Reviews India’s economic growth, India market and factors that account for the long-term viability of business models.

- Impetus to reinvent: Examines two megatrends, climate change and technological disruption caused by GenAI, that compel further reinvention.

- Roadmap to reinvention: Outlines four essential actions to jumpstart continuous reinvention.

With the current economy of India looking up and Indian company heads exploring new ways to advance growth, the survey underscores what it will take to stay the course.

Sanjeev Krishan

Chairperson, PwC in India

Vivek Prasad

PwC India Markets Leader

Almost 9 out of 10 India CEOs believe the economy will improve in their territory.

7 out of 10 India CEOs are very confident about their company’s prospects for revenue growth over the next three years.

Changes in customer preferences, agree India CEOs, are the top reinvention driver.

Cyber and health risks along with inflation are the three key threats in the next 12 months.

Generative AI (GenAI), India CEOs anticipate, will deliver significant top and bottom line benefits and enhance the company’s ability to build trust with its stakeholders.

For India CEOs, the top three reinvention actions to create, deliver and capture value are:

- adopting new technologies

- developing novel products/services

- forming new strategic partnerships.

Explore the survey findings

India’s growth story

Impetus to reinvent

Roadmap to reinvention

India’s growth story

There is good reason for this climate of cheer among India CEOs, for international, domestic and government bodies have all underscored India’s strong GDP growth. The India Development Update1, the World Bank’s half-yearly report on the Indian economy, observed in October 2023 that despite significant global challenges, India was one of the fastest-growing major economies at 7.2% in FY 2022–23. Its growth rate was the second-highest among G20 countries.

Sanjeev Bikhchandani, Entrepreneur and Co-founder, Info Edge (naukri.com, jeevansathi.com, 99acres.com, shiksha.com, naukrigulf.com)

“Great businesses are built on deep customer insights - insights about unsolved problems and about customer behaviour. Naukri.com started based on a simple customer insight - that jobs are a high-interest category of information.”

Sanjeev Bikhchandani in conversation with PwC India chairperson Sanjeev Krishan

According to official figures released in November 2023,2 the GDP grew by 7.6% in the September quarter – significantly higher than the 6.2% recorded during this period in 2022. This rise was propelled by strong growth in sectors including mining, construction and manufacturing on a low base. The index of industrial production (IIP) also recorded a 16-month high of 11.7% in October 2023.

The projections may vary – but there is unanimity about India’s strong GDP growth. If the predictions follow through, the Indian economy will remain resilient despite global challenges in FY 2024–25. Now the world’s fifth-largest economy, India is likely to become the third-largest by 2030 with a projected GDP of USD 7.3 trillion, according to S&P Global Market Intelligence.3 The country’s GDP could expand 6-7.1% every year between 2024 and 2026, S&P Global Ratings stated in December 2023.4

The private sector is expected to play a key role in achieving this goal,5 but as the India CEO responses show, there is little room for complacency. The gross value added (GVA) growth for the services sector slowed to 5.8% in Q2 FY24, while purchasing managers index (PMI) services eased in October and November 2023. This can be due to saturation of pent-up demand and a slowdown in global demand for services. Besides, the conflict in Europe persists, and the war in West Asia may eventually adversely affect India if oil prices, trade flows and shipping costs are impacted. Geopolitical upheavals, lagged effects of high global interest rates and sluggish global demand could slow global economic growth over the medium term.

CEOs’ confidence in sync with India’s growth

The survey reflects confidence, spotlighting the fact that CEOs are more upbeat about their company’s growth than they were last year. India leaders’ optimism about their own territory’s economic growth has seen a nearly 30% increase compared to 2023, with a staggering 86% agreeing that the economy would improve in their own territory.

This year, India CEOs' optimism about their own territory's economic growth sees a nearly 30% increase compared to last year

Q: How do you believe economic growth (i.e., gross domestic product) will change, if at all, over the next 12 months in your territory?

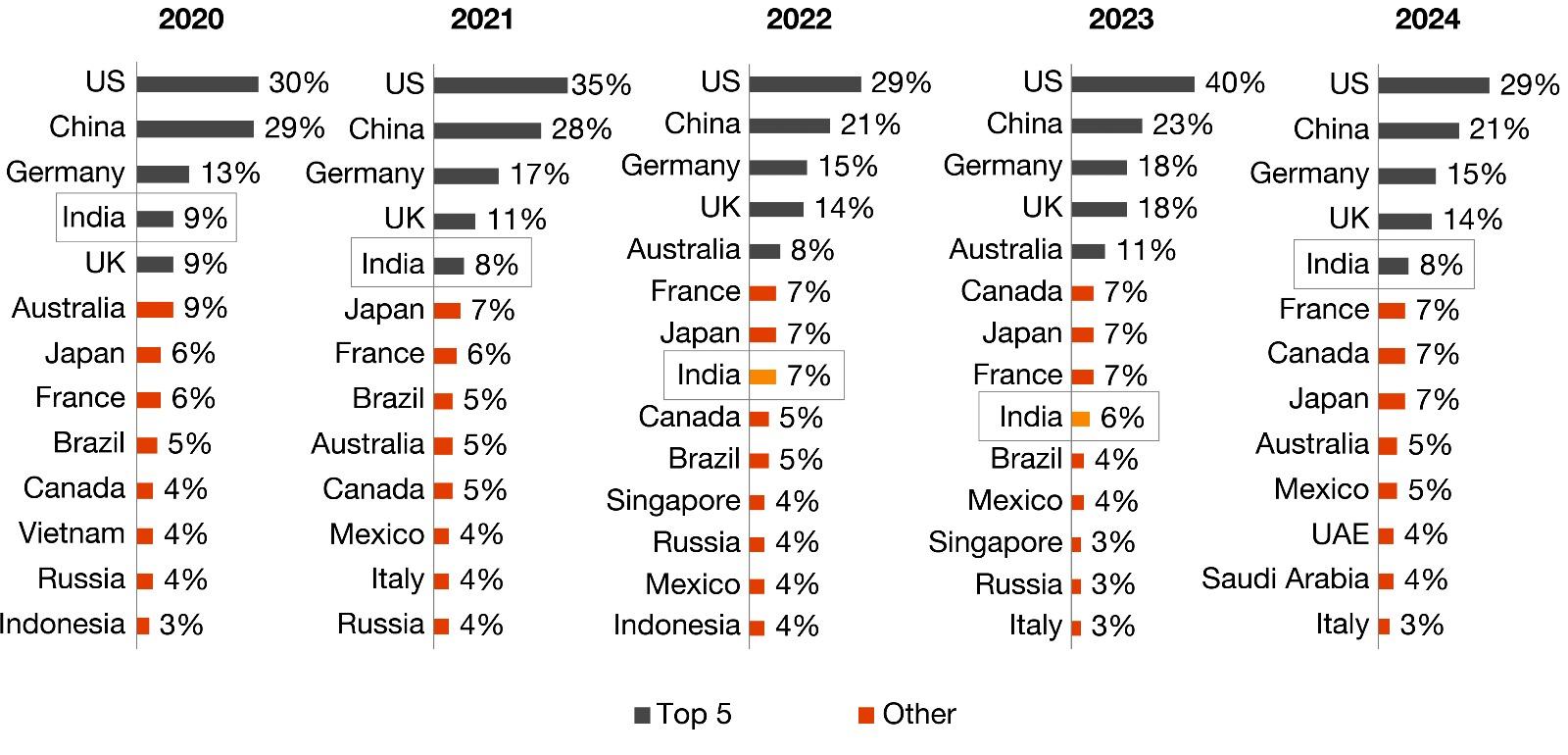

Global perception validates India’s position as an investment destination. India is in the fifth position, up from ninth in 2023. The fourth most-favoured destination in 2020, India slipped to the fifth position a year later, the eighth spot in 2022 and ninth in 2023. The most important investment destinations for India CEOs, the survey showed, are the US, Germany, China, the UAE and the UK, in that order.

As an investment destination, India has moved to the 5th position in 2024 from the 9th position in 2023

Q: Which three countries/territories, excluding the country/territory in which you are based, do you consider most important for your company's propects for revenue growth over the next 12 months?

India appears to have countered the impact of the global economic slowdown through government capex spending, domestic demand and its other economic shock absorbers. Strong fundamentals, healthier balance sheets for banks and corporates, fiscal consolidation, manageable external balance, and substantial foreign exchange reserves contribute to a positive outlook.6

India leaders are convinced that their companies are on the right track. When asked how confident they were about their company’s growth over the next 12 months, 62% of India CEOs said they were ‘extremely or very confident’, as against 37% of global CEOs. About 70% of India CEOs – as against 49% of global CEOs – said they were confident of their company’s prospects for revenue growth over the next three years.

India CEOs have higher expectations of the growth of their own revenue over the next 12 months and the next 3 years than their global counterparts

Need to unlock labour market potential

While most India CEOs are confident about the future of India, a sizeable section is concerned about the need to embrace change to keep pace with shifting trends. While 59% of India CEOs – as against 53% of global CEOs – said their companies would remain economically viable for more than 10 years if they continued on their current trajectory, 38% said their companies would remain economically viable for less than 10 years in this scenario.

59% of India CEOs said if their company continued on its current path, it would be viable for more than 10 years

Q: If your company continues running on its current path, for how long do you think your business will be economically viable?

Impetus to reinvent

India is evolving into a competitive alternative with substantial improvements in manufacturing competitiveness and favourable demographic tailwinds. A slew of policies and incentives – including production-linked incentive schemes, export-linked incentives, refunds under the provisions of GST legislation, tax benefits for start-ups, and a liberal foreign direct investment (FDI) policy – offered across sectors by the government has boosted confidence.

But there is, at the same time, an imperative need for introspection – and change. For long-term viability and growth, companies will have to reinvent themselves keeping in mind a host of direct and indirect issues. Cyber and health risks, and inflation figured high among India CEOs’ concerns around factors impacting the growth of their businesses, while changing customer preferences and technological shifts, primarily evolving GenAI, were identified as top drivers of reinvention. Climate change was the other megatrend expected to accelerate the impetus to reinvent.

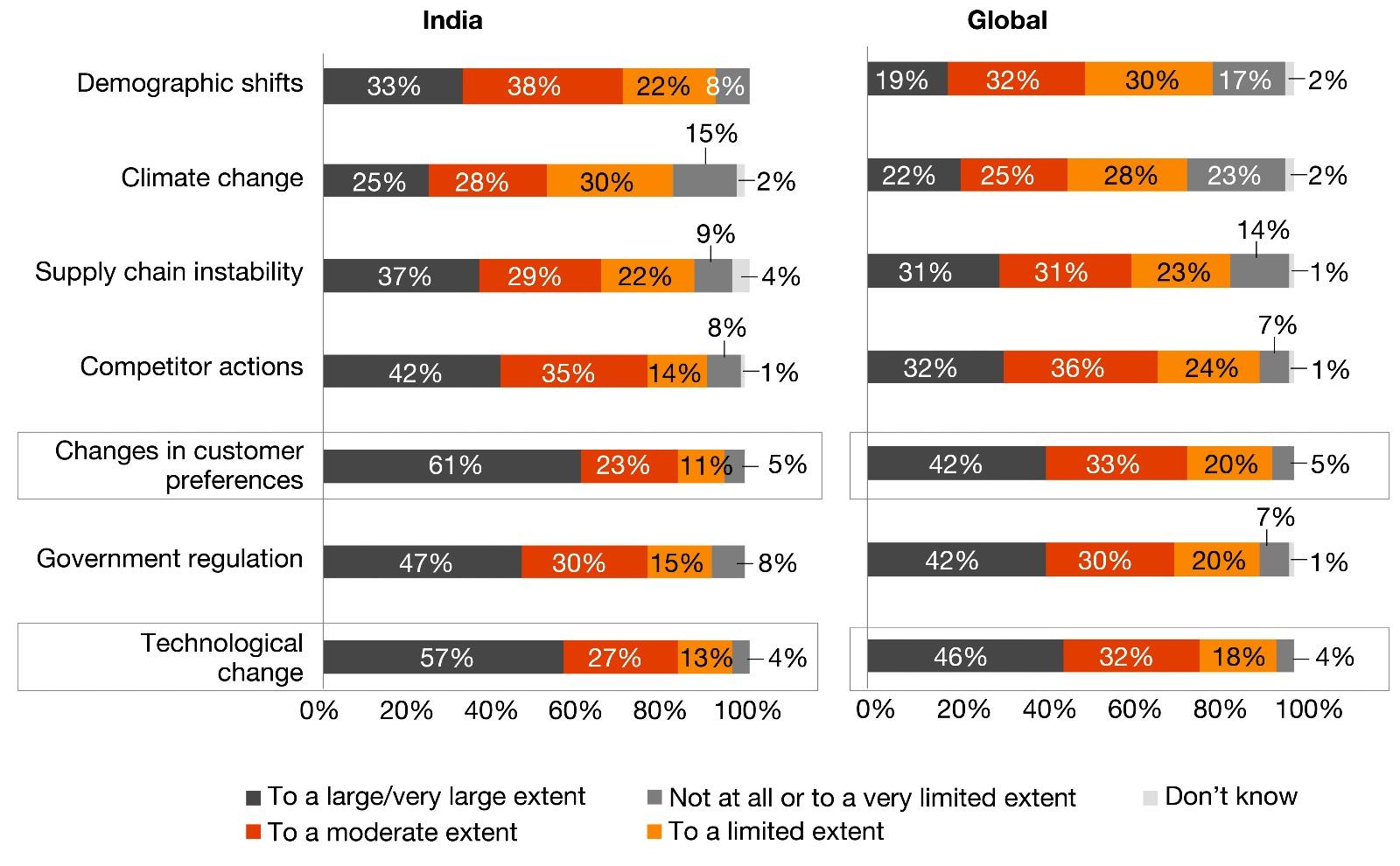

India CEOs rank changes in customer preferences as the top reinvention driver, followed by technological change

Q: Please indicate the extent to which the following factors have driven changes to the way your company creates, delivers and captures value in the last five years

Changing customer preferences is the key driver of the transformative agenda

For India CEOs, the customer is central and 61% said customer preferences had led to changes in how their companies created, delivered and captured value in the last five years. PwC’s 2023 Global Consumer Insights Pulse Survey – India perspective found that altering consumer behaviours have necessitated changes in how businesses manage the consumer experience.7 For instance, consumers now increasingly use the internet to research products before purchase. This means businesses not only have to manage purchase and post-purchase outcomes but also influence pre-purchase behaviour to reach the consumer at the point of decision making.8

Great businesses are built on deep customer insights. Insights about unsolved problems and about customer behaviour. Naukri.com started based on a simple customer insight – that jobs are a high-interest category of information.

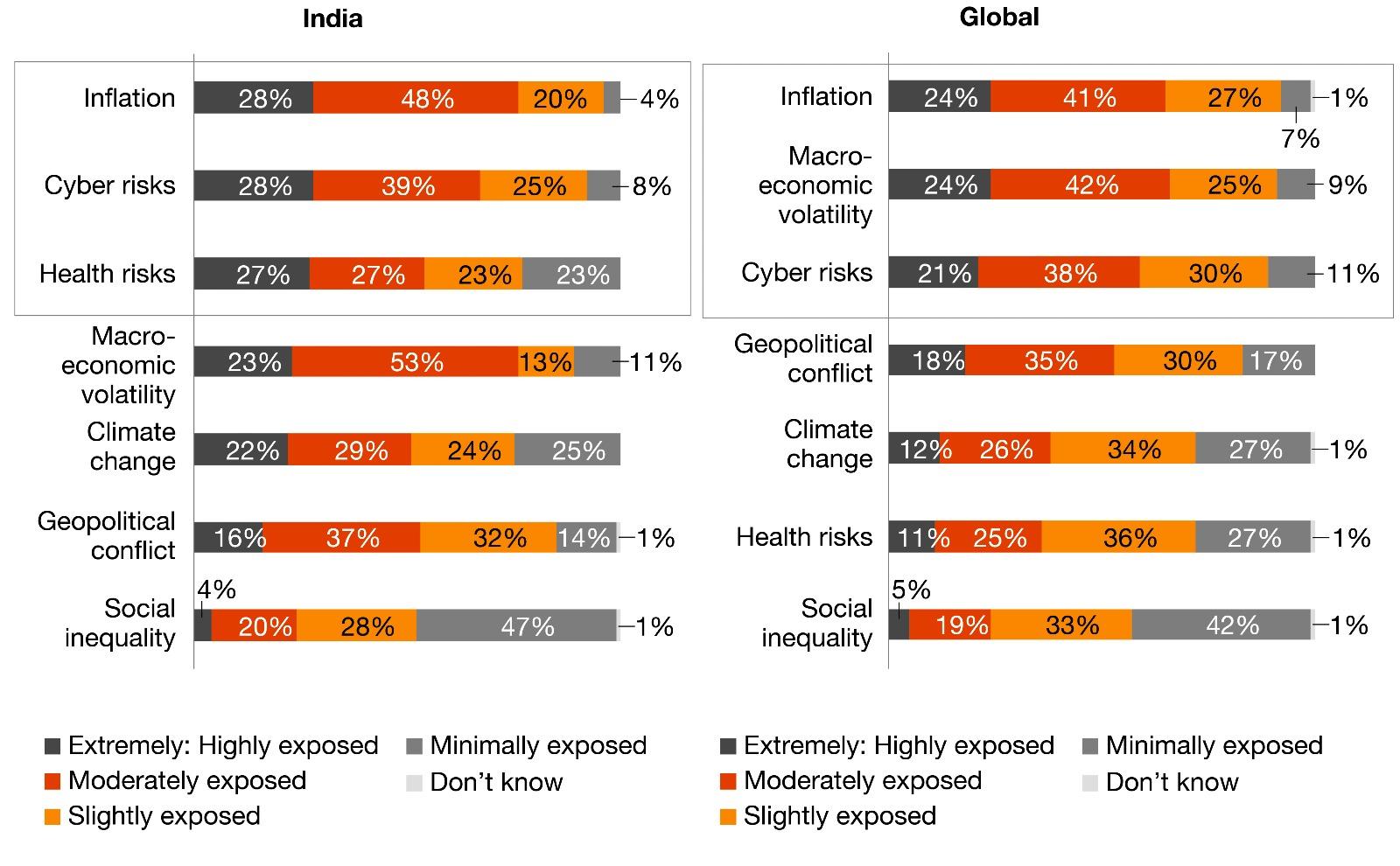

Inflation and cyber risks are the biggest threats in the short term

India CEOs, like their global counterparts, saw inflation and cyber risks as the biggest threats to their businesses in the short term (12-month period). India’s annual retail inflation hit a 15-month high of 7.44% in July but had cooled to around 5.5% in November 2023.9 The current inflation is primarily driven by rising food prices, but – as is evident from CEOs’ responses – it raises concern about more generalised price pressures impacting consumer demand and management of costs.

India CEOs believe cyber and health risks along with inflation are the three key threats in the next 12 months, resulting in greater impetus to reinvent

Q: How exposed do you believe your company will be to the following key threats in the next 12 months?

It comes as no surprise that the perceived risk from cyber threats gained equal prominence in the 2024 survey. 28% of India CEOs expect extreme/high exposure to it, compared to 18% last year.

Sanjeev Bikhchandani, Entrepreneur and Co-founder, Info Edge (naukri.com, jeevansathi.com, 99acres.com, shiksha.com, naukrigulf.com)

“We have a whole bunch of measures in place for cybersecurity and we deploy technology and buy the best tools, and thus far have not had a hack. While we are ultra careful, hackers are always one step ahead. So one can never boast or brag. We can just be a little paranoid and keep working.”

Climate action is work in progress

The ramifications of climate change are particularly alarming for India. Extreme heat waves, droughts, and unpredictable rain threaten lives and jeopardise the country’s agrarian landscape,10 risking the food security of 1.4 billion people. The economic consequences of climate change, too, would be far-reaching. The labour hours lost due to extreme heat and humidity could cost India up to 4.5% of its GDP by 2030.11 Climate-related events are already impacting business. In a PwC analysis, 100 major businesses reported that the financial impacts due to physical climate risks were equal to about 10% of annual sales and 4% of their market value.12

India CEOs’ responses on climate change issues in the 2024 survey show a keen awareness of the urgency to speed up climate action, but they recognise that it is still work in progress. While just 8% said they had completed projects to improve energy efficiency and reduce consumption, 82% said it was in progress, and only 4% said they had no plans.

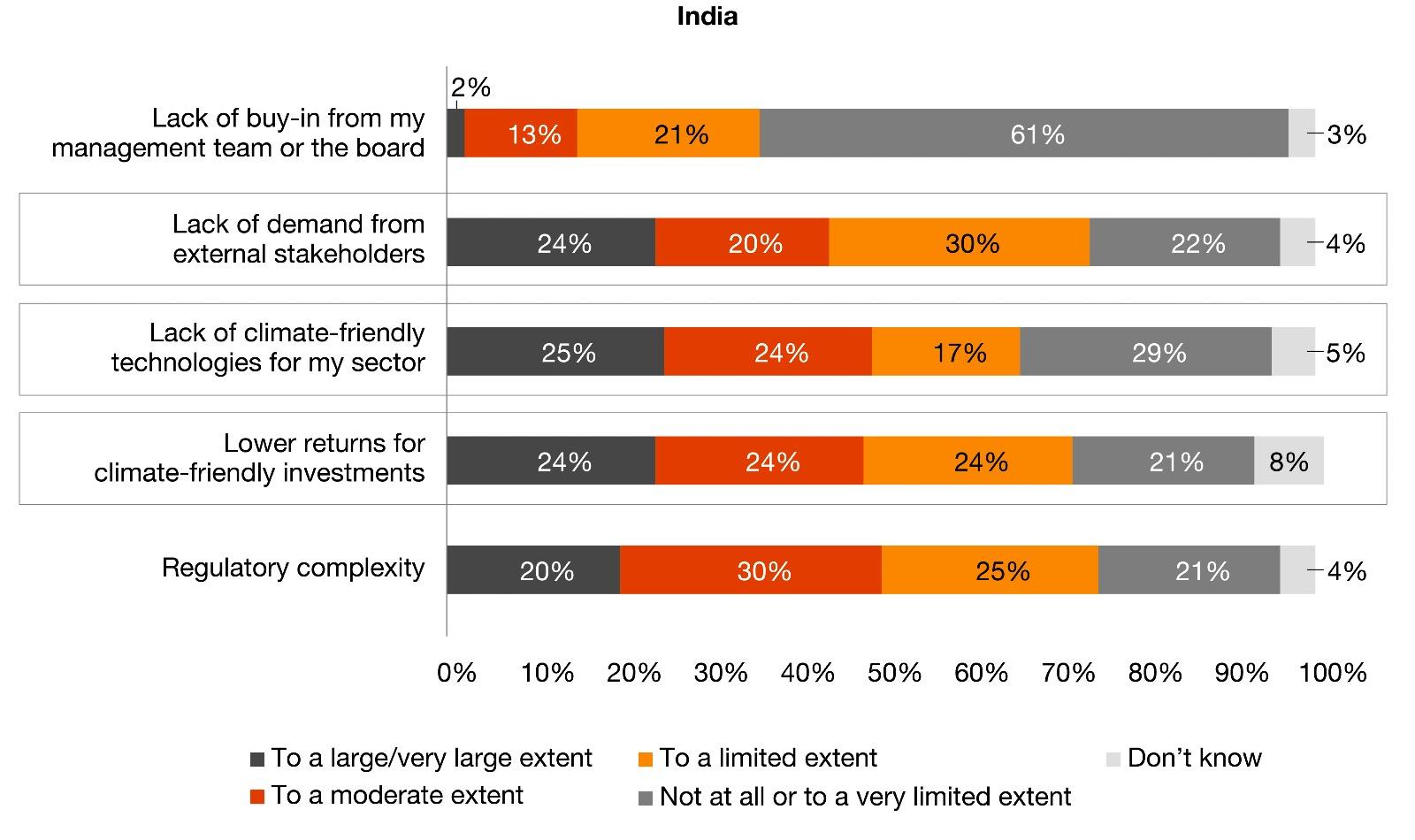

India CEOs reported progress on decarbonisation, climate adaptation, reskilling the workforce and investments in nature-based climate solutions. But they also said lack of climate-friendly technologies (49%), lack of demand from external stakeholders (44%) and lower returns on climate-friendly investments (48%) were inhibiting Indian companies’ ability to decarbonise to a moderate and large/very large extent.

India CEOs report progress on decarbonisation, climate adaptation, reskilling workforce, investments into nature-based climate solutions

Q: Below is a list of actions companies may undertake related to climate. Which of the following best describes your company's level of progress on each of these actions?

Lack of climate-friendly technologies (49%), lack of demand from external stakeholders (44%) and lower returns for climate-friendly investments (48%) are inhibiting India company's ability to decarbonise*

Q: To what extent, if at all, are the following factors inhibiting your company's ability to decarbonise its business model?

*Includes large/very large and moderate extent

GenAI to deliver significant top-end benefits

Technology – in particular, GenAI – was a buzzword in 2023 with recent developments opening new possibilities for businesses.13 GenAI models for applications such as customer support automation are being adopted rapidly across banking, insurance, energy, retail, healthcare and other sectors. The applications include chatbots, marketing content creation that extends beyond text to graphics and video, enhanced data analytics and modelling of complex scenarios. Experts in digital technologies have flagged GenAI’s potential to drive a productivity boom that can lead to significant economic growth. According to a recent Goldman Sachs report, GenAI has the potential to increase global GDP by 7% and boost productivity growth by 1.5 percentage points over a 10-year period.14

The CEO survey corroborates these developments. Around 71% of India CEOs expected GenAI to increase employee efficiency over the next 12 months, while 70% believed it would improve their own performance. It will also likely increase revenue (48%) and profitability (46%).

India CEOs anticipate GenAI will deliver significant top and bottom line benefits

Q: To what extent will GenAI increase or decrease the following in your company in the next 12 months?

Roadmap to reinvention

Reinvention is the formula for the long-term survival and sustenance of businesses. The key is to foresee disruption, anticipate a changing future, understand when to go for a strategic transformation through a change of business models or even core products and solutions, and recognise the obstacles in the way.15

The most significant reinvention barriers India CEOs identified were the regulatory environment, followed by competing operational priorities, lack of skills of their company’s workforce and a lack of technological capabilities. While external factors are at play on supply chain instability and in the formulation or change of regulations that guide a company’s marketing environment, CEOs identified challenges that were mostly within their realm of influence – such as workforce skills, technological capabilities, competing operational priorities and bureaucratic processes.

Many of the reinvention barriers India CEOs are most concerned about are within their realm of influence

Q: To what extent, if at all, are the following factors inhibiting your company from changing the way it creates, delivers and captures value?

The following four actions can help companies jumpstart continuous reinvention:

Turn barriers into growth opportunities

Develop forward-thinking strategies to be fit for purpose

Realign expectations in response to climate priorities

Keep your antennae up

Turn barriers into growth opportunities

India business leaders need to address barriers strategically to turn them into growth opportunities. Regulatory constraints can serve as a catalyst for compliance excellence, while shortage of technological capabilities is an opportunity to invest in technological advancements. Lack of skills in the workforce presents an avenue for talent development. Businesses can therefore:

- Use regulatory compliance to build trust and credibility: Multiple regulatory bodies at the state and central level can increase the compliance burden for Indian businesses. Although the government has launched a slew of initiatives to attract investors, businesses in India are governed by 1,536 Acts and 69,233 compliances.16

- Upskill workforce: Sixty-eight per cent of business leaders in India say that lack of cloud skills remains a considerable challenge in their digital transformation journeys.17 Over 30 million employees with digital skills will be needed in the country by 2026, while approximately half of the current workforce will need to upskill.18

- Invest in building tech capabilities, including green tech: India, like many other developing countries, is yet to take full advantage of frontier technologies 19 which rely on digitalisation and connectivity. Frontier tech includes blockchain, drones, gene editing, nanotechnology, solar power, AI, the internet of things and green hydrogen. Early adopters could reap benefits as the market for frontier technology is poised to grow to over USD 9.5 trillion by 2030.20

Develop forward-thinking strategies to be fit for purpose

Two megatrends in business – technological changes (primarily GenAI) and climate change – are expected to generate opportunities and need to be factored in when developing business strategies. Now is the time for businesses to:

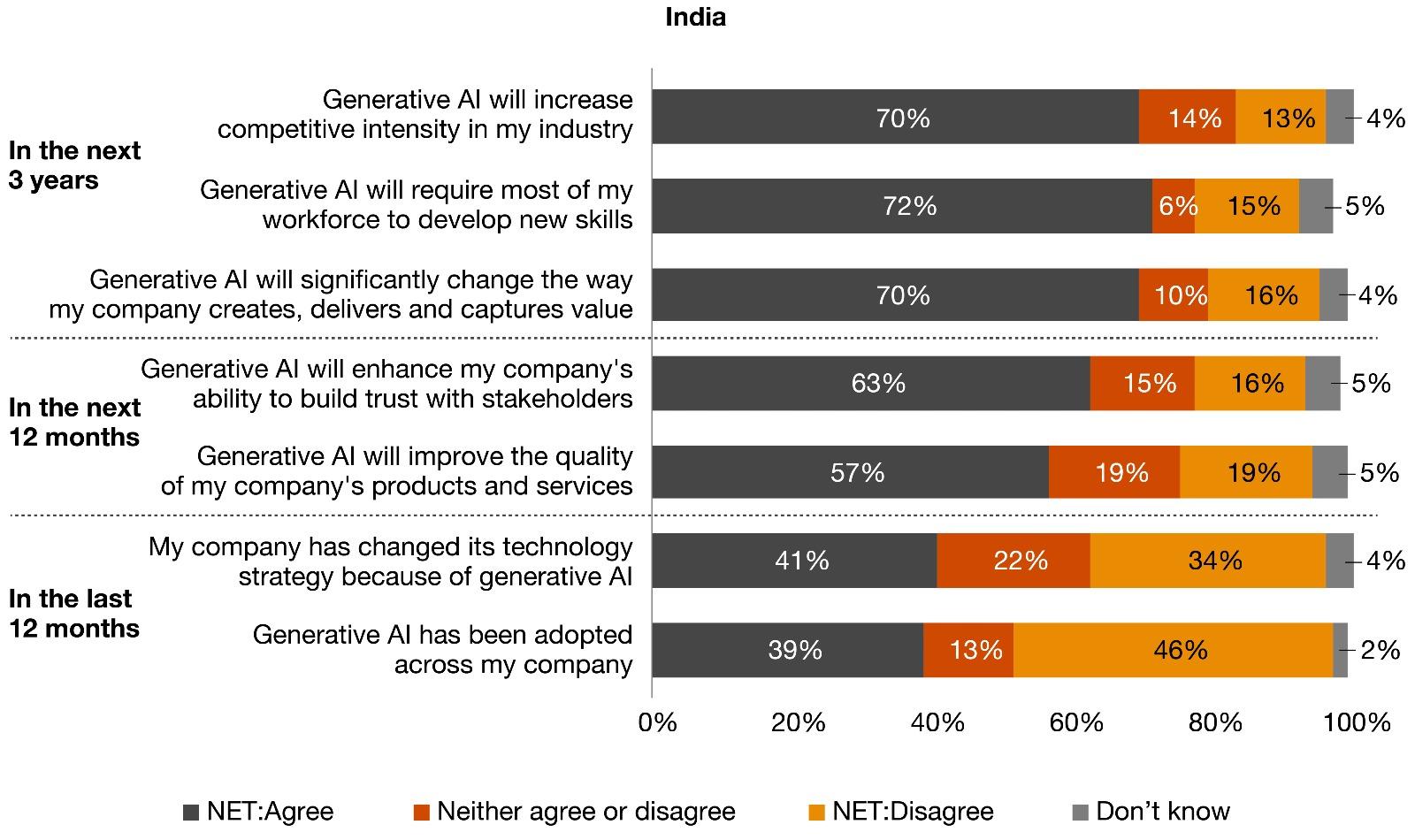

- Ride the GenAI wave: India CEOs’ responses to GenAI showed that although its adoption and strategic integration in their companies were limited, they were anticipating growing impact in the years ahead.

While only 39% of India CEOs said GenAI had been adopted across their respective companies in the last 12 months, 70% believed it would significantly change how their companies create, deliver and capture value over the next three years. Wider adoption of GenAI was also expected to improve the quality of products or services (57%) and enhance the ability to build trust and engage with stakeholders (63%) over the next 12 months. The CEOs also saw GenAI increasing competitive intensity in their respective industries and expected it to have a profound impact on their workforce, requiring most of them to develop new skills over the next three years. - Use GenAI responsibly: India CEOs are fully aware that GenAI comes with its risks and will require vigilant oversight. Around 71% saw it as increasing cybersecurity risk, and 53% thought it would increase legal liabilities and reputational risks; 54% said it would increase the spread of misinformation, while 39% believed it would increase bias towards specific groups of customers or employees.

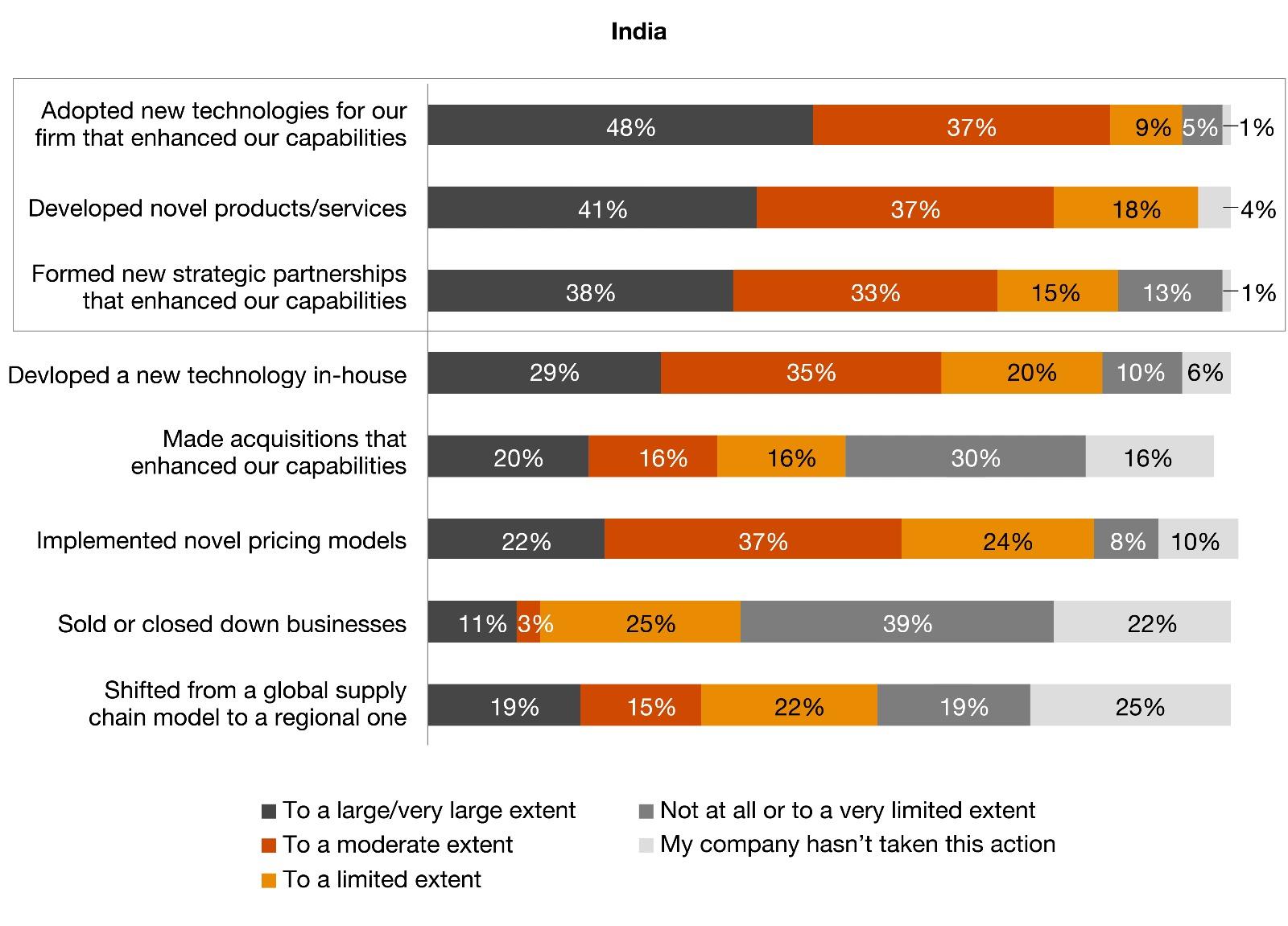

- Reinvent business model: India CEOs are on their toes and recalibrating. Their top three reinvention actions over the last five years are the adoption of new technologies, development of products and services, and new strategic partnerships that enhance capabilities. Such partnerships are critical in a fast-changing environment. Recent PwC research21 suggests that companies can fulfil customer needs by working across industry boundaries.

Although generative AI adoption and strategic integration have been limited, India CEOs anticipate growing impact ahead

Q: To what extent do you agree or disagree with the following statements about generative AI?

When it comes to genrative AI risks, India CEOs are most concerned about cybersecurity

Q: To what extent do you agree or disagree that GenAI is likely to increase the following in your company in the next 12 months?

Top three reinvention actions for India CEOs are adopting new technologies, developing novel products/services, forming new strategic partnerships to create, deliver and capture value

Q: To what extent have the following actions impacted the way your company creates, delivers and captures value over the last five years?

54% of India CEOs have accepted lower rates of return of climate-friendly investments in the last 12 months

Q: In the last 12 months, when evaluating climate-friendly investments, has your company accepted rates of return that were lower than for other investments?

India CEOs are split fairly equally between those who do and do not feel constrained in their decarbonisation efforts*

Q: To what extent, if at all, are the following factors inhibiting your company's ability to decarbonise its business model?

*Responses considered - very large, large and moderate extent

Realign expectations in response to climate priorities

India ranked seventh on the Climate Change Performance Index 2023, up one spot from the previous index, and it also remained among the highest performers.22 Still, the Indian industry needs fast-paced change to make it possible for the country to meet its Nationally Determined Contributions (NDCs). Some of the steps to be taken include:

- Work towards decarbonisation: The development of cheap and adequate non-fossil fuel-generated power, its efficient distribution and other bottlenecks remain, forcing India CEOs to recalibrate their expectations on climate action. The issue of fossil fuels occupied centre stage at the COP28 climate change summit in Dubai in late November-early December 2023, with most nations agreeing to phase out fossil fuels.23 However, the global rate of decarbonisation remains far too slow. Recent PwC research finds that the world needs to decarbonise seven times as fast as the current rate to limit warming to 1.5°C above pre-industrial averages.24

India CEOs were also split fairly equally between those who felt constrained and those who did not in their decarbonisation efforts – 50% felt regulatory complexities were holding back decarbonisation efforts to a moderate and large/very large extent. In comparison, 46% found regulatory complexities had limited or no effect at all on their decarbonisation efforts. Again, on the lack of climate-friendly technologies, 49% felt this inhibited decarbonisation by a very large to moderate extent, while 46% saw very limited or no impact.

Campbell Wilson, CEO and MD, Air India

“We subscribe to the International Air Transport Association’s Net Zero by 2050 commitment, and aircraft that Air India is buying are capable of operating on blended sustainable aviation fuel (SAF). However, the key to SAF being a meaningful solution is for it to be produced and delivered at a much greater scale, so that it becomes cost-competitive; presently, it is four times the price of regular aviation fuel. Achieving net zero will be a multi-pronged effort spanning SAF, technology, carbon offset and more, but the target of net zero is a clear focus for Air India and the industry at large.”

- Tap opportunities to innovate: Climate risks also offer an opportunity to innovate. Climate mitigation and adaptation efforts will generate demand for products and services that help businesses, communities and ecosystems adapt and build resilience to climate risk. Indian business and industry will have to make some bold moves so that their organisations can weather the costs of climate change action and turn them into opportunities.

Keep your antennae up

A few key areas where CEOs need to exercise vigilance include cybersecurity and health risks. The survey indicates that their concern regarding both these heads has increased by 10% and 6% respectively over the past one year. Many business leaders are proactively addressing cybersecurity and health crises emerging from black swan events such as pandemics through diverse risk management approaches.

- Install guardrails: Integrating scenario planning into operations, supply chain, and investments, coupled with crisis plans is an effective way to prepare well. At present, there is an emphasis on agile risk management, highlighting adaptability and on fostering a responsive organisational culture. Companies are also focusing on industry collaboration to share and learn evolving risk management approaches to enhance resilience. The key lies in adopting a comprehensive and dynamic approach that develops alongside the changing scenarios because of Black Swan events. On the other hand, a healthy workforce is essential for exponential growth, and companies are now looking at healthcare benefits as an important incentive for recruitment and retention of employees.

- Monetise innovative products and services: While Indian companies have performed better than their global counterparts in many aspects, the latter have been able to monetise their innovative products better. Around 34% of India CEOs attribute more than 20% of their total sales to new products or services introduced in the last three years. New and innovative products are essential elements of reinvention along with changes in business processes. India CEOs need to find ways to monetise their innovative products more effectively, through improved value propositions and stronger marketing.

India CEOs believe cyber and health risks have increased over the last one year, as compared to inflation and macroeconomic volatility

Q: How exposed do you believe your company will be to the following key threats in the next 12 months?

34% of India CEOs ad against 42% of global CEOs attribute more than 20% of their total sales to new products or services introduced in the last three years

Q: What percentage of your company's total sales from this year are attributable to new products or services introduced in the last three years?

Campbell Wilson, CEO and MD, Air India

“Trust is the bedrock not just for the customer but also for the employees and every other stakeholder in our ecosystem. There is a strong interplay in these relationships and each of those relationships is built on enormous trust and expectation.”

Maintaining the momentum

The efficiency and success of business leaders rest on their ability to foresee change, prioritise their choices for reinvention, and adapt with agility and skill. Reinvention-minded leaders need to shift focus to critical leadership priorities such as the following:25

- Expand executive teams to include experts in areas critical to success such as climate regulation and GenAI.

- Introduce new measures to seek solutions together as unfamiliar problems arise, especially with new technology and climate change action.

- Communicate the urgency for reinvention within the organisation.

- Find approaches for acknowledging concerns, encouraging employees to adapt.

- Reward openness to learning and build trust.

Like CEOs worldwide, India CEOs must look at continuous reinvention to deal with disruptions and barriers and turn challenges into opportunities in a fast-changing landscape impacted continuously by new technology and climate change. But India CEOs have a definite advantage – in that they operate in one of the world’s fastest-growing major economies and a favoured investment destination. They may thus be better placed to reshape the future of their organisations.

Contributors

- Dr Rana Mehta, Partner and Leader Healthcare

- Indranil Mitra, Managing Director, Data and Analytics | Advanced Analytics and AI

- Joseph Martin Chazhoor Francis, Senior Director and ESG Markets Leader

- Rajnil Mallik, Partner and Leader, Advanced Analytics

- Ranen Banerjee, Partner, Economic Advisory Services and Government Sector Leader

- Sambitosh Mohapatra, Partner and ESG Leader

- Siddharth Viswanath, Partner and Leader, Cyber Advisory

- Somick Goswami, Partner and Transformation Leader

- Vishnupriya Sengupta, Senior Director, Markets

- Ruchika Uniyal, Senior Associate, Markets

- Sourav Manna, Senior Associate, Markets

Sources

- India’s growth to remain resilient

- Estimates of GDP

- India set to become third largest economy

- Growth prospects remain strong

- India’s growth story

- RBI keeps repo rate unchanged

- PwC, Global Consumer Insights Survey, India perspective

- Ibid

- India inflation rate

- World Bank, India: Climate change impacts

- How climate change will hurt India’s economy

- World Economic Forum and PwC, Accelerating business action on climate change adaptation

- PwC, Understanding Generative AI

- Gen AI could raise global GDP by 7 percent

- Knowing when to reinvent

- Ease of doing business?

- Gen AI has created new job roles

- India Inc. needs 30 million digitally skilled professionals

- UNCTAD, Technology and innovation report 2023

- Ibid

- Tapping ecosystems to power performance

- India ranks 7th on climate change performance index

- COP28 Summit

- PwC, Net Zero Economy Index 2023

- Strategy+Business, The reconfiguration imperative

Contact us

Vivek Prasad

Markets Leader, PwC India