RBI’s report on Revised Regulatory Framework for NBFCs - A Scale-Based Approach

The RBI’s Discussion Paper on Revised Regulatory Framework for NBFCs – A Scale-Based Approach, released on 22 January 2021, highlights the need for overhauling the Indian non-banking financial company (NBFC) regulatory framework and developing a scale-based approach for their regulation.1

This edition of the Financial RegTech newsletter provides an overview of the RBI’s report.

Evolution of the regulatory framework for NBFCs

In 1964, the regulatory authorities of NBFCs were acquired by the RBI. In subsequent RBI acts, the RBI was granted the authority to inspect and audit NBFCs.

The evolution of the Indian regulatory framework for NBFCs since then is outlined below:

- Regulatory framework – 1998

- Regulatory framework – 2006

- Regulatory framework – 2014

Regulatory framework – 1998

- Classification of NBFCs into public deposit accepting and non-public deposit accepting

- Providing further clarification on the term ‘deposits’

- Minimum credit rating

- Forbidding grant of loans against its own shares as security.

Regulatory framework – 2006

A new classification, namely ‘systematically important NBFCs’, was introduced for NBFCs possessing assets worth more than INR 100 crore. Additional regulations such as capital to risk asset ratio requirements and exposure norms were introduced to mandate these NBFCs.

Regulatory framework – 2014

- Requirement of net owned fund of at least INR 2 crore

- Threshold of INR 100 crore to classify NBFCs as systematically important increased five times

- Origin of funds and customer interface added as additional criteria to differentiate the regulatory approach

- Reconciliation of deposit acceptance and asset classification across various NBFC categories

The NBFC sector has evolved considerably over the years. Its significant growth led to the development of the regulatory framework by the RBI.

The increasing complexity and continued growth of the sector prompted the RBI to update the regulatory framework systematically.

Systemic risk and regulatory arbitrage

The NBFC regulatory framework is lenient compared to that for banks to ensure flexibility in NBFC operations and enable them to providing a wider range of services with ease of access.

This regulatory arbitrage between banks and NBFCs can be classified into

- structural arbitrage and

- prudential arbitrage

Structural arbitrage

NBFCs are favoured by inbuilt structural arbitrage considering the differences between the RBI acts under which banks and NBFCs are regulated.

Below are the vital areas that demonstrate such structural arbitrage:

- cash reserve ratio to be maintained by banks against the liabilities of demand and time

- shareholders’ voting rights

- restriction on buying and selling of goods

- restriction on owning assets which are non-banking in nature

- mandatory board expertise

- deposit insurance

- investing in other companies being controlled.

Prudential arbitrage

Banks are regulated with strict prudential regulations in comparison to NBFCs.

NBFCs enjoy comparative flexibility in terms of classification of assets, provisioning norms, capital to risk ratio and exposure.

Arbitrage leading to concerns of systemic risk

The arbitrage caused by less rigid regulations for NBFCs was because their level of operations was low compared to that of banks and was hence unlikely to result in systemic risk.

However, recently, the NBFC sector has seen tremendous growth and now has greater potential to affect the systemic stability of the wider financial system.

Over the years, a variety of NBFC categories have come up, and the balance sheet size of NBFCs has doubled in the last five years alone.

NBFCs no longer compete with banks but supplement them with a variety of financial services. This interconnected network and enormous growth of the sector could give rise to systemic risks.

- The regulatory arbitrage for NBFCs was less stringent compared to that for banks primarily due to their low scale of operations vis-à-vis banks and to provide them with operational flexibility for growth.

- However, the NBFC sector has shown tremendous growth and scaled up its operations, which may now expose it to various systemic risks considering the leniency of its regulatory framework.

Introducing the scale-based framework

NBFCs are very important to the economy as they supplement economic activities by offering niche services and play a major role in broadening access to financial services access.

The entire economic sector may be disrupted if any of the large NBFCs fail. Considering this, reorientation of the regulatory framework has assumed utmost importance.

A regulatory framework based on the principle of proportionality is proposed to be the best fit. The major objective is to maintain a balance between the financial stability of NBFCs and limiting systematic risks.

Principle of proportionality in the regulatory framework

The rule of proportionality should be based on the factors below:

- Perception of comprehensive risk

NBFCs that break the threshold for the identified parameters (interconnectedness, size, complexity) should be subjected to a higher degree of regulation.

- Size of operations

Once the size of the balance sheet of an NBFC exceeds a certain threshold predetermined by the RBI, it is to be considered systematically important and subject to a higher degree of regulation.

- Activity of NBFCs

Certain NBFCs may pose less risk based on the activities carried out. Hence, these NBFC should be classified based on their activities and regulated appropriately.

Based on the proportionality principle, a regulatory framework for NBFCs that is up to date can be developed.

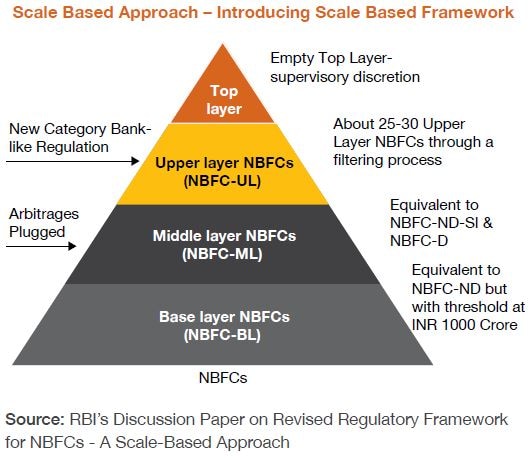

This new regulatory framework can be visualised as a pyramid, layered from bottom to top. Nonsystematically important NBFCs can reside in the bottom-most layer, which is the base layer requiring least regulation.

Moving up, current systematically important NBFCs can comprise the middle layer, which shall have a higher degree of regulation higher than the base layer.

Further up, the upper layer can consist of systematically important NBFCs which have a considerably high potential of systematic risk and can disrupt financial stability.

The pyramid’s top layer is to be left empty. If the RBI supervisors identify any NBFC from the upper layer to constitute extreme risk, the NBFCs residing in the upper layer can be pushed into the topmost layer and subjected to significantly higher regulations.

- To keep pace with the ever-growing NBFC sector, a new regulatory approach is required where the degree of regulation is higher for NBFCs that pose higher risks and is less rigorous for those with a lower risk, allowing them operational flexibility.

- This scale-based approach will allow the RBI to categorise NBFCs and accordingly develop regulations.

Scale-based framework proposed by the RBI

Summary

The RBI’s has proposed a four-layered regulatory framework for NBFCs - base layer, middle layer, upper layer and top layer - with a gradual increase in severity of regulations.

Base layer

NBFCs that are classified as non-systemically important (NBFC-ND) besides Type I NBFCs, NOFHC NBFC-P2P and NBFC-AA will be part of the base layer. The current threshold for systemic importance is INR 500 crore, and it is due to be increased to INR 1,000 crore.

Middle layer

Non-deposit taking NBFCs (NBFC-ND-SI) and all NBFCs that take deposits will be included in the middle layer. This layer will not include NBFCs that have been added in the upper layer. Further, NBFC – housing finance companies (NBFC-HFCs), infrastructure finance companies (IFCs), infrastructure debt funds (IDFs), standalone primary dealers (SPDs) and core investment companies (CICs, regardless of their asset size, will be added in this layer.

NBFCs are covered under a Basel I type framework, under which they are required to maintain a minimum capital to risk weighted assets ratio (CRAR) of 15% with a minimum Tier I of 10% (12% for NBFCs lending predominantly against gold). Presently, capital requirements for NBFCs in the middle layer have been kept unchanged.

Upper layer

The upper layer of the framework comprises only those NBFCs which are specifically identified as systemically significant based on a set of factors. The NBFCs in this layer will be determined based on the composite score obtained through parametric analysis.

Top layer

The top layer will remain empty. If the RBI detects a significant increase in systemic risk spillovers from specific NBFCs in the upper layer, those NBFCs will be added to the top layer. Also, NBFCs that are perceived to have an extreme supervisory risk would be shifted from the upper layer to the top layer.

A higher capital charge, including capital conservation buffers, will be applied to these NBFCs, in addition to extensive supervisory engagement.

With the proposed scale-based framework for NBFCs, the RBI has recommended regulatory changes under the four key aspects of capital regulation – concentration norms, governance norms, disclosure norms and other regulatory arbitrage. With this approach, the RBI seeks to implement a more stringent regulatory framework for NBFCs in order to rein in potential systemic risks going forward.

Regulatory News

Monetary policy announcements

With the current economic scenario, the RBI maintained an accommodative stance by keeping the policy repo rate unchanged at 4% and the reverse repo rate at 3.35% under the liquidity adjustment facility (LAF). Similarly, the marginal standing facility (MSF) rate and the bank rate remained constant at 4.25%. The decision was made to mitigate the impact of COVID-19 and revive economic growth while keeping inflation within the target. The medium-term target for consumer price index (CPI) inflation is 4% with a band of +/- 2%.

RBI issues Master Direction on Security Controls for Digital Payments

The RBI has further tightened the guidelines with respect to the digital payments space. The guidelines are applicable for scheduled commercial banks, small finance banks, payments banks and credit card issuing NBFCs. The circular covers various security and control aspects related to internet banking, mobile payments applications and card payments. These directions have been released at a time when the country has witnessed a huge spike in online transactions along with an increase in cyber frauds, and are expected to strengthen security and bring more stability to digital systems.

RBIA framework for NBFCs/UCBs

To improve the effectiveness of internal audit activities, the RBI has announced the risk-based internal audit (RBIA) framework encompassing the following entities: (1) deposit-taking NBFCs, (2) non-deposit taking NBFCs with INR 5,000 crore and plus asset size and (3) urban co-operative banks (UCBs) with INR 500 crore and plus asset size.

These entities have been instructed to implement the RBIA framework by 31 March 2021 based on the guidelines released by the RBI covering various aspects such as sufficient authority, stature, independence, resources and professional competence. The risk assessment model should be able to identify inherent business risks, evaluate effectiveness of control systems (control risks) and draw up a risk matrix for both the factors.

Financial Literacy Week 2021

For the past five years, Financial Literacy Week (FLW) has been conducted by the RBI to spread financial education. This year, FLW was conducted from 8 February to 12 February 2021 with ‘Credit Discipline and Credit from Formal Institutions’ as the theme. The focus was on (a) borrowing responsibly, (b) borrowing from formal institutions and (c) repaying on time.

Other Regulatory News

NSE to submit report to SEBI on ‘trading halt’ on 24 February 2021

Due to a technical snag, the trading platform of India’s largest stock exchange, the National Stock Exchange (NSE), came to a halt for nearly four hours on 24 February 2021, causing huge panic among brokers and investors. The resumption and extension of trading hours brought some relief to market participants. The Securities and Exchange Board of India (SEBI) has asked NSE to submit a detailed report highlighting the root cause of the incident and an explanation for why trades were not moved to the disaster recovery site.

Framework for Innovation Sandbox

SEBI released a framework for Innovation Sandbox for market participants to explore various innovations in the securities market. The framework aims to provide an opportunity and environment to adopt and test innovations in financial technology for further development and better functioning of the securities market. The ecosystem created will ensure that new innovations are tried and tested effectively before moving to a live environment.

Global Regulatory News

Eurosystem’s agreement on common stance for sustainable investment in central bank portfolios

Eurosystem central banks are aware of the financial consequences and threat posed by climate change. With a view to contribute to the global efforts to reduce the negative impact on climate change, the central banks of the Eurosystem have agreed on a common framework for sustainable and socially responsible investments. These investments apply to non-monetary Euro-denominated portfolios managed under their own responsibility. The common framework includes metrics that will help to measure and report responsible and sustainable indicators like carbon footprint over the next two years and are in line with the recommendations shared by Network for Greening the Financial System (NGFS). This will help the Eurosystem central banks to (1) contribute to low carbon economy, (2) increase the understanding of climate-related risks and (3) improveclimate related disclosures.

Central banks of China and the UAE join digital currency project for cross-border payments

As per a press release by the Bank of International Settlements (BIS), People’s Bank of China’s Digital Currency Institute and UAE’s central bank are joining a cross-border payments project – the Multiple Central Bank Digital Currency Bridge (m-CBDC), a collaborative by BIS Innovation Hub, the Hong Kong Monetary Authority and Bank of Thailand. This project will explore the distributed ledger technology (DLT) for facilitating real-time, multi-currency, 24/7 cross-border payment transactions and remove the current clearing and settlement pain points by means of a proof-of-concept (PoC) prototype.

ECB extends bilateral euro liquidity lines with non-euro area central banks

The European Central Bank (ECB) announced that it has extended temporary euro liquidity lines set up in 2020, from June 2021 to March 2022. The euro liquidity lines were set up in order to meet the euro liquidity requirements in non-euro countries impacted by the COVID-19 pandemic. This euro liquidity is provided to financial institutions by the central banks in the respective countries to facilitate the smooth functioning of ECB monetary policies.

Acknowledgements: This newsletter has been researched and authored by Rahul Kalgutkar, Kanika Aggarwal and Disha Gosar.

Contact us