Foreword

Dear readers,

I am pleased to bring you the latest edition of our newsletter. In this edition, we focus on the key trends in UPI – credit and cross-border use cases, imperatives for the stakeholders, and the pricing structure of UPI and the possible way forward.

I hope you find this newsletter to be a useful and insightful read.

For further details or feedback, please write to: Vivek Belgavi or Mihir Gandhi

Introduction

UPI has evolved as a game-changer in India’s digital payments ecosystem by providing real-time instant interbank transfers with a faster, more convenient and cost-effective way of making transactions.

Since its launch in 2016, UPI has a gained massive acceptance due to the following features

- instant transactions and credit to beneficiaries in real time

- seamless integration of multiple use cases

- using application programming interfaces (APIs)

- convenience in making payments due to interoperability

- secured mode of payments

- no additional costs to customerscollaborative management model engaging all participants in the industry

- adaptive framework for mobile network operators (MNOs) and FinTechs.

Source: RBI and PwC analysis

With active involvement of the regulators, introduction of new features, and international expansion, UPI is poised to experience the next wave of exponential growth.

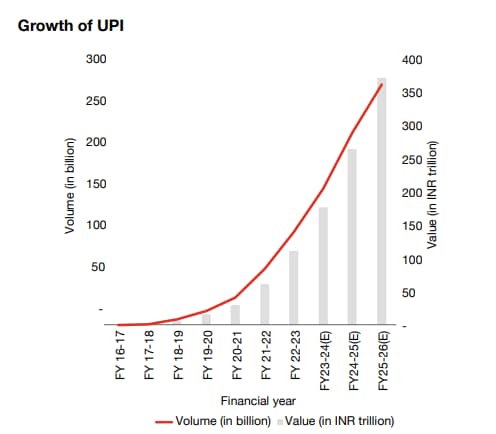

UPI grew from 18 million transactions and INR 69.61 billion in FY16–17 to 83,751 million transactions amounting to INR 139,204 billion in FY 22–23,1 contributing to a compound annual growth rate (CAGR) of 234% in transactions and 196% in value. The following graph depicts the growth of UPI transactions (volume and value) since its inception and provides a projection for the coming years

Key trends in UPI

Some key trends in UPI have been highlighted below

In 2022,2 the Reserve Bank of India (RBI) announced the linkage of RuPay credit cards on UPI with the objective of providing a seamless and digitally enabled credit card lifecycle experience to RuPay cardholders. Customerscan link their UPI ID on either Bharat Interface for Money (BHIM) or other UPI apps with the help of the registered mobile number which is linked to their credit card account.

Impact on ecosystem players

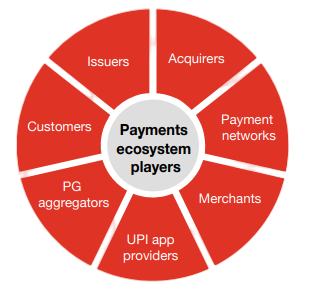

The linkage of RuPay credit cards on UPI is expected to impact a number of ecosystem players.

Some of the key offerings by non-banks in embedded finance include

- Customers

- Payment networks

- Issuers

- Acquirer

- Merchants

- UPI app providers

- Payment gateway (PG) aggregators

Customers

- Making low-value transactions using credit limit: Customers can utilise their credit cards through UPI for low-value transactions rather than making payments through their savings accounts.

- Availing credit limit facility on low-ticket transactions: The credit card on UPI facility will allow users to make low-ticket transactions. This will enable RuPay cardholders to avail the credit limit period of 45–60 days, even on these low-value transactions.

- Incentives for customers on low-ticket transactions: RuPay cardholders can accumulate reward points and earn cashbacks on low-value transactions, resulting in better customer experience and engagement.

Payment networks

Presently, UPI transactions on credit cards are only allowed on RuPay cards.

UPI, being an efficient mode of payment, is expected to increase the adoption of RuPay credit cards, which is currently quite low.

In order to make credit cards on UPI a success, the National Payments Corporation of India (NPCI) will have to jointly work with the regulator on various areas as highlighted below

- Provide incentives to the issuers and acquirers for transactions done via UPI on credit cards to increase the volume and value of transactions

- Around 65%3 of the Indian population residing in rural areas contributes to nearly 25% of the gross domestic product (GDP) and accounts for 40%4 of the transactions. The NPCI and regulators could collaborate with various stakeholders and chalk out a business strategy to tap into the rural market to facilitate the use of credit cards and then focus on increasing the transactions with credit cards on UPI

By adopting the strategies mentioned, it can be assumed that nearly 30–40% of UPI person-to-merchant (P2M) transactions from RuPay credit card customers will move to credit cards on UPI over the next two to three years.5 As per our analysis, the volume and value of RuPay credit card transactions would increase up to 150% and 30% respectively.6

Issuers

Presently, the impact of credit card on UPI transactions will be limited to RuPay credit card issuers.

Issuers will face challenges in terms of enhancing their existing technology/systems to accommodate the changes required for enabling credit cards on UPI.

.Some areas that will require changes are mentioned below.

- linking of new or existing UPI virtual payment address (VPAs) to the credit card account along with mobile-device binding supporting the credit card lifecycle functionalities for UPI-based transactions, including payments’ authentication using the UPI PIN instead of the credit card PIN.

- ensuring disputes related to credit card on UPI are resolved using the Unified Dispute and Issue Resolution (UDIR) system.

- ensuring transactions related to peer to peer (P2P), peer-to-peer-merchant (P2PM) and ard-to-card payments are not permitted by restricting the transactions and making changes in the UPI system.

- maintaining the transaction limit defined by the NPCI – issuers will have to update their UPI systems by adding a flag to set a limit of INR 1 lakh for P2M and INR 2 lakhs for specific merchant category codes (MCCs)7

- ensuring refund and reversal support for credit card on UPI-based transactions such changes will result in an enhanced transaction volume and value which will support the issuers to increase the interchange revenue on UPI payments using credit cards.

Acquirer

Similar to issuers, acquirers will be also impacted in the following ways

- possibility of contractual changes with the merchants because of the recent merchant discount rate (MDR) regulation imposed by the regulator.

- difficulty in enabling credit card on UPI transactions for merchants in their systems.

- need to inform and educate merchants about credit card acceptance via UPI, as well as the associated cost of MDR and interchange.

Merchants

Merchants will be impacted by the newly introduced MDR on UPI. The same would be applicable on credit card on UPI. Some other required changes are mentioned below.

- Modification in the existing contract would be required with the acquirer for accepting credit card on UPI transactions.

- Smaller merchants need to be categorised based on the policy defined by the RBI8 because such merchants – with ticket sizes less than INR 2,000 – will not be impacted much by the proposed interchange.

UPI app providers

UPI app providers will be least impacted due to RuPay credit cards being available for UPI transactions as the only change required on the apps would be the customer registration process. The transactional flow will remain unchanged.

Payment gateway (PG) aggregators

PG aggregators will incur costs for accommodating the required changes in the system, some of which have been mentioned below

- modifying existing tech platforms to enable credit payments on UPI.

- making contractual changes between merchants and PG aggregators to incorporate the required changes.

Business model

The NPCI International Payments Limited (NIPL) has facilitated internationalisation of India’s UPI system to newer markets. Such UPI initiatives have been discussed below.

- UPI for cross-border transactions

- UPI for foreign inbound travellers to India

UPI for cross-border transactions

From 30 April 2023 onwards, NRIs residing in Australia, Canada, Hong Kong, Singapore, Oman, Qatar, the US, the UAE, and the UK would be able to use UPI from their non-Indian mobile numbers for making payments. NRIs would be able do so by first linking their mobile number with a non-resident external/non-resident ordinary (NRE/NRO) account.

Benefits for end customers

- Faster service – i.e. immediate transactions – as compared to the current end-to-end transaction processing time of two to five business days through banks and money transfer agencies.

- Simpler process as compared to the involvement of Society for Worldwide Interbank Financial Telecommunication (SWIFT) and accounting settlements.

- Lower transaction charges as compared to SWIFT transactions for users – for example, sending USD 100 will cost close to USD 6 as transaction charges.9

Facilitating UPI on cross-border transactions will be convenient for the working population and students residing abroad. Additionally, the micro, small and medium enterprise (MSME) sector will get a boost as trade volumes could increase due to easier and faster payments using UPI.

Bilateral linkage of UPI and PayNow

India’s UPI and Singapore’s PayNow have been integrated to enable faster remittances between the two countries. Singapore has now become the first country with which cross-border P2P payments have been launched.

Singapore is considered as the financial hub of the world. Therefore, linkage to its real-time rail PayNow will prove to be instrumental in reaching global markets. Furthermore, it will improve ease of doing trade and business for MSMEs.

The guidelines for different payments systems and regulators vary across different countries. Cross-border payments would require a stricter adherence to guidelines such as anti-money laundering (AML) and financial action task force (FATF). To do this, issuers will have to make changes to their technology systems to ensure compliance and perform risk evaluation and reporting.

Acceptance of UPI in Nepal

UPI’s entry into Nepal has been a major milestone with it gaining significant acceptance within the country. With this, Nepal becomes the first country to adopt UPI and provide its citizens an opportunity to make and receive realtime payments across P2P as well as P2M segments.

Additionally, if the Nepal model is a success, then the NIPL can enable cross-border remittances between India and Nepal to further bolster the economic ties between the two countries

With this, the Nepal model can be thought of as a case study of UPI for neighbouring countries such as Bhutan and Bangladesh, which have close ties with India and are adopting digital payments systems at a rapid pace.

Benefits for ecosystem players

UPI could become the preferred mode over wire transfers, as such issuers and acquirers would earn the MDR through such transactions.

Partnering with local payment aggregators of countries who have similar payment solutions like UPI can help extend support for UPI as an international remittance channel – which is beneficial for both customers and banks.

UPI for foreign inbound travellers to India

On 8 February 2023, the RBI announced a new facility in which foreign tourists travelling to India can now link their prepaid instrument (PPI) wallet to UPI for making local payments in the country.

Presently, UPI for foreign tourists is available only for travellers coming from G20 countries and has been implemented by a few banks and FinTechs. While it is currently available only at selected international airports like Mumbai, New Delhi and Bengaluru, it will soon be implemented across other cities and airports.

Benefits with UPI-linked PPI for foreign tourists

The new initiative of UPI-linked PPI will:

- lead to more money being spent in India.

- benefit local businesses.

- provide convenience to tourists for making payments.

Tourists can use this facility to:

- make hotel reservations and travel bookings.

- pay for public and private transports in the country.

- pay for tickets to historical places and souvenirs.

- dine and shop.

- get health treatments.

Additionally, UPI-linked PPIs will allow tourists to avoid carrying large amounts of cash, thus providing a sense of security.

Opportunity for payments service providers (PSPs) to earn through PPI

The average number of foreign tourists visiting India is approximately 70 lakhs per annum. These tourists tend to spend approximately INR 2.6 lakhs in India.10

As per PwC analysis, 50% of the above-mentioned spends could move to UPI in the next three to four years.

Therefore, the potential revenue opportunity lies at INR 52–60 crore per annum, at a CAGR of 17%.

This initiative by the RBI will enhance the revenue of PSP app providers as foreign tourists will now be using UPI apps for making payments during their stay in India. Additionally, PSP app providers will get a substantial number of new users, which will eventually increase their revenue through discounts, rewards and cashback earn and burn.

n April 2023, the RBI announced that banks can now offer individuals with pre-approved credit lines using the UPI platform, which will further upgrade India’s most preferred payments solution. This feature on UPI platforms would enable transfer to/from pre-approved credit lines at banks, in addition to facilitating deposit accounts, credit card on UPI and international transactions.

This new move will push lenders to come forward and take advantage of this development by designing innovative products and replicating offerings similar to credit cards. Another benefit is that these credit lines can be offered without an actual physical card, thus reducing the card costs for issuers. Also, point of sale (PoS) and swipe machines will not be needed tofacilitate credit transactions. This will enable customers to make payments for both secured and unsecured lending products like personal loans and working capital loan – subject to the UPI limits. Considering the benefits, this move is expected to revolutionise the way in which customers access credit by providing them with flexibility, convenience and efficiency in using the digital banking ecosystem to manage their money.

In addition to the highlighted advantages, this change will lower the infrastructure costs for credit products on UPI, thus boosting the digital payments system in India. Moreover, it will help banks to create buy now pay later (BNPL) products for UPI customers. As of now, there are no charges mentioned on bank account to bank account-based UPI transactions, as such charges on credit line facility through UPI may be similar to a bank account transaction on UPI.

Pricing and revenue model

UPI transactions have attracted zero MDR since their inception. However, effective from 1 April 2023,11 the NPCI has recommended an interchange fee up to 1.1% of the transaction value to be levied on PPI-UPI transactions greater than INR 2,000, which would be fully absorbed by the merchants and paid to the wallet/card issuers with no additional charges to the customers.

UPI is also available with merchants in even the remotest parts of the country. The ticket-size for these merchants is low and their annual turnover is also moderate. Also, the cost of services like last-mile delivery charges and overheads lead to lower margins for such merchants/micro entrepreneurs. Any further charges on UPI will reduce their margins more and disincentivise digital payments over cash. Hence, MDR for small merchants should be waived.

According to RBI’s discussion paper12 published in October 2022, the cost ncurred cumulatively by the ecosystem players in a UPI P2M transaction is nearly 0.25%. This means that for an average UPI ticket size of INR 1,000, the cumulative cost incurred is INR 2.5. In February 2023, the total value of UPI transactions was INR 1,235,847 crore, and the cost incurred by the ecosystem players collectively was nearly INR 3,090 crore. Thus, the subsidies provided by the Government to offset this cost are low and do not cover the entire cost. The government should consider further subsidising the overall costs and re-define incentivising schemes that do not exclude small-ticket values. This will help in creating a balance between digital payments growth and incentivising the ecosystem participants.

Around 28 crore13 transactions are being done on UPI payments on a daily basis. However, when it comes to the details of the fees and charges, ecosystem players like merchants, payments service providers, banks and customers are unclear about the charges and revenue.

To manage these issues, the Government will have to take a few steps to allow pricing to be based on the competition and open market while protecting the interests of smaller merchants and customers to ensure they are not charged.

Moreover, the subsidy provided will have to be re-evaluated based on the measures taken.

This would enhance transparency in the UPI transaction lifecycle and provide a level playing field for all market players.

Overall, the revenue and pricing model for UPI must be based on low-cost payments solutions, benefiting both consumers and businesses, in order to promote digital payments in India.

The way forward

Enabling credit and credit card RuPay payments via UPI is a landmark move by the RBI and NPCI. Overall, this initiative of moving credit on UPI is going to be instrumental and help in further extending the digital payments ecosystem in India. This move will enable the outreach of RuPay credit cards to the next level. Moreover, accepting payments via credit cards will now become easier. Merchants will no longer need to buy any hardware devices to accept credit card payments, which will especially be useful for small merchants across categories who find it difficult to acquire PoS hardware.

Issuers will need to re-design their customer onboarding journey wherein the customer could be given the option of selecting their credit card based on the preference of the network operator, in addition to other attractive features. It will also be interesting to see how the regulator will work towards the inclusion of credit lines, other card payment schemes and mobile apps to expand this feature further.

Although such features will enable ease of digital payments, cardholders will also have to be mindful by using the same in a responsible manner in order to avoid unnecessary accumulation of outstanding dues.

Enabling UPI on international transactions, on the other hand, will have a significant impact on the Indian economy and international businesses, and help expand into a new target segment of NRIs and foreign travellers. Performing cross-border transactions along with a seamless payments’ experience for customers will now become more convenient. For inbound travellers too, this linking of UPI to PPI wallets will be an extremely useful feature and might boost the tourism industry in India.

With UPI going global, FinTech start-ups and payments system operators who are already building innovative use cases in India, will be able to take their services beyond the country and capitalise on new market opportunities.

This growth in the volume of transactions shall also have direct implications on the existing payments infrastructure of PSPs and banks, who will need to ensure that their systems are future-proof and more resilient than ever before. This would require additional investments in terms of system uptimes and processing higher transactions per second (TPS).

The provision of credit lines on UPI will add to the simplification of use of bank credit by customers and drive financial inclusion in urban as well as rural areas. Going forward, a credit line product from a bank will enhance the digital lending ecosystem as well. However, it remains to see how interest rates on such products will be decided.

Overall, credit card on UPI, international transactions for foreign inbound travellers and cross-border transactions on UPI and credit lines on UPI will bring in additional revenue and provide benefits to all ecosystem players. However, the same will have to be implemented with appropriate planning, robust set-ups, and effective alliances to ensure adherence to security and compliance in order to manage transaction volumes successfully.