Decoding the RBI’s Payments Vision 2025

In June 2022, the Department of Payment and Settlement Systems, the Reserve Bank of India (RBI) released the Payments Vision 2025 document.1 The document covers the achievement of the goals set out in the 2019– 21 payments vision and lays out the payments vision for 2025, building on the earlier vision and providing a strategic direction and implementation plan for the development of the payment ecosystem.

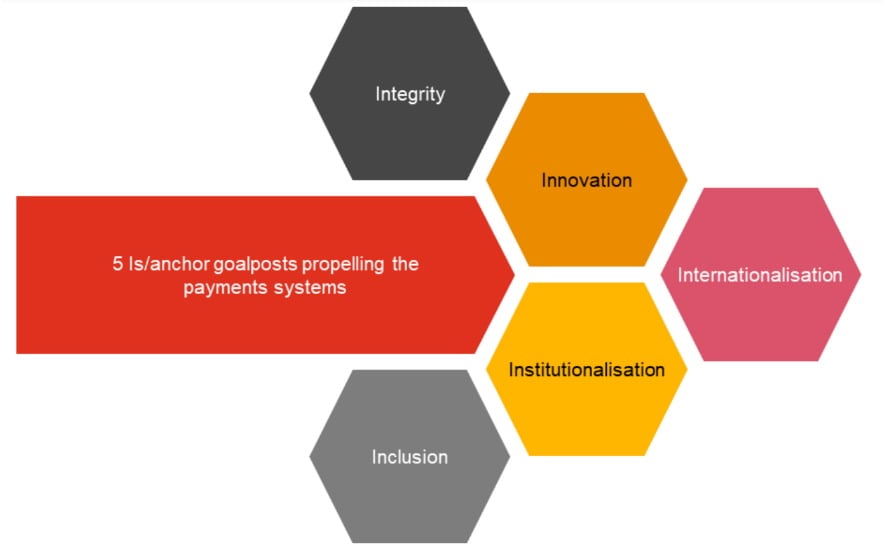

The vision document emphasises the five Is/anchor goalposts of integrity, inclusion, innovation, institutionalisation and internationalisation that drive the payment systems, along with a core theme of four Es, namely e-payments for everyone, everywhere, every time. This theme is built on the six attributes of safe, secure, fast, convenient, accessible and affordable payment systems identified in the previous vision.

In this document, we have analysed the key points in the vision document and their implications for industry players. These have been categorised based on the focal areas below:

| Sr. no. | Points | What do they mean? | Possible implications for industry players |

|---|---|---|---|

| Focal points around cross-border payments | |||

| 1 | Two-factor authentication (2FA) for crossborder card transactions | Introduction of an additional factor of authentication (AFA) for international transactions using cards issued in India shall be evaluated by the RBI to provide additional safety to customers. |

|

| 2 | Global outreach of RTGS, NEFT, UPI and RuPay cards | The feasibility of settling foreign currencies on Indian payment systems using bilateral and multilateral arrangements of the foreign countries will be studied. In addition, the RBI shall also evaluate the possibility of central banks of other countries opening their INR accounts with the RBI and making payments through the Centralised Payment System (CPS). Similarly, the possibility of the RBI opening accounts with other central banks shall be explored. |

|

| 3 | Bring further efficiencies in payment processing and settlements on introduction of Central Bank Digital Currency (CBDC) – domestic and cross-border | The RBI is working towards the introduction of CBDC in India and is exploring use cases for the use of CBDC within India and also globally. |

|

| Focal points around domestic payment and transaction processing | |||

| 1 | Explore local processing of payment transactions | The RBI is exploring the possibility of processing payment transactions within India that currently can be processed abroad. |

|

| 2 | Operationalise a National Card Switch for card transactions at point of sale (PoS) and resultant settlements | At present, card transactions at PoS terminals are processed only through the concerned card network. The RBI has specified the option of implementing a National Card Switch instead of the card network to increase the competitiveness and efficiency of processing card transactions. This is expected to be similar to the National Financial Switch (NFS) for ATM transactions. |

|

| 3 | Migrate all RBIoperated payment system messages to the ISO 20022 standard | The RBI shall take necessary steps to migrate the existing RBI-operated payment system messages that currently do not use the ISO 20022 standard such as NEFT to the ISO 20022 standard. However, the vision document does not speak about NPCI-operated payment systems such as UPI and RuPay |

|

| 4 | Create a payment system for processing online merchant payments using internet/mobile banking | As current settlement through payment gateways and aggregators takes time and involves delays in merchant payments, the RBI plans to introduce a framework to process merchant transactions through payment systems. |

|

| 5 | Review need for multiple payment identifiers | Currently, an FI uses multiple payment identifiers to enable credit to a beneficiary. The RBI is evaluating the use of bank account numbers without using bank IFSC to enable faster and simpler fund transfers. At the same time, the RBI has encouraged the use of the Legal Entity Identifier (LEI) in payment systems and areas of sanction screening, know your customer (KYC), corporate invoice reconciliation, fraud detection, etc. |

|

| 6 | Co-ordinate migration of government receipts and payments to digital mode | The RBI plans to integrate all government payments and receipts via digital payment methods through eKuber. |

|

| 7 | Expand interoperability to contactless transit card payments in offline mode | The transit payment space has evolved considerably from a closedloop system to a full-fledged openloop smartcard-based ecosystem, allowing the use of smart cards outside the transit landscape as well. The objective here is to make smart cards fully interoperable across multiple use cases in a number of locations. |

|

| Focal points around payment policies and guidelines | |||

| 1 | Constitute Payments Advisory Council (PAC) to assist the Board for Regulation and Supervision of Payment and Settlement Systems (BPSS) | The RBI shall constitute a PAC comprising experts and industry stakeholders to assist the BPSS. |

|

| 2 | Revisit guidelines for prepaid payment instruments (PPIs), including closed system PPIs | The RBI plans to review and develop a framework for all types of PPIs. This includes closed system PPIs that are not currently regulated or supervised by the RBI. |

|

| 3 | Explore guidelines on payments involving buy now pay later (BNPL) services | BNPL services would be examined by the RBI and BNPL service providers may be mandated to follow guidelines for providing BNPL services |

|

| 4 | Revisit scope and usefulness of the Payments Infrastructure Development Fund (PIDF) scheme | The RBI shall revisit the effectiveness of the PIDF scheme to check whether it is really working. If required, the RBI may expand the incentives to other areas or allocate more funds towards the PIDF scheme. |

|

| 5 | Active engagement and involvement in international fora (discussions of standardsetting bodies) | India will assume the presidency of the G20 from 1 December 2022 to 30 November 2023. India can play a leadership role in transforming the payment ecosystem across the globe with its active participation in such fora. |

|

| 6 | Undertake evaluation of charges for all payment systems | The RBI shall evaluate the charges for all payment systems levied by FIs on merchants/customers. |

|

| Bringing non-bank entities/players within the regulatory ambit | |||

| 1 | Consider a framework for regulation of all significant intermediaries in the payment ecosystem | Offline PAs may be brought under the regulatory ambit. |

|

| 2 | Attempt regulation of BigTechs and FinTechs in the payment space | BigTechs and FinTechs may be brought under the regulatory ambit. |

|

| Focal points around fraud mitigation | |||

| 1 | Weave in alternative authentication mechanism(s) for digital payment transactions | The RBI may prescribe the forms of AFA considering the concerns associated with authentication using OTP. |

|

| 2 | Leverage the online dispute resolution (ODR) system for fraud monitoring and reporting | As a part of the RBI’s Master Direction on Digital Payment Security Controls,2 regulated entities were expected to set up a robust governance structure, implement standards of security controls and provide a mechanism to customers for immediate notification of fraudulent transactions to the issuer entity. Since building the above feature in the Central Payments Fraud Information Registry (CPFIR) is expected to take some time, the RBI has suggested examining and leveraging the ODR system in the interim period. |

|