The micro, small and medium enterprise (MSME) sector forms the backbone of India’s economic structure, accounting for 29% of the country’s gross domestic product (GDP) and 49%1 of its exports. The Government of India (GoI) aims to increase the contribution of MSMEs to India’s GDP to over 50% and exports to 75% in the forthcoming years.2

However, the exclusion of a large number of MSMEs from formal lending ecosystems inhibits their growth. According to the report prepared by the UK Sinha led Reserve Bank of India (RBI) expert committee on MSMEs, the sector has an estimated credit gap of INR 20–25 trillion.3 A majority of MSMEs do not have access to sufficient credit and liquidity required for daily working capital needs.

MSME sector overview, contribution to GDP, exports and NPA

Source: MSME Annual report, Transunion CIBIL MSME report

Despite the GoI focusing on developing credit and liquidity related policies for MSMEs, the flow of credit to the MSME segment has remained weak. One of the pressing issues has been the reluctance of banks and non-banking financial companies (NBFCs) to lend to MSMEs due to high perceived risks.

Source: Transunion CIBIL MSME report

SMEs have low non-performing asset (NPA) rates (as seen in the figure) compared to large enterprises. Despite the low rates, SMEs have struggled to raise funds from formal sources, resulting in a significant credit gap for the sector.4

Growth of supply chain financing and its role in addressing the credit gap for MSMEs

Supply chain financing (SCF) services could help fill the credit gap for MSMEs in a cost-effective and efficient manner. SCF consists of several options that aim to finance suppliers by using invoices and receivables as intermittent collaterals. Two common SCF methods are factoring and reverse factoring. Factoring is a financial transaction wherein suppliers sell their accounts receivable to a third party (a bank or FinTech) at a discount. Reverse factoring is also an accounts receivable financing mechanism, but in this case the transaction is initiated by the buyer.

Process of factoring

Source: PwC analysis

SCF services can enable MSME suppliers and distributors to increase their working capital and, in turn, make them globally competitive. This type of financing helps lenders extend working capital finance to MSMEs by leveraging the existing commercial relationships between MSMEs and corporates. It also helps large corporates to improve their working capital management and enables financiers to assess, measure, and manage the risks of extending financing to MSMEs more effectively. As India moves towards expanding its export market, the availability of SCF for MSMEs will help significantly in easing the working capital pressure and enhance their linkages to global supply chains.

Banks have traditionally preferred offering working capital loans over supply chainbased financing due to lack of borrower data and difficulty in assessing the collateral provided. However, with growing digitisation and government initiatives, domestic factoring volume has also increased in the past few years.

Source: FCI annual report

Evolution of FinTechs in the SCF space

FinTechs have revolutionised the SCF segment by digitising the interaction between entities. From utilising analytics to providing app-based financing arrangements, technology is set to make the entire lending process more efficient, flexible and transparent. Enabled by remote technology, FinTechs have launched multiple solutions and analytics capabilities to provide a seamless platform for buyers and suppliers. They have further differentiated themselves from banks by focusing on large e-commerce platforms as anchor clients to understand the entire supply chain and the MSME segment, and offer e-vendor financing for supply chain related purposes (e.g. supplier financing against invoices) as opposed to general working capital services.

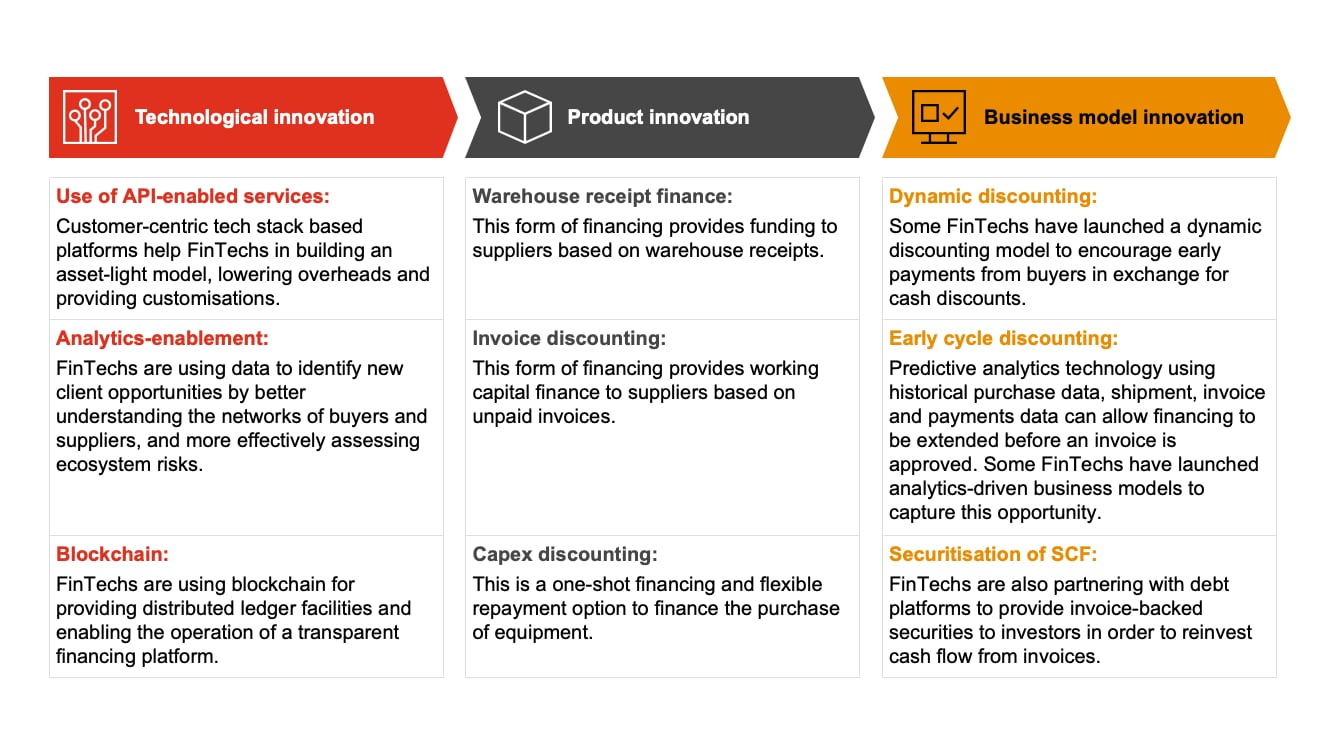

Innovations by FinTechs span technology, product offerings and business models that they develop. Some of these innovations are highlighted below:

Innovations in the Supply Chain Financing ecosystem

Source: PwC analysis

Partnership is another model being leveraged by FinTechs to expand their user base and provide a point of sale (PoS) financing mechanism for marketplace buyers and suppliers.

The convergence between SCF providers and other ecosystem players in the SCF ecosystem is ongoing. Various players along the value chain are partnering with each other to extend their reach and capture new revenue opportunities. Some examples of such partnerships are given below.

- An SCF provider partnered with a procurement software provider to offer financing solutions on an integrated platform. The companies’ combined the procurement and financing stages to provide an integrated source to pay (S2P) process.

- A FinTech procurement platform partnered with multiple banks to provide integrated financing solutions via apps.

- Multiple e-commerce platforms are also extending their services to provide partnered sourcing, financing and shipping services for international trade.

Government/regulator initiatives to boost SCF

The GoI has come up with multiple policies in order to encourage the growth of transparent SCF mechanisms and enable faster exchange of data between buyers, sellers and financiers.

- Trade Receivables Discounting System (TReDS): The TReDS platform facilitates financing/discounting for both buyers and suppliers.

- Multiple companies have come up with their own TReDS platforms to enable accounts receivable financing. Other FinTechs are leveraging the linking of TReDS to the GST Network (GSTN) to understand cash flows of MSMEs and offer them invoice financing options.

- Account aggregator (AA) framework: The RBI has launched an account aggregator framework to bring siloed financial data of customers on a single platform. This would allow customers to decide who gets access to their data and enable financial institutions to access data on a centralised platform.

- The AA framework and its centralised data management can enable suppliers and buyers to access financing options with the transaction data stored on a centrally managed and regulated framework.

Bolstered by the support of government and increasing interest from the FinTech companies, supply chain financing is expected to witness significant innovations in the years to come, with the potential to significantly increase the working capital access for MSMEs.

With inputs from Sanjana Agarwal, Tanvi Vakil and Sanjeev Kumar.

Sources

- MSMEs Contribute 29.7% Of India's GDP

- Vision is to increase MSMEs contribution to GDP to 50%: Nitin Gadkari

- Report of the Expert Committee on Micro, Small and Medium Enterprises

- https://www.google.com/search?q=credit+gap+to+msme&rlz=1C1GCEB_enIN893IN893&oq=credit+gap&aqs=chrome.4.69i57j0j69i59l2j0l3j69i60.5830j0j7&sourceid=chrome&ie=UTF-8

Contact us