From being a mere buzzword to completely transforming the financial services and banking industry in India, FinTechs have come a long way. India is currently home to more than 1,500 FinTech start-ups, both big and small, out of which half were set up over the last two years.1

Any new industry relies on government support, and India has taken the first few steps in this direction. The Government of India’s push towards a digitised economy with demonetisation, the implementation of the Goods and Services Tax (GST), introduction of initiatives such as the Unified Payments Interface (UPI) and the connection of financial services such as bank accounts to Aadhaar have led to a spurt in the growth of FinTechs. Union Budget 2018 has given further impetus to the FinTech community through announcements on the National Programme on Artificial Intelligence, cash flow-based lending, unique business identifiers and a focus on blockchain, etc. While these initiatives will benefit FinTechs, one of the key requirements for ensuring a sustainable FinTech ecosystem is the creation of a friendly, unambiguous and standardised regulatory regime.

Need for regulation in the FinTech space

FinTech is an amalgam of finance and technology. Its heavy dependence on technology—in particular, the Internet—leads to a greater need for regulation as online financial transactions are prone to several security threats. Further, the FinTech space is exposed to the risk of money laundering, terrorist financing, etc.

FinTechs, unlike traditional banks, may not have a very clear idea of regulators and governing bodies and the rules and regulations that they have to adhere to. This is due to several factors. Every FinTech firm has a unique and dynamic business model that functions on the premise of innovation. Innovation leads to constant change and hence governing such companies becomes difficult. Further, while some FinTechs might behave like banks, they might not offer the entire range of services that banks do. Therefore, it becomes challenging for FinTechs to be placed under the same regulatory microscope as traditional banks.

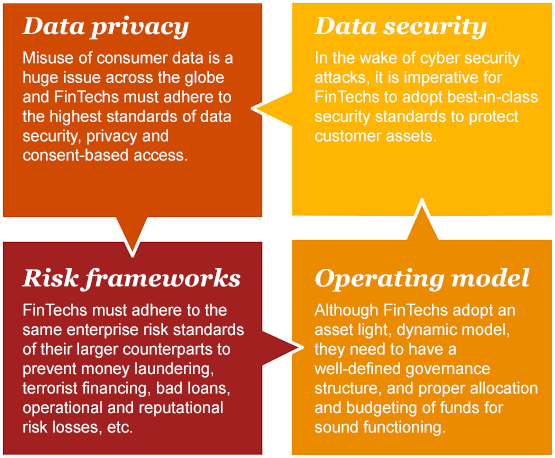

As the FinTech industry matures, regulations will need to keep pace with its evolution so that the four areas below are covered:

A spell of uncertainty

The Indian FinTech space has been governed by multiple entities such as the Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI), Telecom Regulatory Authority of India (TRAI) and Insurance Regulatory and Development Authority (IRDA). Thus, there is no single regulatory body or specific set of guidelines dedicated to FinTechs. Further, each state has its own views on the start-up ecosystem, which tends to hamper the functioning of online-only, interstate models of most of the FinTechs. This has resulted in grey areas and uncertainties for the FinTech community due to the overlap of regulations and contrasting views.

Working towards a uniform regulatory regime

Until 2017, most of the regulators appeared to be treating FinTechs on par with traditional, well-established firms rather than as the fledging industry they represent. However, the recent report of the RBI’s Inter-Regulatory Working Group on FinTech and Digital Banking suggests a change in direction. The Working Group, which included representatives from all financial sector regulators, select banks, FinTech firms and consultants, and rating agencies, undertook a comprehensive study of ‘granular aspects of FinTech and its implications for the financial sector so as to review and reorient appropriately the regulatory framework and respond to the dynamics of the rapidly evolving FinTech scenario’.2

Among its many recommendations, the report encourages the setting up of a regulatory sandbox along the lines of those established by the Monetary Authority of Singapore and the UK’s Financial Conduct Authority. The unique advantage of a sandbox is that it allows FinTech start-ups to test out new services and assess their risks before they are taken to market. FinTech firms and regulators can work together and tweak existing regulations, enabling firms to test their products for a limited time and among a limited number of customers. There are more than 20 such sandboxes across the globe at different stages of development.3

A similar approach, coupled with other recommendations such as graded regulations for FinTechs, disclosure to light-touch to supervision to tight regulation to full-fledged regulation, should foster innovation and encourage FinTechs to effectively test out new services before they are launched.

Need for a more holistic view

Over the last two years, the government and regulators have adopted a supportive approach towards the FinTech industry. However, as India is on the cusp of adopting digital technology in areas such as payments, lending and customer on-boarding on a larger scale, it is necessary to create an even more favourable environment for the industry.

Boosting the FinTech ecosystem in the country

The RBI’s report stresses the need for partnerships and active engagement between regulators, financial sector players, clients and FinTech firms. Such a holistic approach will create a standardised, unambiguous environment and encourage the development of more market-ready innovative solutions for consumers across different segments.

Sources:

- PwC. (2017). FinTech India report 2017. Retrieved from https://www.pwc.in/assets/pdfs/publications/2017/fintech-india-report-2017.pdf (last accessed on 15 January 2017)

- Reserve Bank of India. (8 February 2018). Report of the Working Group on FinTech and Digital Banking. Retrieved from https://www.rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=892 (last accessed on 12 February 2018)

- Communications. (20 November 2017). What is a regulatory sandbox? BBVA. Retrieved from https://www.bbva.com/en/what-is-regulatory-sandbox/ (last accessed on 25 January 2018)