Over the past few years, financial institutions (FIs) have partnered with FinTechs on various aspects of the business. While the principal focus was on customer-facing areas, companies have now started devoting attention to back-end aspects also. With a lot of pressure from regulators on overall data compliance and governance, RegTech as a niche segment within the FinTech ecosystem has gained significance. The next few years could witness FI-FinTech partnerships to tap interesting use cases.

Need for RegTechs

The Financial Service sector has long been replete with regulations. In an attempt to reduce the vast and ever-increasing burden of these regulatory terms, financial institutions are starting to turn to new technology solutions. Around the world, regulatory changes in the financial sector is increasing at a staggering rate. Coping with the sheer volume of new regulatory changes imposes high complexity and stringent timelines upon financial institutions. Over the past decade, regulators have asked financial institutions to undertake several modernisations on their businesses and many of the organisations have struggled with regulatory-driven transformations. Regulatory Technology (RegTech) established a solid foundation within the FinTech ecosystem to overcome this and come up with solutions that are targeted to new and complex regulations, litigation and regulatory remediation areas faced by financial institutions (FI), combined with overall reduction in cost compliance. There are more than 1600 companies worldwide, providing a variety of solutions and services to support other businesses with their compliance needs. Most of these firms help in compliance with regulations such as PSD2, MiFID II, 4MLD and GDRP.2 And most of these RegTech solutions are available for consumption using open APIs and SaaS models.

Current legacy solutions used by banks are ill-fitted to meet the stringent requirements increasingly implemented by regulators all around the world. RegTech is a seamless way for banks to meet these requirements, without the need to overhaul their existing models entirely. RegTech is poised to be the future of facilitating compliance management and minimise regulatory risks.

10 – 15% of workforce is dedicated to Regulatory Compliances

Analyst’s today spend 90% of time only on data collection and organisation, only 10% on data analysis

Global spending on compliance and regulatory - $270 billion

492% volume of Regulatory change during 2008-15

Challenges faced by FIs

FIs face a number of challenges in managing risks, illustrated below. By partnering with RegTechs, who have laser-focused expertise and open architectures, they can be better prepared to handle these uncertainties.

- Frequent additions of financial regulations by governments

- Circulars and modifications on existing regulations

- High overhead costs on production and deployment of solution to comply with the regulation

- High levitation of penalty on non-compliance with the regulations

- Constraints of legacy systems and. insufficient automation and digitisation to meet the pace of regulatory changes

- Non-standardised approach, incompatible systems, insufficient integration of systems

As these challenges are expected to continue to become more complex, it is necessary for FIs to have a long-term, technology-driven platform for an end-to-end governance and regulatory compliance. Through digitisation and automation of processes, RegTech provides a cost-effective solution to meet these regulatory challenges. Technology-based systems can help financial institutions collect data and automate generation of reports according to the format and schedule required by various regulatory bodies. For regulators, it strengthens their regulatory and supervisory capacity by effectively using the data in unified format to monitor the rapid developments happening in the sector.

Areas of intervention and potential benefits

A successful RegTech strategy extends to engagement with other institutions and regulators to test and scale solutions faster with reduced cost and risk. For example, the development of shared testing facilities for solutions using machine learning to automate the management of regulation impact and change. RegTech will help financial institutions to co-create and scale solutions rapidly in partnership with financial institutions and FinTechs.

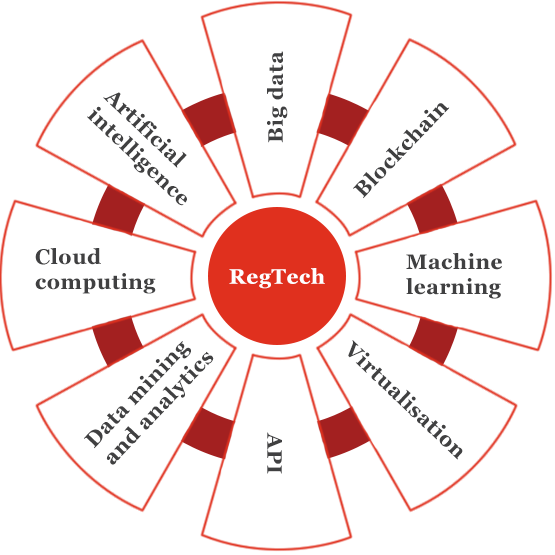

Main technologies supporting RegTech solutions

It is important to develop robust FinTech solutions with RegTech innovation for a sustainable financial products with security Automation of Regulatory Process.

FIs are complex legal entity structures, with various business models, metrics and risks. RegTech enables FIs to internal control and accountability for risk data, compliance assessment, analysis and effective policy and procedure management. The various areas of intervention are:

Remain complaint with regulations

RegTechs enable FIs to comply with the regulatory requirements more effectively and efficiently. They are proactive in working with new and evolving regulations and understanding what if situations, enabling robust solutions by working on Regulatory ecosystem.

Advantages:

- Reducing time needed for client onboarding

- Identifying the frauds

- Adapting to new regulations faster

- Improve data collection and data analytics

RegTech Investments over the years

Simplifies data management

We have witnessed exponential data growth in recent years. FI’s have been looking at ways to consume structured and unstructured data for better insights. Recent regulations such as storage of Aadhaar data, localisation of data storage in India require strategic data management methods. To store and analyse it requires huge computing power as well as compliance with enormous governance and regulations from governing bodies.

To meet regulators’ expectations, banks must store, access, and process data on a scale never previously anticipated. New regulations are pushing banks and brokers to take a more front-to-back approach to data infrastructure. Data sets must be deep and accurate and their contents must be able to be interrogated, viewed and manipulated much more flexibly than earlier, with different latencies and for different purposes.

Enabled by data, RegTech solutions will make regulatory filings more efficient, transparent, and useful for everyone who generates, collects, and consumes them. Policy initiatives such as the Financial Transparency Act in the US and Standard Business Reporting (SBR) in Australia will deliver these changes that can create a solution with RegTech standards, and generate new opportunities to apply emerging technologies, such as Block chain, for regulatory compliance.

Real time reporting

RegTech have the dynamics to completely change the compliance effort to help in real time analysis of the data for financial institutes. Advanced data analytics allows RegTechs to analyse in various ways such as scenario analysis, regulatory ecosystem analysis, and real time user engagement analysis across the globe and thereby, helping firms to proactively identify risks, issues and opportunities.

Data analytics and decision making

A long-term potential of RegTech for risk management is predictive analytics. Predictive analytics can assess the root cause of a regulatory breach and use this to predict future risk areas or compliance issues. It is also useful for risk modelling. Advancements in areas such as cloud computing and artificial intelligence can enhance the usefulness of RegTech solutions

Regulation reframing and implementing new governances

RegTech systems monitor the current state of compliance against upcoming regulations, as well as real-time compliance. This is sometimes discussed as compliance intelligence, referring to the predictive aspect of RegTech, which allows companies to change processes in line with future regulation.

RegTech solutions enable fast, accurate, end-to-end automated regulatory compliant solutions with flexible, future proof solutions to easily comply with today’s and tomorrow’s standards. It recognises that there is an ongoing soft or human aspect to compliance. This risk-based approach of compliance by design identifies regulatory risk through data analytics and systemic issues in human processes. By taking a holistic approach to compliance, companies can identify risk promptly and the front office will be able to do their work better.

Fraud and risk management

Risk management solutions enable automated credit assessments to understand optimal exposure and limits. Whereas collaborating with RegTech solutions can deliver cost savings, and increased return of capital along with all regulatory and compliance needs. RegTech systems in risk management support risk data aggregation for capital planning and liquidity reporting, modeling, scenario analysis and forecasting with stress testing.

RegTech solutions in the areas of know your customer (KYC), real-time AML screening, AI/ML-based fraud prevention, and real-time compliance monitoring had the highest level of adoption by banks. Other areas, which are generating interest are, cloud computing for data standardisation, cleansing and provenance audit and board level governance, analytics dashboard and predictive analytics for advanced risk management and end-to-end automation regulatory reporting, AI/ML-based e-KYC, Real Time AML, sanctions screening and compliance monitoring.

RegTech Innovations for FI

Regulatory sandbox

Sandbox is a new innovation of customised reporting platform for firms looking to be compliant with the EMIR, MiFID, ASIC, and Dodd-Frank. It also provides access to instant insights based on trading data so that decision-makers can make informed data-driven decisions and monitor best execution practices. It also serves the purpose to fulfill the long awaiting need of FIs for data governance—producing, experimenting with, and sharing data within small, isolated groups before deciding if that external data is worth cleansing and ultimately adopting for use throughout the organisation. A good data governance model enables powerful sandbox analytics.

Sandbox will enable more FinTech experimentation within a well-defined space within all the regulatory and governance support. Sandbox can help innovators to increase efficiency, manage risks and reduce go to market time within the regulatory framework.

The number of regulatory sandboxes in the world

Countries implementing or proposing a financial sector sandbox

RegTech as a Service (RaaS)

RegTech as a Service (RaaS) encourages FIs to see RegTech as a way to improve working processes for efficiency as well as regulatory compliance. In the year 2018 RegTech will start to rapidly expand in new directions, enabled by the increasing power to capture and analyse a wealth of both internal and third-party data sources, using bulk storage and artificial intelligence techniques in the cloud with vendors combining both specialised technology with specialised domain and data analysis skills to progressively offer ‘RegTech as a Service’.

Financial institution partner with RegTech

FIs can partner with RegTech providers or with regulatory consulting firms to develop holistic solutions and address issues related to disparate compliance teams. Any RegTech that can add intelligence to data and reduce manual effort is a prime target for use within financial institutions. Finding efficient ways to get a technology solution understood, approved and deployed is part of the puzzle that needs to be solved as soon as possible. For example, online identity verification solutions can provide access to a wide array of trusted and independent data sources, such as government records, utilities and credit files. Various types of partnerships are illustrated below.

Partnership Model |

Sample use case |

Benefits |

|---|---|---|

FI - FI |

Machine Learning Tool for compliance |

Mutual cost compliance and consistent interpretation of regulation |

FI - Regulator |

KYC Utility |

Faster digital onboarding service |

FI - Startup |

RegTech Accelerators RegTech Investments |

Use advanced technology for, better and cost-effective compliance |

FI - Vendor |

Cognitive RegTechs |

Traditional vendors leverage advanced technologies to make strides into the RegTech space |

FI – Regulator - Startup |

Distributed ledger for regulatory reporting |

Develop effective, future proof solutions that meet the needs of all parties involved |

Startup –Startup |

Comprehensive compliance offerings |

Combine niche technology expertise to create a complete solution for compliance—offer compliance in a box |

Regulator - Startup |

Regulator Sandbox Regulator Accelerators |

To test innovation business models and allow regulators to experiment with new technologies. Experiment with Supervisory Technology (SupTech) solutions |

Regulator - Regulator |

Home-host regulator collaboration |

Harmonise policies across borders to promote banks and Fintechs to expand and operate smoothly. Reduction in disparity in scope of regulations across geographies can go a long way in reducing compliance costs and risks for firms. |

Live use cases of RegTech for FIs in a nutshell

A key growth area is the automation of regulatory reporting. Regtech intends to solve the problems caused by multiple data sources, systems and errors arising from manual review. A regtech solution can search multiple data sources and compile reports that are comprehensive, coherent and standardised. Not only does this save considerable time and effort for banks, freeing up people’s time to concentrate on more skilled and value-added tasks, but standardised reporting is a lot easier for the regulator to analyse.

Regtech solutions can be used to verify identities in accordance with regulatory requirements (such as KYC) while cutting out manual processes and flagging checks for review by exception only. This makes the whole process more streamlined, benefiting the bank and its customers.

The analysis of big data– including via open application programme interfaces (APIs) and using solutions developed under various regulations–presents the opportunity for banks to obtain a more holistic view of their customers. This allows banks to demonstrate that they have taken appropriate steps to identify risks and take appropriate customer decisions.

Account information service provider (AISP) services now allow customers to give permission to banks to release account information to the AISP, which can be analysed as part of credit scoring and lending decision making. This can be done in real time and offer a more sophisticated view of the customer’s financial position than a traditional credit check, enabling the bank to make more prudent decisions.

A start-up providesfinancial news feeds powered by Machine Learning. The feed filters irrelevant stories to ensure only the most high impact and popular articles.

An innovation of an interoperable solution of communication to clients on social network in a regulatory compliance manner for financial companies is enabled by one of the start-ups.

RegTech definitely holds a lot of promise in the face of ever increasing complex regulations. It is necessary for FIs to develop a pro-active RegTech strategy and develop financial institutions to look at deploying holistic models, designed, not so much in response to proposed regulations, but to help banks and other financial institutions establish and maintain a competitive advantage.

RegTech updates and case studies

How RegTech Is Helping Banks Manage Risks

Development Asia

Through digitisation and automation of routine compliance obligations, RegTech is helping improve efficiency, reporting accuracy, and transparency in the financial sector.

RegTech – Both relevant and practical for compliance teams

Cordium

One area of focus for RegTech innovation lays in helping compliance teams implement new rules more effectively.

Technology Based Innovations for Regulatory Compliance (“RegTech”) in the Securities Industry

Finra

RegTech tools may facilitate the ability of firms to strengthen their compliance programs, which in turn has the potential to create safer markets and benefit investors.

Why Banks need RegTech to make transaction monitoring more effective and efficient

Fintech Global

Big banks are looking towards RegTech to find more effective solutions for transaction monitoring.

RegTech: Driving Innovation of Banks & FinTech

The RegTech Hub

The RegTech offers significant benefits, its implementation — as with any major technology upgrad.

RegTech: A Triple Bottom Line Opportunity

Medici

Regulators are growing less tolerant to instances of misconduct and are increasingly penalizing financial institutions for non-compliance.

Sources:

1https://www.trulioo.com/blog/rising-regtech-tide/

2PSD2: Payment Services Directive, MiFID II: markets in financial instruments directive, 4MLD: Fourth Money Laundering Directive, GDRP: General Data Protection Regulation