The last few years have witnessed a number of innovations and strategic collaborations aimed at transforming traditional business and operating models. As per PwC’s report ‘Redrawing the lines: FinTech’s growing influence on financial services’, 95% of incumbents in India seek to increase partnerships with FinTechs to roll out innovative solutions to customers. They are actively engaging with FinTechs to embed innovative solutions into mainstream banking post hackathons and demo day events. The following years should see more of these strategic collaborations to drive innovation further. Against this backdrop, the article discusses an important dimension of innovation—measurement of innovation efforts—and attempts to arrive at a set of key performance indicators (KPIs) depending upon the maturity of the organisation.

Why is it necessary to measure innovation?

The world has witnessed four industrial revolutions over the last four centuries, with the fourth one focusing on new age and path-breaking technology aimed at transforming the business ecosystem. The facets of each revolution have been different, yet the underlying theme has remained consistent—innovation. Firms that have developed an environment of sustainable innovation have seen a better growth trajectory and this would hold in the future as well. In light of this, it is imperative for all organisations, irrespective of size and scale, to put numbers around their innovation efforts and fine-tune them in order to contribute to their growth story.

What makes this challenging?

Innovation has traditionally been measured in qualitative rather than quantitative terms. A few reasons why measurement is challenging are:

I. Inherent challenges in measuring ‘disruptive’ innovation

According to Clayton M. Christensen, a professor at the Harvard Business School, innovation can be categorised into two types: ‘sustaining innovation’ and ‘disruptive innovation’.1 In sustaining innovation, research and development efforts are focused on improvements in existing technologies and capabilities that organisations excel in. It leads to performance improvements in existing products for existing customers in the current value chain. Disruptive innovation, on the other hand, requires investments in radically new technologies. The latter doesn’t have a well-defined customer base initially and may seek to enhance the performance of attributes not explicitly sought by a firm’s customers. As a result, the returns may not be realised till the adoption reaches a certain stage among the firm’s existing customer base. This makes RoI calculations inherently more difficult for disruptive innovation.

II. Not a simple one-dimensional process

Research across financial institutions (FIs) indicates that organisations have had mixed results with their efforts towards measuring innovation. Innovation, unlike any product development lifecycle, is not a standard, well-tested straight-through process with well-defined milestones and checkpoints. Rather, innovation efforts bear fruit through a long incremental process involving multiple cogwheels and demand a cultural change for their sustainability. Hence, the most important challenge is accurately linking the output generated to the actual innovative efforts put in.

Complicated link between innovation efforts and the output

III. Multiple tangible and intangible facets

Innovation efforts can manifest themselves through multiple dimensions. They can either culminate in a tangible product or they can create processes and techniques to roll out products faster or optimise costs, or result in intangible gains such as a change in the way the company addresses customer needs. The longevity of each such dimension may vary, making quantification efforts challenging.

IV. Multiple stakeholders

Our article on innovation centres of excellence (CoEs) talked about driving innovation through strategic partnerships with businesses and FinTech firms. FIs are increasingly looking beyond internal organisations for innovation and the teams generally customise products from FinTech firms for their requirements. It is becoming increasingly difficult to accurately assess and attribute the success of any co-created offering to the core product of the FinTech team or customisation and implementation efforts of the CoE.

Gearing up to measure innovation

There is no one-size-fits-all approach to measure innovation. FIs need to assess multiple factors before zooming in on one technique to measure innovation.

However, before measuring innovation effectively, it is necessary to ensure that a few ingredients are in place.

I. Assess current support levels for encouraging innovation

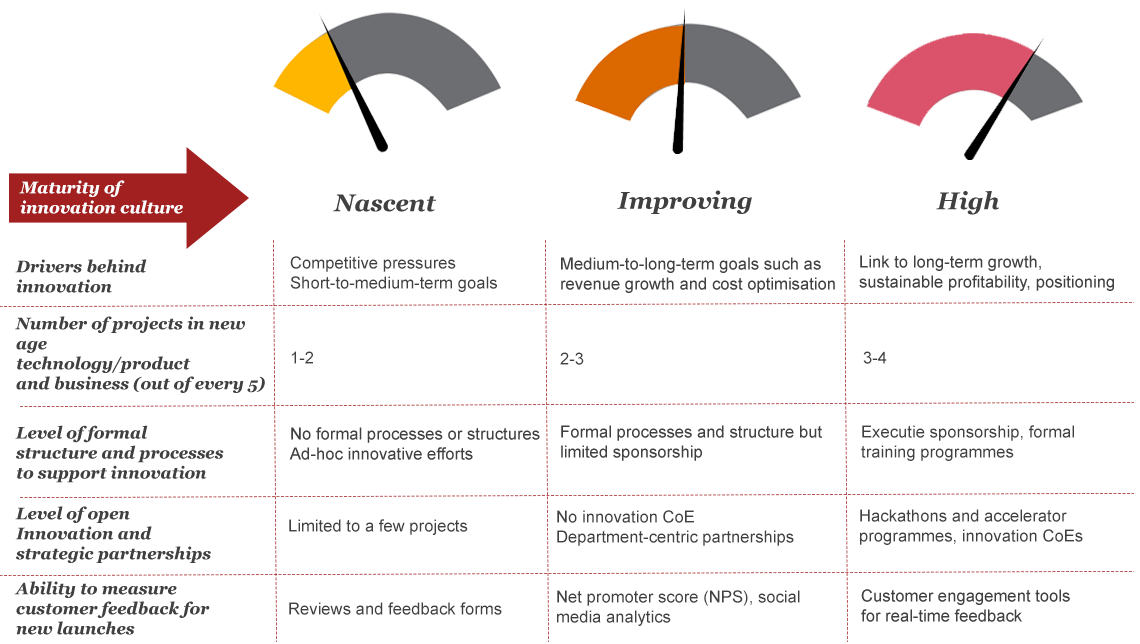

FIs may vary in their levels and platforms created to foster a culture of innovation in the organisation and, hence, in the maturity of their innovation cultures.

Different maturity levels of the innovation ecosystem at FIs

II. Quantify innovation drivers/goals

The innovation ecosystem is an offshoot of the firm’s vision and growth process. Hence, to measure the performance of efforts around innovation, it is critical to first establish the end goal(s) to be achieved in line with the business objectives. The end goals can be expressed in numerous ways, a few of which are depicted below:

Illustrative year 2020 goals of a FI

Once these are defined, the quantification of innovation efforts will become better structured and channelised.

III. Prioritise innovation themes/goals

Organisations, especially small-to-medium scale ones will have a limited budget for innovation. Hence, in order to extract maximum benefit from innovation efforts, it is necessary to adopt a focused approach. A few of the drivers behind the prioritisation of innovation efforts could be:

Once the basic structures are in place, an FI can proceed to more accurately measure its innovation efforts.

The actual measurement process

Based on the current innovation levels and the end goals to be achieved, the FIs should select the most important tools and techniques to gain the most out of their innovation efforts and remain competitive.

Firms which have just embarked upon an innovation journey should focus on measuring the basic ingredients to foster innovation. As firms move up the value chain, they can start quantifying the success of such efforts by measuring the output generated.

Measuring innovation at various stages of the journey

Setting up the right support structures

Measuring innovation is not a straightforward task. Multiple levers and allied functions are necessary to establish an advanced innovation driver and measurement process. A few of these are:

I. Strategic positioning of the innovation CoE

A central innovation CoE needs to transition from marketing and branding initiatives to create a real positive impact.

The innovation CoE needs to occupy a central position in the overall scheme of things and be the seat of all innovation efforts. This will make measuring the velocity of innovation in the firm easier and accurate. To promote a continuous flow of ideas to the innovation CoE, it is necessary to create and encourage simple yet effective levers:

II. Advanced project valuation methodologies

Numerous studies have been conducted to deep dive into financial assessment and measure the success of innovation in financial terms.

A few of them have suggested the following metrics:

- Return on product development expense = (gross margin - product development expense)/(product development expense)2

- Percentage of revenues or profit from products or services introduced in specific years of consideration3

- Return on innovation investment = Innovation magnitude (financial contribution/successful ideas) × innovation success rate (successful ideas/total ideas explored) × investment efficiency (ideas explored divided by total capital and operational investment)4

- Risk-adjusted net present value of the innovation pipeline and the RoI in that pipeline5

- Royalty and licensing income generated from new projects6

- Number of new products launched/new markets entered/business models launched.

While such financial metrics will continue to account for the quantification of innovation to a large extent, it is also critical for firms to assess the overall impact of innovation efforts on the organisation in order to arrive at a fair and comprehensive assessment.

Like innovation itself, its measurement and the subsequent realignment of the course of the journey are also ongoing efforts. Firms should not depend solely on market research for assessing the best ways to measure innovation but also assess the set of metrics which is best suited to drive their growth story ahead.

Sources

- Christensen, C. (1997). The innovator’s dilemma: When new technologies cause great firms to fail. Boston, MA: Harvard Business School Press.

- Balanced Scorecard Institute. (2011). How do I measure ‘Innovation’?

- Kaplan, S. (n.d.). The complete guide to innovation metrics – how to measure innovation for business growth. InnovationPoint.

- Anthony, S. (2013). How to really measure a company’s innovation prowess. Harvard Business Review. Retrieved from https://hbr.org/2013/03/how-to-really-measure-a-compan (last accessed on 30 January 2018)

- InnovationTools.com. (n.d.). How do you measure innovation results and outcomes? InnovationManagement.se. Retrieved from http://www.innovationmanagement.se/imtool-articles/how-do-you-measure-innovation-results-and-outcomes/ (last accessed on 30 January 2018)

- Savkin, A. (2017). How to measure and manage innovations with KPIs. BSC Designer. Retrieved from https://bscdesigner.com/innovation-kpis.htm (last accessed on 30 January 2018)