Evolving business models in the payments industry

Payments drivers in India

The digital payments landscape in India has been growing rapidly over the last few years. The Reserve Bank of India (RBI) reported a compound annual growth rate (CAGR) of 61% in volume and 19% in value for digital payments in India between 2014–2019.1 This growth has been supported and propelled by the continuous emergence of new technologies, payments products/methods, introduction of disruptive market players and regulatory interventions, among many other factors.

Change drivers

The payments industry witnessed a major transformation over the past few years. This changing market dynamics required banks and associated stakeholders in the payments value chain to adapt and shift from traditional business models to newer business strategies, and explore new revenuegeneration/ cost-optimisation avenues from their payments business.

While each player in the payments ecosystem is devising a unique strategy in this fast-evolving industry, there are a few key underlying change drivers that guide the decisions taken by these players:

Evolving customer needs: Customers have been an integral part of the connected economy, having anytime-anywhere access to payments services and methods to compare from multiple offerings. As a result, customer loyalty enjoyed by banks or financial institutions (FIs) is shifting towards non-bank players and creating and maintaining product/service stickiness is becoming difficult in the payments industry.

Moreover, customers are demanding ease of transactions and enhanced experience at competitive prices. Customers are seeking seamless, quick and cost-effective payments experiences across various platforms. Today’s tech-savvy customers prefer digital payments methods that can be accessed via smartphones and mobile apps over traditional methods of availing paper-based services or visiting physical branches.

The constantly evolving needs and demands of customers as well as pricing pressures have led to players relooking at their business models to service their customers in a more price-efficient manner and gain customer loyalty.

Source: PwC analysis of data from industry research

Government and regulatory push for innovation: India is a highly regulated country where the Government and regulators play a critical role in defining the payments landscape. There are various measures undertaken from time to time to protect customer rights, minimise frauds, adhere to know your customer (KYC)/ anti-money laundering (AML) guidelines and strengthen the payments ecosystem. Recently, the RBI issued mandatory KYC compliance guidelines for all wallet service providers and instructions for security requirements at ATMs, extending the option of enabling/ disabling international transactions, etc. Additionally, the RBI directly regulates rules related to pricing structure and oversees not charging customers and limiting/waiving off merchant discount rate (MDR) charges to foster financial inclusion and encourage the Digital India initiative.

Government entities are also promoting cashless transactions among citizens by taking various measures such as encouraging (or mandating) more merchants to adopt digital payments modes, providing tax benefits for digital transactions and pushing banks to issue digital cards. While such progressive measures by the Government and regulators have definitely redefined the payments landscape, additional measures from regulators that could further make the business models of all participants in the ecosystem more sustainable are awaited.

Emerging new technologies: Traditional and legacy payments frameworks continue to work on older and outdated systems that offered minimal services and find it difficult to evolve over time. Replacing such legacy systems involves huge investments and a cumbersome process of data migration which banks and FIs find difficult to execute. There are multiple fragile systems within the payments ecosystem which may be overburdened with changing requirements. This is an area where emerging new technologies have been successful in developing solutions that can be integrated to offer services through front layers, with minimal interactions with core systems. Efficient implementation of technology systems can be a game changer for banks and FIs.

While more agile players have adopted these new technologies, traditional players are struggling with their dependency on legacy architecture. Though FIs find adopting innovative technologies beneficial, they are critically evaluating strategies to upgrade their systems (typically involving high-capital expenditures) and exploring newer business cases using technologies.

Increased competition: Over the years, the industry has welcomed participation from various payments stakeholders ranging from wallets, payment service providers (PSPs), FinTechs and BigTechs who create digital payments platforms and services. While newer players may not provide all services as offered by banks, they identify specific segments and offer rich customer experiences at competitive prices. Additionally, newer players are subjected to limited regulations compared to banks, thereby resulting in cost savings. Rewards and cashbacks are a few popular approaches undertaken by FinTechs/wallets/BigTechs with investments from private equity (PE) firms or group companies to acquire and retain customers. Adoption of such approaches has eventually led to a downward revision of pricing and created competitive pricing strategies in the market. In such a competitive environment, it becomes equally important for existing players to adopt new business models that will help them sustain in the ecosystem.

| Factors impacting business strategies of payment players | Description | Impact on profitability |

| Customer segment | ||

| Price sensitivity of customers | Payments is a price-sensitive industry, with customers preferring services that are available at low cost (or no cost) as the primary decision-making factor | |

| Minimum loyalty | Customers’ loyalty is minimal to any particular player in the market as it is driven by various offers, rewards, cashbacks, etc. | |

| High-growth potential | Lot of scope in increasing the market share of digital payments as over 70–80% of payments in India are still cash based | |

| Customer demand for improved experience | High potential to attract customers and gain market share by offering enhanced customer services | |

| Regulatory and Government interventions | ||

| High regulatory interventions | Stringent regulations involving additional cost implications and investments | |

| Direct control of pricing by regulators | Regulators have direct control on pricing | |

| High Government support | Promotion of digital payments and payments instruments in the country, leading to improved customer awareness and acceptance infrastructure | |

| Market players and competition | ||

| Highly competitive market | Low entry barriers for entrance in the payment services market | |

| Partnerships and alliances | Opportunity to focus on core services and offer value-added services via FinTechs/BigTechs | |

| High investment/PE capital | Potential to attract funding from open-market sources | |

| Services/products/technologies | ||

| Rapidly evolving technologies | Ease of business with new innovative technologies, though it involves huge investments | |

| Product differentiation | Minimal product differentiation opportunities, multiple players offering similar services at aggressive prices | |

| Very thin margins | Higher cost of acquisition but low revenue generation and profit margins | |

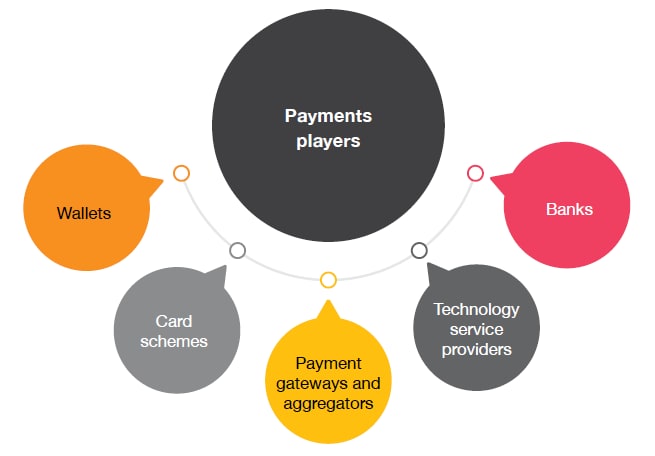

Emerging business models by payments players

Today, payments have become more of a commodity. They offer greater value and attracts more consumer interest. In this section, we will discuss a few measures and business strategies adopted by key stakeholders in the payments value chain that could help them sustain and grow their margins from payments businesses.

Source: PwC analysis of data from industry research

For many years, banks have spent extensively on setting up infrastructure for payments transactions and remained cost centres. However, with evolving customer expectations and market dynamics, payments are becoming a core offering. Banks are exploring new avenues to generate profitability from their payments business. A few such strategies are listed below:

- Cross selling/upselling other banking product and services to existing payments customers.

- Building partnerships and alliances to cocreate and explore new use cases with FinTechs. A few large banks have also acquired small players (e.g. wallet firms) to gain market share.

- Monetising data by using advanced data analytics tool to leverage customer and merchant payments data for generating insights and providing personalised offerings.

- Developing B2B2C models through open application programming interfaces (APIs) provided by banks for FinTechs and other players to offer banking services to end retail customers.

- Alternative merchant offerings to counter the abolition of MDR by:

• increasing settlement time with merchants to earn additional float income

• providing working capital loans to merchants by leveraging their existing payments data and taking calculated risks on loan amounts sanctioned

• increasing current account rates or pricing of other services offered to merchants

• shifting from percentage-based MDR to flat one-time or increased monthly charges for merchant services. - Leveraging digital channels for reducing costs on customer onboarding and servicing by:

• adopting video KYC to onboard customers and reduce costs incurred to schedule physical visits

• encouraging customers for using digital channels (mobile apps, online portals) as the cost of servicing customers on digital channels is much lower than traditional channels of branches and ATMs.

Wallet firms emerged and started offering e-wallet products for online payments. However, these firms are highly impacted by stringent regulatory frameworks and emergence of the Unified Payments Interface (UPI) framework. The RBI’s regulations, including mandatory full KYC compliance for wallet players, led to a total change in the business dynamics of wallets. Firms providing wallet services are largely impacted in finding compelling business proposition as their core business offerings like fund transfer facilities between persons and merchants have been taken over by UPI. Some players exited the market, while others are struggling to survive. Only a few players could afford to deploy field agents to conduct physical KYC checks, leading to many players opting for new strategies. Some of the new strategies adopted are discussed below:

- Exploring adjacencies by expanding the catalogue of services and additional businesses along with wallets:

• a few wallet players adopted marketplace models or developed all-inone apps to service multiple use cases

• a few players expanded their product offerings to include payment gateway/payment aggregator services

• many others received licences as PSPs for UPI and operating units (OUs) for Bharat Bill Pay Service (BBPS) or payment banks. As per a recent press release by the RBI, the payment banks are expected to become small finance banks or universal banks, depending on final guidelines. - Building partnerships with banks and non-banking financial companies (NBFCs) to facilitate loans, insurance policies, mutual funds, etc., on a revenue-sharing basis

- Targeting specific customer segments like corporate wallet solutions, gift cards, meal coupons, transit cards for the B2B segment, etc.

- Adopting cost-effective solutions such as QR codes for merchant payments

- Engaging in competitive pricing to increase market share by a few players, especially ones with PE funding, even with wafer thin or negative margins

Card schemes earn revenue from switching domestic/international card transactions between banks, covering authorisation, clearing and settlements. They benefit from this network and mostly generate revenue by charging the FIs on card issuance and transaction switching. Card payments are still the most used payments method in India and account for around 29% of transactions worth USD 10.6 billion.2 With disruption of payments over the past few years and increasing competition, card schemes have also undertaken aggressive measures to protect their interest and to stay competitive by:

- focusing on non-core revenues by offering value-added services like certifications, change requests and fraud prevention services, in addition to core switching revenues

- acquiring FinTechs with specialised skills in payments/adjacent businesses

- focusing on the sector by introducing products and services targeted for specific segments, e.g. the Government sector, transit sector and the small and medium enterprises (SME) sector.

TSPs have been providing technology infrastructure ranging from banking to switching solutions as a primary service and mostly worked on hosted or license-based models. TSPs have also adopted the strategies discussed below to widen the scope of their business model and boost earnings by:

- leveraging technology prowess to reduce operational costs, i.e. by offering cloud-based solution and automation using robotics

- offering value-added services like customer service, recon and settlement solutions, fraud prevention solutions, analytical solutions, support and maintenance services by extending on-ground manpower

- offering a range of pricing models to banks/non-banks such as plug and play solutions and subscription-based model

- exploring additional regulatory licensing opportunities like selfregulatory organisation SRO and new umbrella entity (NUE) to play a larger role in the payments ecosystem.

The market of payment gateways (PGs) and aggregators in India is expected to grow at a CAGR of 15%3 over the next five years. The integration of PGs has become one of the most critical aspects from a business point of view as the demand for such gateways in the industry increases. Recently, the RBI published the guidelines for regulation of payment aggregators (PAs) and PGs, considering their importance in and contribution to the industry. With these new guidelines, existing players will have to assess and realign their business models to be compliant with regulations. They will require enhancements to existing technology platforms and improvements in operational processes to meet baseline guidelines set by the RBI. With changing dynamics, PGs and PAs are also looking to explore additional ways of boosting their businesses by:

- extending value-added services through software upgradation and technical assistance

- pricing for international transactions involving multiple currencies are levied with higher transaction fees

- charging fees on non-transaction services like chargebacks

- providing access to dashboards and custom views on chargeable basis

- providing a host of features like easy customisation, data insights, checkout facilities and recurring payment facilities to merchants in order to attract more customers

- executing mergers and acquisitions, and strategic partnerships to gain market share.

Evolving business model and strategies

Source: PwC analysis of data from industry research

| S.no. | Business models andstrategies | Description/examples |

| 1 | Data monetisation | Data-driven insights and analytic offerings using customer data/merchant data/demographics, etc. |

| 2 | Alternative pricing models | Subscription model, freemium model, slab-based pricing model, bundled services, subsidised pricing, etc. |

| 3 | Mergers and acquisitions | Mergers, acquisitions and investments between market players |

| 4 | Value-added services | Non-core offerings, like fraud prevention solutions, customised reports, cash@POS, equated monthly instalments (EMIs), certifications, recon solutions, etc. |

| 5 | Applications for regulatory licences | Payment players are trying to get licences to position themselves to the next level, e.g. banks/TSPs applying for SRO/NUE licenses and wallet players applying for payment banks/small finance banks (SFBs) |

| 6 | Exploring adjacencies | Expanding the suite of offerings across the value chain by partnerships, cross selling and upselling of products, e.g. working capital loans, wallet players offering PA/PGs and marketplace model/all-in-one app |

| 7 | Targeted offerings | Sector-specific or customer segment specific offerings, e.g. transit-specific offerings, focused offerings for government payments and corporate offerings |

Way forward

As a developing country, India has witnessed major innovations and enhancements in the payments domain over the years, though the scope for newer opportunities lies underway. It will witness further evolution as businesses accept changing market dynamics and adopt newer or alternative methods.

The demand for digital will continue to expand and accommodate newer players in the market. However, a few smaller players may struggle to remain profitable in the market. In the absence of a clear path to profitability from payments businesses, consumer-facing wallet firms and technology firms may continue to need venture capital funds or group company funds to support their expansion plans or subsidise any losses from existing payments businesses. The payments business is likely to become fundamental with firms focusing on leveraging payments data and customer/merchant relationship to cross sell other service offerings.

Non-banks are likely to become the primary payment interface providers that handle consumer and merchant services, with big banks continuing to handle the underlying payments infrastructure. Instead of competing against each other, banks will increasingly enter into partnerships with FinTechs and TSPs. This kind of partnership is beneficial for both parties involved, with start-ups benefiting from the scale, market brand and pre-existing customer base that established players bring and banks benefiting from the implementation of innovative ideas and advanced technological solutions that new players bring.

As a way forward, the payments industry demands representatives of stakeholders from different domains to come forward and develop an ecosystem where entities following varied business models can coexist and cocreate payments solutions to address the needs of customers.

With input from Pallvi Goyal, Saurav Mangalmurti and Mohit Sethi.

Payments technology updates

RTGS to be available 24*7*365 from Dec 2020

Economic Times

The Reserve Bank of India (RBI) in its Statement on Development and Regulatory Policies has announced that the money transfer facility, RTGS, will be available round the clock, 24 hours a day, 7 days a week from December 2020.

Government employees will receive interest-free RuPay prepaid cards worth INR 10,000

Business Today

Finance Minister Nirmala Sitharaman said that under the Special Festival Advance scheme, the RuPay prepaid cards will be available up to 31 March 2021.

The RBI’s assessment of the progress of digitisation from cash to electronic

Reserve Bank of India

The RBI reported a CAGR of 61% in volume and 19% in value for digital payments in India over the past five years.

The RBI’s framework for authorisation of pan-India Umbrella Entity for Retail Payments

Reserve Bank of India

The RBI has released the final framework for authorisation of a pan-India umbrella entity for retail payments.

The RBI’s draft framework for recognition of a self-regulatory organisation

Reserve Bank of India

The RBI invites comments on the draft framework for recognition of a self-regulatory organisation (SRO) for payment system operators in India.

Growth, trends and forecast for the Indian payment gateway market 2020–2025

Businesswire

The Indian payment gateway market is expected to grow at a CAGR of 15% over the forecast period of 2020–2025.