What lies ahead in digital payments trends for 2021

March 2021

Predicted payments trends

Digital payments in India have witnessed a steep growth curve in the past few years. 48 billion digital transactions were recorded in calendar year (CY) 2020 despite the COVID-19 pandemic and its effect on the economy. This growth has been fuelled by new players entering the payments ecosystem, innovations in technology, initiatives taken to address customer convenience and forward-looking regulatory changes.

Digital payments are set to grow continually and will be adopted on a larger scale in 2021.

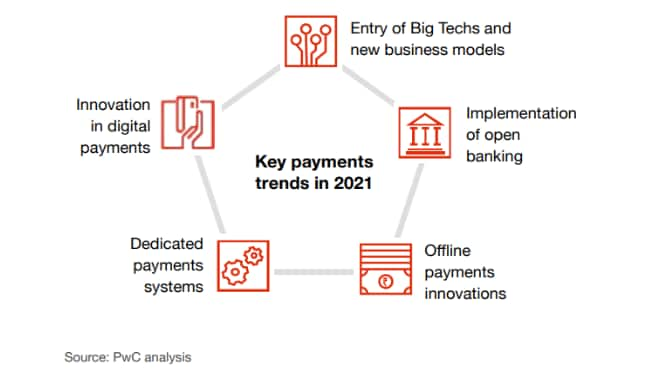

The figure below outlines the five key areas expected to be among the trending themes within the overall payments space in India.

Entry of Big Techs and non-banking players

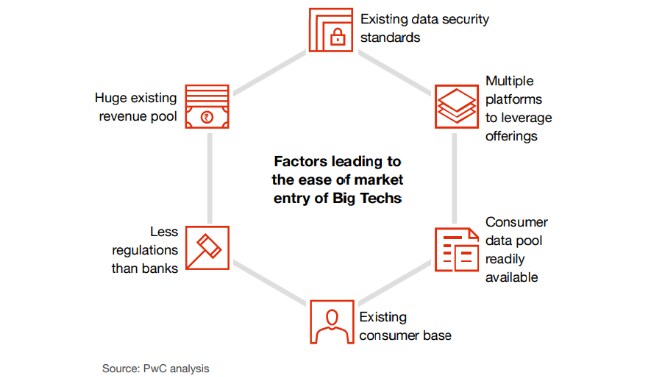

The digital payments space has been attracting Big Techs as they see it as an opportunity worth USD 3.6 trillion.1 Not only are digital payments complementary to the current businesses of Big Techs (in terms of easing payments and collections) but also ensure higher customer stickiness.

A number of Big Techs has already focused on payments and emerging markets for venturing into new growth areas.

A global technology conglomerate has launched a payments service via its messaging app and made it available to 20 million users in India in the first phase. It is being supported by four major banks. Another US-based multinational technology company has made strong inroads into the digital payments space in India. The payments app developed by this organisation had the highest market share in terms of the overall volume of Unified Payments Interface (UPI) payments in the month of November 2020 with over 960 million (43%) transactions.2

As Big Techs further establish their presence in the Indian payments ecosystem, they will develop new revenue models for the industry. These are expected to replace the fee-based models of the past as primary sources of revenue will change with more offerings for the consumer base of Big Techs. Most Big Techs are leveraging their existing consumer base and behavioural data collected over the years to develop better payments solutions. Once they firmly establish themselves in the payments ecosystem, they look to add other complementary products/services that can be cross sold to increase customer stickiness and generate incremental revenue. The vast amount of customer data that will be generated can further help Big Techs to sharpen customer profiles/personas for better targeting.

Big Techs have developed new business models and strategies in the payments market and traditional players (banks, payments service providers [PSPs], etc.) are following suit. Some of these are models are:

- Neobanks and overlay services like payments apps provide both investment and bill payment options. A neobank in India offers payroll services for businesses along with current account and vendor payment facilities.

- New partnerships/acquisitions to gain market share in alternative banking services and explore new capabilities. For example, a card network platform has collaborated with a bank for its FinTech acceleration programme. Similarly, a large Indian conglomerate’s collaboration with a messaging app for payments and a FinTech’s partnership with a remittance player to facilitate global transactions for small businesses and freelancers are some instances of such partnerships/acquisitions.

- Value-added services like recon solutions, fraud detection or customised reports to develop alternative revenue streams.

- Cross-selling or upselling products like digital loans and one-stop apps to the existing set of consumers. For example, a card-issuing FinTech entered into a partnership with a bank to provide digital corporate cards and card-based reward services.

- Alternative pricing models like subscriptions, freemiums or full-stack bundles.

The payments space has also seen the emergence of players from multiple categories, ranging from device manufacturers and Big Techs to telecommunications companies that are working to provide seamless experiences to customers.

Over the years, companies have diversified existing business models through expansion of services such as PSPs, payments banks, wallets and marketplace services.

Wallet companies are exploring opportunities in offering credit and payments banking. FinTechs, which started as mobile wallets, which started as a mobile wallet, are now providing solutions ranging from instant loans to wealth management, buying/selling digital gold and digital insurance. PSPs are planning to scale up their products by providing lending and neobanking services. Another FinTech has come up with post-paid options, personal loans and merchant cash loans in partnerships with banks and non-banking financial companies (NBFCs).

Additionally, regulatory initiatives have encouraged many start-ups to explore and develop solutions that expand the use of digital payments methods, especially for the unserved population of India. We will observe many new entrants in the coming years who explore innovations in offline payments, voice-recognised payments, etc.

Implementation of open banking reshaping the banking industry

The payments industry has been majorly driven by customer-centric models in recent times. Open banking is one such model that third-party services can use to access the banking data of consumers from various financial institutions (FIs) using application programming interfaces (APIs).

Accessing consumer data enables financial service providers and institutions to be transparent in their approach and provide tailored, optimal solutions to customers, and thereby strengthen relationships. Such data can also be used for conducting easy credit checks and risk analysis of customers.

Initiated by some of the leading private sector banks, open banking has now grown to become an integral part of the FinTech segment. As a result, the following changes in the digital banking space can be observed:

- The emergence of account aggregators will assimilate siloed data to provide a more comprehensive and 360-degree view of a customer’s financial details collated from various financial institutions.

- Increased availability of customer information will result in competitive pricing, improved use cases and user experiences as the ecosystem will evolve with the onboarding of a greater number of players. Any initial hesitation will pave the way for greater adoption as the tipping point will be reached.

- Open banking will result in large incumbent banks becoming more competitive with smaller and newer financial institutions, thereby compelling the latter to upgrade their technology and legacy systems to offer new-age and tech-centred solutions.

- Easier access to customer data will now help FinTech start-ups and institutions to come up with more targeted, better-tailored and innovative solutions for new-age customers in insurance, digital lending and various other banking services.

Offline payments

Digital payments have evolved from being plastic cards based to mobile based for online transactions. Offline payments, a largely unexplored area, are the next big opportunity in the payments space. They have so far been mostly used in transit use cases. However, offline payments catering to other use cases will be developed and help bring a significant portion of the unserved and underserved segments under the digital payments fold. This will be particularly beneficial in cities where internet connectivity is sparse.

The Reserve Bank of India (RBI) launched a pilot scheme last year to boost offline payments. Entities have been encouraged to accelerate the development of offline payments solutions via cards and mobile devices. As a result, several solutions have been launched. As far as cards are concerned, there have been attempts to create offline in-card purses that allow cardholders to complete the transaction at a point of sale (PoS) machine without any internet connectivity and the transaction is processed once the terminal is online. Many other companies are focussing on enabling payments through feature phones. Solutions range from encrypted messages and missed calls to sound waves.

With a plethora of innovative solutions in development, customer awareness and education will be the only areas that need to be expanded further before offline payments grow as a result of new customers using digital payments.

Banks and payments companies are expected to have dedicated platforms/systems for managing payments

The rise of digital payments in India is largely fuelled by the increasing number of mobile device users, proliferation of the internet and Government initiatives like the Jan Dhan-Aadhaar-Mobile (JAM) trinity. As a result, digital payments have witnessed one of the steepest growth trajectories in 2020. The total number of digital transactions in 2019–2020 stood at 3,434 crore and grew at an annual growth rate of 44.1%.3 Over 2.2 billion UPI transactions were recorded in the months of November and December 2020.4

However, the rise of digital payments has also led to many instances of failed payments due to technical issues related to infrastructure, network outages and server downtimes, among others. Many major banks faced such problems throughout 2020, which in turn negatively affected customer confidence and satisfaction, and acted as a hindrance to the continued adoption of online payments. Five of the top ten banks had a technical decline rate of 1.8% in 2020, with public sector banks accounting for the top three spots.5

An RBI report on the deepening of digital payments suggests improvement of system design, monitoring and architectural changes to address the issues of technical decline. It also suggests that PSPs and other institutions should ensure that a 25% year-on-year (YoY) decline in failure rates is achieved..6

A few players should also consider having dedicated platforms/systems for all payments apart from changing their IT infrastructure to improve latency and connectivity. This would ensure that the increasing load of payments transactions does not put undue pressure on entire existing banking facilities.

A separate platform to process and authenticate high-frequency transactions could help ease the burden on core/legacy infrastructure. It will also enable faster integration and reuse of capabilities, and act as a single source of truth for customer and transaction data that can also be used for analytics. It is also expected to ease switching for third-party ecosystems in the future.

Having a single platform will help in the following ways:

- Server switching ensures that a connected platform processes a transaction in case the primary server is down.

- Security can be improved with a dedicated full-stack platform that comes with end-to-end encryption and multiple verification levels.

- User experience will be highly improved with a one-stop platform for all services and it can provide overlay services by providing open APIs for integration with multiple businesses.

- Leveraging a secondary UPI ID by automatically switching IDs when the primary PSP is unavailable due to technical issues.7

- Faster transactions will be more convenient as a dedicated channel is utilised for all such transactions.

Given the ever-increasing number of payments avenues, the role of payments hubs will become more important. These are essentially systems that support multichannel payments and provide a unified banking platform, and help with straight-through-processing (STP) as well. This increases operating efficiency and brings in flexibility and scalability while lowering operational overheads and costs. Further, payments hubs also act as repositories of comprehensive payments and transaction data on multiple products which in turn can be used for customising offerings.

Sustained innovations in digital payments

India has been at the forefront of a global innovation in digital payments and this trend will continue throughout 2021. Stakeholders are trying to explore the global payments space and develop innovative solutions. Some of the initiatives that will gain prominence and aid in continued innovation are:

- Cross-border remittances: The RBI is planning to set up an innovation hub to explore technologies and initiatives that can be used to recast and simplify the cross-border payments space, as well as make such payments more accessible and affordable.

- Pan-India umbrella entities: The RBI has developed a framework defining the eligibility and governance criteria, along with a scope of activities for new entities. This was done to encourage healthy competition and strengthen the retail payments landscape. A consortium of banks, payments networks, service providers and financial investors is expected to participate in this race to expand the market by providing innovative payments infrastructure, products and services.

- Payment Infrastructure Development Fund (PIDF): The PIDF will be used to strengthen the digital payments acceptance infrastructure focusing especially on tier 3–6 cities and north-eastern states. The fund has been set up with an initial investment of INR 345 crore and will encourage innovations in the acceptance space in rural India where awareness, costs, connectivity and other factors pose a challenge for the development of digital payments.

Key asks by the payments industry

The payments industry is expected to undergo significant changes in five major areas that will help in further driving an already growing market.

Key asks for 2021

Market-driven pricing and changes in MDR

In December 2019, the Government of India (GoI) took steps to waive the merchant discount rate (MDR) for payments made through:

- debit cards powered by RuPay

- UPI transactions.

The decision was taken to incentivise merchants who offer digital modes of payments to their customers. Businesses with an annual turnover of worth more than INR 50 crore have to mandatorily provide their customers with digital payments options.

The decision has increased penetration and early adoption of digital payments, and has contributed to the growing volumes of UPI transactions in 2020. However, a few areas negatively impacted by zero MDR are:

- Reduced revenue for banks and PSPs as they spend more on revamping IT infrastructure and capabilities to facilitate the growing volumes of digital transactions. Banks/payments companies need to be financially supported to make these technology investments.

- Adjacent costs related to annual maintenance contracts (AMCs), setting up data centres, hiring software engineers and installing PoS terminals must be borne by the players. This could be a problem for smaller banks and payments companies who are yet to get a foothold in the payments space.

To address the above-mentioned and other such issues arising from banks and PSPs having no real incentives to invest in such facilities, the Nilekani Committee Report of 20198 recommended charging a market-based MDR at initial stages that can then be reviewed periodically by a standing committee set up by the RBI.

A sunset period for the zero-MDR regime could be fixed, post which a market-based model could take its place to incentivise FinTech start-ups and small players without deep pockets to enter the payments market and lead to new innovation and healthy competition.

Increased security for transactions and increased customer awareness

The growth of digital payments and participation of multiple players require the security of transactions to be enhanced. Currently, phishing and vishing are not the only methods used to target customers. Databases and servers of banks and PSPs are also being hacked. While PCI-DSS and PA-DSS compliances are mandatory for participants in the payments ecosystem, they fall prey due to lack of implementation, open vulnerabilities and redundant servers that are left unattended. Until recently, instances of customer data being leaked through hijacking a server belonging to a mobile payments solution company were reported. Such data is sold on the dark web and used by fraudsters and imposters to defraud customers.

As per reports from the Ministry of Electronics and Information Technology (MeitY),9 nearly seven lakh cases of cyberattacks were reported until August 2020, almost double than those reported in the previous year. Industry reports estimate the average cost of losses incurred due to fraud in 2020 to be worth INR 14 crore.10

The RBI, MeitY, banks and other players have taken several measures to educate customers and merchants about the importance of maintaining the secrecy of sensitive data. Customers fall prey to fraudulent activities and reveal personal details and it is the responsibility of banks/other players to provide support during such instances. However, there is a strong requirement for written regulations in maintaining the privacy of customer information and increased security of transactions to prevent such fraudulent activities. The RBI has already formed guidelines on regulations of payments aggregators and gateways to maintain the security and submission of periodic reporting.11 Additionally, the RBI has also issued directions on Digital Payment Security Controls.12 The favourable steps taken by the central bank will help the payments industry to adopt a standardised approach in maintaining the privacy and security of customers and their transaction-related information.

India’s indigenously developed digital payments platforms can go global

India has been at the forefront of innovations in the digital payments space over the past decade and witnessed some major breakthroughs in the forms of Aadhaar – a biometric-based national identity, UPI – a real-time payments system that uses virtual IDs associated with bank accounts, Aadhar Enabled Payment System (AePS) for biometric authentication, FASTag for cash-free toll payments and contactless transit cards based on the National Common Mobility Card (NCMC) specifications.

India has been able to successfully develop IndiaStack, an open APIbased solution to enable the Government, banks and other businesses to leverage digital infrastructure for paperless onboarding of customers/ merchants and create interoperability.13 The independent layers of Aadhaar, bank accounts and virtual payment addresses have been linked together to create the stack where the customer can avail a seamless experience from onboarding to payments. There have been multiple use cases based on such technology implementations, ranging from digital onboarding and KYC to direct benefit transfers.

With the passage of time, innovative technologies and interoperability are being used to solve multiple complex problems in India. Other countries are now expecting India to adopt the best practices in solving their country-specific issues and the RBI has also received multiple requests on this regard. This is a suitable time for exploring interoperability with other countries and going international with the developed standards and payments solutions. The adoption of IndiaStack and payments instruments by foreign countries has the potential to develop new use cases of cross-border remittances and gauging real-time settlements. Cheque Truncation System (CTS), National Automated Clearing House (NACH) and National Electronic Fund Transfer (NEFT) are already operational in Bhutan and one-way NEFT transfers from India to Nepal are functional. The National Payments Corporation of India (NPCI) has also created the NPCI International Payments Limited (NIPL), a subsidiary that will enable the usage of RuPay and UPI in other countries, and increase their global presence and acceptance. Such initiatives have the opportunity for players in India to reap benefits from their investments in developing solutions and earn an inflow from foreign players, thereby adding to the India’s GDP.

While such initiatives involve liquidity risk, the involvement of central banks can de-risk adversities through constant coordination and efficient monitoring.

Consolidation of payments (across players and rails)

There is further scope in India for consolidating banking services and payments. The entry of banks, payments banks, payments system operators, technology service providers (TSPs) and FinTechs has increased complexities. While customers get the benefit of choosing from the number of available instruments, redundancy and fragmentation have increased in terms of non-tracked accounts and unused wallets that can be leveraged by fraudsters for money laundering.

There is a need to consolidate payments services to increase efficiency and customer control. India has envisioned implementing the concept of ‘one nation, one mobility card’ and a similar idea of ‘one nation, one bank account’ could help address the banking and payments requirements of customers. It will also reduce the number of bank accounts held by customers, thereby reducing the minimum balances to be maintained and charges incurred for various services. The regulators shall look at limiting the number of accounts held by customers and enabling payments services with an identifier that is also linked to their Aadhaar. In the current competitive market, banks strive to acquire new customers but the active customer base continues to be low. Banks or financial institutions are required to relook at and consolidate their payments offerings with bundled solutions that have a 360-degree focus on customers. The consolidation of payments would essentially utilise banking services at the core and provide an overlay that connects the complexities with over-the-top services.

The RBI has initiated mergers of banks to consolidate the industry. Some public sector banks have been merged with others to consolidate their banking business, curb the issues of bad debts and non-performing assets (NPAs), and move forward with a redefined approach. More such consolidation will take place this year in the banking and payments ecosystem, attracting more investments, larger deals and acquisitions.

Relooking at regulations and new avenues

The rise of digital payments and surge in penetration in the last couple of years have accentuated the demand for safer and robust systems that are well regulated for fairness and integrity of transactions. The RBI has been taking measures related to regulations for expansion and market adoption of various products in the form of PPI Master Directions, Payments Bank Regulations, etc. But the uptake and adoption of some measures have been low. In order to cater to the growing needs of the industry, the RBI may need to relook at some of these regulations and modify them based on current scenarios.

The RBI has granted licences to payments players for setting up white-label ATMs (WLAs), issuing prepaid payments instruments (PPIs) and setting up payments banks. However, the growth has not been as promising as expected in some cases, leading to players moving out of the business by surrendering their hard-earned and coveted licences.

For example, PPIs offer easy onboarding and usage facilities to customers. The Master Directions by the RBI have allowed semi-open PPIs to be available at a cap of INR 10,000 with minimum KYC requirements.14 Nonbank PSPs are now hoping that the central bank allows them to issue open-loop PPIs and cross-border outward remittances for both full- and minimum-KYC customers to induce fair competition in the card market. Customers can benefit from using payments instruments to transfer money and first-time creditors will get to build their credit history from scratch.

Payments banks are required to park 75% of their funds in low-yielding Government securities/treasury bills and cannot participate in lending activities. This model allows payments banks to explore a few business areas with relatively lower margins. Going forward, payments banks would expect the costs of building/maintaining digital infrastructures to be shared with the Government and a liberal policy on deposit limits. Payments banks that have been operational for five years were recently offered the option of converting themselves into small-finance banks. This will enable them to offer lending services, thus providing them with an opportunity to become more profitable. The RBI can also look at other avenues to help out players where the business case has not panned out as expected. While the RBI is taking significant steps to support payments players, it is also important for the central bank to ensure a fine balance between encouraging players to promote the adoption of digital payments in their respective segments and penalising licensed companies that have not been able to achieve their business targets despite being issued specific licenses for WLAs, PPIs and payments banks.

Conclusion

The digital payments ecosystem in India has witnessed various developments in the past, ranging from launching innovative payments solutions and developing dedicated platforms for processing to forming regulations for higher adoption.

Implementing the key asks discussed in the above-mentioned sections is necessary for expanding the digital payments market. Inclusive participation is required from all the players and regulators to achieve appropriate results. From a regulatory perspective, market-driven pricing aspects that possibly eliminate profiteering, allow for amendments in regulatory guidelines, encourage the formation of new regulations on transaction security and consolidate and standardise banks/ payments participants will further strengthen the digital payments ecosystem. The payments platforms that have been indigenously developed over the years should be utilised in other countries for addressing their digital payments requirements. This would ensure profitability for Indian banks/financial institutions and encourage interoperability between nations. India has always been at the forefront of development and innovation, and its contribution towards strengthening the digital payments ecosystem this year is expected to be no different.

With input from Aarushi Jain, Siddharth Gupta, Saurav Mangalmurti, Prachi Dalmia and Shamik Bandyopadhyay

Payments technology updates

RBI launches Digital Payments Index

Economic Times

The Reserve Bank of India has constructed a composite Digital Payments Index (DPI) with March 2018 as the base period to capture the extent of digitisation of payments across the country.

Kirana stores witness 96% rise in AePS transaction volumes during lockdown

MoneyControl

India’s leading hyperlocal fintech start-up PayNearby on January 12 said that during the COVID-19 lockdown there was a rise of 96 percent and 27 percent in volume and value, respectively in AePS withdrawals (Aadhaar ATMs) at Kirana outlets across the country.

India Banking’s digital drive is looking increasingly bright for banking correspondents

ETPrime

Thanks to their role in taking banking and financial services to the last mile, several e-commerce players are interested in tapping them to make inroads into the hinterland.

Digital Payments well entrenched in Indian households across income groups

NPCI Press Release

Digital Payment methods are well accepted by Indian households and are not just the preserve of the rich or well educated, finds a study conducted by People Research on India’s Consumer Economy (PRICE) in partnership with the National Payments Corporation of India (NPCI) which covered 5,314 households across 25 states.

Online sales see growth from Tier 2, 3 cities, UPI to rule payments

Business Standard

For Tier II and Tier III cities, localised customer support in regional languages and dialects will help businesses and brands to gain a competitive edge

Contact us