Web 3.0 and payments

April 2022

Overview of Web 3.0

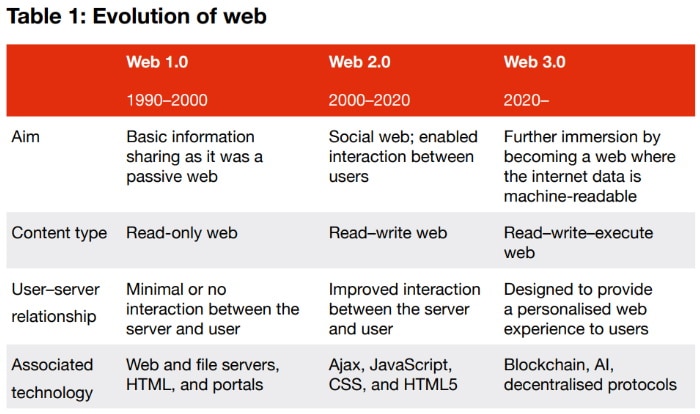

The World Wide Web (commonly referred to as the ‘web’) has revolutionised the world since its inception in 1989. The web has evolved over the last few decades, and each evolution has led to the introduction of new tools and techniques which have helped in enhancing the user experience.

The different phases of the evolution of the web can be categorised into Web 1.0, Web 2.0 and Web 3.0, based on their offerings and features.

Web 1.0 was the read-only web with static information that focused on basic information sharing, while Web 2.0 enabled interactive collaboration with a focus on two-way communication. Various innovations in the last decade on machine-readable data and discussions around owning as well as controlling the data on the web have led to the concept of Web 3.0, which is still in the initial phases of design.

What is Web 3.0?

Web 3.0 is the third generation of internet services, which aims at utilising machine learning and distributed ledger technology (DLT) to create more intelligent, connected and open websites. Moreover, it intends to digitise the world by interconnecting people, processes, data and things.

One of the basic foundations of Web 3.0 is decentralisation, which focuses on transferring powers from big tech companies to individual users. It uses blockchain technology to realise decentralisation and specially designed portals and applications to access Web 3.0, often known as decentralised applications (dApps). One of the limitations of Web 2.0 was that it was dependent on entities such as web hosting services to operate in a more centralised manner. However, with Web 3.0, the operations become autonomous, as it is not controlled by a single entity. Web 3.0 is also expected to bring in opportunities for users to own and control their content while also being able to manage their content profitability. This enables the network to be decentralised, more open, trustless and permissionless.

Features of Web 3.0

Open: It will be constructed on an open-source software and will be executed in the full view of the world.

Trustless: The interaction between the consumers can be done without the involvement of any third party.

Permissionless: Consumers do not need authorisation from the agencies to avail the offered services.

Possible benefits and challenges of Web 3.0

The transition to Web 3.0 is expected to make the web more intelligent and consumers’ lives simpler. However, the capabilities of Web 3.0 are yet to be fully tested since its implementation has just begun.

Web 3.0: Benefits and challenges

Benefits

Transparency and data ownership

Uninterrupted services

Security and encryption

Enhanced communication

Challenges

Accessibility

Costs

Data validation

Scalability and speed

Possible benefits of Web 3.0:

Web 3.0 will introduce significant changes and promote adoption of new technologies. More such benefits are highlighted below.

- Data ownership and transparency: Payment companies are exploring Web 3.0 to decentralise the internet using blockchain technology. The decentralised networks and distributed technologies provide complete ownership of data and eliminate the dependency on financial institutions.

- Uninterrupted services: Web 3.0 will have no single point of failure that results in reduced service denial. This is because the distributed nodes eliminate the need of multiple backup, in order to prevent server failure and help in hassle-free payment processing.

- Security: With peer-to-peer (P2P) communication, security management in Web 3.0 is more distributed. Therefore, access to any information requires consensus from all the key stakeholders. Moreover, data is encrypted before sharing and is fully secured on Web 3.0.

- Enhanced communication: The user interface of the Web 3.0 will provide a more immersive, persistent and interactive version of the payments ecosystem. This will enhance the mobile and internet banking experience for users.

Possible challenges of Web 3.0:

As with any new innovation, Web 3.0 comes with its own set of challenges that may hamper adoption. Some of these have been discussed below.

- Accessibility: In order to access Web 3.0, there will be a need for device upgrades as many devices such as computers, sensors and mobiles may not be compatible with a few features of Web 3.0 (e.g. edge computing, decentralised networks). Web 3.0 will need to be integrated into modern web browsers to enable seamless access to the internet.

- Costs: Costs associated with development and resources, especially for a blockchain set-up for FinTechs, are higher compared to the previous web. This may impact usage by end users.

- Data validation: Although Web 3.0 uses AI applications, it is unable to identify and fix incorrect and misleading data.

- Scalability and speed: Web 3.0 works on blockchain systems. Because of the multiple nodes involved due to its decentralised structure, the processing of transactions is slower than it is on Web 2.0, leading to lower overall transaction speeds. Any changes in payments need to be processed by a miner and then passed through the blockchain network, thus affecting the scalability of the system.

Web 3.0 technology stack

Technology stack

For building dApps or web portals to access Web 3.0, it’s important to understand the layers of Web 3.0 which are key to designing the ecosystem. These layers form the technology stack of Web 3.0 and are used while implementing various Web 3.0 use cases. Considering the initiative is still at a nascent stage, these layers are sometimes defined differently by different organisations and entities.

Web 3.0: Technology stack

- Layer 1: Layer 1 forms the base of the overall ecosystem, i.e. the blockchain platform. The performance, features and scalability of a use case is heavily dependent on the technology platform chosen.

- Layer 2: The second layer protocol defines the interface between blockchain nodes and Web 3.0 browser and applications. It enables functionalities like increased scaling and distributed computing besides ensuring encrypted messaging. This layer also defines the interface between on-chain and off-chain storage to implement solutions in a simplified way.

- Layer 3: This layer defines the framework covering programming languages and libraries that are used to develop applications to enable Web 3.0 use cases. iv. Layer 4: The topmost layer of the stack deals with the user interface, viz. portals and dApps for end users to access the infinite world of Web 3.0. Purchase of digital assets in the form of non-fungible tokens (NFTs), access to DeFi or use of crypto wallets – all require an interface that forms part of this layer.

Enabling access to Web 3.0 via dApps

DApps enable access to the following key components of Web 3.0 with respect to financial services:

DeFi enables a decentralised form of finance by creating an open-source, permissionless and transparent financial service ecosystem that is available to everyone and operates without any central authority/entity. The users of this system maintain full control over their assets and interact with the ecosystem through decentralised P2P applications and DLT-based financial services including lending, payments and credit scoring. DeFi uses cryptocurrencies and smart contracts to provide financial services and does not require financial institutions to act as guarantors.

Users can set up dApps on platforms for writing DeFi programs to establish any financial service and permit smart contracts with automated codes to handle those specific services explicitly.

DeFi elements can be added to an existing financial set-up, introducing an ideal mix of cryptocurrencies and blockchain features, thereby increasing its potential uptake.

Financial institutions can start by enabling DeFi for their customers through their banking services and initiate collaboration with the DeFi community to push for regulations and compliances. Banks should start leveraging their resources to develop sustainable partnerships between the centralised financial services ecosystem and DeFi.

Escrow is an example of a traditional banking function that can be easily replicated and enhanced as a dApp in the DeFi universe. In a smart contract escrow scenario, the transaction is intermediated by a smart contract, which releases the funds if and only if the agreed conditions are met.

The features of DeFi make it suitable for various use cases such as asset management, lending, insurance, decentralised exchanges, data and analytics, margin trading and tokenisation.

What are smart contracts?

Programs that execute an action when a certain event based on predetermined conditions being met occurs are known as smart contracts. These contracts help to automate an agreement by enabling the participants to understand the outcomes of executing the agreement without the involvement of a third party. Moreover, they can also be used to automate a workflow based on the satisfactory completion of predetermined conditions.

Crypto assets are digital assets that support financial transactions. Crypto assets play a key role in the Web 3.0 environment and employ cryptography and DLT.

Cryptocurrencies

Tokens with an attributed value for exchange and transactions, asset/value storage and/or unit of account

Utility tokens

Tokens offering access to platform and often used for supporting services/ functionalities on blockchainbased platforms

Stable coins

Tokens that provide underlying exposure to real-world assets (such as cash and gold); some stable coins may be considered as security tokens

Security tokens

Tokens with security characteristics, (such as equity, debt and derivative) with incomegenerating component

NFTs

Tokens that are unique and cannot be interchanged with the scarcity verified without the need for centralised organisation

NFTs

NFTs are digital assets or data represented on a blockchain. The blockchain acts as a decentralised ledger that traces the ownership and transaction history of each NFT. Because NFTs are considered to be non-interoperable, the information stored in them can’t be exchanged or used in any manner. NFTs can be created via contract-enabled blockchains.

Future of NFT payments

The NFT-based marketplace is integrating with FinTech companies to enable users to easily purchase an NFT using a debit or credit card. Web 3.0 simplifies the purchasing process and opens the marketplace to a wider customer base. Customers will be able to purchase NFTs using a card or any major payment methods during checkout.

Applications of NFTs

Fractionalisation: Different token pools can be substituted in place of digital assets so that the DeFi platform can create liquidity. This can be done by enabling fractionalisation of NFTs which can then be traded to the secondary market without any mortgage.

Collateralisation: NFTs can act as a security to loan issuers as they can represent the digital ownership of certain assets, and also because trading transactions are transparent. Moreover, the same assets can be collateralised twice.

Rewards: A new trend in the NFT space is rewarding holders of a project with a percentage of the fees earned from the sale. One popular feature is that the original creator receives royalties from secondary sales as well.

The total market for NFTs crossed USD 41 billion by the end of July 2021.1 Experts in the crypto industry even speculate that 40% of the new crypto users will use NFTs as an entry point. NFTs enable the creator of the NFT or brand to directly connect with the consumer.

Future of crypto assets and DeFi

If Web 3.0 is completely decentralised in the future and uses the power of blockchain technology, DeFi will play a much bigger role than it currently does. However, we will also witness the merging of centralised finance (CeFi) and DeFi in the future. FinTech companies that are actively working towards closing the gap between CeFi and DeFi are the ones that will have huge opportunities in the financial sector.

Crypto assets offer new revenue streams to traditional businesses. With the DeFi industry locking up USD 100 billion in value,2 crypto assets appear set to grow exponentially in the future. Further, use cases of DeFi and NFTs are being explored in financial services.

Impact of Web 3.0 on payments

Given our high dependency on the internet, it is safe to assume that Web 3.0 will impact the majority of industries. Below are some of the potential impacts of Web 3.0 on the existing digital payments ecosystems:

Impact on cross-border payments:

The present cross-border payments system is facing challenges such as intermediary interference, long transaction routes, and lengthy screening processes for financial crimes. This leads to delayed payments (especially if made on weekends and bank holidays). Customers and banks often wait for long periods for transactions to get processed and settled. Financial systems are not interoperable, and sending money across the world may result in complexities, unpleasant experiences, delayed settlements and higher fees than usual for transactions.

Web 3.0 technology will enable cross-border payments by connecting global banks and making the system interoperable, efficient and affordable. Banks will have a more simplified process for liquidity management and treasury operations. By incorporating Web 3.0 technology, the cost of international payment transactions can be reduced to a level comparable with that of domestic payments. A leading technology company is working to simultaneously clear and settle cross-border payments in real time. This will allow for faster payment processing and lower clearing costs. In addition, it will increase efficiency and facilitate a robust network that eliminates multiple stakeholders from processing transactions, thereby enhancing the security of transactions.

A payment gateway driven by blockchain technology could facilitate global payments. The speed of transactions will be significantly faster than that of payments routed through conventional banking channels, which can take up to three days to get processed.

Web 3.0 uses hashed timelock contract (HTLC) to enable efficient cross-border payments. The HTLC feature uses hashlocks (a hashed or cryptographically scrambled version of a public key generated by the payment initiator, which requires an associated private key to unlock the original hash) and timelocks (functions that set time constraints on contracts generated using HTLC) to ensure the atomicity of a transaction across the payments system. There is no need for trusted third parties as intermediaries when a smart contract is deployed for cross-border payment systems. The HTLC protocol in smart contracts can be used to manage both local and foreign currency transactions and settlements.

Apart from this, HTLC is also being explored to enable Central Bank Digital Currency (CBDC)-based cross-border payments.

Vendor independence and reliance on cryptographic primitives in DLTs are two unique features missing in traditional financial services. With DLTs supporting smart contracts via their programming capabilities, they can introduce more interoperability opportunities by allowing the automatic verification of complex functions and compliance requirements.

Case study:

A DLT network (for RTGS, currency exchange, and remittance) launched in 2012 has enabled secure, instant and nearly free-ofcost cross-border transactions of any size without any chargebacks. Crypto tokens representing fiat currency, loans, mortgages and cryptocurrency along with another unit of value are supported by this network. Such a network model can be used by banks as an opensource payment approach involving fewer intermediaries, thus making the process more efficient and reducing costs.

Integration of Web 3.0 in financial services

The concept of DeFi in Web 3.0 will have a major influence on the way financial services operate. The role of the centralised authority and financial institutions will be impacted by P2P communication while providing more control and options to end users. Two key aspects of Web 3.0 will be the integration of internet and digital payments infrastructure using different technology stacks and achieving a seamless user experience. Distributed ledgers can further help in micropayments with the service provision APIs. In the traditional payments infrastructure, micropayments failed to take off due to the poor integration of the web and relatively high cost of the transactions. Now, with the introduction of Web 3.0, micropayments will be feasible and ad hoc, and not require account set-up and/or subscription.

Open banking in Web 3.0

Open banking is a global banking movement that has led to innovative financial solutions – emerging either from a mandated regulatory framework or a market-led attempt. The practice enables customers to share their financial data with third-party providers through application programming interfaces (APIs).

Till now, a major challenge in the adoption of Web 3.0 technology or blockchain-based platforms has been the limitation in API connectivity between Web 3.0 and Web 2.0. Recent innovations in these APIs by global foundations will help to implement easy API connectivity between the two worlds, thus introducing new opportunities around open banking in the Web 3.0 ecosystem.

Payments in the metaverse

The metaverse is a social network that offers a 3D virtual experience. It came into the spotlight in 2021. The vision of the metaverse is an experience where, instead of just viewing content, consumers can feel immersed in the virtual environment. Several companies are already looking at the metaverse for expansion in the virtual world.

- Investment banks are looking to enter the metaverse with a focus on customer experience, ease of access and collaborating with DeFi institutions. Recently, one of the major banks in the US entered the metaverse, paving the way for other entities to do the same. Banks can utilise their cross-border payments and trading capabilities in the metaverse. The success of the metaverse is dependent on a robust financial ecosystem that can be enhanced through Web 3.0.

- Banks are providing an Integrated Payment Hub (IPH) to clients planning to enter the metaverse. Using DeFi protocols, a new era of digital banks will be able to help users to lend, borrow and invest across various cryptocurrencies and issue debit and credit cards that will work in both the virtual space and real world.

Metaverse payment methods

- Crypto wallets: Users need to have an account on virtual platforms, in order to use a crypto wallet. Once this is done, they can then add their debit/credit cards, add money to their wallets and exchange the currency for crypto tokens of their choice.

- NFT-based cards: As explained above, the tokens held in crypto wallets can be used by users to purchase NFTs.

- Metaverse tokens: Metaverse tokens are metaverse-associated crypto coins. They need an underlying cryptocurrency in order to conduct transactions on a platform. Such tokens can also be exchanged with other currencies, as discussed above.

Future of Web 3.0 on payments

Web 3.0 is still in the initial stages of development. For full-fledged implementation or adoption, the existing form of technology and governance will need to undergo a transformation. Currently, it is more of an industry buzzword, though organisations are exploring multiple use cases in order to not be left behind.

The key features of Web 3.0 such as permissionless, programmability, transparency, immutability and interoperability make it suitable for use cases like lending, insurance, data analytics and tokenisation. Web 3.0 as a technology can also be evaluated to bring various domestic card schemes on a common DLT platform, thus simplifying card interoperability across countries.

Below are various aspects that the key stakeholders like regulators, financial institutes and FinTechs need to consider before Web 3.0 becomes mainstream:

Technology

The inclusion and integration of distributed applications and scalability are some of the major challenges of Web 3.0. DeFi is still very limited, and the process of moving fiat currency (dollars, euros, rupees, etc.) into the crypto economy is complicated. This leads to considerably high processing fees and limits it to specific geographies. Therefore, for enhanced onboarding in the future, there is a need for better customer acquisition platforms and lower processing charges. The migration of platforms to Web 3.0 will need to be done in a phased manner, instead of a sudden jump, and will take time from both the technology as well as the adoption point of view.

Governance

Web 3.0 aims to offer fractional ownership to all the stakeholders who contribute to this system through consensus protocol. Global regulators have a lot to focus on as technology upends the new market. In the financial sector, regulators or policymakers will play a key role in defining the overall ecosystem, and its limitation within their respective regions to ensure transparency and confidence. One of the major focus areas includes fraud and money laundering. There is no source defined for the NFTs bought using cryptocurrencies, which could be from a restricted country or source.

Today, NFTs and crypto tokens are in high demand. However, cryptocurrency values have seen significant fluctuations, negatively impacting wider usage of such products. To manage the fluctuations and limit the inherent risk of the products, these cryptocurrencies should first be regulated to give a major boost to the players and end users. Further, in order to control these fluctuations, use of futures/forward contracts can be beneficial, wherein financial institutions and customers can enter into futuredated agreements and lock the prices in advance.

Tax

There is currently no guidance or standards around taxation of transactions on Web 3.0 and its underlying use cases like DeFi. As the need and use of DeFi transactions increase, new legislations need to be defined to tax these transactions appropriately. Moreover, taxes for each of the key stakeholders need to be defined separately.

Interoperability

Widespread use of Web 3.0 will require interoperability between various dApps as these applications work independently and pose a major challenge for developers. Standard rules and protocols need to be defined to address different shortcomings around interoperability. These will need to be supported by technologies similar to cross-chain interoperability in DLTs to keep the decentralised networks connected.

Other challenges such as device upgrades, multiple platforms and data validation will be addressed by upcoming enhancements in allied industries (e.g. online marketplaces, advertising and gaming applications) which are significantly aligned with the evolution of Web 3.0.

Web 3.0 is expected to bring in exciting growth opportunities and will also be adopted by consumers as their interests are aligned. Furthermore, as highlighted in this newsletter, it seems that the payments industry will benefit from the evolution of Web 3.0, both in terms of efficiency and cost reduction.

Indo–Russian payments corridor

The Russia–Ukraine conflict has resulted in the imposition of severe sanctions by various countries across the globe and the Society for Worldwide Interbank Financial Telecommunications (SWIFT) on Russia. These sanctions on Russia and Russian entities, including banks, may hinder cross-border payments between Russia and India, at least in the short term. Countries that have trade relations with Russia, including India, are now looking at alternative methods to perform trade transactions with Russian entities.

Media reports indicate that some of the alternative P2P, B2B, G2G and C2B payment options being explored include:

- entering into contracts with non-USD-denominated payment arrangements

- rupee–rouble trade payment option

- Central Bank Digital Currency (CBDC) payments between both countries

- use of the Russian messaging platform – System for Transfer of Financial Messages (SPFS)

- retail payments (P2P) by linking India’s UPI and Russia’s Faster Payment System (FPS).

- linkage of RuPay and MIR card infrastructure

- use of bilateral systems through phone, fax or messaging apps.

However, any payment arrangement would need the guidance and approval of the governments and central banks of both countries.