Union Budget 2022–23: Impact on digital payments with a focus on the digital rupee

February 2022

Union Budget 2022–23: Digital payments

Introduction

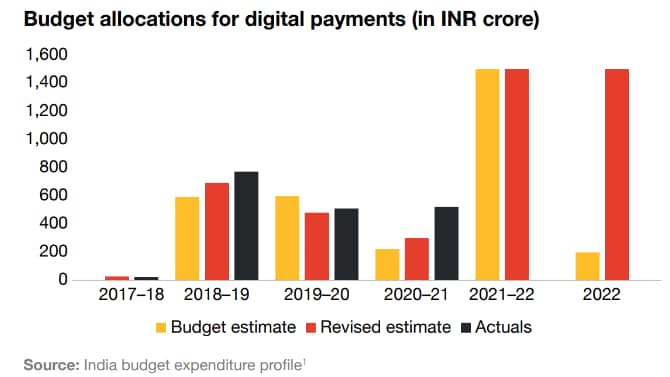

The success of the payments ecosystem in any country is dependent on its regulatory framework and the initiatives of its government. The Government and the regulatory authorities of India are constantly focusing on the advancement of the digital payments ecosystem in the country. This is evident through the new budgetary allocations towards digital payments, to boost the digital payments ecosystem.

Source: India budget expenditure profile1

Highlights of previous budget (2021–22) related to digital payments

The Government of India has played a pivotal role in encouraging digital payment transactions in the country as well as introducing new initiatives related to digital payments in the market. In the past, the Government has made direct budget allocations for boosting digital payments and has also introduced indirect interventions such as tax exemptions, caps on pricing structures, and other measures to discourage cash-based payments.

In Union Budget 2021–22, the Government allocated INR 1,500 crore towards the Ministry of Electronics and Information Technology (MeitY) for the promotion of digital payments.

MeitY used the allocated funds for various activities:

Allocation of INR 1,300 crore towards

various financial incentive schemes for acquiring banks to promote RuPay debit cards and low-value Bharat Interface for Money-United Payments Interface (BHIM-UPI) transactions (up to INR 2,000), which provided a boost to the acquiring segment of the payments business, in terms of promoting the homegrown payments products like RuPay and BHIM UPI.

Allocation of remaining INR 200 crore towards

- promotion of digital payments for unorganised sectors including street vendors, sector-specific schemes, contactless payment solutions and digital payment solutions using feature phones.

- promotion of digital payment activities, including incentive schemes.

- conducting awareness campaigns and capacity building to increase the penetration of digital payments in the market.

Other initiatives such as tax audit exemptions for businesses based on digital payments usage were also announced.

In addition, the provision of INR 15,700 crore to the micro, small and medium enterprises (MSME) sector has improved financial inclusion for MSMEs, especially in the rural regions.

Another focus area of Budget 2021–22 was the development of a FinTech hub at the Gujarat International Finance Tec-City (GIFT), which is the country’s first International Financial Services Centre (IFSC). The International Financial Services Centres Authority (IFSCA) FinTech lab has been inaugurated and aims to connect the FinTech firms in GIFT. Furthermore, the Department of Economic Affairs has approved the FinTech Incentive Scheme 2021 to strengthen the innovation ecosystem at GIFTIFSC. An amount of INR 45.75 crore was allocated for the same over three years.

Highlights of current budget (2022–23) related to digital payments

Having discussed previous budgetary allocations related to digital payments, let’s now look at the digital payment allocations announced in Union Budget 2022–23.

Digital rupee: It has been proposed to roll out a digital currency called ‘digital rupee’ in FY 2022–23 by the Central Bank. The introduction of the Central Bank Digital Currency (CBDC) is expected to promote transparency, traceability and convenience. Further analysis on the introduction of the digital rupee is covered in the next section of this document.

Financial support for promoting the digital payments ecosystem: In 2021–22, the finance minister had set aside INR 1,500 crore for a proposed scheme that would provide financial incentives to promote digital modes of payment and boost the number of digital transactions. This financial support has been continued for FY 2022–23. The key potential initiatives that could be funded by the allocated amount of INR 1,500 crore are as follows:

Compensation for revenue loss due to zero merchant discount rate (MDR) on UPI

There was an introduction of the zero MDR for UPI and RuPay debit cards in the policy announced by Finance Minister Nirmala Sitharaman in 2019. The policy stated that there would be no MDR charged on UPI and RuPay payment modes. This was done to promote the acceptance of digital payments among merchants. However, it was contested by various players in the ecosystem, citing the loss of revenue as a major deterrent for their optimal functioning of the industry and making required investments to process the growing volumes. In order to take care of the industry expectations and to provide support to industry players, a part of the allocated amount is expected to be used for the reimbursement of zero MDR for UPI and RuPay debit person-tomerchant (P2M) transactions.

Below are some of the areas where the INR 1,500 crore fund may be utilised:

- reimbursement for UPI/RuPay to make good the zero MDR policy

- topping up the INR 1,500-crore fund set aside for the Payments Infrastructure Development Fund (PIDF) operationalised in 2021

- further developing digital payment infrastructure/promoting innovations in tier II and III cities that have witnessed significant growth in the past couple of years

In 2021, the transaction value for UPI stood at ~70 trillion.2 Of this transaction value, P2M transactions are valued at ~40% which amounts to INR 28 trillion. This essentially equates to ~ INR 750 crore to be refunded in the form of MDR for UPI only (assuming a flat average MDR rate of 0.25% irrespective of transaction value). Approximately, INR 1,000 crore may be spent on refunding banks for P2M transactions for UPI and RuPay for FY 2021–22. It is, therefore, likely that a majority of the INR 1,500 crore earmarked for digital payments would be allotted towards compensating for the losses incurred by the industry due to the zero MDR policy.

More funds may be required to compensate for the RuPay transaction losses and for promoting the digital payments infrastructure.

Setting up merchant-acceptance infrastructures for digital payments

In addition to the MDR reimbursement, the remaining amount would most likely be allocated to measures like topping up the PIDF fund set up by the RBI and/or setting up centralised processing infrastructure for UPI processing by banks/PSPs. The PIDF is being used to install up to one million physical point of sale (PoS) and three million digital PoS machines in rural India (tier III–VI cities).

While the regulator is targeting to set up three million acceptance points, there remains a large gap with approximately 30 million MSMEs in rural regions that could benefit from digitisation.

Another plan could be to set up a centralised cloud-based infrastructure for the processing of UPI transactions. This would cover switching, fraud and risk, which are quickly scalable at the central level without banks having to make significant investments to process the fast-growing number of UPI transactions.

Encouraging digital payments for toll collection

The National Highways Authority of India’s (NHAI) electronic toll collection system is paying an MDR of 3–4% on FASTag collection, which is considerably higher than the majority of the other payments modes, including cards. The toll industry has witnessed a 2.5–3% decrease in MDR, and acquirers have to bear the majority of the losses, with bidding as low as 0.3%. In the current year, (Apr’21 to Feb’22), INR 339 billion3 was collected through FASTag, out of which MDR accounted for INR 800– 900 crore. Here, the acquirers can be compensated up to 0.5% of the toll collection for promoting FASTag adoptions, amounting to approximately another INR 150 crore.

If state governments consider installing FASTags on approximately 500 state highways and assuming INR 30 crore is collected from each highway in a year, an amount of INR 15,000 crore would be added to the total toll collection. Therefore, if acquirers are compensated 0.5% of the toll collection to achieve the target of 500 tolls, the Government can allocate approximately INR 75–100 crore for promoting the digitisation of toll collection on state highways.

Investing in marketing, awareness and innovation

Marketing and awareness campaigns by the Government and the industry are the key pillars for encouraging digital payments initiatives in the country. Given that the industry has spent more than INR 2,000 crore on the promotion of digital payments and incentives to improve uptake over the last two to three years, it can be expected that a marginal share of 5–10% of the Government’s INR 1,500 crore expenditure may be allocated for such campaigns.

Overall, in our opinion, while the allocation of INR 1,500 crore yet again is a welcome move that enables important changes in the industry, the Union Budget could have considered an additional allocation of INR 4,000–4,500 crore to address various issues, including MDR compensations for largeticket transactions, setting up of digital infrastructures, digitisation of state tolls and other targeted initiatives.

Digital banking units: The Government is continuously encouraging digital banking, digital payments and FinTech innovations. Moreover, it is ensuring that the benefits of digital banking reach every corner of the country in a consumer-friendly manner. It has proposed to set up 75 digital banking units (DBUs) in 75 rural districts of the country to enable all sections of the society to get the benefits of the digital payments innovations. It is expected that digital kiosks will be installed in such locations, which will be staffed, and other banking services will also be provided.

Banks in rural areas have historically relied on a brick-and-mortar business model that limits its potential to properly penetrate the rural market with innovative financial products. With the help of digitisation and a lean business model offered through digital banking units (DBUs), banks are now empowered to take digital payments to the remotest part of the country in a cost-effective manner. A DBU works on a model that is relatively less labour intensive and places a higher impetus on a platformbased approach for new product development. This essentially translates to an above-average yield for the parent bank and would be an enabler for banks to effectively tap the rural market. Having said that, the banks will have to make necessary investments to set up the DBUs and also deploy adequate staff to take care of the operations in the rural districts.

Anytime–anywhere post office savings: Under this initiative, 1.5 lakh post offices in India are proposed to be incorporated with the core banking system (CBS) in 2022.

Core banking is a bank’s centralised system that is responsible for a seamless workflow by automating the backend and the frontend processes within a bank. The CBS enables a single information view across all areas and branches within the bank and facilitates information delivery across all channels. Below are some of the key advantages that CBS can bring to the modernisation programme for post offices:

- automation of various processes like bookkeeping, passbook maintenance, etc

- process standardisation within branches

- lower operational risks

- customer convenience as banking facilities can be accessed from any branch

- facilitates decision making and targeted customer propositions through the use of reporting and analytics.

Getting the post offices on CBS is expected to increase the access of these accounts to digital channels – such as net banking, mobile banking and ATMs – thereby increasing the number of digital payment transactions in the country. This initiative will enable financial inclusion and interoperability by providing online transfers of funds between the post office and bank accounts. This will be especially helpful for farmers and senior citizens in rural areas.

In order to ensure the successful implementation of CBS, following elements should be noted:

- Delta analysis of features: It is critical for the post offices to understand their business requirements and accordingly determine the selection of CBS with the features that are most relevant. Features may also be added on a priority basis.

- Time and cost management: CBS projects usually have longer time frame and therefore have an inherent risk of cost overruns. It is therefore critical to have a project governance structure in place to manage the CBS implementation.

- Approach for go live: Post offices need to determine their approach to go live – this can be done in a phased manner or through a big bang approach. Both approaches have their pros and cons. While the phased approach is considered to be less risky as the current systems and new CBS run concurrently, the costs of running dual systems are high. Similarly, the big bang approach comes with the inherent risks that the new system may not function as intended.

- Vendor selection considerations: Transformation to CBS being a long-term project, post offices may utilise the vendors’ services for the implementation of the CBS. While selecting the vendor, the following things should be assessed: vendor’s business model, methodology and past experience in implementing the CBS or CBS transformation projects.

- Cleaning up and simplifying the business: Introduction of the CBS is an opportunity to get rid of obsolete features and simplify the business.

- Testing the features and processes: Functionality testing of the CBS is yet another essential factor that needs to be taken care of to ensure that the CBS is functioning as intended.

- Migrations/Conversion activity management: The post office has to ensure that the migration of the data and records from the existing system to the CBS is seamless and that there is no data loss. Setting up dashboards to monitor the progress of the migration activities in real-time and practicing timed runs would help in ensuring a seamless migration.

- Providing training to employees: With newer systems in place, employees would need to be trained to use the CBS. Providing handson training for employees becomes very important for the successful implementation and use of the CBS.

Online e-bill system for central ministries: The Government has planned the introduction of a paperless, online e-bill system to manage payments of all central ministries for their procurements. The system will enable suppliers and contractors to submit their digitally signed bills and claims online and track their status from anywhere. This is expected to enhance transparency and reduce delays in payments.

There is also a possibility of linking a payment gateway to this system to facilitate the ease of payments fund flow. In addition, other payment options such as scheduled payments, bill discounting and supply chain payment innovations can be linked to this system.

GIFT city – payments business set-up: The Government’s support in developing a FinTech hub, GIFT city, is expected to provide small digital payments technology firms with a platform to explore and innovate more cost-efficient and easily adaptable financial products.

The model of the GIFT city is in line with global cities that have focussed on providing a suitable environment for FinTechs, which can translate into substantial capital inflows for the industry.

One of the key value propositions offered by IFSC is the presence of a single regulator within the region, i.e. IFSCA, that has been granted the necessary powers by the Securities and Exchange Board of India (SEBI), RBI and Insurance Regulatory and Development Authority of India (IRDAI) to govern activities. This enables start-ups to comply with regulations in a more effective and seamless manner. In addition to this, the provision of several financial incentives like tax holidays provides a conducive environment for new start-ups to be incubated and promotes GIFT as India’s offshore banking destination.

Taxation of virtual digital assets (VDAs): The Government has proposed to launch a scheme for the taxation of VDAs such as cryptocurrencies and non-fungible tokens (NFTs). It has been proposed that the income from VDAs would be taxed at 30%, while the losses from the sale of VDAs would not be allowed to be offset against other incomes. Further, gifts of cryptocurrencies would be taxed at the receiver’s end. This move would formally bring VDAs under the tax net, thereby increasing the probability of such assets being recognised by the Government and in the Crypto Bill being formulated for approval.

Allocation of funds for cybersecurity: The Government has allocated INR 1.85 lakh crore to the Ministry of Home Affairs, where a significant amount has been allocated for cybersecurity and intelligence gathering apparatus. Considering the growing number of cyber breaches, the Government’s move towards allocation of funds for cybersecurity would help in providing security for the payment transactions and also increase trust in the digital payments ecosystem.

Exploring the digital rupee

The latest announcement by the Government regarding CBDC makes India one of the latest entrants to the long list of countries that are developing their digital currency (which would be treated at par with the fiat currency). This move has been welcomed by the industry as it not only enables India to further streamline its payment framework but also plugs in the residual gaps in the current framework. Given the context, this section tries to shed some light on how the RBI can go about implementing CBDCs and its implication on the Indian financial ecosystem.

Choice of a sustainable operating model

There are two operating models to choose from when it comes to CBDC distribution strategy i.e. single-tier vs multi-tier. Globally speaking, multi-tier is the most adopted model by central banks. Countries such as, China and Nigeria, have started introducing the multi-tier model for CBDC distribution, wherein the central bank issues and settles CBDC and licensed intermediaries – such as banks and wallet players – act as a store of value. This ensures that innovation is not reduced, and everyone has a role in the new framework. Below are some considerations that make the multi-tier model more sustainable and holistic, enabling it to serve industry, regulators and end users well:

- It is not the central bank’s job to interact directly with the end users.

- Multi-tier model reduces the risk of disintermediation which helps banks and FinTechs to continuously innovate in the space and build financially feasible business models.

- Such models enable CBDCs to reach a larger segment of the population by leveraging existing relationships of financial intermediaries.

- Customer grievances and query resolution can be done at the bank, which has a greater presence and more proximity to end users

In India’s context, the payment intermediation ecosystem is mature, with several banks and non-banking institutions already catering to a vast segment of the Indian population. Considering the existing landscape of operations, we foresee the Indian regulator opting for a multi-tier operating model, with various intermediaries acting as enablers for the last-mile delivery of the digital currency.

From a design consideration perspective, below is an indicative list of questions that need to be answered while implementing the CBDC solution:

- For which entities would the CBDC be available?

- Where will the CBDC be held and in which form i.e., account-based or token-based in wallets?

- Should there be constraints imposed on transaction size and account balances?

- For what purpose should the programmable feature of CBDC be used?

Technology design pillars

To evaluate a feasible technology design for CBDCs, below are some of the pillars that need to be evaluated while debating on a key decision regarding distributed ledger technology (DLT)-based design vs non-DLT based design for CBDCs.

DLT vs non-DLT based CBDC

Technology choices have a material impact on how the implemented CBDC system can stack up against the principles mentioned above on resilience, speed and interoperability. For this reason, it is essential to choose a technical approach that is best placed to match these principles.

CBDCs are generally associated with DLT networks. However, CBDCs can be built on technology stacks that are centralised like traditional digital payment frameworks.

Below is a comparative analysis of CBDC structure built on a DLT and nonDLT network:

Permissioned DLT-based CBDC technology stack

The CBDC technology stack could be based on a permissioned DLT platform. Hence, it is important to consider all major features of the platform from the country’s viewpoint. There are several permissioned DLT platforms available in the market. They provide various features such as scalability, modularity, extendable architecture, etc.

Even though India may opt for proprietary or any other permissioned DLT platform, a comparison of the available permissioned DLT platforms based on their features would assist in determining the selection of the DLT platform. These features are listed below:

- alignment of the platform’s vision with digital rupee

- consensus mechanism used

- use of smart contract programming language

- level of confidentiality

- level of scalability

- availability of sandbox

- number of contributors/developers (approx.).

Applicable use cases of CBDC in India

CBDC is digital money based on DLT and thus can leverage multiple features such as smart contracts, cryptography and immutability. A few key use cases that CBDC can enable in India in retail and corporate areas have been shown below.

Retail

- Programmable money

Programmable money can only be used for the purpose it was intended for. This makes it a fit for subsidy distributions by governments and employee benefits distribution (e.g. fuel expenses). - Retail payments

The irrefutable nature of CBDC, when combined with ownership record transfers, can provide evidence of proof of ownership. All types of payments generally made by a customer (e.g. Customer2Customer, Customer2Business, Customer2Government, Business2Customer, Government2Customer) can be possible using the digital rupee. Additionally, it can boost digital payments and increase accessibility and usability for people who stay far away from bank branches and have difficulty accessing physical cash. - Cross-border remittance

India has a huge remittance market. CBDCs can help to reduce the cost and time required to make cross-border payments if the country collaborates with major economies on CBDC infrastructure and services. There are already pilot projects like Multiple CBDC (mCBDC) bridges under progress to explore the features of DLT in enhancing financial infrastructure, to support multi-currency cross-border payments.

Corporate

- Instant settlement between banks

CBDCs offer instant settlements through automation and decentralisation, thus reducing counterparty risks. - Securities market

The delivery versus payment (DVP) risk involved in the securities settlement process can be minimised by automating the entire process using smart contracts. Further, tokenisation allows the digital ownership of securities, which is irreversible and immutable, minimising risk and assuring the security holder. This can be a game-changer in both the primary and secondary securities market. Further dividend distribution can be done by the digital rupee. - Corporate payments

CBDCs could offer not only a mode for digital payments but also additional features such as condition-based payments and automation of manual tasks related to payments. For example, CBDCs can be used by corporates to automatically time their compliance payments like taxes. Additionally, given the digital audit trails created by CBDC transactions, financial compliance processes, such as audits, can be streamlined.

Impacted stakeholders and key considerations

The following are some of the potential impacts of CBDC and key considerations that must be taken into account to facilitate a smooth transition.

- Government

CBDC will impact the monetary policies as well as the financial stability of the country. Therefore, all decisions about the same need to be taken such that any arbitrage between bank deposits and CBDC is minimal.

- While issuing CBDC, the Government has to consider the below key points:

- interest rate

- anonymity

- transaction volume/value limits

- offline payments

- cross-border remittance

Given below is a comparison of the leading CBDC projects of different countries based on the above parameters, to give a sense of where they are headed in future.

- Regulatory policies need to be revisited to align Financial Action Task Force (FATF) standards for anti-money laundering and combating financing of terrorism (AML/CFT), while relevant provisions for penal action should be present for violations against CBDC guidelines.

- Transaction data privacy is an important consideration, as many Indians prefer to use cash given the anonymity it offers.

Central bank

The central bank has a key role to play in implementing CBDC in the country. This would require a secure and resilient digital rupee management system in place which can onboard commercial banks onto it while having additional features mentioned below:

- issuance and exchange of digital currency against cash reserves for banks

- minting, burning and transfer of digital currencies across wallets

- interoperability with other payment rails, dashboard for monitoring

- sandbox testing, pilot testing, roll-out of CBDC.

Additionally, the central bank needs to define regulatory, operational standards for the digital rupee and monitor to ensure its compliance with set regulations

Commercial banks

Although several different areas of banks will be impacted by CBDC, given below are four key areas for consideration:

- Technology

- Banks need to be prepared for CBDC as an additional payment rail. Irrespective of wholesale or retail CBDCs, banks will play a crucial role in the ecosystem. Thus, the existing technology stacks need to be ready to integrate with a distributed ledger, in order to offer a seamless experience to the customers.

- Banks will need to be able to onboard the central bank digital rupee management system to request CBDC as per the requirement of its end users.

- Operation

- Banks will have to facilitate customer onboarding to CBDC wallets to use the digital rupee. This will require KYC verification, time and effort and at the same time, awareness and customer education.

- In a two-tiered setup, the bank is the point of contact for the end user. Hence, a robust customer grievance redressal system needs to be implemented.

- Different branches of a bank can be made responsible for the customers under its area of operation, in order to facilitate and support customers for onboarding, servicing and other activities like dispute resolution related to CBDC.

- Banks need to monitor and be cautious about a sudden spike in withdrawal or transfer of a large volume of CBDC, as this poses a risk and could lead to a massive outflow in a short amount of time. Also, there needs to be a system in place to alert central banks of a possible run-on-bank scenario in such a situation.

- Periodic regulatory reporting of the CBDC will also have to be considered by banks.

- Product innovation

- Banks will have to envision service offerings, such as a wallet, to store CBDC as a custodian or deposits, ease of conversion of CBDC to electronic currency, or even cash for corporates/institutions.

- Banks can introduce new products and services on top of the CBDC infrastructure, such as a mobile application for customer touchpoint to DLT, cash withdrawal at an ATM using CBDC and interoperability between customer’s digital money and other digital assets (which can lead to a new revenue mode generation).

- CBDC can provide banks with a huge opportunity to automate security in cases of payments on delivery and collateral management of securities to reduce cost and time. Liquidity improvement, margin expansion, data analytics and monetisation are other avenues that can be explored.

- Upskilling

- A bank needs to ensure that its staff is well aware of CBDC and the underlying technology and is able to then make the customers aware of the same. This will help to avoid any confusion among the customers and spread the right information. Furthermore, it would boost the bank’s trust and reputation among existing and potential clients.

- Banks also need to make sure that their employees are fully aware and able to use new applications which are rolled out by the central bank for managing the digital currency at the bank/branch level.

- Workshops and training on upcoming technologies and how they will impact the bank’s ecosystem and its employees’ future have become crucial in today’s time.

FinTechs/Technology vendors

- The DLT infrastructure for a peer-to-peer transaction is relatively new in the Indian ecosystem. Thus, attaining scalability and efficiency is quite critical.

- Digital rupee will require the development of a DLT network, which will have to coexist with the existing payment modes. FinTech and technology providers specialising in blockchain/DLT would thus be required to help in developing payment rails and suitable products supporting CBDC.

- Additionally, at a commercial bank-level integration of banks, a CBS with digital currency management system would be required along with modification in other channels like eBanking, mobile app, transaction sourcing, reporting, etc. This will create a demand for external technology providers.

- The interoperability between the fiat currency and CBDC needs to be seamless to have a greater reach and acceptance among end users.

Merchant

- Merchants play an important role in small-value payment in India. Therefore, their participation is a must in the adoption of the digital rupee. However, merchants will have to enable prevailing acceptance modes to accept CBDC as a mode of payment.

- Establishing an alternate mode of payment acceptance requires a merchant to integrate CBDC in the payment gateway, or simply have a QR code to scan and pay at a physical store.

Customers

- CBDC will be an ‘additional’ option for customers. They will have to secure a digital wallet from a bank or financial institution to store and utilise the digital currency and set up their security credentials to access it.

- For CBDC to have widespread adoption, it will be imperative that customers are educated, and the overall value proposition is attractive to them. A possible solution for this could be to offer discounted pricing when a customer makes a payment using the digital rupee for increasing the uptake.

- Customer convenience and a simple user interface would be required to make CBDC user-friendly.

- Given the high volume of digital transactions (e.g. UPI), the cost of operating should be such that the fees on such transactions are affordable to the banks, merchants as well as customers.

Conclusion

In Union Budget 2022–23, the Government has set the stage for India to take the next leap on its digital payments journey. This will enable the country to clock a growth of nearly 5–10x in its digital payments volumes in the next 4–5 years. The key initiatives announced by the Government focus on the aspects of innovation and incentivisation for further enabling digital payment adoption in India.

One of the key announcements made by the regulator was the introduction of the digital rupee. By providing an alternative mode for money supply in the economy, India has joined the list of regulators that are exploring digital currencies as a viable option for not only payments but also overarching economic policy operations. The introduction of digital currency bodes well with the multiple initiatives taken by the regulator earlier. On reaching the next phase in digital payments, initiatives such as integrating CBDC tokens on an offline payment framework – which was recently announced by the RBI, post-intensive cohort testing – can be explored. However, it should be noted that CBDCs are not a competing framework with the current digital payment initiatives (e.g. UPI) but rather a supplement/overlay to these, and can later be integrated with these for wider-reaching payment systems.

In addition, the discretionary spending announced in the budget aims at incentivising the digital payments ecosystem. A special focus on MSMEs and the rural segment augurs well for the digital financial inclusion framework of the RBI and is expected to gain traction in the future.

The Government has also made FinTech innovation a key focus, both from an infrastructure and framework viewpoint. This will enable FinTechs to penetrate deeper into the real ‘Bharat’ from a payments perspective and build upon it to extend their value proposition to other areas like insurances and microloans.

Overall, the Government’s focus on the digital payments ecosystem and other budgetary announcements is expected to help accelerate digital payment adoption and encourage growth in terms of innovations. Moreover, it will set the tone for further policy changes and reforms.