Payments regulations: Understanding the global state of play

July 2020

Rapid evolution of digital payments

The payments industry has undergone fundamental changes over the past ten years. According to the Global Payment Systems Survey (GPSS) conducted by the World Bank, the use of retail payments instruments differs among countries due to cultural, historical, economic and legal factors.1

Central banks worldwide have been designing policies to build cashless economies while ensuring safe, secure and robust payments systems. There are multiple triggers that have been driving reforms across the global landscape of payments systems. Some of these are customer behaviour and expectations, technological innovation, emergence of non-banking and FinTech players, financial inclusion and the need for better payments instruments and settlement services.

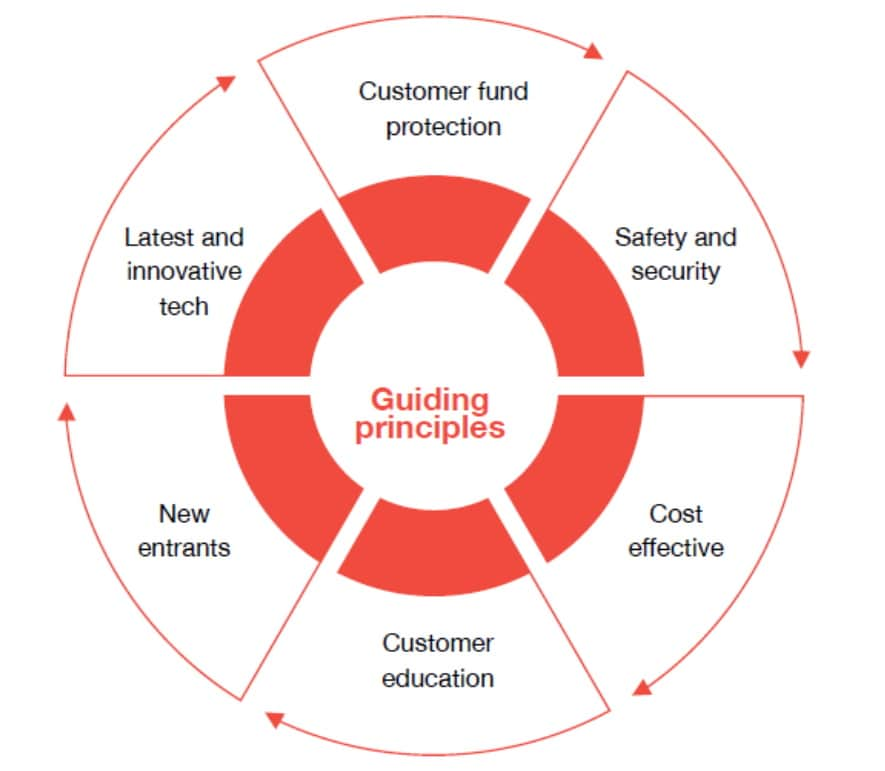

Regulatory institutions and central banks follow certain guiding principles to draft policies and guidelines to regulate and govern key stakeholders within the digital payments ecosystem.

These guiding principles broadly cover the following areas:

- Customer fund protection: The digital payments instrument being used by customers should ensure that their funds are protected from any losses. In case a digital transaction fails, the amount is credited back to the customer’s bank account.

- Safety and security: The payments data is sensitive and it is mandatory for the payments instrument provider to maintain security by adopting new messaging standards and maintaining data security. There are countries that have issued Payment Services Directive 2 (PSD 2) for identification of customers whenever a transaction above a certain limit is recorded in order to reduce the risk and increase security.

- Cost effective: Digital payments options need to be cost effective in terms of fees/charges to replace cash and enable large-scale adoption. Central banks have been also helping the digital payments ecosystem by allocating dedicated funds to boost the existing payments infrastructure. For example, the Reserve Bank of India (RBI) has published a framework for setting up a Payment Infrastructure Development Fund (PIDF) to increase the acceptance of cards in tier 3 to 6 cities.2

- Customer education: Customers are required to be educated and informed about the usage of digital payments instruments while keeping sensitive information confidential to avoid any fraudulent activities/ transactions.

- New entrants: Central banks are exploring options for lowering the entry barriers into the digital payments ecosystem for payments and lending FinTechs, payments service providers and other non-banking entities. In some countries, these players are encouraged to apply for licences for issuing of stored-value facilities (SVFs), credit cards, digital currencies, setting up merchant acquiring businesses and cross-border remittance businesses. These companies are provided licences under a pre-defined criterion by central banks.

- Latest and innovative tech: Innovation is the backbone of technology and payments instruments are also required to develop innovative solutions to address existing challenges and utilise the latest technology to enhance digital payments. In addition to the guiding principles, regulators are also undertaking steps to ensure regulatory supervision through data-driven or rule-based approach, principle-based approach and hybrid approach. In this section, we will be focusing on some of the global reforms across key payments instruments.

Guiding principles for regulators and central banks

1. Retail payments systems (RPS)

Cards continue to be the preferred payments instrument, along with cash. Although there has been a significant shift towards mobile and contactless payments, prepaid cards or SVFs are widely accepted.

International card networks dominate more than 70% of the card payments market. Central banks are regulating the retail payments schemes in respective countries and are issuing licences to payments system operators, allowing them to set up domestic card schemes.

Regulators and the central banks of developed countries like the US, the United Arab Emirates (UAE) and Singapore, as well as developing countries like India, have been proactively taking initiatives to boost digital payments and increase their adoption.

Some of the key initiatives taken by central banks worldwide are given below:

- Introduce faster payments services for small- to mid-value transactions in Asia, South Africa, the US and Russia.

- Formulate acts for payments and settlements in Singapore and India.

- Set up a dedicated framework to arrange for funds to develop the payments infrastructure in India.

- Form data protection and localisation laws in the European Union (EU), India and China.

2. Develop high-value payment systems (HVPS)

HVPS plays a vital role in the overall financial infrastructure by ensuring settlement of payments obligations between banks. HVPS has come a long way from deferred net settlement (DNS) systems which settle transactions only at the end of each day to real-time gross settlement (RTGS) systems which settle transactions on a continuous basis. RTGS systems have been adopted by almost all countries. More than 150 RTGS systems are currently in operation, a few of which have also introduced multi-currency functionality to enable cross-border payments.

A few key payments trends adopted by countries worldwide are detailed below:

- Adoption of ISO 20022 messaging standards.

- Adoption of increased settlement cycles and sophisticated liquidity management systems with high availability. For example, the US Federal Reserve will be developing the real-time payment (RTP) system FedNow for high-value payments.

- Setting up of cross-border and multi-currency payment systems, e.g. the Gulf Cooperation Council (GCC).

- There will be no charges for RTGS transactions by some countries.

- Introduction of new features and renewal of existing infrastructure. For example, the Bank of England has initiated an RTGS Renewal Programme.

3. Cross-border remittances

International remittances contribute to more than 20% of the gross domestic product (GDP) of certain countries. Central banks have recognised the importance of remittances for economic development and growth, and have therefore drafted policies to control the operations of remittance service providers (RSPs). Commercial banks, international money transfer operators (MTOs), local MTOs, postal networks, exchange bureau and agents can all be categorised as RSPs. Cash is still one of the dominant payment instruments in developing countries. Regulators and central banks in many developing countries are forming policies and guidelines to enable the use of e-money and account-to-account bank transfers to reduce the overall dependency on cash and gradually move towards a cashless economy. The average cost of remittance currently stands at 7% and is targeted to be lowered up to 3% under the United Nations (UN) designed Sustainable Development Goals by inviting new players to operate and leverage on partnerships.

4. Financial inclusion

Financial inclusion has been able to bring unbanked population from primarily rural/semi-urban areas under the ambit of banking services. It has also given rural banking services an opportunity to become a part of mainstream banking. As per a survey conducted by the Bank for International Settlements (BIS) in 2015 that focused on the measures taken by central banks on financial inclusion, more than half of the central banks worldwide have some sort of policy/mandate on financial inclusion.3 The survey also mentions that the central banks can directly contribute across three major areas of promoting financial education, acting as financial supervisors and leading inclusive initiatives targeted at the financially excluded population segments.

In recent years, Brazil has been successful in increasing financial inclusion because it adopted and worked towards the concept earlier than other countries.

Nearly 70% of the global population has been given access to formal banking services through initiatives like government schemes, policy changes and inclusive regulations, but a large segment of the global population remains unbanked.4 The World Bank has outlined some key measures in partnership with central banks of some countries to eliminate the existing challenges in the sector of financial inclusion.

5. Governance and cooperation

In the last five years, there has been a substantial growth in the digitalisation of economies worldwide. Central banks are playing an important role in constituting working committees/groups to review the developmental status in improving the digital payments ecosystem. One of the key objectives of such committees is to contribute towards developing consultative papers comprising vision, benchmarking and a future roadmap strategy for the growth of digital payments. The consultation papers are drafted to invite views and recommendations from public and industry experts, and further improve existing digital payments ecosystems. Due to the ongoing technological revolution and changing business operating models, the objectives, scope and legal framework of oversight will change over the next few years. In order to adapt to the changing scenario, central banks have come up with clear and focused objectives of separating the roles and responsibilities of a regulator and entities like payment operators. For example, the National Payment Corporation of India (NPCI) is a retail payments infrastructure and system operator which is regulated under the RBI’s Payments And Settlement Systems Act (PSS Act), 2007.

The Global Payment Systems Survey conducted by the World Bank in 2018 defines two critical aspects related to the scope of payments systems oversight – depth dimension and breadth dimension.5 The depth dimension typically defines the roles of the operator and the breadth dimension captures the central bank’s engagement model, typically controlling the critical fund transfer systems.

Whilst some changes are evolutionary, others are disruptive and thus require regulators to formulate differentiated approaches. Central banks play a critical role in regulating payments systems to meet the public policy objectives of safety and efficiency, and end-user needs and expectations. In the following sections, we will look at the regulatory approaches at the disposal of central banks with proposed payments regulations in different jurisdictions.

Regulatory goals and response considerations

The various risks related to payments demonstrate the need to put in place regulations as safeguards against market failures. The major objectives of a well-constructed payments regulatory system are to:

- ensure stable financial services

- educate consumers

- protect consumers against fraud

- provide a level-playing field for all participants

- promote competition by involving non-traditional players

- foster innovation

- combat money laundering

- ensure efficient capital allocation/economic liquidity

- ensure proper macro-economic functioning.

Regulatory responses to supervise the changing payments landscape vary across jurisdictions and are dependent on multiple factors. The two key general approaches for the achievement of regulatory objectives are rules-based regulatory approach and principle-based regulatory approach.

A rules-based approach generally involves rules that are precisely drafted and highly prescriptive. This approach advises participants on the actions they can and cannot engage in and provides no or limited exceptions and limited flexibility. For example, the RBI adopts a rulebased approach when it comes to achieving regulatory objectives.

On the other hand, in the case of a principle-based approach, the regulators tend to define parameters like goals and outcomes, along with the principles and standards to be followed at a high level. This allows regulated participants to define and follow their own approaches in order to achieve the defined outcome. For example, the EU and Monetary Authority of Singapore (MAS) have adopted a principle-based approach.

Both the approaches have their own merits and demerits. Due to its low flexibility, the rule-based approach requires all the participants to follow defined approaches that leave no scope of ideating or evaluating the best approach. However, in this approach, all the participants follow a uniform approach that removes ambiguity and the regulator takes up the ultimate ownership.

In the case of a principle-based approach, the regulator only outlines the regulations and gives an opportunity to the participants to define their own approaches. This creates flexibility in the ecosystem through individual learnings.

It is also evident that there are downsides to following only a single approach and hence, it is very rare to see that only a rule- or a principle-based approach being followed. As an optimal solution, a hybrid of both the approaches are followed, creating a balance and serving the ultimate purpose.

A comparison between both the approaches is discussed below.

Comparison between rule-based and principle-based approaches

Rule-based approach

A process-based approach that defines a list of specific procedures to be complied with

Advantages:

- Certainty, predictability and transparency

- One size fits all, enabling relatively easy implementation of compliance

- Consistent behaviour by regulated entities

Challenges:

- Inability to address areas not covered by existing rules

- Checkbox compliance disconnects with underlying purpose

- Fast-paced environments create obsolete rules and grey areas

Principle-based approach

An outcome-based approach that defines broadly stated guidelines

Advantages:

- Builds awareness of purpose and importance

- Encourages innovation of firm compliance practices to drive efficiency

- Removes rigid, unnecessary activities

- Offers flexibility and innovation in rapidly changing environments

Challenges:

- Uncertain and inconsistent regulatory judgement

- High cost of tailored compliance

- Inadequate deterrence of specific problematic behaviour or activities

Source: PwC analysis of data from industry research

Recent regulatory actions

Central banks and regulators have been coming up with policies, circulars, guidelines, advisories and consultation papers focusing on cashless payments and the associated issues of seamless customer experience and robust risk and fraud mitigation mechanisms.Central banks have been exploring a number

In the past couple of years, central banks have enabled a friendly regulatory environment for non-banking players such as third-party service providers, FinTechs and other payments service providers looking to enter the digital payments ecosystem. Central banks in the US, Singapore and the UK have already set up separate FinTech advisory arms to engage with FinTechs through different initiatives such as open banking and sandbox regulatory frameworks. Data protection is one of the critical considerations in digital payments and regulators have mandated banks to share customer data only with authorised third-party service providers after consent has been obtained from the customer. For example, the General Data Protection Regulation (GDPR), a data protection and privacy regulation for the EU, addresses the issue of transfer of data within and outside the EU.

Central banks have been exploring a number of use cases in blockchain technology. Central bank digital currency (CBDC) is an interesting concept and approximately 80% of the central banks worldwide (as per a survey by the Bank for International Settlements) are experimenting in this space.6 For example, the Bank of Canada and MAS have conducted a successful pilot programme on cross-border and cross-currency payments using CBDCs.

In the near future, regulators will have to converge regulations with technology and transform existing laws to enable real-time monitoring of financial markets infrastructure and granting licences to consumer technology giants by implementing stricter laws on data protection and digital lending.

Select regulatory decisions

In this section, we will look at select countries where regulators and central banks have introduced acts and policies to regulate SVFs, HVPS and RPS for increased adoption, better security and customer convenience.

Payment Services Act, 2019

- The Payment Services (PS) Act was introduced on 28 January 2020 by MAS.7

- The PS Act will govern both licensing and designation frameworks.

- Moving forward, the PS Act and its subsidiary legislations will be activity based, risk focused and modular in their licencing.

SVFs and retail payment activities

Type of licences:

- Money-Changing Licence

- Standard Payment Institution Licence

- Major Payment Institution Licence

Regulated activities include:

- Account issuance

- Domestic money transfer

- Cross-border money transfer

- Merchant acquisition

- E-money issuance

- Digital payment token

- Money changing

HVPS

MAS may designate a payments system under the PS Act if it is considered to be a systemically important payments system or a system-wide important payments system, or if it is in the public interest to do so.

Some known examples of such payments systems are:

- Fast and Secure Transfers (FAST)

- Inter-bank GIRO (IBG) System

- Network for Electronic Transfers (Singapore) Pte Ltd (NETS)

PSD 2

- The European Regulatory body focuses on aligning payment scheme regulations for European countries on:

- the regulation and supervision of payments systems in Europe

- the definition of payments services and activities, rights and obligations, and requirements in order be registered and licensed for financial institutions (FIs), both banks and non-banks.8

- Each country is required for local transposition of European directives and responsible on the definition of specific country regulations, ensuring overall compliance with the European directives and national law and supervision practices.

- The European Central Bank provides requirements in order to participate in HVPS.

SVFs

The E-money Directive (EMD) and PSD 2 set out the rules for business practices and supervision of e-money institutions. Non-banks providing services like gift card schemes, loyalty programmes and e-money issuing are the participants in such programmes.9

HVPS

- TARGET-RTGS (Trans-European Automated Real-time Gross Settlement Express Transfer System)

- A European single-market infrastructure gateway with multi-vendor connectivity, available for all FIs performing HVPS activities based on XML requirements according to ISO 20022 standards.

RPS

- PSD2

PSD2 includes:- definition of payments services, providers and activities, as well as rights and obligations of payments providers

- requirements for banks to provide account information and payment initiation by third-party providers (TPPs)

- payments infrastructure alignment by the European Banking Authority (EBA) working group on application programming interfaces under PSD2

- regulatory technical standards (RTS) on strong customer authentication enhancing consumer protection, promoting innovation and improving security

- interchange fee regulation (IFR) set requirements related to the independence of payment card schemes and processing entities.

- Payment Account Directives (PAD)

- PAD ensures that access to payments accounts for consumers is regulated, e.g. non-discriminatory.

- Participants: All parties (banks and non-banks) performing retail payments activities or processing are required to be licensed. The requirements are based on the business model of the concerned parties and the type of business they are engaged in.

Payment Services Provider Regulations (PSPR)

- The Saudi Arabian Monetary Authority (SAMA) regulates all payments systems (SVF, HVPS and RPS) in accordance with the Charter of the Saudi Arabian Monetary Agency issued by Royal Decree (RD) No. 23 and the Banking Control Law issued by RD No. M/5.10

SVFs

The SAMA has issued specific regulations governing SVFs, namely:

- The PSPR which governs SVFs in the form of electronic money. The PSPR distinguishes between four categories of payment services providers (PSPs) and sets out the rules governing those, namely each of (i) a micro payment institution (PI), (ii) a major PI, (iii) a micro-electronic money institution (EMI) and (iv) a major EMI.

- The Regulatory Rules for Prepaid Payment Systems (RPPS), 2012, issued by SAMA in 2012 govern prepaid SVFs, including prepaid cards.

HVPS

SAMA regulates LVCSS.

- The principal system used for LVCSS in Saudi Arabia (KSA) is the RTGS system Saudi Arabian Riyal Interbank Express (SARIE).

- SARIE is an important component of the payments infrastructure and environment in the KSA. SARIE has facilitated the development of a wide range of electronic banking systems.

- Licensed banks, non-banking finance companies (NBFCs), third-party service providers, exchange houses, etc., are participants in the KSA’s RTGS system.

RPS

- SAMA regulates RPS and activities.

- SAMA regulates all payment systems in accordance with its powers pursuant to its: (i) charter and (ii) the Banking Control Law.

- Key rules, regulations, and circulars include: (i) circulars on regulatory rules, procedures and instructions for payments systems in the KSA (ii) the policy statement which formalised the implementation of Principles for Financial Market Infrastructures (FMIs) (iii) the RPPS (iv) the PSPR.

- SAMA regulates the below designated payment systems: (i) ATM/point of sale (PoS) (MADA formerly SPAN), (ii) Electronic Bill Presentment and Payment (SADAD) and (iii) RTGS (SARIE).

- Licensed banks, NBFCs, third-party service providers, exchange houses, money-transfer services, merchant acquisition service providers and new RPS providers under SAMA’s regulatory sandbox are participants in the KSA’s RPS.

The Federal Reserve Act

The Federal Reserve is the Central Bank of the United States under The Federal Reserve Act of 1913. It performs general functions to promote effective operations of the US economy. It broadly:

- formulates monetary policy and moderate long-term interest rates

- promotes the stability of the financial system and minimises risks

- promotes the safety of FIs and monitors their impact

- fosters the safety and efficiency of payments and settlement systems through services to the banking industry

- promotes consumer protection and community development through supervision and administration of consumer laws and regulations.

HVPS

The Clearing House Interbank Payments System (CHIPS) is a private clearing house owned by FIs and governed by the Federal Reserve to manage HVPS in real time.

- Fedwire funds service provides RTGS facility without netting of funds and order-by-order settlement is made to institutions and customers.

- The Federal Reserve allows participants in private clearing arrangements to settle transactions on a net basis using account balances held at the reserve. Users of the Federal Reserve’s National Settlement Service (NSS) include cheque clearing houses, automated clearing house (ACH) networks and bank card processors.

RPS

The Electronic Fund Transfer Act (EFTA), 1978

- EFTA establishes the roles and liabilities of participants as well as customers participating in electronic fund transfer using debit cards, ATMs, PoS machines, direct deposits and automatic withdrawals from bank accounts.

- The act protects consumers and limits liability in case of lost or stolen cards.

Credit Card Accountability Responsibility and Disclosure (CARD) Act of 2009:

- The act describes regulations around prepaid cards, stored gift cards and credit cards.

- It describes guidelines around charges, fees and expiry dates for customers.

- The Federal Reserve is the nation’s largest ACH operator that processes credit and debit transfers initiated by depository institutions.

With inputs from Monindro Saha, Aarushi Jain, Siddharth Gupta and Saurav Mangalmurti.

Sources

- PAYMENT SYSTEMS WORLDWIDE

- RBI announces creation of Payments Infrastructure Development Fund

- Irving Fisher Committee on Central Bank Statistics

- Financial Inclusion on the Rise, But Gaps Remain, Global Findex Database Shows

- BIS Papers No 107

- Payments

- E-money

- Payment services (PSD 2) - Directive (EU) 2015/2366

- PAYMENT SERVICES PROVIDER REGULATORY GUIDESLINES

Payments technology updates

Payment systems worldwide

World Bank Group

Payment Systems Worldwide: A Snapshot is a study presenting the outcomes of the fourth iteration of the World Bank Global Payment Systems Survey. The study could be conducted due to the collective efforts of the Payment Systems Development Group (PSDG).

Universal Financial Access (UFA) by 2020

World Bank Group

By the end of 2020, adults globally will have access to a bank account or an electronic instrument to store and send money, and receive payments as the basic building block to manage their finances.

Payment and Settlement: The Plumbing in the Architecture of India’s Financial System

Reserve Bank of India

In India, the policy approach to build a cashless economy while ensuring safe, secure, efficient and robust payments systems has yielded phenomenal growth in digital transactions.

Central Banks Mull Creating a CBDC, but Not on a Blockchain: Survey

CoinDesk

Central banks in 46 countries are considering creating a central bank digital currency (CBDC) using a constrained form of distributed ledger technology (DLT), according to a new survey. But they’re leery of blockchain.