Central Bank Digital Currency in the Indian context

September 2021

Introduction

Central banks are an important pillar of the financial ecosystem. Fundamentally, they have always provided efficient, quick, seamless, stable solutions for their respective economies. This includes payment systems and the issue of currency. Recent advancements in technology and the global economy have pushed these apex bodies to revisit their basic functions and adapt.

The Reserve Bank of India (RBI) has defined Central Bank Digital Currency (CBDC) as the legal tender issued by a central bank in a digital form. It is the same as a fiat currency and is exchangeable one-to-one with the fiat currency.2

Money as a concept has evolved over time, beginning with the barter system where goods were exchanged as ‘money’ to metallic and paper currency, banking instruments and now digital currency. Despite the changing forms of money, it has always had three basic characteristics:

- It is a store of wealth.

- It can be used as a medium of exchange.

- It acts as a unit of account.

Currency is this ‘form’ of money which the central bank of any jurisdiction issues, assumes liability for and accepts as legal tender.

Due to its various forms, rapid innovation and private nature (not sovereign issued), the emergence of digital money was accompanied by a lot of hesitation with respect to usage. There were also concerns about its security and decentralised nature, which gave rise to a very volatile environment for cryptocurrency or stable coins. However, over time, increased usage of these forms of digital money gave central banks across the world a push to meet this demand, especially with the growing preference for electronic payment methods and the increasing cost and operational hassles involved in printing money.

Central banks around the world, including those of China, Russia, Bahamas or the USA, are developing or researching the use of CBDC.3 A survey conducted by the Bank for International Settlements (BIS) in 2021 revealed that 86% of central banks around the globe were actively researching the potential for CBDCs, 60% were experimenting with the technology and 14% were deploying pilot projects.4 Retail CBDC projects appear to be more advanced in emerging economies with financial inclusion stated as an expected outcome. Wholesale efforts are mostly conducted in more advanced economies with more developed interbank systems and capital markets.5

They come with their own set of benefits that the governments of these countries can leverage.

The RBI has also talked about CBDC in its ‘Report on Currency and Finance 2020-21’6 and is exploring the case for issuing and operationalising a CBDC.

A CBDC is a digital form of the fiat currency issued by the central bank of a country and is in lieu of the paper/metal currency issued which is the direct liability of the central bank – that is, it is denominated in the national unit of account. A CBDC acts as a safe, government-backed, and ultimate medium of settlement by eliminating all claims that occur during a transaction.

A general-purpose CBDC needs an underlying system for issuance and distribution to the public in a convenient way. Depending on the model adopted, the whole ecosystem will need various players to function, which includes the RBI, public and private banks, payment service providers (PSPs) and operator(s). If we consider the wider ecosystem, we can also include other financial institutions and third-party service or application providers. While issuance models implemented may not be inherently different from the current intermediary system of currency issuance, every central bank and commercial bank will need to adopt a parallel end-to-end blockchain enabled system for CBDC issuance and circulation.

Stages of global adoption of CBDC

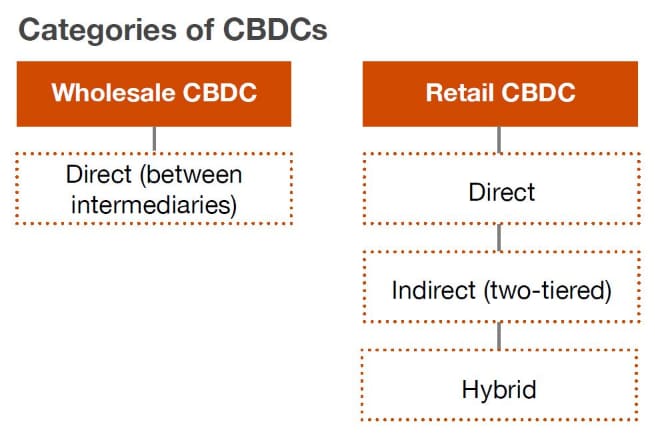

Wholesale CBDC can play a significant role in the evolution of wholesale payments which central banks are trying to modernise. Wholesale CBDC will facilitate interbank settlements on net basis. It will also support conditionality of payment where settlement will be dependent on another payment transaction or delivery of an asset/security. Wholesale CBDC can be used for interbank settlements, cross-border remittances, and capital and security markets. It is expected that wholesale CBDC will make existing payment transactions efficient.7

Ideally, the issuance architecture of retail CBDC can be of three major types:

- Direct issuance: The central bank issues directly to the public. The CBDC claim is on the central bank.

- Hybrid issuance: The central bank issues to PSPs, which onboard clients and execute payments. The bank periodically records the retail balances.

- Indirect (two-tier): The claim is on the intermediary commercial bank but backed by the central bank. The banks on-board customers and handle retail payments. The central bank handles wholesale payments.

Categories of CBDCs

CBDC can be broadly divided in two major categories based on usage within a country’s financial and monetary ecosystem.8

Infrastructural design considerations

CBDCs are mostly built on DLT, but evolving research suggests the feasibility of hybrid architecture. The choice of technology, however, depends on the CBDC design.

Retail CBDC models are more suited for accountbased models, allowing users to create accounts with the central bank or intermediaries to receive CBDC. Such a design must be easy to use and access and can be open instead of permissioned. This would allow private entities to develop products and services over the network in an easy manner. Wholesale models, on the other hand, can use tokens to create a wholesale payment network and increase efficiency. This infrastructure does not have the adoption, scaling and regulatory complexities that retail CBDC infrastructure does. There are also general use models, which can be used for both wholesale and retail issuance.

In the case of retail CBDC, central banks must also consider if the CBDC will be issued directly, indirectly or in a hybrid manner. A central issuance model allows the central bank to retain control of the underlying CBDC network. However, it has to be implemented within an ecosystem of commercial banks, financial institutions and service providers. The network can also lead to disparity in security, distribution and data privacy, as private parties can design their own access bridges to the network. The central bank would also have to bear overhead cost and network responsibilities in the direct model.

Indirect models allow users to interact with decentralised applications and solutions. With multiple participants in the system shouldering the responsibility of the network and the cost, the security risk is also reduced. Central banks would have limited control over the design of payment rails. Additional processing and network capabilities to interface the ledger with existing financial applications would also have to be considered, along with ways to notify participants about events such as updates.

Hybrid models combine direct and indirect models, and private and financial players can be allowed to operate participatory nodes. Such a model is quite resilient but requires significantly complex operational structures.

Key principles/considerations for CBDC in India

Although CBDCs are issued by central banks across the globe in different formats based on the broad categories discussed above, it is still bound by three foundational or key principles or considerations that dictate its issuance across diverse geographies.

In the context of India, it becomes necessary for the government and the RBI to consider these key principles before issuing a CBDC within the country based on their common public and monetary policy objectives, because in the current economic landscape, they have to maintain both financial and monetary stability by making the CBDC ecosystem as trusted as that of the fiat currency.

When issued by the RBI as a new form of money, the CBDC should in no way interfere with the overall public policy objectives of the government and it should not be an impediment to the RBI’s ability to carry out its mandate with respect to both monetary and financial stability. It should, in effect, maintain the integrity and uniformity of the Indian currency and let the general public use all forms of the currency interchangeably, which in turn will reinforce the singleness of all these forms of currency in existence.

The CBDC should coexist or complement the other existing forms of currency, including cash and settlement accounts. It should also coexist with all the commercial bank accounts and work in harmony with fiat currency. The CBDC should in no way push for replacement and rather should support all other alternatives like cash, as long as the public demand for such forms of currency exists.

In a country like India, which had around 190 million unbanked citizens in 2017,10 it is very crucial for the government to have a plan for all forms of currency to coexist, and to use CBDC as a tool for the inclusion of the underbanked and unbanked sections of society. CBDC is also expected to revolutionise the way citizens pay using digital payment modes and will run parallel to existing payment rails.

The CBDC ecosystem, once introduced, should continuously innovate and boost its overall efficiency through healthy competition with the other existing set of digital payment systems, so that the average user in a country like India, who has a plethora of instruments, some of which are less safe than CBDC, still adopts CBDC as their preferred mode of transaction in day-to-day activities.

The role of third-party PSPs as well as public and commercial banks will be crucial in putting CBDC at the forefront of innovation. Together, PSPs and banks will not only help in much faster adoption but also create an accessible and robust system for the distribution of CBDC within the country’s jurisdiction. It is also essential for private economic agents, be it an organisation or an individual, to be free to decide and choose between all existing forms of the currency as well as the different payment systems to conduct their transactions.

Use cases and business models for CBDC in the Indian context

Benefits of CBDC

CBDCs can be instruments that support the public policy objectives of the government by providing a safe and resilient means of payments. They promote efficient, inclusive and innovative payments if properly monitored, and the risks involved are overcome through effective means.

The RBI has also highlighted some of the benefits of the CBDC in its report on currency and finance,11 including the ability to monitor transactions, and the distribution of ‘helicopter money’ as a form of aid during emergencies. It has also stated the potential of CBDCs in targeted distribution of money for particular goods and services as well as for aids and subsidies. Recently, the RBI Deputy Governor highlighted that CBDC would not only create desirable benefits in payment systems but also protect the general public from the environment of volatile virtual currency.12

Apart from these, CBDC also helps in implementing anti-money laundering (AML) and combating financial terrorism (CFT) measures by acting as a highly secure way for cross-border transactions. It can speed up the high-value transactions as no post reconciliation is needed due to the existence of the DLT. It can also benefit many sections of the society by being a tool for offline payments through digital tokens.

Use cases for CBDC in the Indian context

Programmable

Cross-border remittances

Retail payments

MSME lending

Offline payments

Apart from being a tool for digital transformation of payments, CBDC has multiple facets. It has multiple forms in terms of usage across different geographies. Four major use cases in the Indian context are discussed below.

Major use cases of CBDC

A possible use case for CBDC is ‘fit-for-purpose’ money used for social benefits and other targeted payments in a country. For such cases, the central bank can pay intended beneficiaries pre-programmed CBDC, which could be accepted only for a specific purpose. For example, pre-programmed CBDC could be issued for LPG subsidies as direct benefit transfer (DBT). This CBDC could only be accepted at authorised LPG agencies and would be declined for use in other areas. LPG agencies would be able to convert this CBDC to a general-purpose CBDC or fiat currency at any commercial bank, which would have the necessary authorisation to change the nature of the CBDC.

Such subsidies can also be extended to other sectors such as agriculture, where subsidies for fertilisers could be transferred via the CBDC route. This CBDC could only be accepted at authorised fertiliser outlets, ensuring minimal leakage in the subsidy programme.

Programmable payments can also be used by other organisations for their employees’ expenses, including for fuel and telecom bills. Moreover, programmable payments can also be used in industrial supply chain ecosystems. In this case, pre-programmed digital CBDC could only be used for specific purposes such as fuel expenses and state border taxes.

Key participants

RBI, commercial banks, commercial organisations merchants, software and hardware providers, general public

Benefit

Minimises misuse of social benefit programmes and other subsidies as it ensures correct usage of money transferred

CBDCs could be used for faster cross-border remittance payments. International collaboration among the major economies of the world, including India, could help create the necessary infrastructure and arrangements for CBDC transfer and conversion. Such infrastructure must ensure interoperability of CBDCs across jurisdictions and quick transfer of CBDC for success. In such an environment, CBDC remittances could happen in real time, rapidly reducing the time required for the payment to be received by the intended recipient.

Key participants

RBI, other central banks, commercial banks, software providers, general public

Benefit

Fast, real-time remittance of money and reduction of time required for receiving payments across borders

CBDCs can also be used for retail payments. Payment instruments could be made available for payment transactions to be made via CBDC. Furthermore, universal access attributes of a CBDC could also include an offline payment functionality.

Retail CBDC distributed by the RBI and commercial banks would have to be held in electronic wallets/ accounts by the end users. This would enable payment means between the following:

- Consumer to consumer: Where consumers could exchange CBDC between their wallets

- Consumer to business: Where consumers can use CBDC to pay for products and services

- Business to business: Where businesses can exchange CBDC between their corporate account wallets

As CBDCs offer instant settlement, they lower the risk in clearing and settlement of retail payments, thus reducing counterparty risk.

CBDC’s underlying technology, along with the currency’s digital nature, make it superior to existing digital payments. Its irrefutable nature combined with ownership record transfers can provide irrefutable evidence of proof of ownership.

| India Stack for digital currency | Layers | Purpose | Enablers | Owners |

|---|---|---|---|---|

| Consent layer | Data-sharing framework | Transaction ledger | RBI | |

| Cashless layer | Payment network | Blockchain/DLT-based payment system, i.e. faster payments, offline payments, remittances, transit, etc. | Payment system operators, Institute for Development and Research in Banking Technology (IDRBT), consortium of banks and nonbanks | |

| Paperless layer | Digital storage and retrieval of information | Aadhaar Mapper, DigiLocker | Account aggregators, Central Registry of Securitisation Asset Reconstruction and Security Interest (CERSAI), Depositories, Ministry of Electronics and Information Technology (MeitY) | |

| Presence-less layer | Open access based identity validation | Aadhaar, PAN | UIDAI, National Securities Depository Limited (NSDL) |

Key participants

RBI, commercial banks, businesses, software and hardware providers, OEMs, general public

Benefit

Alternative secure payments which are instantly settled and lower risk in clearing of payments

Instant lending to micro, small and medium enterprises (MSMEs) in India can be possible with the help of CBDC. As more MSMEs use CBDC, banks can draw up a more accurate borrower risk profile. This can be used to promptly meet MSME financing requirements.

Moreover, stimulus for MSMEs can also be disbursed quickly from the central bank. This can help businesses grow and sustain themselves during periods of uncertainty where availability of cash is limited. CBDC’s traceability can help MSMEs prove their creditworthiness. Moreover, it leads to transparency and can be extremely resilient to forgery.

Key participants

RBI, commercial banks, businesses, software and hardware providers, general public

Benefit

Accurate risk profile of borrowers, faster disbursement of loans, accurate tracking of loan usage

Offline payment is another avenue which can be enabled by CBDC. The offline wallet in general would be a separate wallet and could be based on near-field communication (NFC) technology.

The digital wallet/application can be used in NFCenabled devices – a feature phone or a smartphone. In areas with weak networks or with no internet, it will be highly secure and easy solution for peer-to-peer payments. The verification of identity, confirmation of a transaction and payment will happen over the offline wallet in an account-agnostic way without the need for an internet connection.

Although there are a multitude of advantages of introducing a CBDC in India, it also carries its potential set of risks that can cause instability for the RBI.

Key participants

RBI, commercial banks, businesses, software and hardware providers, OEMs, general public

Benefit

Caters to the needs of people living in areas without internet connectivity by serving as a secure mode of payment

Potential risks involved in CBDC

Potential risks of CBDC

- Cyber hacks and threats

- Impact on monetary policy

- Impact on the role of commercial banks

- Impact on financial inclusion

- Threat to privacy

Cyber hacks and threats

CBDCs might be subjected to cyber hacks which might lead to server blockages or unforced timeouts or service declines. Decentralised systems are usually good at handling such situations, but a resilient system with anti-hack measures should be preferred.

Other than such cyber hacks, CBDC can be exposed to other cyberthreats that primarily include distributed denial-of-service (DDoS) attacks that disrupt services, supply-side attacks to infrastructure and side channel attacks to user devices and payments applications.13

CBDC systems based on DLT are vulnerable to DDoS attacks because for a transaction to occur, it needs to interact with all other nodes in the network. A DDoS attack is usually an attempt to disrupt the traffic towards any server or network by overwhelming it with a huge amount of traffic in a very short time. And if these cyberattacks are not taken care of by the government, they will jeopardise the integrity of the CBDC system, and the general public will lose confidence in the ecosystem.

Impact on monetary policy

The high adoption of CBDC within a country’s financial system could have an impact on the monetary policy, creating unnecessary instability in the economy without proper measures.

Higher adoption rates curb the flow and use of fiat currency and in extreme circumstances the economy is forced into substituting the Indian rupee for any foreign currency like the dollar. This happens in rare cases is when the country’s fiat currency has lost its value due to instability or hyperinflation. However, such substitution can be prevented if there are limits on the amount of CBDC held by any individual.

Other ways to handle any negative impact are to improving awareness about CBDC among people and educating them so as to build trust in the usage of CBDC.

Impact on the role of commercial banks

Two-tier issuance architecture is a good approach for a retail CBDC as it helps in saving a run on the central bank. In this architecture, the central bank backs the issuance of CBDC and distribution to the general public by the commercial banks based on securities or cash deposits held at the central bank. The role of banks needs to be clearly defined in the whole distribution and management of CBDC with proper measures against disintermediation.

The disintermediation of banks happens when commercial banks can’t support a large-scale withdrawal of money in its deposits by the public or the conversion of such deposits into CBDC deposits, which forces them to go back to the central bank for financial support. Thus, the overall load of multiple banks falls on the central bank in such a case, destabilising the financial system.

The conversion of fiat currency into CBDC would depend a lot on the interest rates being given for banking deposits and CBDC. A large number of people will convert at least part of their deposits into CBDC and with higher incentives for CBDC, the risk of such heightened withdrawals from banks and conversions to CBDC will increase. The outflow of such deposits would be harmful for commercial banks as they would need an alternative source to fund the lending business, thus decreasing the ability of banks to give loans to the public.

Some policies regarding limits on the amount of CBDC deposits and zero interest on such digital wallets/accounts can help address some of these issues faced by commercial banks. It would be safe to say that these areas need further deliberation by the central bank and the government.

Impact on financial inclusion

In a country like India, where around 550 million people still use feature phones,14 it is important for CBDC to not only cater to the tech-savvy youth, but also to include feature phone users and people from lower socioeconomic groups within the country. Another 845 million15 people have smartphones, out of which many still dn’t use mobile banking or digital payments in their daily lives.

There are a plethora of reasons for exclusion to occur in the case of something like CBDC. These can range from economic factors, lack of knowledge, propensity of people in tier-2 or tier-3 cities to use cash, and unawareness of the existence of CBDC in some markets.

To build a CBDC ecosystem and make it sustainable, it is essential to address all these issues and for CBDC to act as a tool for inclusion by solving the problems through innovation, as in the case of offline payments.

Threat to privacy

The introduction of CBDC will increase the security and safety of transactions as all of them will be validated and captured in a distributed ledger. However, there is a small trade-off between combatting AML and CFT and privacy because transactions of people and businesses will not be completely anonymous.

Therefore, it is very important for the authorities to strike a balance between AML and other measures intended to curb illegal activity and maintain the confidentiality of personal and financial information of citizens.

There will be a need for strong cooperation between different government agencies and regulatory bodies so that a balance is maintained and a proper data or information collection framework is implemented which oversees the ecosystem.

Other key considerations for CDBC in India

The RBI has outlined some of the benefits and risks with CBDC in its ‘Report on Currency and Finance 2020-21’, which indicates that the concept is still in its initial exploratory phase and the issuance model may be ready by year end. As we discussed some of the use cases of a CBDC in the Indian context, it is also necessary for us to explore how the digital currency will change or affect the regulatory landscape along with the country’s monetary and fiscal policies. To understand the impact of CBDC, there are three major areas which need to be explored where changes are expected:

Change in regulations to curb impact on monetary policy

The implementation of CBDC in an emerging market like India, which has a large credit market dominated mostly by commercial banks, can have major implications for the current monetary policy as well as the financial stability of the country.

To manage any potential impact on the monetary policy, one way is to use two-tiered architecture for the issuance and distribution of CBDC wherein there is a ceiling on the amount of CBDC that can be held by any individual in their digital wallets. This would help the government to curb the conversion of current account savings account (CASA ) accounts on a large scale to CBDC holdings. Another way to ensure minimal conversion is to provide zero interest on such CBDC e-wallets, which will minimise any arbitrage between bank deposits and CBDC.

From a regulatory perspective, some regulatory policies for penal action against people who violate the ceiling on CBDC can be made mandatory, such as having zero/negative interest rates on such digital wallets/accounts.

With the usage of CBDC in cross-border remittances, it is imperative for us to understand the AML/CFT risks that can arise due to the anonymity and value of transactions. The lack of clarity in compliance or supervision might have an adverse effect on the country’s fiat currency. A good option to combat these complications and follow the standards set by the Financial Action Task Force (FATF) is to have new regulations and a central oversight body set up by the RBI to enforce such measures for all cross-border transactions and to mandate the capturing of some necessary information about the sender and receiver within the CBDC transaction node itself for future tracking and references.

Impact on existing payment rails

CBDC, which may rely on DLT, will result in the development of a new CBDC network or payment system which will coexist along with the existing payment modes. Working along with existing players and upcoming PSOs, payment umbrella entities, FinTechs and technology providers specialising in blockchain/DLT will help in developing payment rails and products supporting CBDC.

RTGS, which primarily deals with high-value settlements, can be integrated into the distributed ledger which will automatically do the liquidity saving mechanism (LSM) that is currently used to identify the net settlement value at the end of the day, because the ledger in itself will validate each transaction, thus reducing the need for further reconciliation.

Payment rails around CBDC can create additional revenue streams for the participants and stakeholders. These revenue streams can further be expanded with the expansion of payment-related use cases for CBDC.

Further, CBDC may increase the traceability and reliability of transactions as information will be stored in the decentralised network. For any transaction to be authentic, multiple parties will have to attest it before it is stored in the DLT. The currency can function without the need for an external body to reconcile all transactions, although the decentralised network itself can be operated and owned by the RBI.

Technology architecture

The technology used for CBDC transactions is generally DLT, which provides a peer-to-peer network encrypted through public key cryptography and runs on consensus algorithms.

The advantage of having CBDC is that it keeps immutable and irreversible records for each transaction, by which the true ownership can be known.

It also helps implement the concept of ‘programmable money’ as the digital currency transaction nodes within the DLT can store and validate useful information or metadata about transactions and one can also add security features to prevent any misuse.

Conclusion

The sudden spike in interest in CBDC is due to the value central banks foresee in terms of fulfilling public policy objectives, maintaining economic stability, and providing people with a convenient, safe and reliable payments system.

Each country’s position with respect to adopting CBDC varies. A few countries are conducting research and testing iterations in order to set up their CBDC in a phased manner, while others are sprinting towards deployment. In the Indian context, there are ongoing discussions and efforts to evaluate how and when CBDC can be implemented. This will unlock significant opportunities for the ecosystem players to come up with services that make it easier and convenient for citizens to transact and make digital payments for various use cases and requirements.

With inputs from Zubin Tafti, Kanishk Sarkar, Aditya Chowdhury, Shamik Bandyopadhyay and Vasundhara Kulshrestha.

Sources

- Central Bank Digital Currency – Is This the Future of Money

- Central Bank Digital Currency – Is This the Future of Money

- Central Bank Digital Currency Tracker

- BIS Innovation Hub work on central bank digital currency (CBDC)

- PwC CBDC global index

- Report on Currency and Finance 2020-21

- CBDCs: an opportunity for the monetary system

- WHAT IS CBDC? A COMPREHENSIVE GUIDE

- Central bank digital currencies: foundational principles and core features

- THE UNBANKED

- Report on Currency and Finance 2020-21

- Central Bank Digital Currency – Is This the Future of Money

- Security of a CBDC

- Overall India handset market growth to fall in 2020

- Number of smartphone users in India in 2010 to 2020, with estimates until 2040

- Report on Currency and Finance 2020-21

Contact us