FinOps and cloud cost optimisation

Capture cloud inefficiency and reinvest in the future of business.

Current challenge with cloud adoption

Public cloud providers have fueled business growth, innovation, and agility. However, the cloud consumption model is a double-edged sword that has disrupted traditional technology sourcing and financial management practices. Companies have witnessed business cases fall apart as they have executed against their cloud strategy.

Cloud FinOps market

The growth of cloud is exponentially increasing and companies will need to monitor and optimise cloud spend:

What is FinOps?

FinOps is an evolving cloud financial management discipline and cultural practice that enables organisations to get Improved business value by helping engineering, finance, technology and business teams to collaborate on timely data-driven decision making through increased visibility, governance, optimisation and efficiency.

FinOps promotes the following:

Increase value

Increase business value of cloud by bringing technology, business and finance together to maximise ROI.

Cost awareness

Promote a cost aware culture by developing transparency between teams and empowering them to manage their costs.

Collaboration

Deliver faster and keep financial control by collaborating on timely data-driven decision making.

Our Cloud FinOps framework takes an agile approach to the FinOps lifecycle to help inform the organisation, help optimise cloud expenditures and operate with the intention to maintain cloud savings.

Our framework

PwC India Cloud FinOps offerings will address the following core ideologies:

- Increasing cloud spend transparency across enterprises.

- Identifying cloud optimisation opportunities with tactical solutioning.

- Developing processes and governance to sustain and mature cloud spend operations.

Inform

Cloud spend transparency

- Rationalise client cloud spend with PwC proprietary tooling

- The on-demand and elastic nature of the cloud makes it necessary for accurate visibility to enable intelligent decisions.

- Determine the total cost of ownership to migrate and host workloads in the cloud

Optimise

Cloud spend optimisation

- Design/refresh tagging policy and levers for optimisation

- Allocate cloud costs to downstream business units

- Identify waste reduction and optimisation opportunities across the current cloud landscape

Operate

Mature cloud spend operations

- Establish cloud governance with policy and standards

- Sustain cloud efficiencies with key metrics, automation, architecture, controls and operating model

- Design processes for continuous tracking of cost savings

- Measure business alignment based on speed, quality, and cost.

Why work with us?

Our holistic approach covers six domains for sustained efficiency and cost reduction:

- Transparency: Showback, reporting/dashboarding, tagging, cloud subledger

- Process: Capacity/utilisation management, cost management, budget/ forecasting, procurement/ vendor management and continuous service delivery

- People: Executive support, FinOps operations culture, finance-procurement-IT interaction

- Governance: Cloud center of excellence, compliance/policies, escalation path and exception management

- Tools: Cloud cost management, cloud reporting, monitoring and alerting

- Automation/architecture: Database, PaaS, serverless and containers

- Cloud efficiency scorecard: PwC's cloud efficiency scorecard helps to identify weakness across the four domains and provides recommendations to improve cloud spend.

- Optimisation techniques: An extensive library of methods to improve cloud spend for all major cloud service provider. The techniques are based on PwC and industry leading practice.

- Strategic alliances: spanning cloud providers (Amazon Web Services, Microsoft Azure, Google Cloud Platform) and other cloud integration providers.

- Our deep expertise in financial audit and operational excellence, along with our deep knowledge in cloud, provides unique capabilities for cloud cost effectiveness.

- Over 3,500 cloud practitioners across PwC's global network.

- A cloud innovation lab that is geared towards advancing knowledge, leading practices, and insights.

- Over 800 cloud engagement performed over the past 12 months at over 550 clients.

- Over 40% of clients engaged PwC for additional cloud services.

Challenges

25% of cloud spend is wasted due to inefficiencies

Complexity of cloud services and pricing models promotes poor decision making and limits effective forecasting

Lack of understanding of overall cloud spend and operational cost savings being eroded by additional tax costs

Dynamic scaling capabilities in cloud could lead to spiraling costs and require constant monitoring and controls

Historical “on-premise” mindset lingers in cloud delivery operating models

Availability of talent with cloud finance experience is limited

How organisations think differently on FinOps during transformation lifecycle

Organisations will need to think differently about FinOps throughout transformation lifecycle to enable cloud optimisations

Cloud optimisations

IT Finance plays a significant enablement role as an organisation evolves through its cloud journey. At various stages of the journey, IT finance helps fund the transformation, set savings expectations, incentivise adoption, and help adopters adopt efficiently.

The challenge

- Public cloud providers have fueled business growth, innovation, and agility.

- However, the cloud consumption model is a double-edged sword that has disrupted traditional technology sourcing and financial management practices.

- Companies have witnessed business cases fall apart as they have executed against their cloud strategy.

Transformation enabled through FinOps foundational elements

There are six foundational elements to maturing and growing a FinOps capability, which provide three key results. Based on level of maturity across the FinOps lifecycle, companies should be looking to target certain aspects of each elements.

Key features

Planning and budget

- Spend allocation-based on tags, account or business mapping

- Container cost allocation

- Multi-cloud visibility

Capacity and demand management

- Cost and consummption forecasting

- Utilisation metrics

- Cost optimisation

- Reserved VM planning tool

- Right sizing and auto shutdown

- Orphaned / Idle Resource management

- Hub (Hybrid use case benefit - Azure only)

- Container optimisation

Monitoring, reporting and governance

- Cloud financial dashboards and reports

- Alerting

- Tagging governance & remediation

- Anomaly/outlier detection tool

- Resource visibility

- Spend trend analysis

Billing and invoicing

- Showback

- Visibility of cloud spend

- Container cost visibility

PwC Cloud FinOps tool - FinOps analyser

FinOps Analyser is PwC proprietary Cloud FinOps tool used to analyse large data sets of cloud host providers billing and utilisation data to identify patterns that denote potential cost savings and support an overall Advisory designed to promote cloud transparency.

Key features

- Spend allocation-based on tags, account or business mapping

- Container cost allocation

- Multi-cloud visibility

- Cost and consummption forecasting

- Utilisation metrics

- Cost optimisation

- Reserved VM planning tool

- Right sizing and auto shutdown

- Orphaned / Idle Resource management

- Hub (Hybrid use case benefit - Azure only)

- Container optimisation

- Cloud financial dashboards and reports

- Alerting

- Tagging governance & remediation

- Anomaly/outlier detection tool

- Resource visibility

- Spend trend analysis

- Showback

- Visibility of cloud spend

- Container cost visibility

Critical Success Factors (CSFs) to evolve for a comprehensive FinOps operating model

PwC identified the main critical success factors to bring visibility into cloud usage and consumption, enabling the continuous optimisation of the cloud infrastructure

| Areas | FinOps main success factors |

|---|---|

|

|

|

| Areas | FinOps main success factors |

|---|---|

|

|

|

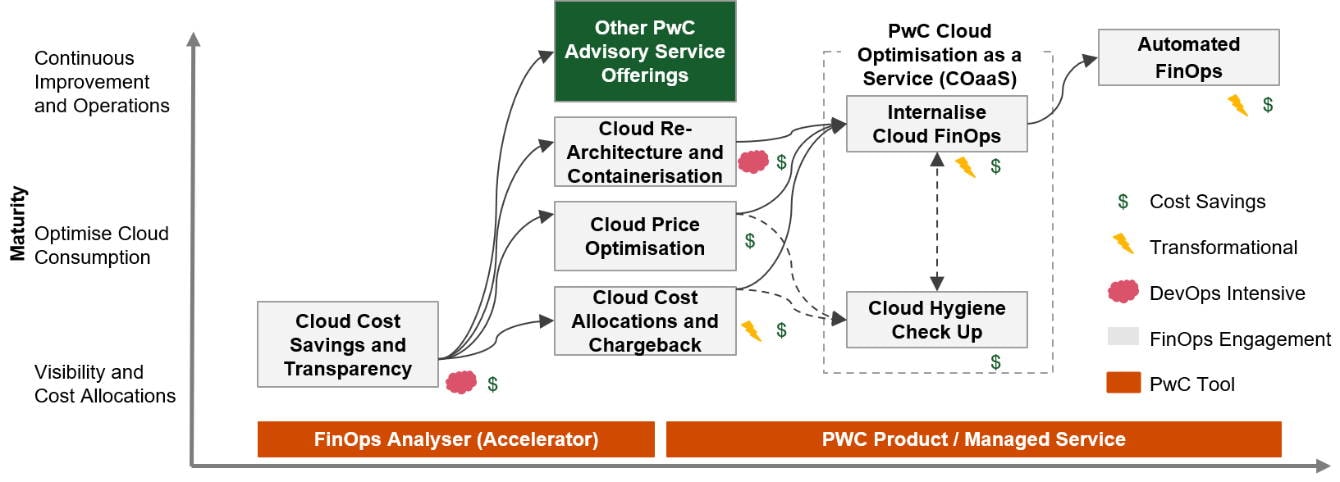

Our tailored FinOps offering allowing companies at various stages of maturity to scale and reap the value through new business capabilities

PwC understands the complexity of client’s journey into a hybrid or cloud native infrastructure. Depending on the maturity or readiness of the client, PwC can meet you where you most need support.

Success stories

- For a large financial service institution, to manage the cost and more transparency, PwC implemented a technology business management (TBM) reference taxonomy solution and the client’s Apptio cost management system to design a new IT cost allocation model covering both labour costs and IT hardware/software assets.

- To build governance and cost control structures for a large regional bank, PwC created a detailed TCO model with the client’s finance team that accounted for DC facilities, network connectivity, software licensing, and labour costs.

- A large-scale cybersecurity software company decided to migrate its product workloads to a public cloud platform to eliminate nearly $25m in enterprise-wide infrastructure costs and introduce greater resource flexibility on a global scale. PwC supported the implementation of cloud governance processes around financials, tools and automation. This included governing, managing, and optimising public cloud spend through initiatives such as tagging compliance and KPI tracking.

Contact us