Download the report

In the past couple of years, over 150 multinational corporations have established their global capability centres (GCCs) in India. With over 1,600 GCCs, India’s position in the GCC landscape is growing stronger each day and by 2025, the country is poised to have 1,900 such centres with the market size touching USD 60 billion.1

Technology’s role in ESG

The expansive global reach and robust capabilities of GCCs present a unique opportunity for the ESG function of the organisations to spearhead their sustainability initiatives. By leveraging the expertise and innovation inherent in GCCs, the ESG function gains access to the necessary infrastructure and resources to create robust digital ecosystems and advanced architecture using technology-based solutions. Using digital technology like blockchain, machine learning (ML), artificial intelligence (AI), big data, and the internet of things (IoT) can play a huge role in incorporating sustainability into the development of products and services. Several prominent technology firms are advancing their efforts in ESG initiatives. One such example is the integration of sustainability principles into operational frameworks like the incorporation of sustainability features into enterprise resource planning systems. Another notable advancement includes the development of cloud platforms designed to facilitate ESG reporting, compliance, and improvement tracking for businesses aiming to enhance their environmental and social impact.

ESG and digital technology can be seen as two sides of the same coin. Digital technology should be at the core of a company’s ESG journey, anchoring the strategy and transformation from start to finish. The incorporation of technology stands as a cornerstone in ensuring the alignment of a company’s ESG strategies with the shifting industry practices and ever-evolving regulatory terrain.

Navigating the shifting tides of regulatory challenges in ESG

Regulatory authorities are increasingly advocating ESG considerations, recognising the peril that climate change poses to financial stability through both physical and transitional risks. The emerging global regulatory landscape, particularly in the EU, the UK, the US and India, reflects a concerted effort to address ESG considerations.

The global regulatory landscape for ESG exhibits a notable degree of jurisdictional fragmentation. The evolving regulatory landscape is not merely shaping the sustainability narrative but fundamentally transforming the modus operandi of companies across diverse jurisdictions. As businesses face the task of staying informed about the regulatory developments, companies must disclose their ESG performance and associated risks to comply with the mandates, and to ensure transparency and accountability. The repercussions for enterprises falling short of these ESG benchmarks extend beyond just profits, encompassing reputational damage and a waning of investor trust.

Deciphering investor’s expectations

Sustainability is clearly a priority for investors and they want to understand how companies incorporate sustainability into their strategic decision-making processes, risk management and financial statements. Investors want to know how a company’s sustainability plans are aligned with its business model and, ultimately, its prospects for creating long-term value.

According to a PwC survey, investors are signaling a significant opportunity for businesses – 69% of them are planning to boost their investments in companies which effectively tackle sustainability challenges relevant to their operations.2 Investors are putting their money in companies which demonstrate a commitment to mastering sustainability and navigating challenges posed by climate change and societal shifts. Addressing investor expectations which are aligned to the principles of non-financial reporting set by standard setters require significant revamping of internal processes on target setting, investment decision making, capital project management, performance monitoring and risk monitoring.

Consumers want businesses to focus more on sustainability

According to the World Meteorological Organization, 2023 was the planet’s warmest year on record.3 In the wake of the COVID-19 pandemic, consumer preferences have noticeably evolved with an increased emphasis on sustainability. The pandemic has expanded the cohort of socially conscious consumers who are more willing to invest in brands which prioritise health, safety, and environmental and social responsibility. As per the findings of PwC’s Consumer Intelligence Series survey on ESG, 76% of respondents indicated their readiness to sever ties with companies which exhibit poor treatment towards employees, communities, and the environment. 83% of consumers believe that companies should actively contribute to ESG best practices.4 These numbers reveal that consumers are more likely to support companies with a clear sense of purpose and a commitment to sustainability. It is clear that twenty-first century’s consumers focus on human rights, tackling climate change and supporting businesses which embrace circular economy practices.

Building strategic synergies: The role of GCCs in nurturing ESG objectives

The integration of a GCC and a company’s ESG agenda emerges as a poignant endorsement to competitive yet responsible business practices. This partnership goes beyond mere compliance and includes a shared commitment to environmental stewardship, social equity and robust governance. GCCs serve as catalysts for organisational transformation with technology and innovation setting the stage for guiding companies towards a future where the profitability of a business endeavour is aligned to making a purposeful impact. Below is a table which highlights how GCCs can support the ESG agenda of a company.

Table 1: How GCCs can support an organisation’s ESG agenda

| ESG aspects | How GCCs can support the ESG agenda |

|---|---|

| Reporting and assurance | Develop advanced reporting systems by leveraging data analytics and digital platforms to ensure accurate and transparent ESG reporting. |

| Risk assessment | Utilise analytical capabilities to conduct comprehensive risk assessments, integrating technological solutions for real-time monitoring of ESG risks. |

| Sustainable supply chain | Implement data-driven tools and analytics to assess and enhance the sustainability of the supply chain, collaborating with suppliers to meet ESG standards. |

| Climate risk | Utilise climate modelling and data analytics to assess climate-related risks, enabling proactive strategies to mitigate potential impacts. |

| Decarbonisation and net Zero | Leverage technology to optimise energy usage and integrate renewable sources. |

| Stakeholder engagement | Establish digital platforms for effective stakeholder communication, facilitate dialogue and feedback mechanisms to strengthen engagement. |

| ESG training and capacity building | Develop digital learning platforms for ESG training and ensure that employees have access to continuous education on sustainability. |

| Corporate social responsibility | Focus on community engagement and impact assessments through digital tools, leveraging local expertise to tailor programmes that align with the SDG goals. |

| Circular economy and resource efficiency | Implement circular economy principles through technological solutions, optimising resource use and minimising waste in product life cycles. |

| Carbon markets | Explore participation in carbon markets, leveraging financial and market expertise to navigate and contribute to carbon credit initiatives. |

| Water risk resilience | Develop water risk management strategies, utilising data analytics and technology to enhance resilience against water-related challenges in operations and supply chains. |

The role of GCCs as an enabler in developing ESG value

In today’s business landscape, the integration of ESG principles isn’t just a moral imperative; it’s the cornerstone for access to markets, license to operate, create long term value and build financial and operational resilience. GCCs can aspire to be at the forefront of value creation by strategically integrating ESG factors into the company’s operational fabric. The International Integrated Reporting Council (IIRC) identifies six categories of capital which help an organisation create value: financial, manufactured, intellectual, human, social and relationship, and natural.5 Recognising that value transcends mere financial metrics, GCCs leverage these six fundamental value creation pillars to derive ESG benefits while carefully mitigating negative costs. This comprehensive approach aligns organisations with global sustainability imperatives and positions GCCs as pioneers in responsible business practices, fostering innovation, resilience and purpose.

Figure 3: Linking ESG to the capital

| ESG aspects | How GCCs can support the ESG agenda | |

|---|---|---|

| Financial

|

Enhanced access to sustainable financing options, improved credit ratings and potential cost savings through efficient resource use. | Financial penalties for non-compliance, higher borrowing costs due to perceived ESG risks, and potential divestment from ESG-focused investors. |

| Manufactured

|

Streamlined production processes reducing environmental impact, increased demand for sustainable products, and positive brand perception. | Regulatory fines for environmental violations, reputational damage from unsustainable manufacturing practices, and increased costs for compliance. |

| Intellectual

|

Recognition as an innovative and responsible company, attracting top talent, and fostering positive relationships with stakeholders. | Loss of competitive advantage due to poor ESG performance. |

| Human

|

Improved employee satisfaction and retention, attract diverse talent. | Legal and reputational risks from poor labour practices, difficulty in recruiting top talent and potential negative impact on employee morale. |

| Social and relationship

|

Strengthened community ties, positive stakeholder relationships and enhanced brand loyalty. | Community and customer opposition due to perceived negative impacts, strained relationships with stakeholders and potential regulatory challenges. |

| Natural

|

Efficient use of resources, reduced environmental footprint. | Fines and penalties for environmental damage, reputational harm from unsustainable practices, and vulnerability to supply chain disruptions due to climate-related issues. |

Key considerations for GCCs

PwC’s suggested approach to integrate the ESG function within a GCC’s strategy is based on the business performance improvement (BPI) methodology and involves seven steps starting with the examination of the status quo and maturity of the company’s ESG performance to the implementation of associated ESG initiatives.

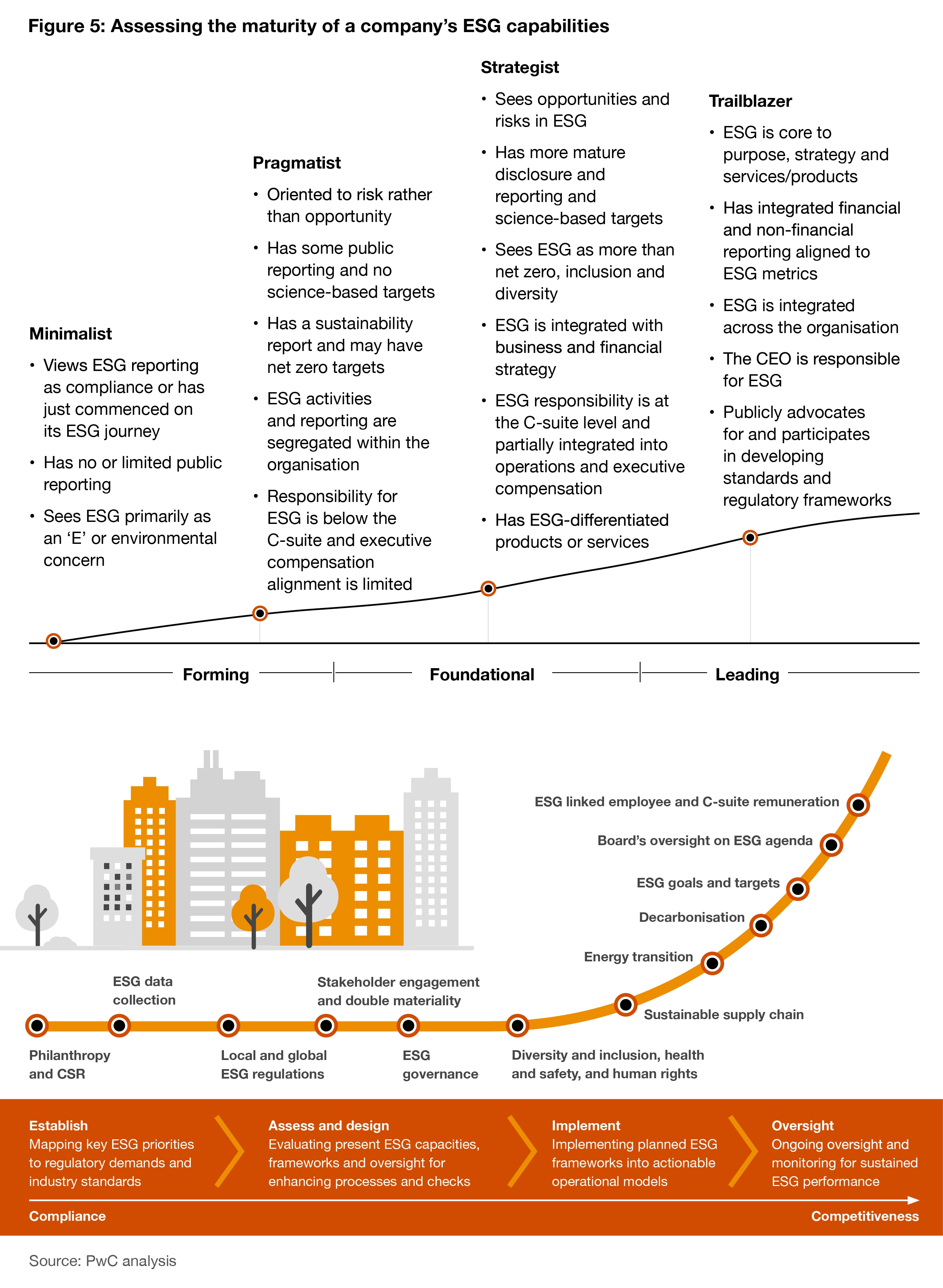

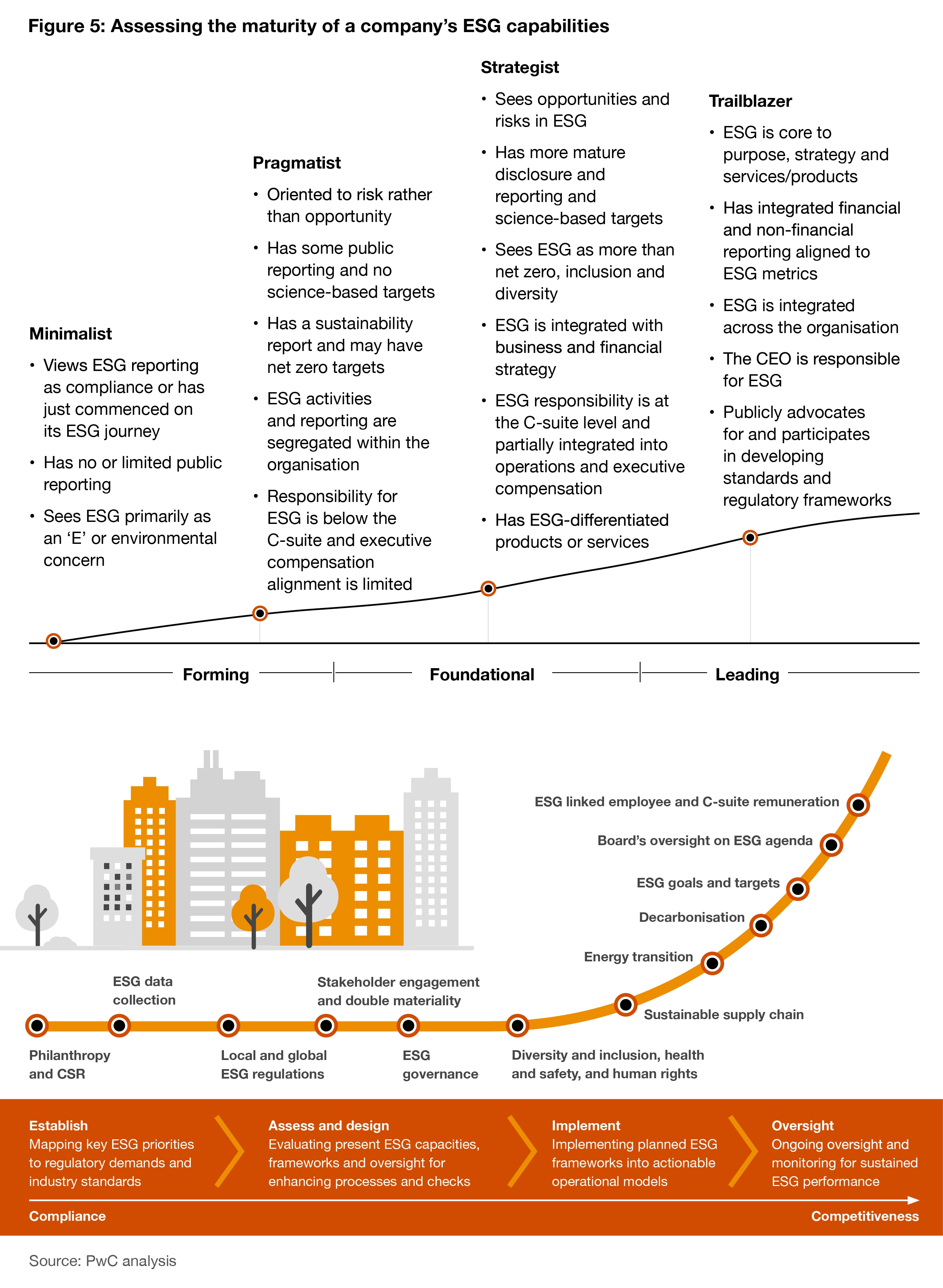

GCCs should conduct comprehensive evaluations to understand where the organisation stands in its ESG journey. Evaluating an organisation’s position in its ESG journey is pivotal as these assessments provide a nuanced understanding of the organisation’s current strengths and the areas which need attention. This approach acts as a strategic compass, allowing GCCs to harness their full potential in helping companies set meaningful and attainable ESG goals aligned with industry benchmarks and best practices in an ever-changing business landscape.6 Figure 6 illustrates the maturity assessment of an organisation’s ESG initiatives.

Questions to consider in the transition:

- Do you have a clear ESG vision and mission?

- How are you measuring the value which you are

delivering to the stakeholders? - Are you aware of the pressure points in your

ESG ecosystem? What could erode trust?

The process commences with an evaluation of an organisation’s current ESG practices, comparing its performance with industry benchmarks, peer best practices, regulatory standards, and global sustainability frameworks. This helps to bridge the identified gaps and capitalise on untapped ESG opportunities. The focus of GCCs is on identifying significant ESG material issues, risks, or opportunities that are important for both internal and external stakeholders and can impact the business. By aligning their efforts with ESG goals, companies can go beyond risk management, and adopt a proactive approach that leverages ESG as a driver for innovation, resilience and long-term value creation.

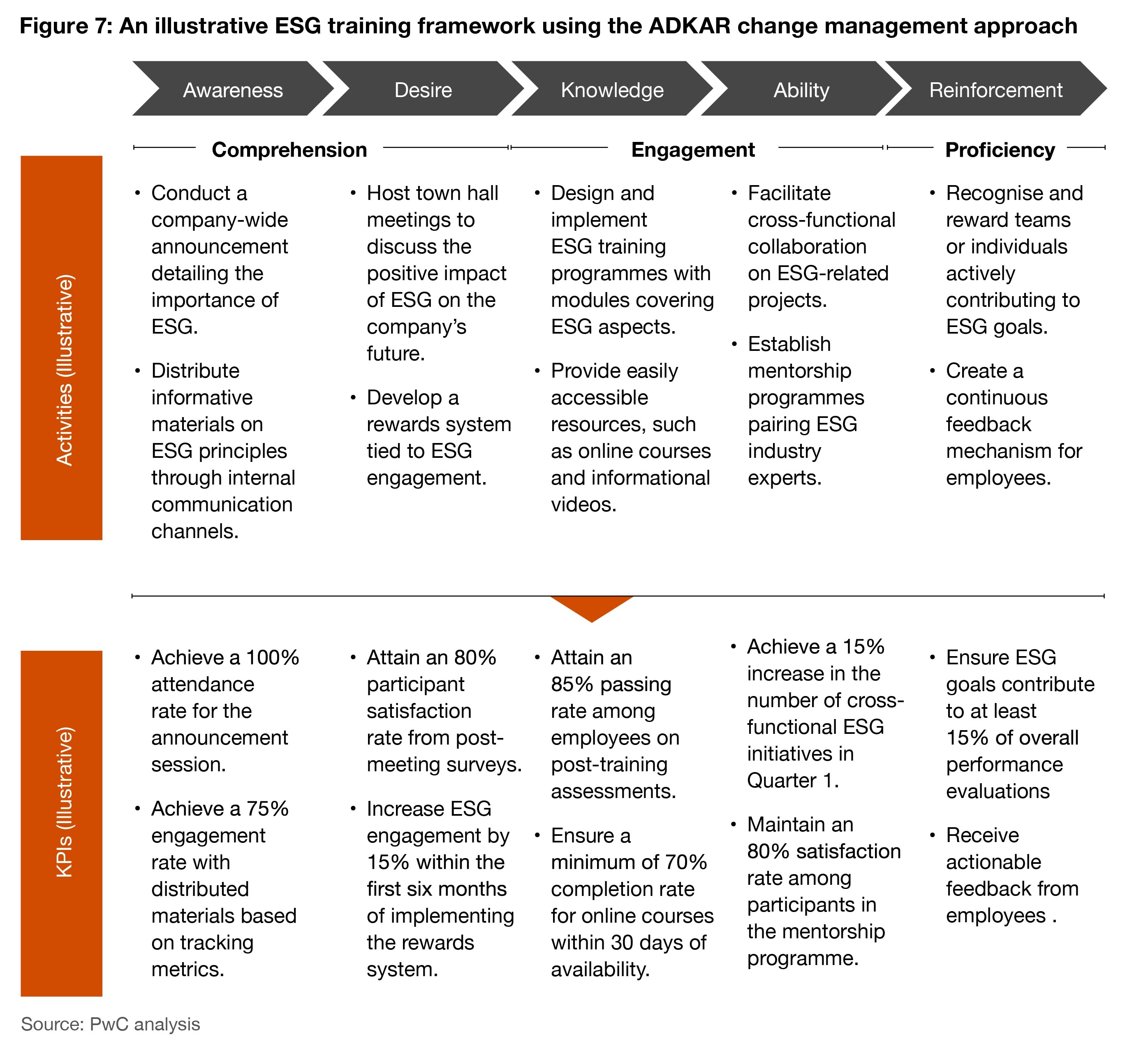

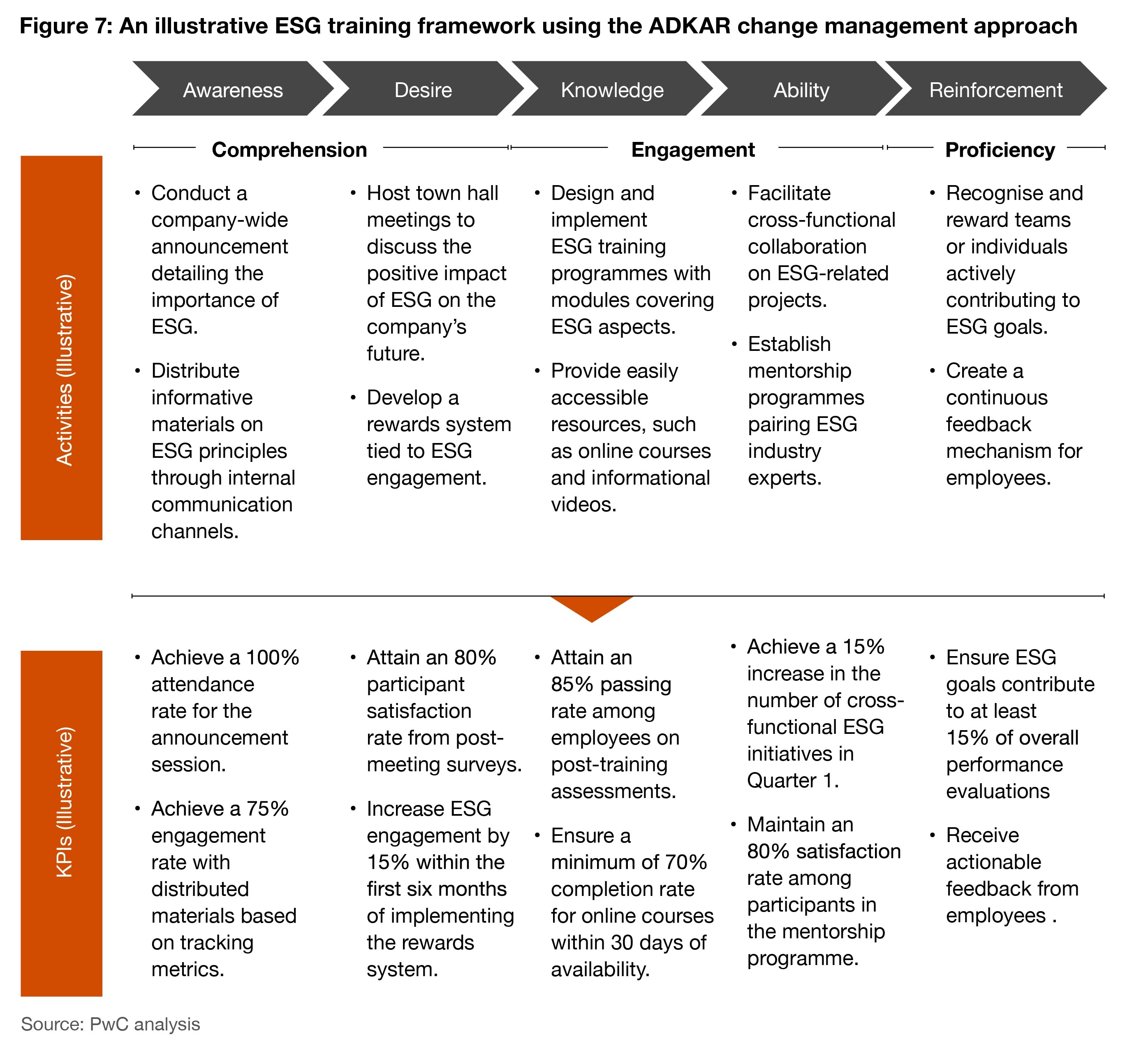

Conducting ESG capacity building sessions for the workforce follows a structured approach guided by the ADKAR model.7 The first step is the ‘Awareness’ phase which discusses the significance of ESG principles to the company and helps them understand the need for change. The next step ‘Desire’ involves measures to underscore the importance of ESG and develop a personal motivation for the change within the employees. The ‘Knowledge’ phase entails the development and execution of comprehensive ESG training programmes augmented by scheduled sessions with ESG subject matter experts. Transitioning into the ‘Ability’ stage, practical workshops and simulations are organised which help employees gain hands-on experience in integrating ESG principles into their day-to-day functions. The ‘Reinforcement’ phase emphasises acknowledging and rewarding teams for their outstanding ESG contributions.

With the help of this structured approach, the integration of ESG principles into an organisation’s business strategy evolves from theoretical conception to pragmatic application. This alignment underscores an organisation’s commitment to embedding sustainable practices at the core of operations.

Figure 7: An illustrative ESG training framework using the ADKAR change management approach

As ESG is not restricted to a segment of business, it demands collective effort. Effective governance begins with a robust board, leadership team, and a well-defined accountability framework. The establishment of a boardappointed sustainability committee, along with the approval of its mandate and member appointments, emphasises high-level oversight of sustainability initiatives, directly reporting to the board. Simultaneously, a management level committee, initiated by the executive committee, focuses on detailed operational aspects and is often led by key executives like the chief sustainability officer (CSO), chief technical officer (CTO), or chief risk officer (CRO). The day-to-day execution of the ESG strategy typically falls under the purview of senior management. GCCs should adopt various approaches in establishing and staffing their ESG teams, outlining internal reporting structures and adopting formal procedures for governance at the management level.

A robust governance structure becomes imperative to meet evolving stakeholder expectations, fortify risk resilience, and capitalise on growth opportunities within the ESG framework. ESG leadership cannot be fragmented among part-time contributors; instead, it necessitates a centralised and a dedicated approach to ensure progress.

Figure 8: GCCs and ESG governance: Key questions to set the stage for governance

Business model

- Should we adapt our business model, or is winding down a particular business line more viable?

- Who holds responsibility for implementing changes to the business model?

ESG strategy alignment

- How is our company’s strategy aligned with ESG factors?

- Who is accountable for identifying ESG-related goals, setting milestones, and ensuring timely delivery?

ESG integration

- Do considerations of ESG factors extend to the evaluation of a company’s cultural values?

- How are ESG factors incorporated into our enterprise risk management (ERM) framework?

People and competencies

- Does our orgainsation possess the necessary competencies?

- What new competencies and training are required, and can existing expertise within the organisation be utilised?

Governance and structure

- What additional governance structures are necessary to support our ESG strategy?

- Are roles and responsibilities adequately clarified?

Board oversight and integration

- Are the board and committees equipped to support a systemic approach to ESG integration?

- How are responsibilities distributed for oversight, information exchange, and control related to ESG matters?

Existing committee’s oversight

- What mechanisms will the audit committee employ to oversee sustainability reporting effectively?

- How does the risk committee evaluate and oversee key ESG risk areas, ensuring robust ESG risk mitigation strategies are in place?

- How does the nominations committee guarantee access to the right skills and competencies, aligning with ESG requirements?

- Does the remuneration committee ensure that senior management and executive remuneration structures align appropriately with sustainability objectives?

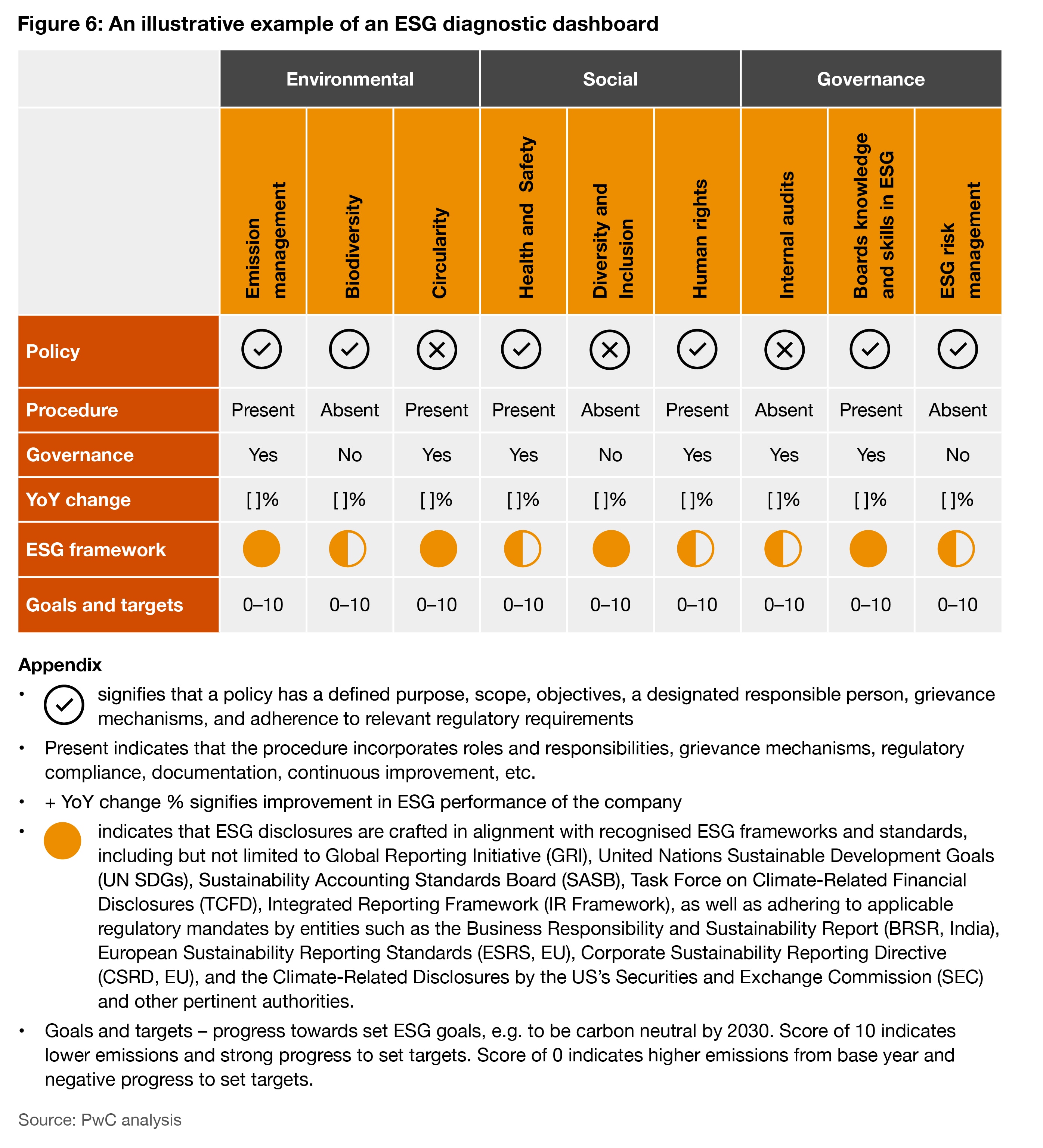

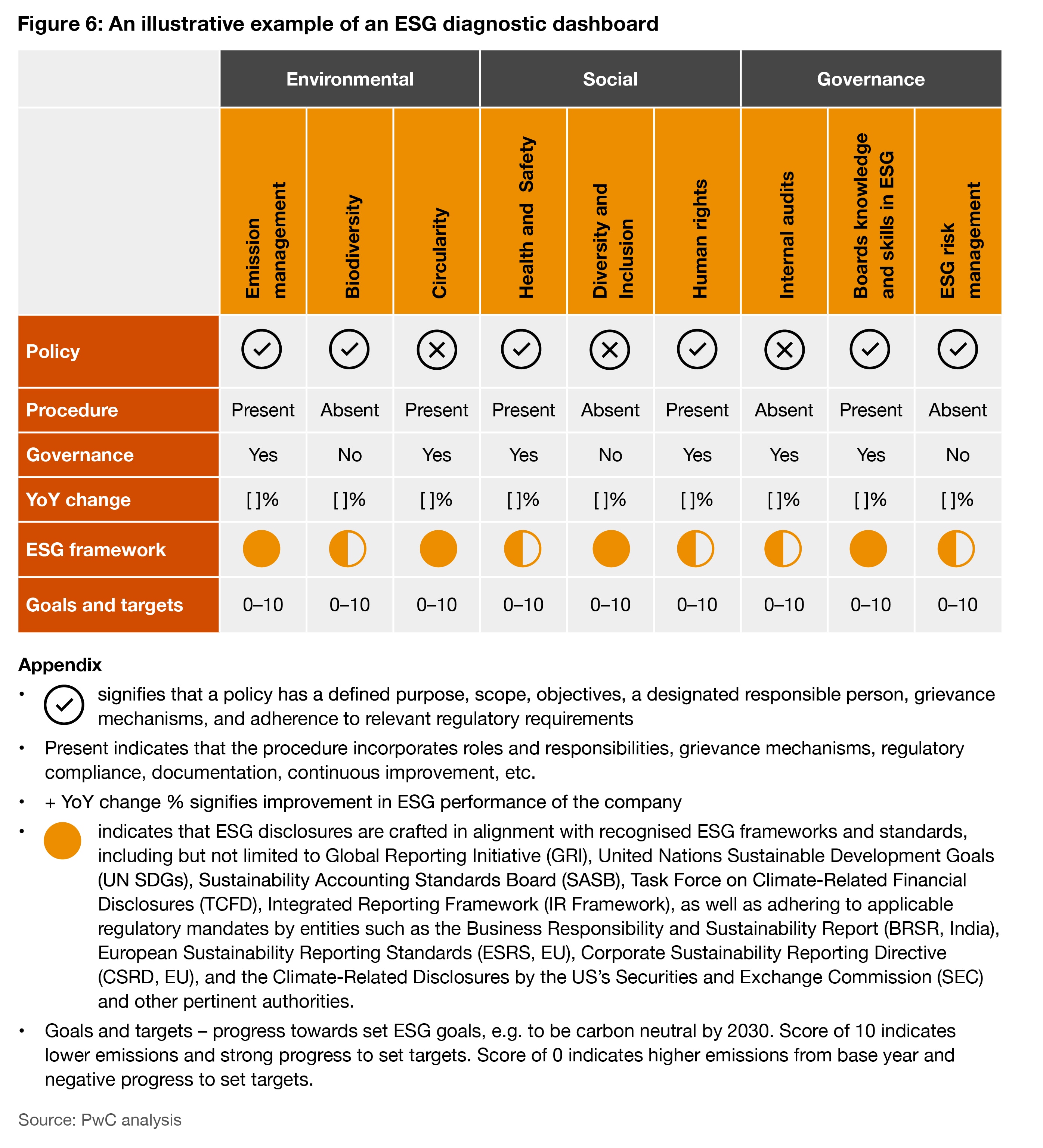

The ESG diagnostic helps define focal points, set preliminary goals, and establish a time-bound implementation roadmap through cross-functional collaboration. Leveraging insights from materiality assessments and maturity diagnostics, GCCs must identify strategic avenues to mitigate risks, capitalise on opportunities, and reinforce a resilient business model. The subsequent phase involves mapping and identifying relevant ESG and climate key performance indicators (KPIs) and metrics aligned with industry standards, stakeholder expectations, and the key issues that are material to the company. Communicating non-material ESG KPIs in the public domain heightens the risk of external criticism for greenwashing or false commitments. It is imperative to channelise the organisational efforts towards initiatives and communication that aligns with material governance controls, metrics, and robust reporting.

In order to integrate ESG into the operational framework, a thorough understanding of workforce requirements, supply chain dynamics, operational processes, controls, technology, infrastructure and governance is essential. These insights establish the groundwork for a well-planned path toward realising an organisation’s ESG goals.

The current state is evaluated against a structured framework comprising five progressive stages: Nascent, Articulated, Managed, Monitored, and Innovating. Simultaneously, a comprehensive analysis is conducted to assess the alignment of the existing ESG initiatives with an envisioned ideal future state. This dual-pronged approach enables a nuanced understanding of organisational maturity while providing a strategic lens to gauge the effectiveness and alignment of ESG efforts towards the desired future state.

Role of data and internal controls in investor-grade reporting:

Once the metrics and KPIs are identified, a thorough evaluation of organisational control over this information becomes indispensable. Becoming an ESG-ready company depends on centralising data collection. The quality and granularity of data is important as it helps derive meaningful insights which can help the leadership in making informed decisions. Managing diverse metrics, such as GHG emssions, energy, water, waste, Sulphur oxides (SoX), Nitrogen oxides (NoX), gender diversity attrition rate from multiple data owners often requires a streamlined data collection methodology across the organisation.

The most effective approach involves taking a detailed journey through each metric’s lifecycle, from its source data to its inclusion in the final report. Establishing crucial rules for information governance involves implementing an impactful tiered approach, and categorising data based on relevance and impact. Organisational clarity is ensured by clearly defining these categories and aligning them with specific requirements. This streamlines the incorporation of existing metrics, and paves the way for a seamless integration of new metrics into the ESG reporting framework.8

Communication plays an important role in convincing sceptical observers about the sincerity of the company’s ESG endeavours. Sustainability reports are gaining importance as investors and stakeholders are urging companies to share more about their ESG strategy. Several laws are in the works, or already in effect, making it mandatory for companies to disclose non-financial information.

There are standards that are non-mandatory and non-binding such as the GRI, IR Framework, SASB, TCFD, UN SDGs among others. There are also standards and frameworks which companies must comply with such as the BRSR, ESRS, CSRD, and the Climate Related Disclosures by SEC.

In certain cases, internationally accepted reporting frameworks such as GRI, SASB, TCFD, Integrated Reporting are referred to by regulatory authorities for cross referencing. At times, the frameworks and standards share similarities, however, there are also instances where they don’t align. This can pose practical challenges for companies which are aiming to create unified and consistent reports that meets the expectations of both investors and jurisdictional compliance and regulations. Ensuring alignment of standards and frameworks is crucial for developing a comprehensive reporting procedure.

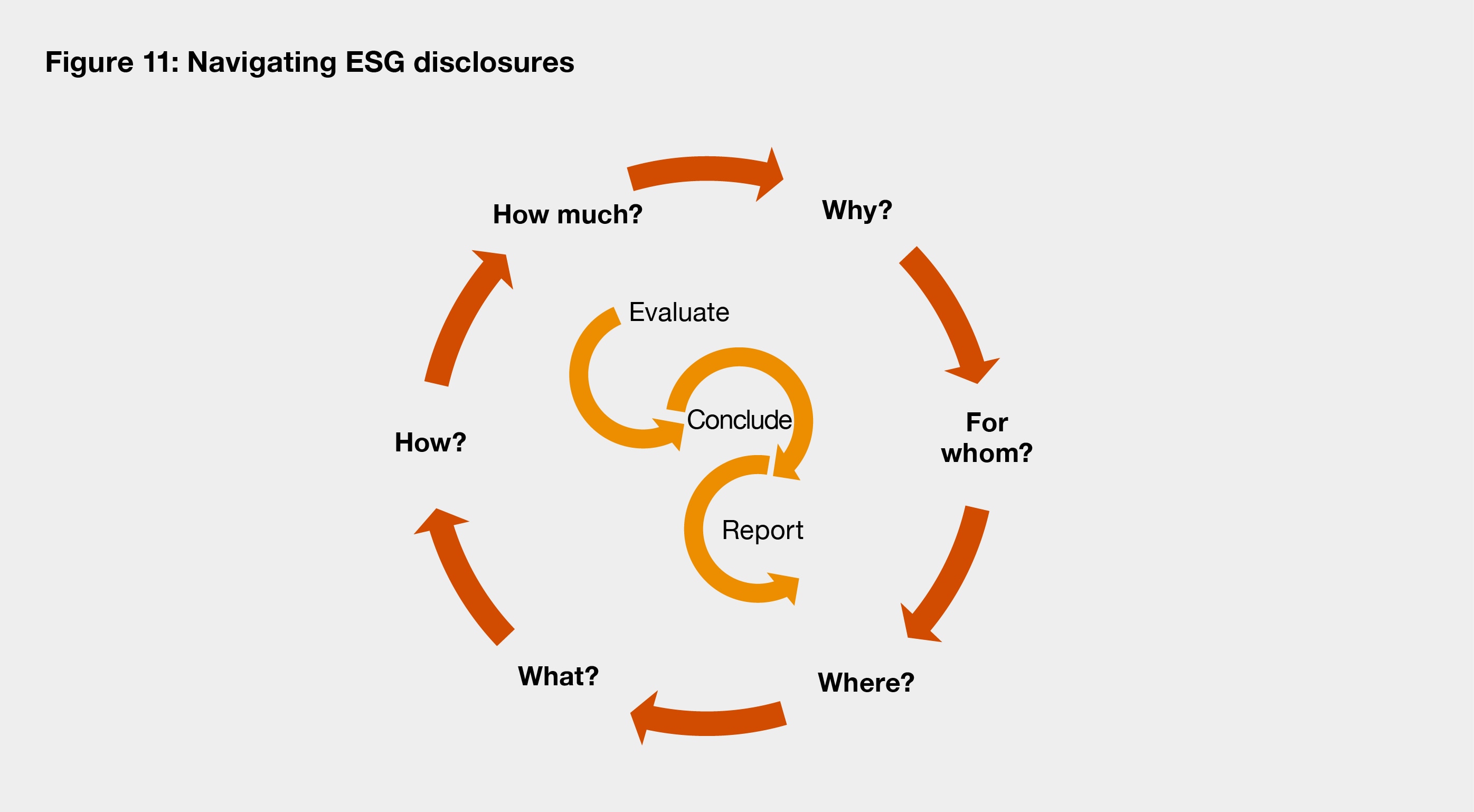

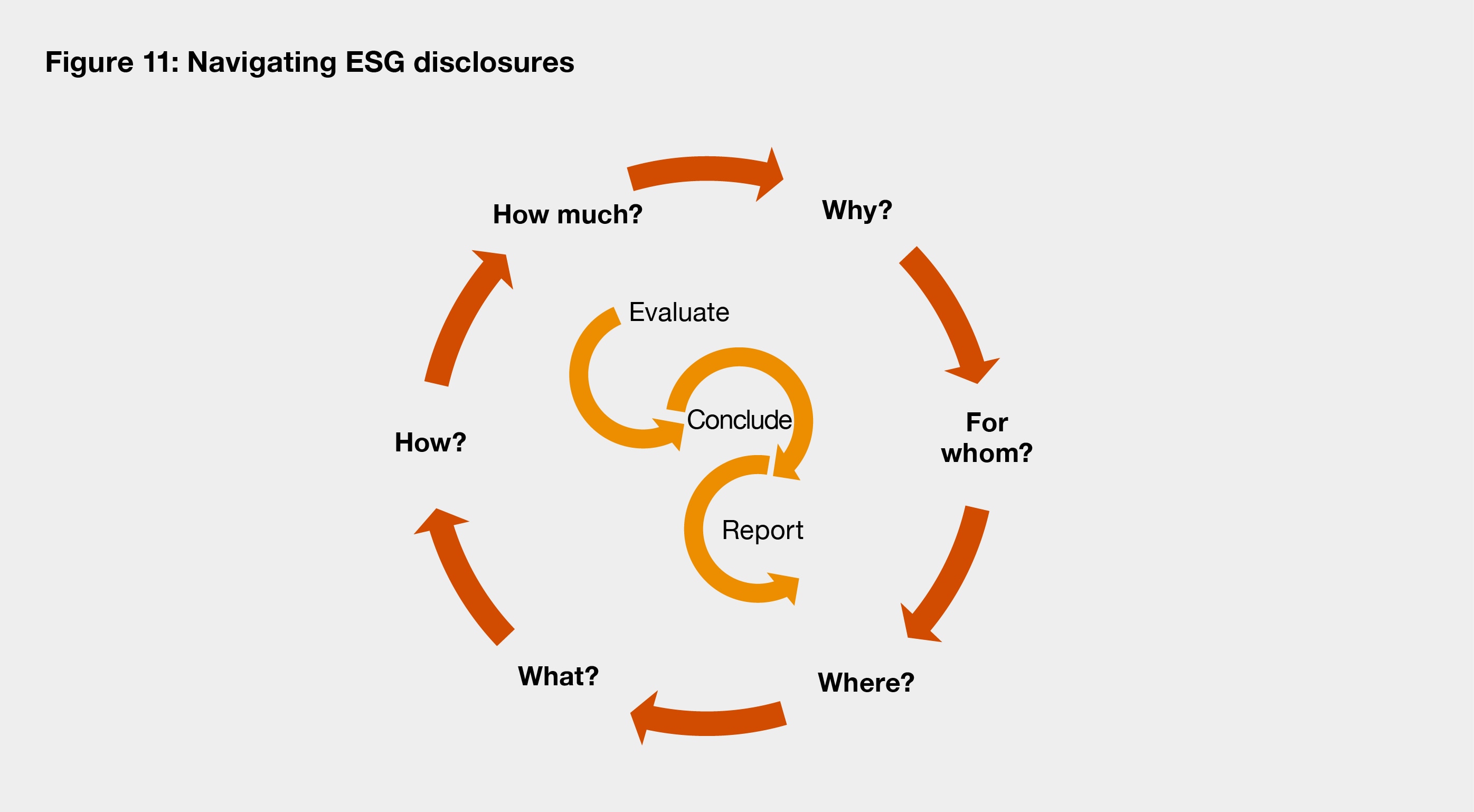

The ESG disclosure process involves three key steps – evaluate, conclude, report – coupled with six fundamental questions (as given in the figure below). These steps and questions provide a straightforward lucid, and practical approach to enhance the confidence in externally reported ESG information. The questions cover why ESG information is reported and for whom, setting the stage for subsequent decisions on where to report, what to report, how to report, and how much to report. Addressing questions 1 and 2 guides companies in determining the purpose and audience for ESG reporting. This foundation, in turn, informs decisions on where and what to report, how to prepare and present the information, and how much information to disclose. While questions 1 and 2 precede the others, the dynamic nature of the process acknowledges the interplay between questions and steps, emphasising their interconnectedness when making judgments about ESG information disclosure. The strength of an organisation’s ESG initiatives lies in their relevance and transparency, reinforcing their commitment to authentic and impactful sustainability practices.

ESG maturity of a company

GCCs should conduct comprehensive evaluations to understand where the organisation stands in its ESG journey. Evaluating an organisation’s position in its ESG journey is pivotal as these assessments provide a nuanced understanding of the organisation’s current strengths and the areas which need attention. This approach acts as a strategic compass, allowing GCCs to harness their full potential in helping companies set meaningful and attainable ESG goals aligned with industry benchmarks and best practices in an ever-changing business landscape.6 Figure 6 illustrates the maturity assessment of an organisation’s ESG initiatives.

Questions to consider in the transition:

- Do you have a clear ESG vision and mission?

- How are you measuring the value which you are

delivering to the stakeholders? - Are you aware of the pressure points in your

ESG ecosystem? What could erode trust?

ESG diagnostics

The process commences with an evaluation of an organisation’s current ESG practices, comparing its performance with industry benchmarks, peer best practices, regulatory standards, and global sustainability frameworks. This helps to bridge the identified gaps and capitalise on untapped ESG opportunities. The focus of GCCs is on identifying significant ESG material issues, risks, or opportunities that are important for both internal and external stakeholders and can impact the business. By aligning their efforts with ESG goals, companies can go beyond risk management, and adopt a proactive approach that leverages ESG as a driver for innovation, resilience and long-term value creation.

Nurturing talent

Conducting ESG capacity building sessions for the workforce follows a structured approach guided by the ADKAR model.7 The first step is the ‘Awareness’ phase which discusses the significance of ESG principles to the company and helps them understand the need for change. The next step ‘Desire’ involves measures to underscore the importance of ESG and develop a personal motivation for the change within the employees. The ‘Knowledge’ phase entails the development and execution of comprehensive ESG training programmes augmented by scheduled sessions with ESG subject matter experts. Transitioning into the ‘Ability’ stage, practical workshops and simulations are organised which help employees gain hands-on experience in integrating ESG principles into their day-to-day functions. The ‘Reinforcement’ phase emphasises acknowledging and rewarding teams for their outstanding ESG contributions.

With the help of this structured approach, the integration of ESG principles into an organisation’s business strategy evolves from theoretical conception to pragmatic application. This alignment underscores an organisation’s commitment to embedding sustainable practices at the core of operations.

Figure 7: An illustrative ESG training framework using the ADKAR change management approach

ESG governance

As ESG is not restricted to a segment of business, it demands collective effort. Effective governance begins with a robust board, leadership team, and a well-defined accountability framework. The establishment of a boardappointed sustainability committee, along with the approval of its mandate and member appointments, emphasises high-level oversight of sustainability initiatives, directly reporting to the board. Simultaneously, a management level committee, initiated by the executive committee, focuses on detailed operational aspects and is often led by key executives like the chief sustainability officer (CSO), chief technical officer (CTO), or chief risk officer (CRO). The day-to-day execution of the ESG strategy typically falls under the purview of senior management. GCCs should adopt various approaches in establishing and staffing their ESG teams, outlining internal reporting structures and adopting formal procedures for governance at the management level.

A robust governance structure becomes imperative to meet evolving stakeholder expectations, fortify risk resilience, and capitalise on growth opportunities within the ESG framework. ESG leadership cannot be fragmented among part-time contributors; instead, it necessitates a centralised and a dedicated approach to ensure progress.

Figure 8: GCCs and ESG governance: Key questions to set the stage for governance

Business model

- Should we adapt our business model, or is winding down a particular business line more viable?

- Who holds responsibility for implementing changes to the business model?

ESG strategy alignment

- How is our company’s strategy aligned with ESG factors?

- Who is accountable for identifying ESG-related goals, setting milestones, and ensuring timely delivery?

ESG integration

- Do considerations of ESG factors extend to the evaluation of a company’s cultural values?

- How are ESG factors incorporated into our enterprise risk management (ERM) framework?

People and competencies

- Does our orgainsation possess the necessary competencies?

- What new competencies and training are required, and can existing expertise within the organisation be utilised?

Governance and structure

- What additional governance structures are necessary to support our ESG strategy?

- Are roles and responsibilities adequately clarified?

Board oversight and integration

- Are the board and committees equipped to support a systemic approach to ESG integration?

- How are responsibilities distributed for oversight, information exchange, and control related to ESG matters?

Existing committee’s oversight

- What mechanisms will the audit committee employ to oversee sustainability reporting effectively?

- How does the risk committee evaluate and oversee key ESG risk areas, ensuring robust ESG risk mitigation strategies are in place?

- How does the nominations committee guarantee access to the right skills and competencies, aligning with ESG requirements?

- Does the remuneration committee ensure that senior management and executive remuneration structures align appropriately with sustainability objectives?

ESG roadmap

The ESG diagnostic helps define focal points, set preliminary goals, and establish a time-bound implementation roadmap through cross-functional collaboration. Leveraging insights from materiality assessments and maturity diagnostics, GCCs must identify strategic avenues to mitigate risks, capitalise on opportunities, and reinforce a resilient business model. The subsequent phase involves mapping and identifying relevant ESG and climate key performance indicators (KPIs) and metrics aligned with industry standards, stakeholder expectations, and the key issues that are material to the company. Communicating non-material ESG KPIs in the public domain heightens the risk of external criticism for greenwashing or false commitments. It is imperative to channelise the organisational efforts towards initiatives and communication that aligns with material governance controls, metrics, and robust reporting.

In order to integrate ESG into the operational framework, a thorough understanding of workforce requirements, supply chain dynamics, operational processes, controls, technology, infrastructure and governance is essential. These insights establish the groundwork for a well-planned path toward realising an organisation’s ESG goals.

The current state is evaluated against a structured framework comprising five progressive stages: Nascent, Articulated, Managed, Monitored, and Innovating. Simultaneously, a comprehensive analysis is conducted to assess the alignment of the existing ESG initiatives with an envisioned ideal future state. This dual-pronged approach enables a nuanced understanding of organisational maturity while providing a strategic lens to gauge the effectiveness and alignment of ESG efforts towards the desired future state.

Data and internal controls

Role of data and internal controls in investor-grade reporting:

Once the metrics and KPIs are identified, a thorough evaluation of organisational control over this information becomes indispensable. Becoming an ESG-ready company depends on centralising data collection. The quality and granularity of data is important as it helps derive meaningful insights which can help the leadership in making informed decisions. Managing diverse metrics, such as GHG emssions, energy, water, waste, Sulphur oxides (SoX), Nitrogen oxides (NoX), gender diversity attrition rate from multiple data owners often requires a streamlined data collection methodology across the organisation.

The most effective approach involves taking a detailed journey through each metric’s lifecycle, from its source data to its inclusion in the final report. Establishing crucial rules for information governance involves implementing an impactful tiered approach, and categorising data based on relevance and impact. Organisational clarity is ensured by clearly defining these categories and aligning them with specific requirements. This streamlines the incorporation of existing metrics, and paves the way for a seamless integration of new metrics into the ESG reporting framework.8

ESG communication

Communication plays an important role in convincing sceptical observers about the sincerity of the company’s ESG endeavours. Sustainability reports are gaining importance as investors and stakeholders are urging companies to share more about their ESG strategy. Several laws are in the works, or already in effect, making it mandatory for companies to disclose non-financial information.

There are standards that are non-mandatory and non-binding such as the GRI, IR Framework, SASB, TCFD, UN SDGs among others. There are also standards and frameworks which companies must comply with such as the BRSR, ESRS, CSRD, and the Climate Related Disclosures by SEC.

In certain cases, internationally accepted reporting frameworks such as GRI, SASB, TCFD, Integrated Reporting are referred to by regulatory authorities for cross referencing. At times, the frameworks and standards share similarities, however, there are also instances where they don’t align. This can pose practical challenges for companies which are aiming to create unified and consistent reports that meets the expectations of both investors and jurisdictional compliance and regulations. Ensuring alignment of standards and frameworks is crucial for developing a comprehensive reporting procedure.

The ESG disclosure process involves three key steps – evaluate, conclude, report – coupled with six fundamental questions (as given in the figure below). These steps and questions provide a straightforward lucid, and practical approach to enhance the confidence in externally reported ESG information. The questions cover why ESG information is reported and for whom, setting the stage for subsequent decisions on where to report, what to report, how to report, and how much to report. Addressing questions 1 and 2 guides companies in determining the purpose and audience for ESG reporting. This foundation, in turn, informs decisions on where and what to report, how to prepare and present the information, and how much information to disclose. While questions 1 and 2 precede the others, the dynamic nature of the process acknowledges the interplay between questions and steps, emphasising their interconnectedness when making judgments about ESG information disclosure. The strength of an organisation’s ESG initiatives lies in their relevance and transparency, reinforcing their commitment to authentic and impactful sustainability practices.

The winning partnership

It is important to understand how ESG is evolving globally and to assess how a company needs to adapt to the rapid changes in the industry. Implementing an organised ESG framework within GCCs can enhance profitability, streamline costs, and draw interest from institutional investors across various industries.

The synergy between GCCs and ESG opens doors for driving technological innovation, fostering business transformation, and endorsing responsible business practices. This concentrated effort towards sustainable practices ensures a legacy of responsible stewardship for future generations to come.

Figure 12: Spotlight on critical concerns

Cultural alignment:

Data availability and quality:

Skill-set and expertise:

Strategic collaboration for innovation:

Cross-functional collaboration at a mature ESG company is more strategic. Various departments actively work together to innovate and implement advanced ESG initiatives. Dedicated, crossfunctional teams can also focus solely on sustainability goals.

Global diversity and local context:

Technological integration:

About PwC

At PwC, our purpose is to build trust in society and solve important problems. We’re a network of firms in 151 countries with over 360,000 people who are committed to delivering quality in assurance, advisory and tax services. Find out more and tell us what matters to you by visiting us at www.pwc.com.

PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

© 2024 PwC. All rights reserved.

Contributors

Dr Gargi Ghorpade and Somesh Das

Contact us

Sambitosh Mohapatra

Partner and Leader, ESG, PwC India

Rajesh Ojha

Partner & GCC Market Segment Leader, PwC India

Gargi Ghorpade

Executive Director - ESG Strategy and Transformation/Sustainability and Climate Strategy, PwC India

Somesh Das

Senior Associate, ESG Strategy and Transformation/Climate and Sustainability, PwC India